Sports App Market Report Scope & Overview:

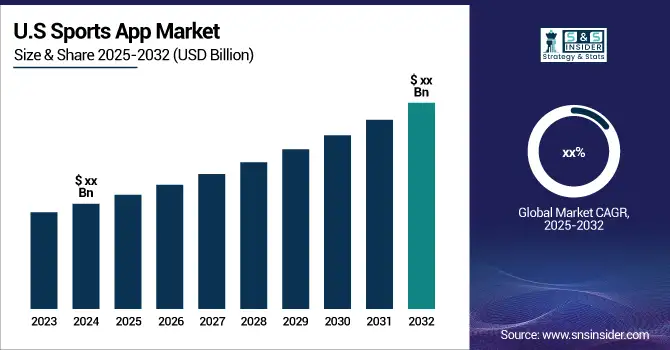

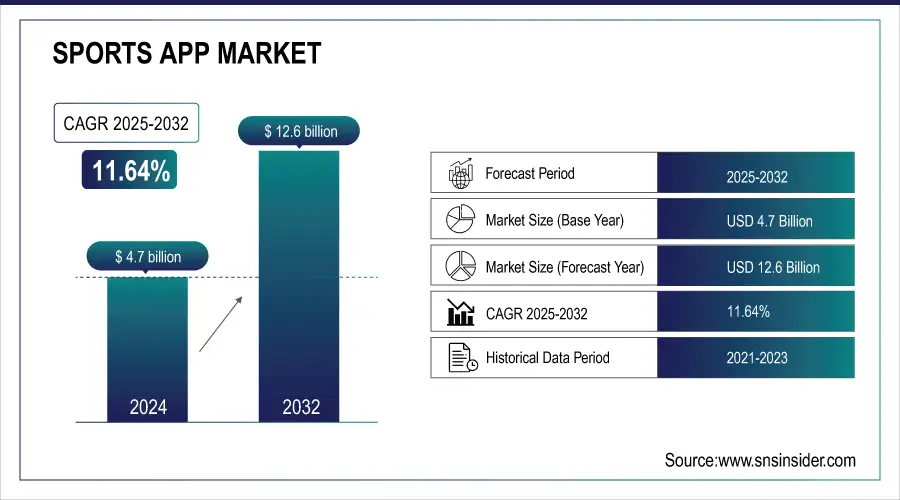

The Sports App Market was valued at USD 4.7 Billion in 2024 and is expected to reach USD 12.6 Billion by 2032, growing at a CAGR of 11.64% from 2025-2032.

The Sports App Market is experiencing rapid growth, driven by increasing smartphone penetration, rising fan engagement, and the integration of live streaming, fantasy gaming, and betting features. Advancements in AI, AR/VR, and data analytics are enhancing personalized user experiences, while partnerships between leagues, broadcasters, and app developers are expanding digital sports ecosystems.

Market Size and Forecast:

-

Sports App Market Size in 2024: USD 5.24 Billion

-

Sports App Market Size by 2032: USD 12.60 Billion

-

CAGR: 11.58% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Sports App Market - Request Free Sample Report

Key Sports App Market Trends

-

Surging popularity of fitness tracking and personalized workout apps is driving user engagement and subscription growth.

-

Integration of AI and machine learning enables customized coaching, performance analytics, and real-time health monitoring.

-

Rising use of wearable devices and IoT integration enhances connectivity and data accuracy across sports platforms.

-

Gamification and social sharing features are boosting motivation, community engagement, and competitive participation.

-

Growing demand for live sports streaming and on-demand content is transforming fan engagement and monetization models.

-

Expansion of esports and fantasy sports applications is creating new revenue streams and attracting younger audiences.

-

Increasing partnerships between app developers, fitness brands, and sports organizations are fostering innovation and ecosystem growth.

Sports App Market Growth Drivers

-

The widespread use of smartphones and improved mobile internet access are driving sports app engagement and growth.

The number of smartphone users is growing and mobile internet connectivity is broadening rapidly, which are the two primary growth factors in the sports app market. As the streaming quality increases with improved latency on 5 G networks, users are doing more with live sports, fantasy leagues, and eSports platforms. The increasing access to smartphones with low-cost plans in developing economies has helped create a wider user base, further propelling the demand for sports apps. AI-powered personalization along with real-time updates only amplifies this user interaction experience. With sports leagues establishing a digital footprint through deals with mobile platforms and online streaming rights, apps are seeing a rise in downloads, and mobile platforms are now the top entry point for sports consumption.

Sports App Market Restraints

-

Intense competition and market saturation make it challenging for new sports apps to acquire and retain users.

Sports apps here come to face stiff competition from established brands and new entrants with the launch of mega brand products fighting for the attention of users. Current players like ESPN and DAZN and Yahoo Sports are still in command, new apps have a hard time to grow. App store cluttering compels firms to spend enormously on promotion and user acquisition, leading to increased expenses. User retention becomes a challenge, as consumers move in and out of different apps depending on content and subscription pricing. many areas have regulatory restrictions on sports betting apps, which crowds the ability to monetize these offerings. All such factors pose a challenge for the new player to retain long-term growth in the competitive sports app ecosystem.

Sports App Market Opportunities

-

AI-powered features like real-time insights and personalized recommendations are enhancing user engagement in sports apps.

AI, ML Effect on Sport App Development Trends As the adoption of AI and ML is rising high, the advent of sports application development gets a huge opportunity at the horizon. Real-time game insights, predictive analytics, and personalized recommendations drive user engagement and retention, among other AI-driven features. And apps are adopting AI to provide personalized content, including customized match highlights, fantasy sports recommendations, and predictions of player performance. Also, AI chatbots and voice assistants enhance user interaction, offering instant updates and stats. As immersive sports experiences based on AR/VR are accelerating, AI-driven fan engagement is in line to ramp up. Add to that the revenue generation via AI-powered personalized and niche segmentation advertisements and subscriptions for the sports apps.

Sports App Market Challenge

-

Sports apps face challenges in protecting user data and complying with stringent privacy regulations.

Especially with the use of AI, analytics, and user tracking increasing, data privacy and security has become one of the main challenges sports apps need to overcome. Due to the large amounts of user data that sports apps gather, such as their location, how many times the user has utilized the app, and their payment details, cybercriminals could be motivated to attack. Operational complexities are further compounded by data protection laws such as GDPR and CCPA mandating security measures in the app. Moreover, safe payment gateways and stopping access to high fee content remains a continual concern. In a world of increased privacy concern, trust needs to rely on clear-cut policies regarding data, emphasis on well-developed encryption, and use of multi-factor authentication for data protection.

Sports App Market Segmentation Analysis

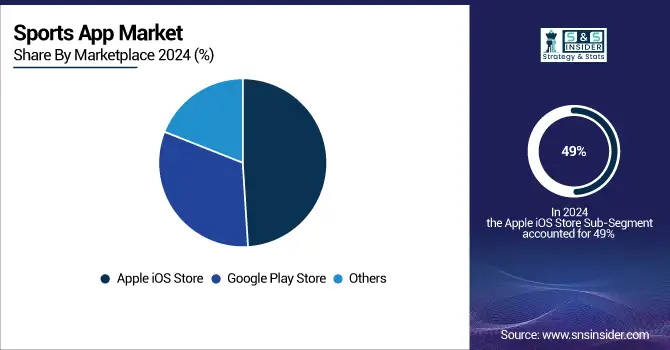

By Marketplace

In 2024, the iOS store segment dominated the market and accounted for 49% of revenue share. This is due to the rise of high interaction-based interface-based apps required by their consumers based out in the U.S. and the UK. Moreover, market growth is driven by the growing 3D features, and on top of that, effortless connectivity with add-on security. This perfect combination of hardware, software, and an impressive user interface nurtured a vibrant ecosystem where a myriad of sports-focused applications could be developed and widely adopted.

The iOS Google Play Store segment is expected to register the fastest CAGR during the forecast period. The segment growth is propelled by the open ecosystem, the easy access of in-app purchase of customizable user interface of apps, and the advanced multitasking system. Tools for sports broadcasting video editing on the Android platform.

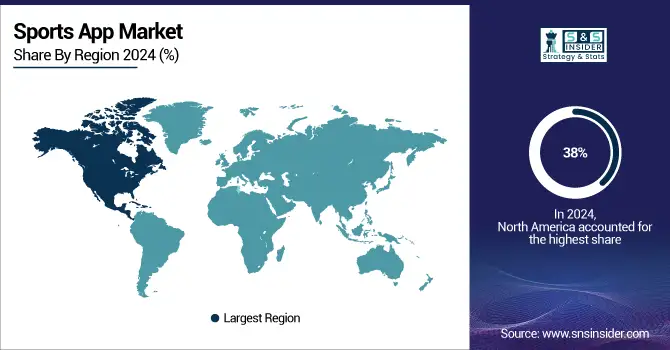

Sports App Market Regional Analysis

North America Sports App Market Insights

In 2024, North America dominated the market and accounted for 38% of revenue share, owing to the increasing demand for Wrestling AEW sports live streaming among the consumers in the U.S. and Canada. Market growth is being driven by an increasing trend in the U.S. favoring the use of technology-driven content management apps. Increasing demand for the AI-based, Standalone Streaming application is expected to increase the revenue share of the U.S.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Sports App Market Insights

The Asia Pacific segment is expected to register the fastest CAGR during the forecast period. It is due to the rising demand for cloud-based sports apps among consumers in China and India. And in China at least, there is a new trend toward the adoption of subscription-based apps. In addition, increasing digital payment service demand in China is expected to drive market growth. The increasing acceptance of sports applications that provide translation in a regional language is expected to further accelerate the growth in India during the forecast period.

Europe Sports App Market Insights

The Europe Sports App Market is poised for substantial growth in 2024, supported by increasing consumer interest in fitness, wellness, and active lifestyles. Countries such as the U.K., Germany, and France are witnessing strong adoption of mobile fitness and team management apps. Integration of AI, GPS tracking, and performance analytics tools is improving user experience and training outcomes. Additionally, government initiatives promoting digital health and sports participation, along with rising collaborations between app developers and sports organizations, are accelerating regional growth.

Latin America (LATAM) Sports App Market Insights

The LATAM Sports App Market is showing consistent growth in 2024, driven by increasing smartphone access, digitalization of fitness programs, and growing enthusiasm for football and other team sports. Brazil and Mexico are leading markets, with a strong culture of sports participation and fan engagement. The rise of online fitness coaching and fantasy sports platforms is enhancing user retention. Moreover, collaborations between local telecom operators and app developers are improving accessibility and affordability, further supporting market penetration across the region.

Middle East & Africa (MEA) Sports App Market Insights

The MEA Sports App Market is witnessing promising growth in 2024, propelled by government initiatives promoting sports, wellness, and digital transformation. Countries such as the UAE, Saudi Arabia, and South Africa are seeing increased adoption of fitness, wellness, and live sports apps. Expanding 5G infrastructure and rising use of wearable devices are enabling advanced tracking and streaming functionalities. Furthermore, partnerships between fitness centers, healthcare providers, and app developers are fostering ecosystem growth and enhancing user engagement across the region.

Competitive Landscape for Sports App Market

National Hockey League (NHL)

The National Hockey League (NHL) is one of North America’s premier professional sports organizations, known for pioneering fan engagement and integrating technology into sports entertainment. The league continues to explore digital innovations that enhance the viewing experience and attract younger audiences.

-

In February 2024, the NHL introduced an innovative “STEMcast” broadcast during a game between the Boston Bruins and Florida Panthers. This alternative broadcast combined animation with STEM education elements, aiming to engage younger viewers by blending digital interactivity and educational content into the live sports experience.

Flutter Entertainment plc

Flutter Entertainment is a global leader in online sports betting, gaming, and entertainment, operating renowned brands such as FanDuel, PokerStars, and Betfair. The company focuses on responsible gaming and strategic market expansion to strengthen its presence in the rapidly growing digital betting sector.

-

In March 2024, Flutter Entertainment projected a 34% increase in core profit for 2025, following a 26% growth in 2024. This forecast reflects the company’s continued success in the U.S. sports betting market and FanDuel’s dominant position within the segment.

Circa Sports

Circa Sports is a Las Vegas–based sports betting operator recognized for its innovative mobile betting platforms and high-limit wagering options. The company continues to expand its national footprint through strategic partnerships and regional market entries across the United States.

-

In May 2024, Circa Sports expanded its mobile sports betting app to Kentucky, partnering with the Cumberland Run horse track in Corbin. This expansion marked a significant step in the company’s efforts to broaden its reach and strengthen its position in the competitive U.S. sports betting landscape.

Diamond Sports Group

Diamond Sports Group is a major operator of regional sports networks in the United States, providing live coverage of professional sports events to millions of viewers. The company focuses on integrating sports media with digital content and sports betting technologies to enhance audience engagement.

-

In October 2024, Diamond Sports Group rebranded its Bally Sports regional networks to the FanDuel Sports Network, following a strategic partnership with FanDuel Group. The transition included an update of the Bally Sports app to the new FanDuel Sports Network app, enhancing user experience and integrating sports betting content for a more interactive fan environment.

Sports App Market Key Players

The major key players along with their products are

-

DAZN

-

Bleacher Report

-

CBS Sports

-

FanDuel

-

DraftKings

-

SofaScore

-

365Scores

-

theScore

-

OneFootball

-

Bet365

-

FIFA

-

UEFA

-

FOX Sports

-

Sky Sports

-

Sportradar AG

-

Bleav Network

-

FloSports

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.24 Billion |

|

Market Size by 2032 |

USD 12.60 Billion |

|

CAGR |

CAGR of 11.58% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Marketplace (Google Play Store, Apple iOS Store, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

ESPN, DAZN, Yahoo Sports, Bleacher Report, CBS Sports, NBC Sports, FanDuel, DraftKings, SofaScore, 365Scores, theScore, OneFootball, Bet365, FIFA, UEFA, FOX Sports, Sky Sports, Sportradar AG, Bleav Network, FloSports |