Immunomodulators Market Report Scope & Overview:

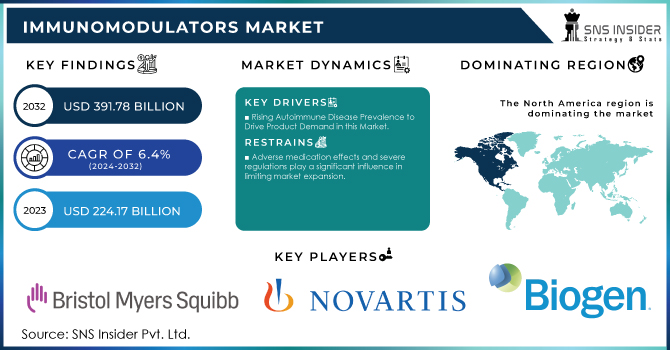

The Immunomodulators Market size was USD 224.17 Billion in 2023 and is expected to Reach USD 391.78 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period of 2024-2032.

Get More Information on Immunomodulators Market - Request Sample Report

The Immunomodulators Market refers to the global pharmaceutical market segment that focuses on drugs or therapies designed to modulate or modify the immune system's response. Immunomodulators are substances that can enhance or suppress the immune system to achieve a therapeutic effect. Immunomodulators are used in the treatment of various diseases and conditions in which the immune system plays a significant role. These include autoimmune disorders, such as rheumatoid arthritis, psoriasis, and multiple sclerosis, as well as certain types of cancer, allergies, and infectious diseases.

The market for immunomodulators has been experiencing significant growth in recent years, driven by factors such as the increasing prevalence of autoimmune diseases, advancements in immunotherapy, and growing research and development activities in the field. The market includes a wide range of products, including biologics, small molecules, and vaccines. Key players in the immunomodulators market include pharmaceutical companies, biotechnology firms, and research institutions. These companies invest in research and development to develop new immunomodulatory therapies and bring them to market. They also engage in strategic collaborations and partnerships to enhance their product portfolios and expand their market presence. The immunomodulators market is influenced by factors such as regulatory policies, healthcare infrastructure, and reimbursement systems in different regions. North America and Europe have traditionally been the leading markets for immunomodulators, but emerging economies in the Asia Pacific and Latin America are also witnessing significant growth due to improving healthcare infrastructure and increasing awareness about immunomodulatory therapies.

The rising prevalence of post-covid illnesses has accelerated the growth of the immunomodulator industry. Immunotherapies and immunomodulatory approaches in clinical trials, due to respiratory difficulties established after covid in many patients regardless of age group, led to the growth of immunotherapies when vaccines were in short supply. Due to the lack of a vaccine or drugs against COVID-19, immunotherapies using convalescent plasma, immunoglobulins, antibodies (monoclonal or polyclonal), and the use of immunomodulatory agents to promote immunity are important options. The rising prevalence of chronic diseases such as asthma, allergic conditions, cancer, and multiple sclerosis drives the immunomodulators market. For example, a study published in the American Cancer Society predicts that due to population growth and ageing, there will be 16.5 million cancer deaths and 27.8 million new cancer cases worldwide by 2040. The burden is expected to rise in the future as the prevalence of risk factors such as smoking, poor diet, and physical inactivity increases in economically developing countries.

MARKET DYNAMICS

DRIVERS:

-

The pharmaceutical business and academic organizations are substantially investing in immunomodulator research and development. Exploration of novel targets and mechanisms of action is being prioritized in order to generate more tailored and effective medicines.

-

Rising Autoimmune Disease Prevalence to Drive Product Demand in this Market.

Multiple sclerosis has surpassed cardiovascular disease as the world's second leading cause of death. Demand for immunomodulators is expected to be driven by factors such as the rising number of current clinical trials for the development of immunotherapeutic medications in the treatment of multiple sclerosis, such as ozanimod, ponesimod, and laquinimod.

RESTRAIN:

-

Immunomodulatory medication development and commercialization need significant expenditure in research and development, clinical trials, and regulatory processes. These operations' high costs might be a severe constraint for smaller pharmaceutical businesses or research organisations with limited resources.

-

Adverse medication effects and severe regulations play a significant influence in limiting market expansion.

Infection is more likely, including both initial infection and return of latent infections. Hepatitis B and C viruses, fungal infections, tuberculosis (TB), and HIV are examples of such illnesses. Considerable risk of progressive multifocal leukoencephalopathy (PML) exists as well. As a result, before beginning immunomodulatory therapy, patients must be checked for these dangers or previous exposure to viruses linked with these disorders.

OPPORTUNITY:

-

Immunomodulatory medications have shown significant effectiveness in the treatment of various cancers, including melanoma, lung cancer, and haematological malignancies. There is a great possibility to broaden the use of immunomodulators in cancer, including the creation of combination therapy and the investigation of novel targets.

-

Emerging biologics and cell therapies are a great opportunity for this market.

The advancement of biologics, such as monoclonal antibodies, and cell-based treatments, such as CAR-T cell therapy, has created new opportunities for immunomodulation. These cutting-edge medicines have demonstrated promising outcomes in a variety of ailments, including cancer and autoimmune disorders. Continued improvements in manufacturing processes, gene editing, and cell engineering provide potential for the creation of innovative biologics and cell-based immunomodulatory therapy.

CHALLENGES:

-

Immunomodulatory therapies can have significant side effects and safety concerns. Modulating the immune system can lead to increased susceptibility to infections, autoimmune reactions, or other adverse events.

-

This market has significant challenges due to complex systems and a lack of awareness.

The immune system is a complicated and convoluted network of interactions, and the processes underpinning immunomodulation remain unknown. A lack of understanding of the immune system and the specific mechanisms of action of immunomodulatory medications can stymie the development of more tailored and effective treatments. To solve this obstacle, more immunology research and knowledge is required.

IMPACT OF RUSSIA-UKRAINE WAR

The war between Ukraine and Russia has seen an impact in all sectors, but as far as the pharma sector and healthcare sector are concerned, there has been a huge jump in the market share of their key players, such as the Pfizer company's share market in 2021. There has been a jump of 20 billion in comparison to Pfizer in 2021, where the market share of Pfizer was 81 billion, in 2022 it has increased to 100 billion, and the market share of Johnson and Johnson has seen a jump of 2%.

Even after the war, there is no visible impact on the healthcare company, so the immunomodulator market will definitely grow.

IMPACT OF ECONOMIC SLOWDOWN

A recession, defined as two consecutive quarters of negative GDP growth, can be harmful to the population's health because economic downturns are strongly associated with a decline in healthcare utilisation and a deterioration in health outcomes. Suicides and murders, for example, surged among working-age men and women during previous recessions in Europe. The number of uninsured non-elderly Americans climbed by 5.8 million during the current recession, and more than a quarter of Americans reported reduced routine usage of medical care. Over the same time period, insurance policy deductibles and copayments for doctor visits and prescription medications grew, putting a heavier financial strain on individuals. The recession affected different countries differently, and they sought to overcome budgetary restrictions in various ways. The recession had an impact on European pharmaceutical policies. Major therapeutic classes in nations before and after the Recession. There were changes in the pharmaceutical industry. Some cost-cutting strategies, such as those impacting out-of-pocket payments, would put the financial burden of pharmaceuticals onto patients, and drug sales are expected to fall during this era, particularly in less economically stable nations. Due to the ongoing recession, the Immunomodulators Market definitely grow up.

REGIONAL ANALYSIS:

North America: North America will have the greatest share of the Immunomodulator market. This is owing to the rising occurrence of autoimmune illnesses, as well as more immunomodulatory trials and research. According to research issued in September 2020 by the National Multiple Sclerosis Society, there are 2.6 million individuals worldwide who have multiple sclerosis, with more than 1.2 million living in the United States alone.

Asia Pacific: Asia Pacific is expected to have the fastest CAGR due to the increasing number of clinical trials using immunomodulators and the region's growing senior population. Latin America, the Middle East, and Africa, on the other hand, are expected to increase at a slower pace due to lower uptake of pricey pharmaceuticals and a lack of product approvals in the majority of developing nations.

Get Customized Report as per Your Business Requirement - Request For Customized Report

KEY MARKET SEGMENTATION

By Product Type

-

Immunostimulants

-

Immunosuppressants

-

Other

By Application

-

Respiratory

-

Oncology

-

HIV

-

Other

By End Users

-

Clinics

-

Hospitals

-

Other

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major players in Immunomodulators Market are Novartis AG, F. Hoffmann-La Roche Ltd, Teva Pharmaceutical Industries Ltd., Biogen, Bristol-Myers & Squibb Company, Amgen, Inc., Eli Lilly and Company, Merck Sharp & Dohme Corp., Petrovax, Acrotech Biopharma, LLC. and other players.

RECENT DEVELOPMENTS

Sun Pharma: Sun Pharma announced CEQUA, a calcineurin inhibitor immunomodulator that combines nano micellar (NCELL) technology to increase the bioavailability and physicochemical stability of cyclosporine to boost ocular tissue penetration, in Canada in 2022.

Merck: Merck announced the purchase of Pandion Therapeutics in 2021, expanding its pipeline of candidates addressing a wide variety of Autoimmune Diseases. Pandion has built a robust pipeline of candidates using its TALON technology that attempts to modulate the immune response and might be used to treat a number of autoimmune disorders.

| Report Attributes | Details |

| Market Size in 2023 | US$ 224.17 Bn |

| Market Size by 2032 | US$ 391.78 Bn |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Immunostimulants, Immunosuppressants, Other) • By Application (Respiratory, Oncology, HIV, Other) • By End Users (Clinics, Hospitals, & Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Novartis AG, F. Hoffmann-La Roche Ltd, Teva Pharmaceutical Industries Ltd., Biogen, Bristol-Myers & Squibb Company, Amgen, Inc., Eli Lilly and Company, Merck Sharp & Dohme Corp., Petrovax, Acrotech Biopharma, LLC. |

| Key Drivers | • The pharmaceutical business and academic organizations are substantially investing in immunomodulator research and development. Exploration of novel targets and mechanisms of action is being prioritized in order to generate more tailored and effective medicines. • Rising Autoimmune Disease Prevalence to Drive Product Demand in this Market. |

| Market Restraints | • Immunomodulatory medication development and commercialization need significant expenditure in research and development, clinical trials, and regulatory processes. These operations' high costs might be a severe constraint for smaller pharmaceutical businesses or research organizations with limited resources. • Adverse medication effects and severe regulations play a significant influence in limiting market expansion. |