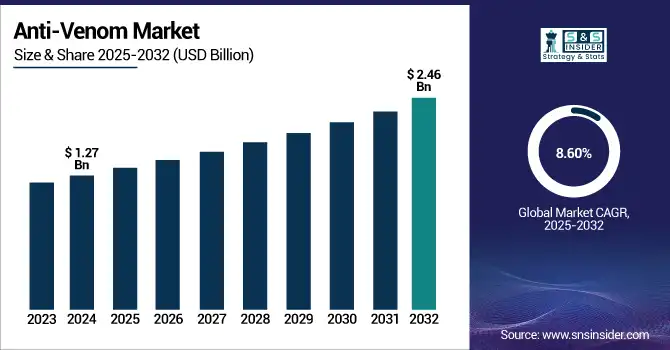

Anti-Venom Market Size Analysis:

The Anti-Venom Market size was valued at USD 1.27 billion in 2024 and is expected to reach USD 2.46 billion by 2032, growing at a CAGR of 8.60% over the forecast period of 2025-2032.

The global anti-venom market is experiencing strong growth due to the high incidence of venomous bites and stings, particularly in rural and tropical regions. The growth of the market is mainly ascribed to the rising awareness and access to healthcare, and the disposal of government to curb the mortality due to snakebite. Innovation of antivenom formulations and increasing support from global health organizations are also contributing significantly to market growth. Moreover, the expansion of research & development in regional-specific and multi-valent antivenoms is supporting increased incidence of demand for more effective and specific treatments globally through 2032.

To Get more information on Anti-Venom Market - Request Free Sample Report

The U.S. anti-venom market size was valued at USD 0.43 billion in 2024 and is expected to reach USD 0.80 billion by 2032, growing at a CAGR of 8.12% over the forecast period of 2025-2032. The U.S. plays a pivotal role in North America's anti-venom market, contributing significantly to the region's leadership position. The reasons for this dominance include the strong pharmaceutical sector, developed healthcare system, and high levels of research and development in the country. High level of awareness amongst health care professionals across the U.S. market, and the population around envenomation, ensures that the cases are diagnosed & treated in time.

Anti-Venom Market Dynamics:

Drivers:

-

High Incidence of Snakebites and Other Venomous Bites is Driving the Market Growth

In particular, venomous snakebites, scorpion stings, and spider bites are a neglected global health problem in tropical and subtropical areas, where venomous species are widespread. Due to the high frequency of such bites, it becomes a medical emergency and needs antivenom for immediate treatment. The high incidence of stings and bites promotes an ongoing need for anti-venoms and therefore, a significant demand for effective products that can be used as anti-venom to reduce morbidity and mortality associated with venomous bites.

Each year, about 4.5–5.4 million persons are bitten by snakes, according to the World Health Organization (WHO), with 81,000–138,000 deaths 400 000 permanent disabilities globally.

-

Advancements in Biotechnological Research are Propelling the Market Growth

The latest progressions in biotechnology have changed how anti-venoms are produced. Novel antibodies are also used to develop both broad-spectrum antivenom and recombinant forms of antivenom that are more efficacious and contain fewer side effects per weight of venom type. Such advancements enhance the safety profile, efficacy, and accessibility of antivenom, making these antivenoms more effective and available than before, and thus accelerating the anti-venom market growth.

In 2025, it was reported in Cell that researchers had neutralized the venom of 19 species of dangerous snakes in mice using their antibodies (produced after voluntarily suffering multiple venomous snakebites) in combination with a toxin inhibitor. Such an approach could help provide a universal antivenom.

Restraints

-

Market Penetration is Moving Slowly as there is Limited Access in Low- and Middle-Income Countries

One of the most important limitations of the anti-venom market is that it is accessible in low- and middle-income countries (LMICs), where snake bites and other related cases arise most often. Even though the highest burden of bites from venomous snakes occurs in rural areas of sub-Saharan Africa, South Asia, and Latin America, there are very few doses of anti-venom as these regions are where supply chains are weak, the healthcare infrastructure is poor, and is mitigated by affordability issues. As production is so expensive, manufacturers are unable to afford to distribute anti-venom in low-income settings, and sometimes, little government funding and low healthcare support restrict its availability. Many victims, therefore, either receive ineffective treatment or are left without treatment at all, resulting in unnecessary deaths or permanent disabilities.

Anti-Venom Market Segmentation Analysis:

By Species

The snake segment dominated the market and accounted for 51.22% market share in the anti-venom market in 2024, owing to the high prevalence of snakebites globally, especially in rural areas of Asia, Africa, and Latin America. Most venomous snakebites are caused by snakes of the cobra, krait, and viper species, and can lead to serious morbidity and even death if untreated. The high prevalence of these snake species, along with minimal access to emergency care in rural areas of countries where these snakes are endemic, continues to fuel global demand for snake-specific antivenoms.

The scorpion segment is anticipated to grow at the fastest CAGR throughout the forecast period, due to the rising incidence of scorpion stings in the Middle East, North Africa, and South Asia regions. Although the potency varies among species, scorpion venom, especially that of the pale-yellow scorpion (Leiurus quinquestriatus) and common black scorpion (Androctonus australis), can present a highly toxic neurotoxic threat, especially to children. This is partly driven by the increasing urban encroachment into natural habitats and partly due to improved diagnostic recognition resulting in higher rates of confirmed cases. These factors, coupled with the presence of various targeted government initiatives, are expected to create lucrative growth opportunities for scorpion antivenoms within the local market.

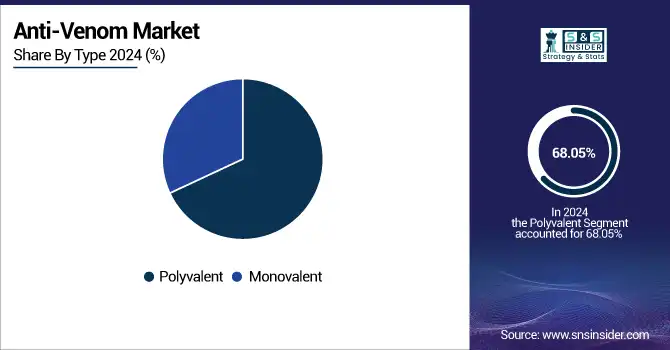

By Type

In 2024, the polyvalent segment led the anti-venom market with around 68.05% market share, as it is effective against bites from several venomous species. In regions (including India, Africa, and parts of Southeast Asia) where biodiversity is high and more than one venomous snake species occurs, the use of polyvalent antivenoms is a practical solution when the species responsible for a case of envenomation is unknown. Having the capability to counter multiple toxins with one treatment means they are an essential tool in any emergency care room, and a huge part of what makes these medicines popular among public health systems.

The monovalent segment becomes the fastest growing during the forecast period, supported by targeted therapies and venom profiles by regions. Healthcare workers are increasingly able to give species-specific antivenoms, as diagnostic tools develop, and snakebite identification improves. When the species is correctly identified, monovalent antivenoms are often more effective, have a lower risk of adverse reactions, and provide better patient outcomes. The rapid growth trajectory of this segment is being supported by an increase in investments for localized venom research and formulation of precision/exact-based antivenoms.

By Mode of Action

Neurotoxicus segment dominated the market and accounted for 33.15% market share in the anti-venom market in 2024, owing to a high proportion of life-threatening envenomation by snakes, such as cobras, kraits, and mambas that exert neurotoxic effects. When this neurotoxic envenomation occurs, it may cause respiratory paralysis and result in rapid death that demands the timely administration of an effective antivenom. The need to neutralize potentially lethal neurotoxin is a pressing demand for neurotoxic-targeted therapeutics, particularly in several countries across Asia and Africa, where this group of snake species is dominant and local public health authorities are focused on rapid-response formulations.

The cytotoxic segment is anticipated to grow at the fastest rate over the forecast period, owing to a significant number of envenomation by Russell's viper and puff adders that lead to severe tissue damage, necrosis, as well as possibly permanently debilitating long-term disabilities. There is greater recognition of the sequelae resulting from cytotoxic bites, including loss of limbs or chronic wounds, and this has led to increasing calls for early treatment with specific cytotoxic antivenoms. These are expected to further support the rural and urban healthcare sectors shortly, which will aid in the growth of this segment due to improvements in venom characterization and the development of better cytotoxin-neutralizing formulations.

By End Use

The hospitals segment dominated the anti-venom market share with a 61.28% in 2024, due to the increasing admission rates of severe envenomation requiring intensive care as well as specialized treatment in a hospital setting. Emergency response infrastructure, experienced personnel, and powerful monitoring of complications from neurotoxic, cytotoxic, or hemotoxic bites are better equipped in hospitals. They are the first depository for critical cases (particularly in urban and semi-urban areas) due to their capacity to store a wider diversity of antivenom and to provide high-level supportive care.

The clinics segment is expected to grow at the fastest rate, as primary healthcare access expands to rural and remote areas where snake bites and other envenomation are a significant problem. Via the provision of anti-venoms and training for rapid drop-in use at clinics, NGOs, and governments, they are bolstering local health system capacity. Rural healthcare facilities and further monitoring have allowed for quicker first-response treatment, and with this, fewer deaths and chronic complications.

Regional Insights:

North America dominated the anti-venom market with a 38.4% market share in 2024, due to the presence of well-established healthcare infrastructure, a developed regulatory framework, and wide research & development investments globally. Regional demand is fueled by the well-established presence of principal pharmaceutical companies, the boost of government-supported health programs, and the enhanced awareness of poisonous bites among medical professionals. The region also benefits from well-organized emergency services and extensive access to healthcare capacity, which allows for prompt delivery of antivenoms. In particular, the U.S., home to the legacy of these partnerships between universities and biotech firms that continue to develop new antivenoms, dominates.

The fastest growth in the anti-venom market in Asia Pacific is expected to be observed with a 9.44% CAGR due to the high incidence of venomous bites in the rural and tropical regions, especially in countries such as India, China, and Southeast Asian countries. The increasing pressure of snakebite envenomation and concurrent government efforts to fortify rural health services and enhance the availability of antivenom are propelling market growth. Additionally, local manufacturers partnering with global players for the development of region-specific affordable antivenoms, coupled with rising academic research in venom studies, are the major factors propelling the volume sales of antivenoms in this region, further complemented by favorable regulatory approvals.

The anti-venom market is growing significantly in Europe. In southern countries, including France, Italy, Spain, Greece, and Portugal, where vipers are widely distributed, the number of snakebites has increased across the region. The increased cases of envenomation have led to more awareness of its public health impact and the need for a concerted effort for effective antivenom therapies by governments and the biopharmaceutical industry. Moreover, the European Union's harmonization of regulations guarantees that the quality and safety of antivenom products are uniformly assessed, while making them available in its member nations. Several health organizations partner with pharmaceutical companies to enhance the development and supply of modern antivenom in the region.

The anti-venom market in Latin America is expected to experience moderate growth due to the high prevalence of venomous species and elevated rates of envenomation cases. To support market development. However, persistent logistical challenges, difficulties in delivering to rural areas, and inconsistent funding hinder a faster expansion of anti-venom market trends throughout the region.

Snakebite is an important public health problem in Latin America that is responsible for an estimated 70,000 cases of snakebite envenomation each year, but the true number is likely higher than the reported value, as underreporting is a concern.

The Middle East & Africa (MEA) region shows steady growth driven by the increasing burden of venomous bites, especially in rural and underserved populations. The market is benefiting from increased healthcare infrastructure and life-saving treatment accessibility through various government and NGO-led initiatives. But structural challenges surrounding production costs, extraction, and access to care are not facilitating faster development in the anti-venom market analysis.

Get Customized Report as per Your Business Requirement - Enquiry Now

Anti-Venom Market Key Players:

CSL Limited, Pfizer Inc., Merck & Co. Inc., Bharat Serums and Vaccines Ltd., VINS Bioproducts Limited, Rare Disease Therapeutics Inc., Instituto Bioclon, MicroPharm Ltd., Haffkine Bio-Pharmaceutical Corporation Ltd., Instituto Butantan, and other players.

Recent Developments in the Anti-Venom Market:

-

May 2025 – Scientists at Columbia University, in collaboration with biotech firm Centivax, have created the world's first broad-spectrum antivenom that can counteract neurotoxins from 19 of the deadliest snake species, such as cobras, mambas, and kraits. The breakthrough was achieved by examining the blood of self-immunizing volunteer Tim Friede, who has survived more than 200 venomous snakebites over 18 years.

-

June 2024 – MicroPharm Limited revealed the acquisition of Sanofi Pasteur's antivenom equine immunoglobulin product line, including Viperfav, Bothrofav, Scorpifav, Fav-Afrique, and Favirept, which was completed successfully. The process entailed the transfer of intangible and certain tangible assets, representing a strategic addition to MicroPharm's antivenom portfolio.

-

August 2022 – Bharat Serums and Vaccines (BSV), a biopharmaceutical major, collaborated with the Indian Institute of Science (IISc), Bengaluru, to create the next generation of snakebite therapies. The partnership, with IISc's Evolutionary Venomics Lab, seeks to produce region-specific antivenoms. Existing therapies in India are based on a single polyvalent antivenom against the nation's 'big four' snake species, making it imperative to have more targeted remedies.

Anti-Venom Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.27 Billion Market Size by 2032 USD 2.46 Billion CAGR CAGR of 8.60% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Species (Snake – Common Cobra, Common Krait, Russell Viper, Others; Scorpion; Spider; Other Species)

• By Type (Polyvalent, Monovalent)

• By Mode of Action (Cytotoxic, Neurotoxic, Haemotoxic, Cardiotoxic, Myotoxic, Others)

• By End Use (Hospitals, Clinics, Ambulatory Surgical Centers)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles CSL Limited, Pfizer Inc., Merck & Co. Inc., Bharat Serums and Vaccines Ltd., VINS Bioproducts Limited, Rare Disease Therapeutics Inc., Instituto Bioclon, MicroPharm Ltd., Haffkine Bio-Pharmaceutical Corporation Ltd., Instituto Butantan, and other players.