Technology CAD Software Market Report Scope & Overview:

The Technology CAD Software Market is valued at USD 16.15 billion in 2025E and is expected to reach USD 30.17 billion by 2033, growing at a CAGR of 8.20% from 2026-2033.

Growth in the Technology CAD Software Market is driven by increasing adoption of digital design tools across manufacturing, construction, automotive, and electronics industries. Rising demand for 3D modeling, simulation, and cloud-based CAD solutions supports faster product development and design accuracy. Integration of AI, automation, and advanced visualization enhances productivity, while growing infrastructure projects and Industry 4.0 initiatives further accelerate global CAD software adoption.

In 2025, global Technology CAD Software adoption rose by 13%, fueled by infrastructure expansion and Industry 4.0—65% of automotive and electronics firms used cloud-based 3D CAD with AI-driven simulation, cutting time-to-market by 30% and boosting design precision.

To Get More Information On Technology CAD Software Market - Request Free Sample Report

Technology CAD Software Market Size and Forecast

-

Market Size in 2025E: USD 16.15 Billion

-

Market Size by 2033: USD 30.17 Billion

-

CAGR: 8.20% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Technology CAD Software Market Trends

-

Growing adoption of AI-enabled CAD tools to automate design workflows and improve accuracy across engineering applications

-

Increasing demand for cloud-based CAD platforms supporting remote collaboration and scalable design environments

-

Rising integration of simulation and analysis features within CAD software to accelerate product development cycles

-

Expansion of CAD usage across electronics, construction, and manufacturing industries for complex design requirements

-

Growing preference for subscription-based and SaaS CAD models to reduce upfront costs and improve accessibility

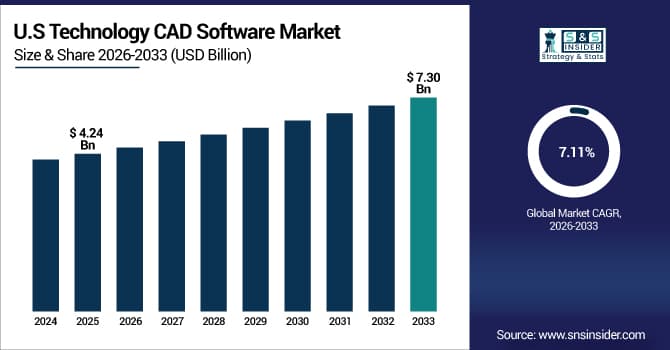

The U.S. Technology CAD Software Market is valued at USD 4.24 billion in 2025E and is expected to reach USD 7.30 billion by 2033, growing at a CAGR of 7.11% from 2026-2033.

Growth in the U.S. Technology CAD Software Market is supported by strong adoption of advanced design tools across manufacturing, aerospace, automotive, and construction sectors. Increasing use of cloud-based CAD, AI-driven design automation, and rising investments in digital engineering and smart infrastructure projects further drive market expansion.

Technology CAD Software Market Growth Drivers:

-

Increasing adoption of 3D modeling, simulation, and digital prototyping across manufacturing and construction industries is driving demand for advanced CAD software solutions

Manufacturers and construction companies are increasingly adopting 3D modeling, simulation, and digital prototyping to improve design accuracy, reduce development time, and minimize production errors. CAD software enables virtual testing, design optimization, and early detection of flaws before physical production begins. This reduces costs and accelerates product development cycles. Growing demand for complex product designs, customized components, and precision engineering further strengthens reliance on advanced CAD tools, making them essential across automotive, aerospace, industrial machinery, and construction sectors worldwide.

In 2025, 68% of manufacturing and construction firms adopted advanced CAD software for 3D modeling and digital prototyping—boosting design accuracy by 32% and cutting physical prototyping costs by 40% globally.

-

Growing integration of AI, cloud computing, and automation in design workflows is enhancing productivity and accelerating CAD software adoption globally

The integration of artificial intelligence, cloud platforms, and automation is transforming traditional CAD workflows. AI-driven features such as generative design, predictive modeling, and automated drafting significantly improve design efficiency and innovation. Cloud-based CAD enables real-time collaboration, remote access, and scalable computing power. These technologies reduce manual effort, improve productivity, and shorten design cycles. As organizations embrace digital transformation and distributed work environments, advanced CAD solutions with intelligent and cloud-enabled capabilities are witnessing accelerated adoption across global industries.

In 2025, AI and cloud integration in CAD workflows drove a 38% increase in global adoption, with design teams achieving 30% faster prototyping and 25% higher accuracy through intelligent, automated modeling and real-time collaboration.

Technology CAD Software Market Restraints:

-

High software licensing costs and subscription fees limit affordability for small businesses, startups, and individual designers, restricting broader CAD software adoption

Advanced CAD software often involves high upfront licensing fees or recurring subscription costs, making it financially challenging for small enterprises and independent designers. Additional expenses related to hardware upgrades, add-on modules, and maintenance further increase total ownership costs. These financial barriers discourage adoption among cost-sensitive users, particularly in emerging markets. Smaller firms may rely on basic or open-source tools, limiting access to advanced features. As a result, high pricing structures restrict broader market penetration and slow adoption among smaller organizations.

In 2025, 65% of small businesses and independent designers cited high licensing and subscription fees—often exceeding USD2,000 annually—as key barriers, significantly limiting access to advanced CAD tools despite growing demand for digital design capabilities.

-

Steep learning curve and requirement for skilled professional slow implementation of advanced CAD tools, increasing training costs and reducing operational efficiency

Advanced CAD platforms require specialized skills and extensive training to operate effectively. Complex interfaces, advanced simulation tools, and customization features demand experienced designers and engineers. Organizations must invest in training programs, certifications, and skilled personnel, increasing operational costs. The shortage of CAD-trained professionals further complicates adoption, particularly for small companies. Slow onboarding and reduced productivity during learning phases can delay implementation. These challenges limit rapid deployment of advanced CAD solutions and reduce efficiency gains, especially in organizations with limited technical expertise.

In 2025, 60% of manufacturers reported delayed CAD adoption due to steep learning curves, with training costs rising by 25% and operational efficiency lagging by up to 30% amid shortages of skilled CAD professionals.

Technology CAD Software Market Opportunities:

-

Rising demand for cloud-based and SaaS CAD platforms offers opportunities to provide scalable, collaborative, and cost-effective design solutions across industries

Cloud-based and SaaS CAD platforms are gaining popularity due to their flexibility, lower upfront costs, and ease of access. These solutions enable real-time collaboration among distributed teams, automatic updates, and scalable storage without heavy infrastructure investments. Small and medium-sized enterprises benefit from subscription-based pricing models that reduce financial barriers. Cloud CAD also supports remote work and global project coordination. As digital collaboration becomes essential, vendors offering secure, cloud-native CAD solutions can capture new customers and expand market reach.

In 2025, 70% of design teams adopted cloud-based and SaaS CAD platforms, enabling real-time collaboration, reducing upfront costs by 35%, and accelerating product development across automotive, aerospace, and consumer goods sectors.

-

Expansion of smart manufacturing, Industry 4.0, and digital twin technologies creates opportunities for CAD software vendors to deliver integrated, intelligent design ecosystems

The growth of smart manufacturing and Industry 4.0 initiatives is driving demand for CAD software integrated with digital twins, IoT, and simulation platforms. Digital twin technology allows real-time visualization and optimization of products and processes throughout their lifecycle. CAD vendors can offer integrated ecosystems combining design, simulation, and manufacturing data. This enhances predictive maintenance, performance optimization, and innovation. As industries adopt connected and intelligent manufacturing systems, CAD software providers have significant opportunities to deliver comprehensive, data-driven design solutions supporting end-to-end digital transformation.

In 2025, 65% of CAD vendors integrated AI and digital twin capabilities—driving a 40% increase in intelligent, connected design ecosystems adopted by smart manufacturing and Industry 4.0 initiatives globally.

Technology CAD Software Market Segment Highlights

-

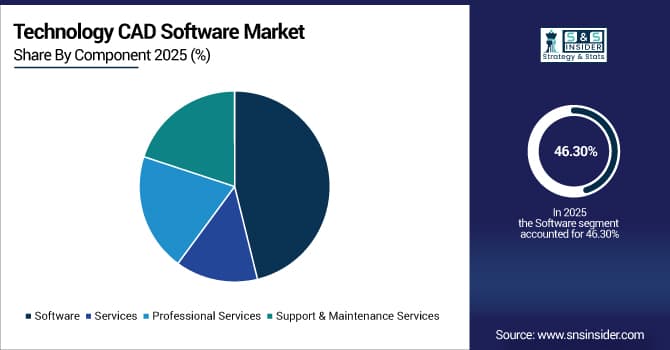

By Component: Software led with 46.3% share, while Professional Services is the fastest-growing segment with CAGR of 11.4%.

-

By Technology: 3D CAD led with 41.8% share, while AI-Enabled CAD is the fastest-growing segment with CAGR of 13.6%.

-

By Application: Product Design & Development led with 39.5% share, while Simulation & Testing is the fastest-growing segment with CAGR of 12.1%.

-

By End User: Automotive led with 34.7% share, while Electronics & Semiconductor is the fastest-growing segment with CAGR of 12.9%.

Technology CAD Software Market Segment Analysis

By Component: Software led, while Professional Services is the fastest-growing segment.

Software dominates the Technology CAD Software market as it forms the core platform for design, drafting, modeling, and simulation across industries. High adoption among automotive, aerospace, construction, and manufacturing firms drives consistent demand. Continuous upgrades, cloud-based deployment, subscription pricing models, and integration with PLM and CAM systems further reinforce dominance. Software solutions enable productivity improvements, accuracy, and faster design cycles, making them indispensable for both large enterprises and small-to-medium design teams.

Professional Services is the fastest-growing component segment due to rising demand for customization, implementation, consulting, and training services. As CAD platforms become more complex with AI, cloud, and simulation capabilities, organizations increasingly rely on expert services to optimize deployment and maximize ROI. Growth is also supported by digital transformation initiatives, migration from legacy systems, and increasing adoption among SMEs that require external expertise for workflow integration and advanced design automation.

By Technology: 3D CAD led, while AI-Enabled CAD is the fastest-growing segment.

3D CAD dominates the technology segment due to its ability to support detailed visualization, parametric modeling, and accurate product representation throughout the design lifecycle. It enables efficient collaboration, error reduction, and seamless transition from design to manufacturing. Widespread use across automotive, aerospace, and industrial machinery sectors, along with compatibility with additive manufacturing and simulation tools, ensures sustained dominance. Continuous enhancements in rendering, cloud collaboration, and real-time design validation strengthen its market position.

AI-Enabled CAD is the fastest-growing technology segment as artificial intelligence increasingly automates design processes, optimizes geometry, and enhances decision-making. Features such as generative design, predictive modeling, and automated error detection significantly reduce development time and costs. Growing demand for smart design tools, coupled with advances in machine learning and cloud computing, is driving adoption across high-tech manufacturing and electronics industries seeking faster innovation and improved design accuracy.

By Application: Product Design & Development led, while Simulation & Testing is the fastest-growing segment.

Product Design & Development dominates application usage as CAD software remains central to conceptualization, modeling, and iterative refinement of products. Industries rely heavily on CAD tools to shorten time-to-market, improve design accuracy, and support cross-functional collaboration. Integration with simulation, prototyping, and manufacturing workflows further enhances its importance. The constant need for innovation, customization, and rapid product upgrades sustains strong demand for CAD solutions in design and development activities.

Simulation & Testing is the fastest-growing application segment due to increasing emphasis on virtual validation, cost reduction, and performance optimization. Organizations are shifting toward digital testing environments to minimize physical prototyping and accelerate development cycles. Advances in computational power, AI-driven simulation, and real-time analysis tools enable engineers to test multiple scenarios efficiently. Regulatory compliance requirements and demand for lightweight, high-performance designs further fuel growth in simulation-driven CAD applications.

By End User: Automotive led, while Electronics & Semiconductor is the fastest-growing segment.

The automotive sector dominates CAD software usage due to its high design complexity, frequent model updates, and stringent safety and performance standards. CAD tools are extensively used for vehicle design, powertrain development, aerodynamics, and manufacturing optimization. The transition toward electric and autonomous vehicles further increases reliance on advanced CAD solutions. Continuous innovation cycles, large production volumes, and strong R&D investment ensure automotive remains the leading end-user segment.

Electronics & Semiconductor is the fastest-growing end-user segment driven by rapid advancements in miniaturization, chip design, and smart device manufacturing. CAD software supports precise layout design, thermal analysis, and integration of complex electronic components. Growing demand for consumer electronics, IoT devices, and semiconductor fabrication capacity is accelerating adoption. Increased investment in high-performance computing, AI chips, and advanced packaging technologies further strengthens CAD software demand in this sector.

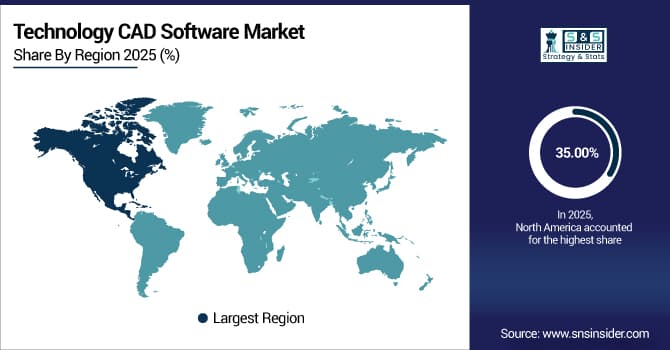

Technology CAD Software Market Regional Analysis

North America Technology CAD Software Market Insights:

North America dominated the Technology CAD Software Market with a 35.00% share in 2025 due to strong adoption across automotive, aerospace, construction, and industrial manufacturing sectors. The presence of leading CAD software developers, high R&D investments, and early adoption of advanced technologies such as AI-enabled design and cloud-based CAD platforms further reinforced regional dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Technology CAD Software Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 10.12% from 2026–2033, driven by rapid industrialization, expanding manufacturing bases, and increasing adoption of digital design tools. Rising infrastructure development, growth of automotive and electronics industries, and increasing investments in smart manufacturing technologies are accelerating CAD software demand across the region.

Europe Technology CAD Software Market Insights

Europe held a significant share in the Technology CAD Software Market in 2025, supported by strong industrial engineering capabilities, widespread adoption across automotive, aerospace, and construction sectors, and high demand for precision design solutions. The region’s emphasis on innovation, sustainability-driven design standards, and continuous investment in digital manufacturing and Industry 4.0 technologies strengthened market growth.

Middle East & Africa and Latin America Technology CAD Software Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Technology CAD Software Market in 2025, driven by expanding infrastructure projects, gradual industrial modernization, and increasing adoption of digital design tools. Rising construction activities, growing manufacturing investments, and improving access to cloud-based CAD platforms supported the regions’ emerging market presence.

Technology CAD Software Market Competitive Landscape:

Autodesk Inc.

Autodesk Inc., headquartered in the United States, is a global leader in 3D design, engineering, and entertainment software. Renowned for its flagship products like AutoCAD, Fusion 360, and Revit, Autodesk serves industries ranging from architecture and construction to manufacturing and media. The company emphasizes innovation, cloud-based solutions, and collaboration tools, enabling efficient design workflows and enhanced productivity. Autodesk’s focus on sustainability, digital prototyping, and industry-specific solutions has made it a key player in the global CAD software market.

-

2024, Autodesk expanded Fusion with Fusion Electronics, a unified platform for PCB design, schematic capture, and circuit simulation—bridging mechanical and electronic design.

Dassault Systèmes

Dassault Systèmes, based in France, is a premier provider of 3D design, engineering, and simulation software. Its flagship platform, CATIA, along with SOLIDWORKS and ENOVIA, serves sectors such as aerospace, automotive, industrial equipment, and consumer goods. The company focuses on digital twin technology, collaborative innovation, and lifecycle management solutions, empowering organizations to optimize product design, simulation, and production processes. Dassault Systèmes has a strong global presence, helping clients improve efficiency, reduce costs, and accelerate innovation across industries.

-

2023, Dassault Systèmes launched the 3DEXPERIENCE Semiconductor Suite, a multi-scale platform for chip-package-system co-design and thermal-stress simulation.

Siemens Digital Industries Software

Siemens Digital Industries Software, part of the Siemens AG group in Germany, offers comprehensive CAD, CAM, and PLM solutions under the NX and Solid Edge brands. The company supports manufacturing, automotive, aerospace, and electronics industries with integrated software for design, simulation, and product lifecycle management. Siemens focuses on digitalization, smart manufacturing, and industrial IoT, helping businesses accelerate innovation, improve product quality, and reduce time-to-market. Its solutions enhance collaboration, efficiency, and precision across global engineering workflows.

-

2025, Siemens launched the Xpedition Hyperintegration Platform, unifying IC layout, PCB design, and multi-physics simulation for AI/ML accelerators, 5G RF, and automotive SoCs.

Technology CAD Software Market Key Players

Some of the Technology CAD Software Market Companies

-

Autodesk Inc.

-

Dassault Systèmes

-

Siemens Digital Industries Software

-

PTC Inc.

-

Bentley Systems

-

Trimble Inc.

-

Hexagon AB

-

Nemetschek Group

-

ANSYS Inc.

-

Altair Engineering Inc.

-

Bricsys NV

-

ZWSOFT

-

IronCAD LLC

-

Corel Corporation

-

Graebert GmbH

-

Onshape Inc.

-

AVEVA Group plc

-

EPLAN Software & Services

-

ActCAD LLC

-

Solid Edge (Siemens)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 16.15 Billion |

| Market Size by 2033 | USD 30.17 Billion |

| CAGR | CAGR of 8.20% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services, Professional Services, Support & Maintenance Services) • By Technology (2D CAD, 3D CAD, Building Information Modeling, Simulation & Analysis CAD, AI-Enabled CAD) • By Application (Product Design & Development, Drafting & Modeling, Prototyping & Visualization, Simulation & Testing, Manufacturing Design) • By End User (Automotive, Aerospace & Defense, Industrial Machinery, Construction & Architecture, Electronics & Semiconductor) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Autodesk Inc., Dassault Systèmes, Siemens Digital Industries Software, PTC Inc., Bentley Systems, Trimble Inc., Hexagon AB, Nemetschek Group, ANSYS Inc., Altair Engineering Inc., Bricsys NV, ZWSOFT, IronCAD LLC, Corel Corporation, Graebert GmbH, Onshape Inc., AVEVA Group plc, EPLAN Software & Services, ActCAD LLC, Solid Edge (Siemens) |