Telecom Equipment Market Report Scope & Overview:

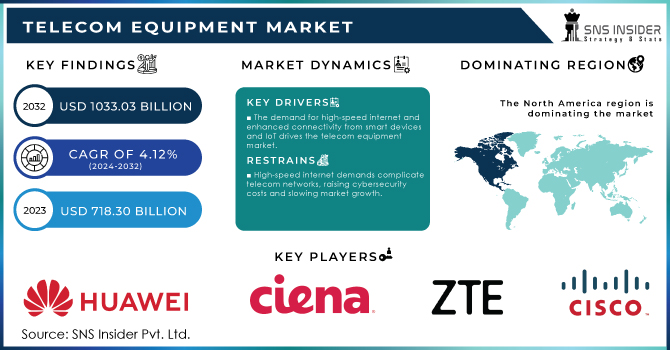

The Telecom Equipment Market size was estimated at USD 747.89 Billion in 2024 and is expected to reach USD 1033.03 Billion by 2032 at a CAGR of 4.12% during the forecast period of 2025-2032.

TV and radio broadcasters, as well as line-based communication equipment, are excellent examples of how telecom equipment producers can increase revenue and market presence. The telecommunications equipment industry is experiencing growth due to the expansion of radio and television broadcasts, as well as social media platforms, along with the increased adoption of 4G and LTE networks, leading to progress in the sector. Additionally, the rise of the telecom cabling equipment industry is being driven by the growth of cell towers and the demand for advanced network gear for 5G.

Get more information on Telecom Equipment Market - Request Free Sample Report

Key Trends Shaping the Telecom Equipment Market

-

5G Expansion & Infrastructure Demand: Rapid rollout of 5G networks drives demand for advanced telecom equipment, including base stations, antennas, and network core systems.

-

IoT & Edge Computing Growth: Increasing adoption of IoT and edge computing fuels telecom infrastructure upgrades for faster connectivity and low-latency performance.

-

Cloud-Native Networks: Shift toward cloud-native architectures accelerates adoption of virtualized and software-defined networking (SDN) solutions.

-

Cybersecurity Integration: Rising cyber threats push telecom providers to integrate advanced security features directly into network equipment.

-

Sustainability & Green Initiatives: Demand for energy-efficient telecom hardware rises, driven by environmental regulations and corporate sustainability goals.

Telecom Equipment Market Drivers:

-

The surge in demand for high-speed internet and enhanced connectivity, driven by the proliferation of smart devices and the Internet of Things (IoT), is a significant driver of the telecom equipment market.

The proliferation of smart devices and the Internet of Things (IoT) has significantly driven the need for faster and more reliable internet connections. With the growing number of connected devices, the demand for robust and dependable internet infrastructure has surged. This trend compels telecom companies to upgrade their networks to handle higher data transfer speeds and lower latency effectively. Consequently, there is a marked increase in the telecom equipment market as service providers invest heavily in new technologies. These advancements are designed to support the expanding ecosystem of interconnected devices, ensuring seamless connectivity and enhancing user experiences. The focus on improving network capabilities is critical to meet the evolving demands of modern digital environments, making it a key driver in the growth of the telecom equipment sector.

-

Increasing demand for high-speed internet and connectivity is driven by technological advancements in telecom, such as 5G, AI, and ML, which enhance service efficiency and reliability, supporting innovations like autonomous vehicles, smart cities, and advanced healthcare solutions.

The telecommunications industry is being transformed by developments in technology like 5G, artificial intelligence (AI), and machine learning (ML), leading to major improvements in service efficiency and reliability. The high-speed connectivity and low latency of 5G technology allow for the creation of cutting-edge applications such as self-driving cars, smart cities, and advanced healthcare solutions. AI and ML play a role in enhancing network management, forecasting maintenance requirements, and customizing customer interactions. With the advancement of these technologies, telecommunications networks need to adjust to accommodate higher data usage and back advanced applications, leading to a need for more advanced equipment and infrastructure. This advancement is driving expansion in the telecom equipment industry, with companies purchasing state-of-the-art technology to remain competitive and fulfill the increasing demands of contemporary digital services.

Telecom Equipment Market Restraints:

-

The growing complexity of telecom networks, driven by the demand for high-speed internet and connectivity, increases their vulnerability to advanced cybersecurity threats, requiring expensive and continuous security investments that can slow down market growth and the adoption of new technologies.

The increasing intricacy of telecommunications networks, driven by rising need for fast internet and widespread connectivity, has greatly increased their susceptibility to advanced cybersecurity risks. Telecom companies face a higher likelihood of cyberattacks, like data breaches and network intrusions, as they enhance their infrastructure and incorporate cutting-edge technologies to cater to customer demands. The increased danger level requires significant and continuous funding in cybersecurity tools like advanced firewalls, intrusion detection systems, and routine security audits. These financial obligations may burden resources and redirect funds from other important sectors, which could hinder the implementation of new technologies and hinder market expansion. Telecom companies face difficulties in maintaining strong security measures while also focusing on developing and growing their networks due to the continuous need for reliable security solutions.

Telecom Equipment Market Segmentation Analysis:

-

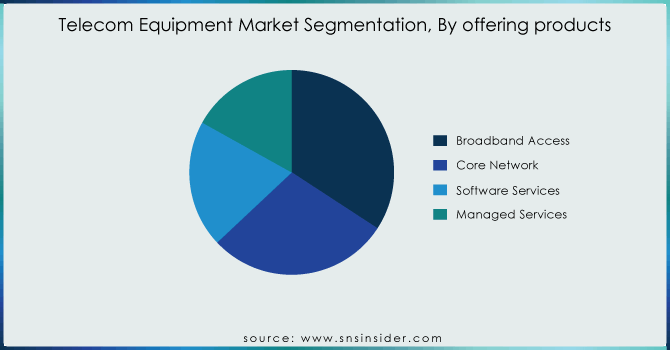

By offering products, Broadband Access Products Lead the Telecom Equipment Market with 34.2% Share in 2024

Broadband Access products dominated the telecom equipment market in 2024 with a market share 34.2%, due to the continuous expansion of high-speed internet services. This dominance is driven by the increased demand for high-speed internet, fueled by the growing consumption of streaming services, online gaming, and remote work, necessitating robust broadband infrastructure.

Software Services are emerging as the fastest-growing segment in the telecom equipment market due to several key factors. The shift towards network virtualization through software-defined networking (SDN) and network functions virtualization (NFV) is reducing reliance on hardware, increasing demand for software solutions.

Get Customized Report as per your Business Requirement - Request For Customized Report

-

By Infrastructure, Wireless Infrastructure Dominates Telecom Equipment Market with 58% Share in 2024

Wireless infrastructure led the telecom equipment market in 2024 with a market share 58% and encompasses equipment and technologies such as mobile base stations, antennas, routers, and related components essential for cellular networks, including 3G, 4G, and the rapidly expanding 5G networks. The dominance of this segment is driven by the widespread adoption of mobile devices, as the proliferation of smartphones and other mobile gadgets continuously demands enhanced mobile network capacity and coverage

Telecom Equipment Market Regional Analysis:

-

North America Telecom Equipment Market Insights

In 2024, North America dominates the Telecom Equipment Market with an estimated share of 38.02%, driven by rapid 5G rollout, widespread broadband expansion, and increasing demand for mobile connectivity. The region benefits from advanced network infrastructure, high smartphone penetration, and continuous investments in wireless and fiber-optic networks. Adoption of software-defined networking (SDN), network virtualization, and edge computing enhances network efficiency, capacity, and reliability, supporting extensive deployment of telecom equipment that strengthens communication, digital services, and enterprise operations across North America.

-

United States Leads Telecom Equipment Market in North America

The U.S. dominates with the largest market share, supported by early 5G deployment, strong government initiatives, and significant telecom operator investments in high-speed networks. Continuous expansion of broadband access, deployment of mobile base stations, and adoption of cloud-based network solutions improve connectivity and service delivery. Innovation in wireless technologies and fiber infrastructure reinforces U.S. leadership, ensuring the country remains the key driver of North American telecom equipment market growth.

-

Asia Pacific Telecom Equipment Market Insights

Asia Pacific is the fastest-growing region with an estimated CAGR in 2024, fueled by rapid industrialization, urbanization, and rising mobile broadband demand. Government initiatives supporting 5G networks and digital transformation accelerate infrastructure expansion. Increasing smartphone penetration, IoT adoption, and demand for high-speed connectivity drive large-scale telecom equipment deployment. The region also benefits from growing domestic manufacturing of network devices and cost advantages that attract global telecom investments, promoting faster market growth.

-

China Leads Telecom Equipment Market Growth in Asia Pacific

China dominates the Asia Pacific market due to its large-scale 5G deployment, extensive fiber networks, and government-backed digital infrastructure initiatives. Domestic telecom operators are aggressively expanding mobile networks, while equipment manufacturers invest in R&D for advanced wireless technologies. High adoption of smartphones, IoT devices, and cloud services fuels telecom equipment demand. These factors position China as a central driver of market growth, enabling Asia Pacific to rapidly expand its telecom infrastructure.

-

Europe Telecom Equipment Market Insights

In 2024, Europe holds a significant share in the Telecom Equipment Market, driven by digital transformation initiatives, 5G adoption, and demand for high-speed broadband and IoT infrastructure. Enterprises and governments are upgrading networks to support smart cities, industrial automation, and connected services. Investment in sustainable and energy-efficient telecom equipment also contributes to steady growth, ensuring Europe remains competitive in global digital connectivity.

-

Germany Dominates Europe’s Telecom Equipment Market

Germany leads the European market due to strong industrial and manufacturing sectors, early 5G adoption, and government support for digital infrastructure. Telecom operators are deploying advanced wireless and fiber-optic networks to enhance connectivity, industrial automation, and smart city applications. The country’s focus on technology innovation and sustainable network solutions strengthens Germany’s position as Europe’s leading market for telecom equipment.

-

Latin America and Middle East & Africa Telecom Equipment Market Insights

The Telecom Equipment Market in Latin America and MEA is witnessing steady growth in 2024, driven by mobile network expansion, broadband penetration, and digital infrastructure projects. Investments in 4G and early 5G upgrades, alongside rising smartphone adoption, support telecom equipment demand. Regional governments are promoting connectivity initiatives, enhancing network coverage, and enabling enterprise and consumer access to high-speed communication services.

-

Regional Leaders in Latin America and MEA

Brazil leads Latin America due to extensive fiber and mobile network expansion, rising smartphone penetration, and strong telecom operator investments. In MEA, the UAE dominates, supported by smart city projects, government-backed infrastructure upgrades, and growing demand for high-speed mobile and broadband networks, positioning the country as the region’s leader in telecom equipment adoption.

Competitive Landscape Telecom Equipment Market:

Cisco Systems, Inc.

Cisco Systems is a global leader in networking and telecom solutions, providing advanced hardware, software, and cloud-based services. The company offers routers, switches, wireless solutions, and security systems, alongside innovative cloud platforms like Cisco Workflows that streamline network management and automation. Cisco focuses on enabling digital transformation across enterprises, data centers, and service providers by integrating AI, analytics, and automation into its solutions. Its strong global presence, extensive R&D investments, and strategic partnerships allow organizations to enhance connectivity, operational efficiency, and cybersecurity, making Cisco a key player in the evolving telecom and IT infrastructure landscape.

-

In June 2024, Cisco introduced Cisco Workflows, a cloud-based service designed to simplify and automate networking configuration across branches, campuses, data centers, and cloud environments. The platform aims to reduce operational friction, enhance efficiency, and streamline the management of network tasks through automated workflows.

Ericsson AB

Ericsson is a leading provider of telecom infrastructure, software, and services, specializing in 5G networks, IoT solutions, and managed operations. The company delivers cutting-edge radio access networks, core network solutions, and enterprise-focused connectivity services, including private and neutral host 5G solutions. Ericsson emphasizes flexibility, scalability, and simplified deployment to meet diverse enterprise and service provider needs. With a strong global footprint, continuous innovation, and strategic collaborations, Ericsson drives network modernization, supports digital transformation, and enhances wireless connectivity. Its expertise in end-to-end telecom solutions positions the company as a critical player in the global telecom equipment market.

-

In September 2024, Ericsson launched its Enterprise 5G solutions, including private and neutral host networks, targeting mission-critical 5G connectivity for diverse enterprise environments. Leveraging advanced radio, software, and managed operations technologies, Ericsson’s offerings address the limitations of Wi-Fi and distributed antenna systems, emphasizing flexible, easy-to-deploy solutions across the entire lifecycle—from acquisition and installation to operation.

Telecom Equipment Market Companies:

-

Huawei Technologies Co., Ltd.

-

Ericsson AB

-

Nokia Corporation

-

Samsung Electronics Co., Ltd.

-

Cisco Systems, Inc.

-

ZTE Corporation

-

Ciena Corporation

-

Juniper Networks, Inc.

-

NEC Corporation

-

Fujitsu Limited

-

Corning Incorporated

-

CommScope Holding Company, Inc.

-

ADTRAN, Inc.

-

Infinera Corporation

-

Arista Networks, Inc.

-

Extreme Networks, Inc.

-

Tellabs, Inc.

-

Motorola Solutions, Inc.

-

Ribbon Communications Inc.

-

Datang Telecom Technology & Industry Group Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 747.89 Billion |

| Market Size by 2032 | US$ 1033.03 Billion |

| CAGR | CAGR of 4.12% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By offerings products (Broadband Access, Core Network, Software Services and Managed Services) • By Infrastructure (Wireless Infrastructure and Wired Infrastructure) • By End User (Consumer Electronics, BFSI, Retail, Media, Defense and others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Huawei Technologies Co., Ltd., Ericsson AB, Nokia Corporation, Samsung Electronics Co., Ltd., Cisco Systems, Inc., ZTE Corporation, Ciena Corporation, Juniper Networks, Inc., NEC Corporation, Fujitsu Limited, Corning Incorporated, CommScope Holding Company, Inc., ADTRAN, Inc., Infinera Corporation, Arista Networks, Inc., Extreme Networks, Inc., Tellabs, Inc., Motorola Solutions, Inc., Ribbon Communications Inc., Datang Telecom Technology & Industry Group Co., Ltd. |