Audio Codec Market Report Scope & Overview:

Get More Information on Audio Codec Market - Request Sample Report

The Audio Codec Market Size was valued at USD 6.8 Billion in 2023 and is expected to reach USD 10.9 Billion by 2032, growing at a CAGR of 5.5% over the forecast period 2024-2032.

The audio codec market is growing rapidly due to the growing adoption of streaming audio services and a wide demand for high-definition audio. According to the latest statistics of the U.S. Bureau of Economic Analysis, the entertainment and media industry in the United States alone generated around USD 877 billion in 2023, with audio streaming services contributing highly towards this growth. In addition, government initiatives for example Federal Communications Commission's (FCC) activities towards developing broadband access have further supported the environment for the consumption of digital audio content. Increased use of smart devices has also increased demand for codecs in applications such as telecommunications, automotive, and consumer electronics. The growing interest in audio quality improvement and user experience results in sophisticated audio codecs with improved compression and fidelity of sound. The progress towards 5G is also increasingly going to boost the audio codec market because the streaming and high-quality audio experience become smoother on multiple platforms. In addition, the audio codec market will have growth with these dynamics in place, coupled with beneficial government policies and an expanding consumer base looking for better audio experiences.

The rising popularity of smart home devices, smart speakers, and home assistants is leveraging this trend of growing popularity to trigger the increasing demand for high-quality audio codecs. They are needed for voice recognition, including proper processing of commands, thereby ensuring clear voice interactions. As the smart home market grows, the need for advanced audio codecs will likely increase, highlighting the importance of superior audio processing in connected devices. In addition, there is a growing demand for high-resolution audio, also known as Hi-Res Audio set of sound qualities beyond common formats. Both audiophiles and mass users are looking for devices and services that can ensure their delivery of improved audio fidelity. The demand for advanced audio codecs capable of enabling higher bit and sample rates requirements for delivering the level of detailedness that Hi-Res Audio formats represent is an aftermath of these trends. This trend is boosting the adoption of advanced audio codecs capable of supporting higher bit and sample rates, which are vital for delivering the detailed sound that Hi-Res Audio formats require. With more streaming services and audio equipment manufacturers adopting Hi-Res Audio, the market for compatible codecs is expected to expand.

Audio Codec Market Dynamics

Drivers

-

The significant rise in smartphone ownership is driving the demand for audio codecs, as these devices are essential for high-fidelity audio streaming and playback, enhancing user experience across various applications

-

The rapid growth of digital streaming platforms, including music and video services, is creating a substantial need for efficient audio codecs that can handle high-quality audio transmission and adaptive bitrate streaming, leading to market growth.

-

Innovations in audio technology, particularly the development of AI-powered codecs, are improving audio quality and efficiency. This trend is fostering demand for more sophisticated codecs that enhance performance across devices and applications

The growing penetration of streaming services is one of the major growth factors for the audio codec market. The explosion of digital streaming services has increased the need for high-quality audio playback. According to a recent report, global music streaming revenue is projected to reach $20 billion by 2025, driven largely by increasing subscriptions and user engagement on platforms like Spotify and Apple Music. Such services depend primarily on modern audio codecs for efficient bandwidth while maintaining better sound quality. For instance, adaptive bitrate streaming technologies, which adjust the quality of audio based on the user's internet speed, are becoming increasingly popular. This ensures uninterrupted playback and an enhanced user experience, particularly for listeners in regions with inconsistent connectivity.

Additionally, AI-powered codecs that use intelligent algorithms to compress audio without compromising quality have taken the game to a different level. Increasingly, Dolby and other firms are incorporating their deep codecs into streaming platforms, providing users with immersive audio experiences. As more users opt for streaming over traditional media, the reliance on effective audio codecs to meet quality and efficiency demands will only intensify, making this a critical driver for the audio codec market.

Restraints

-

The evolving standards and protocols for audio codecs can create compatibility issues across devices and platforms, posing a challenge for manufacturers and developers in the market.

-

The costs associated with research and development of advanced audio codecs can be prohibitive, particularly for smaller companies, which may limit competition and innovation in the market.

One of the major challenges of the audio codec market is the complexity of the standards of the codec. As audio technology is evolving continuously, people invent new standards and protocols continuously, which leads to compatibility issues across different kinds of devices and platforms. For manufacturers, inconsistency in media would be challenging as they need to support a large array of audio formats while ensuring that these products maintain high-quality performance.

Moreover, the lack of universally adopted standards can result in fragmentation, complicating the integration of new codecs into existing systems. This may, in turn, discourage organizations from investing in advanced audio technologies and therefore oppose innovation. The situation is exacerbated by the need for testing and certification in vast areas due to disparate regulatory demands, which expands the time frame as well as associated costs in bringing new products to market.

Audio Codec Market Segmentation Overview

By Component Type

The hardware segment held the highest market share in 2023, accounting for approximately 62% of the total audio codec market. This growth is driven by the audio codecs found wide adoption within various hardware devices, such as smartphones, tablets, gaming consoles, and also multimedia equipment. According to a report by the International Telecommunication Union, there are more than 6.4 billion subscriptions to smartphones worldwide. Subscriptions even increased 12% when compared to the previous year. Increased smartphone usage enhances the demand for high-performance audio codecs to support advanced audio formats along with high-quality sound reproduction. The government, in addition, spent on smart cities and digital infrastructure, thus increasing the utilization of audio-enabled devices. This is because the U.S. Department of Commerce invested $65 billion for the expansion of broadband access thereby indirectly enhancing demand for hardware audio codecs in the market. As manufacturers strive to deliver improved audio experiences in their products, the hardware segment is expected to maintain its leading position, catering to the evolving needs of consumers and businesses alike.

By Function

In 2023, the without Digital Signal Processing (DSP) accounted for 77% of global revenue share. The extensive adoption of non-DSP audio codecs in general-purpose applications can be attributed to the low cost and ease with which audio codecs deliver high-quality audio, making them a popular choice for cost-sensitive markets. Government statistics from the National Telecommunications and Information Administration (NTIA) show that households using low-cost audio devices have grown by 15% in the past year, the result of a major shift toward budget-oriented approaches to technology. Non-DSP audio codecs are used in applications that do not require advanced audio processing, such as basic telecommunications or low-end consumer electronics. Furthermore, the growing popularity of streaming services, coupled with the need for efficient audio transmission, has increased the demand for simpler audio solutions that do not require complex processing. The explosion of this segment is also driven by government initiatives on digital inclusion and cost reduction for technology that is allowing people from different walks of life to afford quality sound experiences without high-end equipment. While the market never remains stagnant, this non-DSP segment will continue to be a powerhouse addressing diverse consumer needs.

By Application

Smartphones and tablets segment dominated the market with the highest revenue share of the audio codec market, in 2023. This dominance is fueled by the insatiable spread of mobile devices and smartphone dependency to listen to audio content. As the Mobile Marketing Association (MMA) more than 80% of the global population owns a smartphone, with an average daily usage time of over three hours dedicated to audio-related applications, including music streaming and podcasts. Increased user engagement has resulted in an increased need for high-quality and low-latency audio codecs in mobile devices. According to a government report, mobile application downloads related to audio consumption have more than doubled so far this year with a 25% increase in the number of audio streaming apps downloaded apps in 2023 as compared to apps downloaded in 2022. In addition, a lot of innovations are performed by manufacturers to ensure the same audio playback experience in smartphones and tablets thereby accelerating the growth of advanced audio codecs. With mobile devices emerging as the primary platform for audio consumption, high-quality audio codecs designed for smartphones and tablets are projected to remain the leading application segment in the global audio codec market.

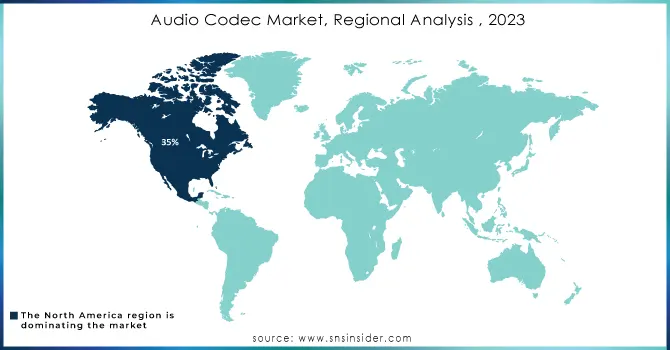

Audio Codec Market Regional Analysis

North America dominated the audio codec market with 35% of the global market share in 2023. This high share has been due to a robust technological infrastructure, higher disposable income, and a robust consumer electronics market in the region. Federal Communications Commission (FCC) stated that over 90% of households in the U.S. are accessing broadband, ensuring high-quality audio streaming services are easily accessible and the presence of market leaders like Qualcomm and Apple in North America has been quite a supporting factor toward its dominant position in the region.

The US audio codec market is witnessing more prominence in wireless and streaming technologies. Growth is now being driven more by a new shift into the adoption of a wireless and high-quality audio transmission capability. Most of the consumers view Bluetooth headphones, smart speakers, and streaming services as something great. This automatically increases demand for efficient and high-performance audio codecs, underpinning a focus on making the wireless audio experience.

On the other side, the Asia-Pacific region will see the highest CAGR during 2024-2032. This growth is driven by the rapid expansion of the smartphone market, increasing internet penetration, and the middle class is increasing in countries like India and China. Strengthening initiatives for digitalization by the government, like India's Digital India, are going to create an enabling environment for audio technologies. Smartphone penetration in Asia Pacific reached 56% in 2023, and this region is expected to have more demand for advanced audio codecs in the near future. As the market evolves, North America will continue to lead, while the Asia-Pacific region will emerge as a key growth driver in the audio codec landscape.

Need Any Customization Research On Audio Codec Market - Inquiry Now

Recent Developments

-

In March 2024, AEQ launched the Solaris Codec, a new compact tool for broadcasters. It can handle up to 64 channels bidirectional in stereo, making it ideal for various setups of broadcasting. Because it also offers IP audio I/O via Dante and AES-67 compatibility, it guarantees smooth integration and redundancy of different options, making it perfect for a variety of STL and remote-broadcasting applications.

-

In August 2023: Qualcomm launched its latest audio codec solutions aimed at improving audio playback quality in mobile devices and automotive applications, With features like low-latency audio streaming and high-resolution audio playback, the new codecs cement Qualcomm's stature as a player in the audio codec market.

Key Players in Audio Codec Market

Service Providers / Manufacturers:

-

Qualcomm (AptX HD, aptX Adaptive)

-

Apple (ALAC, AAC)

-

Texas Instruments (TLV320AIC3204, TLV320AIC3101)

-

Cirrus Logic (CS47L35, CS47L24)

-

Realtek (RT5631, ALC5621)

-

Analog Devices (ADAU1761, ADAU1978)

-

NXP Semiconductors (SAK-TC277TP, SAIC-40100)

-

Broadcom (BCM43455, BCM43438)

-

Amlogic (S905X3, S912)

-

Wolfson Microelectronics (WM8960, WM8994)

Key Users of Services/Products

-

Sony (Sony WH-1000XM4, Sony SRS-XB43)

-

Samsung (Galaxy Buds Pro, Galaxy S21)

-

Amazon (Echo Dot, Fire TV Stick)

-

Google (Nest Audio, Pixel Buds)

-

Bose (Bose QuietComfort 35 II, Bose SoundLink Revolve)

-

LG Electronics (LG Tone Free, LG XBOOM)

-

Microsoft (Surface Headphones, Xbox Wireless Headset)

-

JBL (JBL Charge 5, JBL Flip 5)

-

Beats by Dre (Beats Fit Pro, Beats Studio3)

-

Panasonic

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.8 Billion |

| Market Size by 2032 | USD 10.9 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Hardware Codecs, Software Codecs) • By Function (With DSP, Without DSP) • By Application (Automobile, Television Sets, Smartphones and tablets, Desktop and laptops, Headphone, Headsets and Wearable devices, Music & Media Devices and Home Theatres, Gaming consoles, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, Apple, Texas Instruments, Cirrus Logic, Realtek, Analog Devices, NXP Semiconductors, Broadcom, Amlogic, Wolfson Microelectronics |

| Key Drivers | • The significant rise in smartphone ownership is driving the demand for audio codecs, as these devices are essential for high-fidelity audio streaming and playback, enhancing user experience across various applications • The rapid growth of digital streaming platforms, including music and video services, is creating a substantial need for efficient audio codecs that can handle high-quality audio transmission and adaptive bitrate streaming, leading to market growth. |

| RESTRAINTS | • The evolving standards and protocols for audio codecs can create compatibility issues across devices and platforms, posing a challenge for manufacturers and developers in the market. • The costs associated with research and development of advanced audio codecs can be prohibitive, particularly for smaller companies, which may limit competition and innovation in the market. |