Thermal Conductive Polymer Material Market Report Scope & Overview:

Get E-PDF Sample Report on Thermal Conductive Polymer Material Market - Request Sample Report

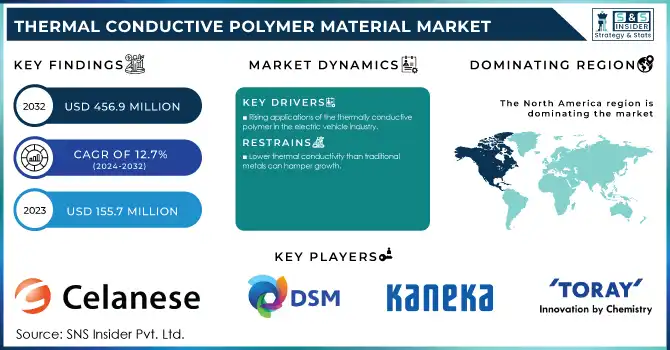

The Thermal Conductive Polymer Material Market size was USD 155.7 Million in 2023 and is expected to Reach USD 456.9 Million by 2032 and grow at a CAGR of 12.7% over the forecast period of 2024-2032.

Thermally conductive polymer materials are engineered to efficiently dissipate heat, making them valuable in industries such as electronics, automotive, and aerospace. These materials offer advantages over traditional metals and ceramics, including reduced weight, design flexibility, and cost-effectiveness. The market for these materials is experiencing significant growth, driven by the increasing demand for effective thermal management solutions in high-performance electronic devices and the rising adoption of electric vehicles (EVs). In EVs, thermally conductive polymers are essential for managing heat in battery packs and electronic components, contributing to vehicle safety and performance. Additionally, the miniaturization of electronic devices necessitates materials that can efficiently dissipate heat while allowing for compact and lightweight designs.

Advancements in material science have led to the development of polymers with enhanced thermal conductivity, expanding their application range. For instance, incorporating fillers like ceramic particles, metal particles, carbon particles, or graphene into polymers such as polyamide, polycarbonate, and polyphenylene sulfide has resulted in materials that meet specific thermal management requirements across various industries. The market is characterized by ongoing research and development efforts aimed at improving the thermal conductivity and mechanical properties of these materials. According to research in R&D investments, particularly in developing polymers with enhanced thermal conductivity levels exceeding 10 W/mK, compared to conventional materials that range between 1–2 W/mK. The electronics industry accounts for approximately 45% of the total demand, with automotive applications closely following. With governments and industries increasingly focusing on energy-efficient and sustainable solutions, the market for thermal conductive polymers is expected to remain robust in the coming years, driven by innovation and expanding industrial applications.

MARKET DYNAMICS

DRIVERS

- The Thermal Conductive Polymer Material Market is driven by growing demand in electronics, automotive, and LED lighting, fueled by lightweight, efficient, and sustainable thermal management solutions.

The Thermal Conductive Polymer Material Market is experiencing robust growth, driven primarily by the surging demand for lightweight, heat-dissipating materials in electronics and electrical applications. These polymers are increasingly preferred for their ability to effectively manage heat while offering flexibility, durability, and lightweight properties, making them ideal for compact and efficient electronic devices. With the rapid advancements in consumer electronics, such as smartphones, tablets, and wearable devices, the need for materials that enhance thermal management without adding bulk is becoming crucial, fueling market expansion.

In addition to electronics, the automotive sector is embracing thermal conductive polymers to reduce vehicle weight and improve fuel efficiency. These materials are replacing traditional metals in components like battery casings and engine covers, aligning with the industry's push toward sustainability and electric vehicles (EVs). Moreover, the rising adoption of energy-efficient LED lighting systems has opened new avenues for these materials, as they are critical for managing heat dissipation in high-performance lighting. Key market trends include innovations in material science to enhance thermal conductivity and the development of recyclable polymer solutions. While challenges such as high production costs and competition from metals persist, the market's outlook remains positive, supported by growing demand across diverse industrial sectors.

RESTRAINT

- The high cost of thermal conductive polymers stems from expensive raw materials and complex manufacturing processes compared to traditional materials like metals and ceramics.

The high cost of thermal conductive polymers is a significant challenge hindering their widespread adoption. These materials are produced using specialized raw materials, such as high-performance polymer bases and thermally conductive fillers, which are inherently expensive. Additionally, the manufacturing process is complex, requiring advanced technologies to ensure uniform dispersion of fillers and maintain the desired thermal and mechanical properties. This complexity adds to production costs, making these polymers significantly more expensive than traditional alternatives like metals and ceramics. For cost-sensitive industries, such as consumer electronics and automotive, this price disparity poses a barrier to large-scale implementation. While thermal conductive polymers offer advantages such as lightweight, corrosion resistance, and design flexibility, their higher upfront cost remains a critical restraint, particularly in emerging economies or applications where cost efficiency is prioritized over advanced thermal management capabilities.

MARKET SEGMENTATION

By Application

The Electrical & Electronics segment dominated with the market share over 38% in 2023, driven by the increasing need for efficient thermal management in electronic devices such as smartphones, laptops, and semiconductors. These devices generate significant heat, necessitating advanced materials for heat dissipation. Thermal conductive polymers offer an ideal solution due to their lightweight, flexible, and cost-effective properties. On the other hand, the Automotive sector is witnessing the fastest growth. With the rise of electric vehicles (EVs), thermal management has become crucial for enhancing battery performance and ensuring the safety of power electronics.

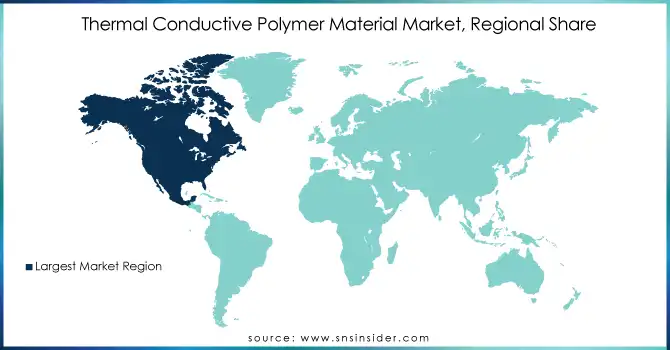

KEY REGIONAL ANALYSIS

North America region dominated with the market share over 42% in 2023. This strong market presence is driven by the growing demand for advanced materials in high-performance applications across key industries such as automotive, electronics, and telecommunications. In the automotive sector, the increasing adoption of electric vehicles (EVs) and the need for lightweight, thermally efficient materials for battery management contribute significantly to the demand for thermal conductive polymers. Similarly, the electronics industry requires these materials for heat dissipation in high-performance devices like smartphones, laptops, and power electronics. Additionally, the telecommunications industry relies on these polymers for thermal management in network equipment and communication devices.

The Asia-Pacific region is witnessing the fastest growth in the Thermal Conductive Polymer Material Market due to several key factors. Rapid industrialization in countries such as China, India, and South Korea is driving the demand for advanced materials. The expansion of the electronics and automotive sectors, particularly with the rise of electric vehicles (EVs), is significantly contributing to this growth. Thermal conductive polymers are crucial in managing heat dissipation in electronic devices and EV components. Furthermore, technological advancements in smart devices, consumer electronics, and telecommunications are increasing the need for efficient thermal management solutions. Countries like Japan and South Korea are at the forefront of innovation, creating new applications for these materials in high-performance systems.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Thermal Conductive Polymer Material Market

- Celanese Corporation (Vamac, Hostaform)

- DSM (Akulon)

- KANEKA CORPORATION (Kaneka Thermally Conductive Polymers)

- TORAY INDUSTRIES, INC. (Toledyne)

- SABIC (LNP Thermocomp)

- HELLA GmbH & Co. (Thermal Management Materials)

- MERCK KGaA (Liquid Crystal Polymers)

- Saint-Gobain (Thermal Conductive Polymeric Materials)

- Arkema (Rilsan)

- RTP Company (Thermally Conductive Compounds)

- Brenntag GmbH (Thermally Conductive Masterbatches)

- Covestro AG, (Makrolon)

- BASF SE (Ultradur, Ultramid)

- Kenner Material & System Co., Ltd. (Thermal Conductive Polymer Resins)

- 3M (Thermal Interface Materials)

- PolyOne Corporation (Thermally Conductive Compounds)

- Mitsubishi Chemical Corporation (Thermal Conductive Compounds)

- Huntsman Corporation (Thermal Management Polymers)

- LyondellBasell Industries (Hifax)

- LG Chem (Thermal Conductive Materials for Electronics)

Suppliers for (thermoplastic and silicone-based solutions, ideal for heat-sensitive applications) on Thermal Conductive Polymer Material Market

- Celanese Corporation

- Covestro AG

- SABIC

- 3M Company

- Saint-Gobain

- DOW Inc.

- Momentive Performance Materials Inc.

- Polymicrospheres

- Mitsubishi Chemical Corporation

- LyondellBasell Industries

RECENT DEVELOPMENTS

On March 11, 2024: Toray Industries Inc. developed an ion-conductive polymer membrane boasting 10 times the ion conductivity of its predecessors. This innovation could significantly enhance the performance of solid-state and lithium metal batteries, offering a major boost to the electric vehicle and other transportation markets.

In January 2, 2024: LG Chem has developed the world's first biodegradable material with mechanical properties comparable to synthetic resins like polypropylene. The new material, made from 100% bio-based contents, offers improved flexibility and transparency, with over 90% biodegradation within 120 days.

| Report Attributes | Details |

| Market Size in 2023 | USD 155.7 Million |

| Market Size by 2032 | USD 456.9 Million |

| CAGR | CAGR of 12.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyamide, Polybutylene Terephthalate, Polycarbonate, Polyphenylene Sulfide, Polyetherimide, Others) • By Application (Electrical & Electronics, Industrial, Automotive, Healthcare, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Celanese Corporation, DSM, KANEKA CORPORATION, TORAY INDUSTRIES, INC., SABIC, HELLA GmbH & Co., MERCK KGaA, Saint-Gobain, Arkema, RTP Company, Brenntag GmbH, Covestro AG, BASF SE, Kenner Material & System Co., Ltd., 3M, PolyOne Corporation, Mitsubishi Chemical Corporation, Huntsman Corporation, LyondellBasell Industries, LG Chem. |

| Key Drivers | • The Thermal Conductive Polymer Material Market is driven by growing demand in electronics, automotive, and LED lighting, fueled by lightweight, efficient, and sustainable thermal management solutions. |

| RESTRAINTS | • The high cost of thermal conductive polymers stems from expensive raw materials and complex manufacturing processes compared to traditional materials like metals and ceramics. |