Thermal Energy Storage Market Report Scope & Overview:

The Thermal Energy Storage Market Size was valued at USD 4.72 Billion in 2025E and is expected to reach USD 8.23 Billion by 2033 and grow at a CAGR of 7.21% over the forecast period 2026-2033.

The Thermal Energy Storage Market analysis, driven by Increasing industrial and non-industrial uses of peak load shifting, support from international communities for clean energy sources are some other factors drive the demand growth along with rapid technological developments in molten salt and phase change materials continue to push the market’s horizons. According to study, about 48% of the adoption of thermal energy storage (TES) is driven by renewable‐energy integration (solar & wind).

Market Size and Forecast:

-

Market Size in 2025: USD 4.72 Billion

-

Market Size by 2033: USD 8.23 Billion

-

CAGR: 7.21% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Thermal Energy Storage Market - Request Free Sample Report

Thermal Energy Storage Market Trends:

-

Growing integration of concentrated solar power systems with thermal energy storage.

-

Rising government investments to promote renewable and sustainable energy infrastructure.

-

Increasing adoption of molten salt and phase change materials for storage.

-

Expanding use of smart grids for efficient energy load management.

-

Technological advancements enhancing thermal storage efficiency and operational reliability.

-

Growing focus on reducing carbon emissions through energy-efficient storage solutions.

The U.S. Thermal Energy Storage Market size was USD 1.02 Billion in 2025E and is expected to reach USD 1.75 Billion by 2033, growing at a CAGR of 6.92% over the forecast period of 2026-2033, due to renewable energy integration, grid modernization, and energy-efficient technologies. Growing industrial and commercial applications, coupled with supportive policies and advancements in molten salt and ice-based storage systems, drive market growth.

Thermal Energy Storage Market Growth Drivers:

-

Concentrated Solar Power Drives Strong Growth in Thermal Storage Market

One of the leading market growth characteristics of Thermal Energy Storage Market is the technological advancement in concentrated solar power systems. Philosophy of Concentrated Solar Power Plant Where Mirrors or Lenses Focus Sunlight to Heat Energy and Stored in Molten Salts to Generate Water into Steam When There is no Sunlight to Drive the Generators and Produce Electricity. Having this storage capacity ensures a continuous power supply and stability of the grid. Aging global renewable energy targets are moving at record pace, and both governments and the private sector are funding CSP projects that include thermal storage to provide energy redundancy and higher carbon independence.

Over 21 GWh of molten-salt thermal energy storage capacity is currently installed globally, driven by concentrated solar power deployment.

Thermal Energy Storage Market Restraints:

-

High Setup and Infrastructure Costs Challenge Market Expansion Globally

One of the major restraints impacting the Thermal Energy Storage Market is the high initial cost of setup and infrastructure. The large-scale thermal storage system with the molten salt, insulated tank and advanced heat exchanger may be costly to implement. Furthermore, installation of these systems within an existing energy infrastructure is costly in terms of engineering and maintenance. These economic hurdles reduce the rate of adoption in less developed areas, even though there are long-term operational benefits and sustainability advantages.

Thermal Energy Storage Market Opportunities:

-

Smart Grid Integration Unlocks New Opportunities for Thermal Storage

The combination of thermal energy storage with smart grid and sophisticated energy managment systems is a significant market growth opportunity. Smart grids facilitate real-time monitoring and wise distribution of stored thermal energy leading to optimum demand-side management and peak demand leveling. With the growing technologies like AI, IoT and automation, thermal storage can help in energy efficient consumption, reducing operating costs and enabling more flexibility to the grid. The integration promotes building of sustainable intelligent energy systems all over the world.

IoT-enabled smart grid technologies have enabled up to 20% reduction in greenhouse gas emissions through improved load management and renewable integration.

Thermal Energy Storage Market Segmentation Analysis:

-

By Product Type: In 2025, Sensible Heat Storage led the market with a share of 42.50%, while Thermochemical Heat Storage is the fastest-growing segment with a CAGR of 13.20%.

-

By Technology: In 2025, Molten Salt Technology led the market with the largest 30.40% share, while Ice-based Technology is the fastest-growing segment with a CAGR of 12.40%.

-

By Storage: In 2025, Molten Salt led the market with a share of 40.51%, while Phase Change Material (PCM) is the fastest-growing segment with a CAGR of 16.40%.

-

By Application: In 2025, District Heating & Cooling led the market with a share of 34.70%, while Power Generation is the fastest-growing segment with a CAGR of 14.80%.

-

By End-user: In 2025, Industrial led the market with a share of 51.53%, while Utilities is the fastest-growing segment with a CAGR of 14.70%.

By Product Type, Sensible Heat Storage leads the market, while Thermochemical Heat Storage shows the fastest growth.

The Sensible Heat Storage lead the market in 2025, due to due to simple design, effectiveness, and to store thermal energy with material easily available like water, molten salts, rocks in the sensible heat. It is widely used in district heating and industrial application due to its reliability and efficiency.

Meanwhile, Thermochemical Heat Storage is the fastest-growing segment, owing to features such as greater energy density, long-term storage capability, and suitability for renewable integration provide an opportunity for higher performance and efficiency for large scale, long-duration energy storage applications.

By Technology, Molten Salt Technology leads the market, while Ice-based Technology shows the fastest growth.

The Molten Salt Technology lead the market in 2025, owing to its widespread used globally in CSP (concentrated Solar power Plant) for its high-temperature long-term heat storage capability. Due to its established track record and scalability, it is widely used in utility-scale energy storage and power generation.

Meanwhile, Ice-based Technology is witnessing the fastest growth segment, driven by the increasing demand for commercial and residential cooling systems since it allows for economical peak load management and increases the energy efficiency of air-conditioning and refrigeration applications.

By Storage, Molten Salt leads the market, while Phase Change Material (PCM) shows the fastest growth.

The Molten Salt leads the market in 2025, due to it has the highest thermal capacity with lower costs and the long-term heat retention, thereby it is the most widely used in Concentrated Solar power and large-scale industrial applications. It is able to maintain stable power generation and grid in high temperature operations.

Meanwhile, Phase Change Material (PCM) is the fastest-growing segment, owing to its unique properties in storing and releasing large quantities of latent heat, which is a practical solution for energy-efficient residential, commercial and cold storage applications.

By Application, District Heating & Cooling leads the market, while Power Generation shows the fastest growth.

The District Heating & Cooling leads the market in 2025, due to it, being widely used in the urban infrastructure to balance the energy demand and improve the overall system efficiency. Facilitating the efficient use of waste heat and renewable sources and, thus, lowers its carbon emissions and operating costs.

Meanwhile, Power Generation is the fastest-growing segment, driven by the growing penetration of renewable energy sources like solar and wind, in which thermal energy storage systems improve grid reliability, meet continuous electricity demand, and improve the performance of both solar thermal electric and concentrating solar power plants.

growth. By End-user, Industrial leads the market, while Utilities show the fastest

The Industrial leads the market in 2025, due to its the enormous process heating, waste heat recovery, and energy optimization demand in various industries, including chemical, food processing, and manufacturing. Thermal storage systems assist industries in increasing energy efficiency and minimizing operational costs.

Meanwhile, Utilities represent the fastest-growing segment, driven by the increasing integration of large-scale thermal storage solutions to support grid stabilization, peak load management and renewable penetration, paving the way toward flexible and resilient energy infrastructure.

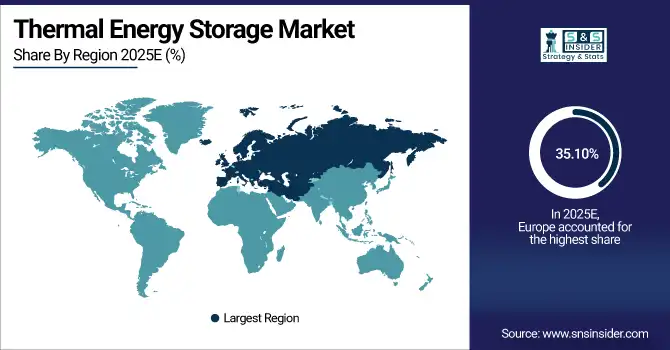

Thermal Energy Storage Market Regional Analysis:

Europe Thermal Energy Storage Market Insights:

The Europe dominated the Thermal Energy Storage Market in 2025E, with over 35.10% revenue share, due to its strong focus on integration of renewable energy, decarbonization targets, and advanced energy infrastructure. Market growth is fueled by the application of district heating and cooling systems in countries such as Germany, Denmark, Sweden and thus widespread adoption in the region. Well-established government policies, research funding and investments in large-scale concentrated solar power and energy-efficient building technologies reinforce Europe’s leadership. Additionally, continuous advancement in technology of molten salt and phase change materials the efficiency and sustainability of the system in all application areas.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.K and Germany Thermal Energy Storage Market Insights

The Germany and the U.K. lead the Thermal Energy Storage Market due to strong renewable energy commitments, advanced district heating infrastructure, and government support for carbon-neutral initiatives. Their investments in smart grids, solar integration, and energy-efficient technologies drive widespread adoption of innovative thermal storage solutions.

Asia Pacific Thermal Energy Storage Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 8.44%, driven by the rapid development of renewable energy infrastructure and growing demand for energy management systems. The region is experiencing robust expansion for industrial and commercial applications in particular related to process heating, cooling and peak load management. Adoption is further accelerated by supportive government policies, increasing energy demand and technological advancements in energy-efficient storage technologies. Ongoing improvements in molten salt and phase change materials about performance, have made the region an established player in global market growth.

China and India Thermal Energy Storage Market Insights

China and India are experiencing rapid growth in the Thermal Energy Storage Market due to rising energy demand, renewable energy expansion, and government initiatives promoting clean technologies. Increasing industrialization, infrastructure development, and adoption of efficient energy management systems are driving large-scale investments in thermal storage solutions.

North America Thermal Energy Storage Market Insights

The North America Thermal Energy Storage Market is well-established, due to rising investments in renewable energy integration and smart grid modernization. A rigorous emphasis on sustainable energy systems and decarbonization aspirations in the region propel investment in advanced storage technologies at the industrial, utility, and commercial levels. This also drives the market from growing adoption of the cost-effective method of centralized solar power and Ice-based cooling systems. Additionally, ongoing research, favorable regulatory frameworks, and advancements in phase change and Molten Salt Technologies are improving energy efficiency and grid reliability in North America.

U.S and Canada Thermal Energy Storage Market Insights

The U.S. and Canada are witnessing strong growth in the Thermal Energy Storage Market driven by renewable energy integration, grid modernization efforts, and rising adoption of energy-efficient technologies. Supportive government policies, expanding industrial applications, and advancements in molten salt and ice-based storage systems further boost market development.

Latin America (LATAM) and Middle East & Africa (MEA) Thermal Energy Storage Market Insights

The Latin America Thermal Energy Storage Market is gradually growing, due to rapid awareness amongst the consumers regarding utilization of renewable energy and demand for an efficient energy management solution. In addition, thermal storage technologies continue to attract investments as the demand for electricity rises and investment in solar power projects increases. Increased Efforts of Integrating Systems with Molten Salt and Phase Change Material to Enhance Energy Reliability and Reduce Reliance on Conventional Fossil Fuel Based Systems throughout the Region by Governments and Private Players

However, The Presence of solar potential and high focus on renewable energy diversification makes the Middle East & Africa region lucrative for thermal energy storage market. In various countries in the region, rapid expansion of large-scale solar projects has unveiled a demand for integration of thermal storage to balance the grid and optimize efficiency. Increasing trend of urbanization led by expanding district cooling infrastructure and supportive policy frameworks is acting as another set of drivers of growing demand. Molten salt and other solar-related storage enablers are helping the region emerge as a technology market.

Thermal Energy Storage Market Competitive Landscape

CALMAC Manufacturing Corp., now part of Trane Technologies, leads in ice‑based thermal energy storage with its IceBank tanks widely used in commercial, institutional and utility settings. Their modular tank systems reduce footprint up to ~20% and simplify field installation. CALMAC’s products help shift cooling loads to off‑peak hours, reducing peak electrical demand and mitigating the need for supplemental power plants, thus enhancing grid flexibility and lowering energy costs.

-

In April 2025, CALMAC Manufacturing Corp introduced its new IceBank C‑Model modular thermal‑energy storage tanks featuring internal headers, reducing footprint by about 20 %.

DN Tanks specializes in designing and constructing large‑scale prestressed concrete thermal energy storage tanks, serving district cooling, utility and industrial sectors globally. With capacities ranging from 40,000 gallons up to 50 million gallons, the company emphasizes durability, minimal maintenance and high thermal efficiency. Their turnkey solutions leverage decades of craftsmanship and are customized for unique project requirements, making DN Tanks a preferred partner for large‑capacity sensible heat storage applications.

-

In April 2024, DN Tanks Inc. released a new Thermal Energy Storage tank brochure showcasing capacities from 40,000 gallons up to 50 million gallons, custom dimensions and enhanced durability

Baltimore Aircoil Company provides modular ice‑based and chilled‑water thermal energy storage solutions for commercial, institutional, and district cooling applications. Their Thermal Storage Unit (TSU‑M ICE CHILLER) stores cooling during off‑peak hours and delivers chilled fluid during peak times, shifting load and reducing energy consumption and greenhouse gas emissions. With a broad product range (90 to 125,000 ton‑hours) and focus on integration with building and cooling systems, BAC is driving efficient HVAC thermal storage adoption.

-

In May 2025, Baltimore Aircoil Company launched a new thermal‑energy‑storage integrated cooling system for district‑cooling plants, emphasising retrofits of existing HVAC infrastructure.

Thermal Energy Storage Market Key Players:

Some of the Thermal Energy Storage Market Companies are:

-

CALMAC Manufacturing Corp.

-

Abengoa Solar S.A.

-

Ice Energy Technologies Inc.

-

DN Tanks Inc.

-

SolarReserve LLC

-

Burns & McDonnell

-

BrightSource Energy Inc.

-

Baltimore Aircoil Company

-

Cryogel Thermal Energy Storage

-

Dunham Bush Holding Bhd.

-

Goss Engineering Inc.

-

Steffes Corporation

-

TAS Energy

-

Evapco Inc.

-

Sunwell Technologies

-

Finetex ENE Inc.

-

Caldwell Energy

-

Axiom Energy

-

MAN Energy Solutions

-

KraftBlock GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.72 Billion |

| Market Size by 2033 | USD 8.23 Billion |

| CAGR | CAGR of 7.21% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage) • By Technology (Molten Salt Technology, Electric Thermal Storage Heaters, Solar Energy Storage, Ice-based Technology, Miscibility Gap Alloy Technology) • By Storage (Molten Salt, Phase Change Material, Water) • By Application (Process Heating & Cooling, District Heating & Cooling, Power Generation, Ice Storage Air-Conditioning, Others) • By End-user (Industrial, Utilities, Residential & Commercial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CALMAC Manufacturing Corp., Abengoa Solar S.A., Ice Energy Technologies Inc., DN Tanks Inc., SolarReserve LLC, Burns & McDonnell, BrightSource Energy Inc., Baltimore Aircoil Company, Cryogel Thermal Energy Storage, Dunham‑Bush Holding Bhd., Goss Engineering Inc., Steffes Corporation, TAS Energy, Evapco Inc., Sunwell Technologies, Finetex ENE Inc., Caldwell Energy, Axiom Energy, MAN Energy Solutions, KraftBlock GmbH, and Others. |