Thermal Transfer Tapes Market Report Scope And Overview:

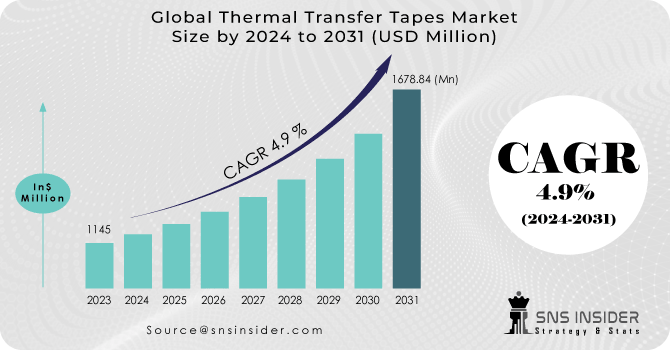

The Thermal Transfer Tapes Market size was USD 1145 million in 2023 and is expected to Reach USD 1678.84 million by 2031 and grow at a CAGR of 4.9% over the forecast period of 2024-2031.

The market value is experiencing growth due to increased urbanization, modernization, and globalization. Further driving this growth are ongoing product innovations within the manufacturing industry, heightened awareness of the benefits associated with thermal transfer tapes, escalating demand for electronic gadgets, and advancements in flexible packaging solutions. Additionally, the market is being propelled by increased research and development capabilities, manufacturers' efforts to minimize production costs while maintaining quality standards, rising demand for electric vehicles in Western economies, technological advancements in packaging equipment to accommodate diverse product ranges, and the expanding influence of the e-commerce industry.

Get More Information on Thermal Transfer Tapes Market - Request Sample Report

Industries' pursuit of enhanced inventory management has led to an increased demand for dependable and effective heat transfer systems. Furthermore, the market gains momentum from the expanding e-commerce sector, where efficient labeling and tracking systems drive convenience. However, despite these favorable trends, certain obstacles hinder the market's seamless growth.

MARKET DYNAMICS

KEY DRIVERS:

-

The ongoing trend towards miniaturization of electronic devices such as smartphones, laptops, and wearables underscores the need for effective thermal management solutions.

-

The rising use of LED lighting in automotive, commercial, and residential sectors requires effective thermal management to maintain performance and longevity.

Thermal conduction tapes are crucial in this scenario as they aid in dissipating heat from LEDs, thereby reducing the risk of overheating and ensuring consistent light output. This functionality contributes significantly to the market expansion of LEDs by enhancing their reliability and performance in various applications across industries such as automotive, commercial, and residential sectors.

RESTRAIN:

-

Alternative cooling solutions serve as barriers to market growth by limiting the advancement of thermal conduction tapes.

-

The thermal transfer tape market encountered hurdles associated with environmental issues and sustainability.

OPPORTUNITY:

-

Due to stricter environmental regulations and increasing consumer preference for sustainable products, the popularity of eco-friendly thermal conduction tapes is on the rise.

-

Ongoing research and development are aimed at enhancing the thermal conductivity of tapes to improve heat dissipation in high-performance computing and electronics.

These initiatives are driven by advancements in material science, which are yielding tapes with superior thermal interfaces. These enhanced tapes are designed to meet the stringent thermal management requirements of modern electronic devices, ensuring optimal performance and reliability even in demanding applications.

CHALLENGES:

-

Achieving compatibility between heat conduction tapes and various substrates presents a challenge.

-

High-performance thermal conduction tapes are excessively costly for small producers or applications operating with limited budgets within the market.

IMPACT OF RUSSIAN UKRAINE WAR

The Russia-Ukraine conflict holds significant importance for global energy and metal markets due to Russia's status as the largest exporter of oil and gas. Notably, one-third of Europe's oil and gas supply comes from Russia, underscoring the potential economic ramifications of sanctions against the country. Such sanctions could have far-reaching consequences not only for European economies but also for the global economy at large. Moreover, sanctions imposed on Russia's conventional energy sector have spurred increased demand for clean energy alternatives. The ongoing conflict between Russia and Ukraine has led to substantial losses in global financial markets, while concurrently providing a boost to renewable energy companies.

IMPACT OF ECONOMIC SLOWDOWN

The global economy faces a critical juncture marked by various interconnected challenges and crises. Uncertainty surrounding the ongoing Russia-Ukraine conflict and its implications for global stability contribute to continued concerns about inflation. Persistent food and fuel inflation pose ongoing economic challenges, while higher retail inflation could dampen consumer confidence and spending. Governments may respond to inflationary pressures by raising interest rates, potentially leading to a slowdown in new job creation and overall economic activity. Moreover, companies may delay capital expenditure due to inflation concerns and weakened demand. These factors, coupled with slower growth and elevated inflation, suggest that developed markets may be on the brink of entering a recession. The complexity of challenges is compounded by volatile financial markets, escalating trade tensions, a more stringent regulatory landscape, and increasing pressure to integrate climate change considerations into economic decision-making processes.

KEY MARKET SEGMENTS

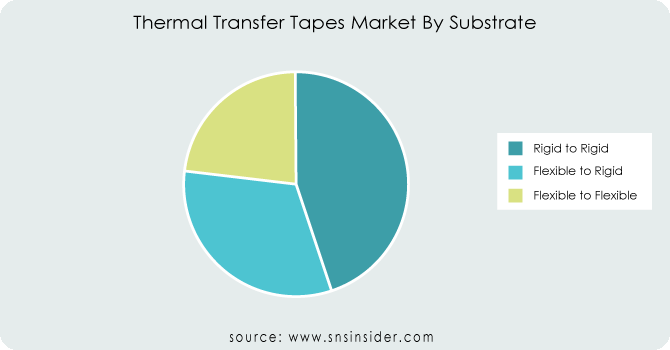

By Substrate

-

Rigid to Rigid

-

Flexible to Rigid

-

Flexible to Flexible

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Material

-

Paper

-

Plastic

-

Polypropylene

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyvinyl Chloride

-

Polyamide

-

Others

By Product Type

-

Double Sided

-

Single Sided

By Adhesive Type

-

Solvent Based

-

Acrylic Based

By Thickness Type

-

Up to 1 mm

-

1 – 2 mm

-

Above 2 mm

By End- User

-

Automotive

-

Electrical and Electronics

-

Building and Construction

-

Shipping and Logistics

-

Aerospace and Defense

-

Other Industrial

The electrical & electronics segment is expected to lead the thermal transfer tape market. This dominance is attributed to the crucial role thermal conduction tapes play in managing heat across various electronic devices, spanning from consumer electronics like smartphones and laptops to industrial and automotive electronics. As electronic devices become more powerful and compact, the need for efficient heat dissipation becomes paramount to ensure reliability, performance, and longevity. The growth of this segment is further propelled by rapid technological advancements and the increasing global demand for electronic gadgets.

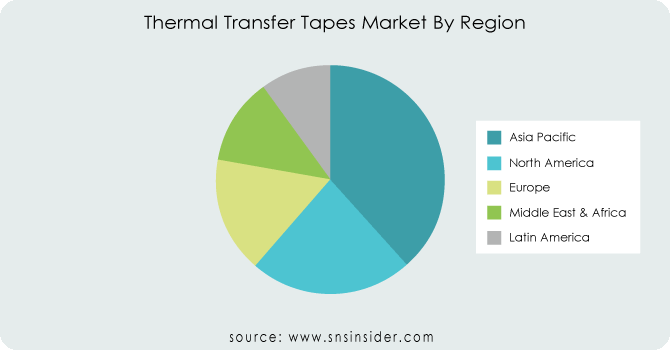

REGIONAL ANALYSIS

The Asia-Pacific region is positioned to lead the global thermal transfer tapes market. This dominance is attributed to the proliferation of manufacturing industries, increasing demand for packaged goods among consumers, expansion across various end-user sectors, rapid industrialization, heightened awareness regarding the advantages of thermal transfer tapes, rising adoption of electronic devices, surging demand for electric vehicles, and a rise in personal disposable income.

In North America, particularly the United States, there exists a robust technical ecosystem supported by substantial investments in research and development. This environment fosters innovation in thermal management technologies, including advancements in thermal conduction tapes, leading to their widespread adoption across various high-tech applications. The region hosts numerous leading electronics and semiconductor manufacturers, whose demand for efficient thermal management solutions significantly contributes to the dominance of the thermal transfer tape market. Europe's stringent environmental and sustainability regulations are fueling the need for effective and eco-friendly thermal management solutions. Thermal conduction tapes, especially those made from sustainable materials, are gaining popularity to fulfill these rigorous demands, thereby stimulating market growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Major players in the Thermal Transfer Tapes Market are CCL Industries Inc., Henkel Adhesives Technologies India Private Limited., 3M, Apogee Industries Inc., LINTEC Corporation., PPI Adhesive Products, Speciality Tapes Industry, Scapa Group Ltd, Vraj Corporation., Dexerials Corporation., and others.

CCL Industries Inc -Company Financial Analysis

RECENT DEVELOPMENT

-

In February 2024, Henkel unveiled its latest lineup, the Loctite Thermally Conductive Gap Fillers range, featuring thermal tapes designed for a diverse array of uses spanning automotive and consumer electronics sectors.

-

In November 2023, 3M introduced the 3M™ Thermally Conductive Double-Sided Tape 9703, a top-tier tape engineered to meet the rigorous heat management requirements of the automotive and electronics industries.

-

In October 2023, Rogers Corporation revealed a partnership with a leading electric car manufacturer to develop an innovative thermal management solution leveraging Rogers’ superior-quality thermal tapes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1145 Million |

| Market Size by 2031 | US$ 1678.84 Million |

| CAGR | CAGR of 4.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Substrate (Rigid To Rigid, Flexible To Rigid, Flexible To Flexible) • By Material (Paper, Plastic, Polypropylene, Polyethylene, Polyethylene Terephthalate, Polyvinyl Chloride, Polyamide, Others) • By Product Type (Double Sided, Single Sided) • By Adhesive Type (Solvent Based, Acrylic Based) • By Thickness Type (Up To 1 Mm, 1 – 2 Mm, Above 2 Mm) • By End- User (Automotive, Electrical And Electronics, Building And Construction, Shipping And Logistics, Aerospace And Defense, Other Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CCL Industries Inc., Henkel Adhesives Technologies India Private Limited., 3M, Apogee Industries Inc., LINTEC Corporation., PPI Adhesive Products, Speciality Tapes Industry, Scapa Group Ltd, Vraj Corporation., Dexerials Corporation. |

| Key Drivers | • The ongoing trend towards miniaturization of electronic devices such as smartphones, laptops, and wearables underscores the need for effective thermal management solutions. • The rising use of LED lighting in automotive, commercial, and residential sectors requires effective thermal management to maintain performance and longevity. |

| Opportunities | • Due to stricter environmental regulations and increasing consumer preference for sustainable products, the popularity of eco-friendly thermal conduction tapes is on the rise. • Ongoing research and development are aimed at enhancing the thermal conductivity of tapes to improve heat dissipation in high-performance computing and electronics. |