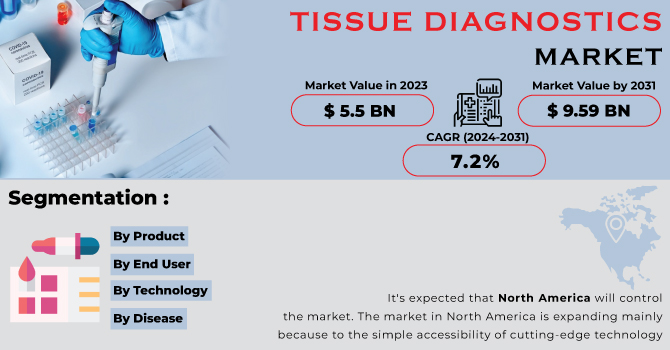

Tissue Diagnostics Market Report Scope & Overview:

The Tissue Diagnostics Market Size was valued at USD 6.83 billion in 2023 and is expected to reach USD 14.18 billion by 2032 and grow at a CAGR of 8.47% over the forecast period 2024-2032. This report highlights the rising incidence and prevalence of cancer and other diseases, driving the need for advanced diagnostic solutions, while also examining the growing adoption of tissue diagnostic technologies, including immunohistochemistry and molecular diagnostics, to enhance disease detection and treatment. Additionally, it explores healthcare spending on tissue diagnostics across regions, showcasing investment disparities and emerging markets fueling growth. The study also investigates shifting preferences toward precision medicine and automated diagnostic platforms, as well as the impact of regulatory policies and technological advancements on market expansion.

Get more information on Tissue Diagnostics Market - Request Sample Report

Market Dynamics:

Drivers

-

Expanding applications and rising healthcare expenditure fuel the tissue diagnostics market

The tissue diagnostics market is driven mainly by the increasing prevalence of cancer and chronic diseases. With cancer still among the top causes of death, the demand for early detection and accurate diagnosis propels the use of tissue diagnostics. Improvements in technology through digital pathology, AI-based diagnostics, NGS, and automation have improved accuracy and efficiency in tissue-based diagnostics. With an increased focus on personalized medicine, the demand for companion diagnostics is increasing. These allow targeted therapies based on tissue biomarkers. Additionally, with growing healthcare expenditure and government-aided initiatives in cancer screening, the market is gaining growth momentum. With digital pathology and AI-enhanced image analysis improving diagnostic accuracy and reducing turnaround times, the transition is also becoming a key factor in driving growth. The aging population, which is more prone to chronic diseases, is driving the demand for advanced diagnostic technologies. Moreover, tissue diagnostics are being increasingly used in non-oncology fields like infectious diseases, autoimmune conditions, and regenerative medicine, hence driving the market. The volume of biopsy procedures is also on the rise and there is an increased demand for in vitro diagnostics (IVD) and point-of-care testing, which further contribute to market growth.

Restraints

-

Addressing issues of accessibility, workforce shortages, and data security in tissue diagnostics

The main challenge for the tissue diagnostics market is the cost of advanced diagnostic instruments and procedures, which hinders accessibility, particularly in developing regions. The adoption of digital pathology and AI-driven technologies demands substantial investments in infrastructure and skilled personnel, making it difficult to deploy on a large scale. Stringent regulatory approvals for diagnostic tests and reagents can also delay product launches and increase costs for manufacturers. The standardization of tissue sample collection, storage, and processing may have an impact on the diagnostic outcome's accuracy and reliability. Besides, reimbursement policies are also not well-developed in some countries, and therefore, this might limit patient access and the healthcare provider's adaptation. Inadequate numbers of qualified pathologists and laboratory professionals also influence the quality and efficiency of the services. Moreover, diagnostics through tissues are more invasive than other techniques like liquid biopsies, which may eventually push patients toward less invasive alternatives. Lastly, the rise of digital pathology and cloud solutions fuels data security as well as privacy issues.

Opportunities

-

AI, digital pathology, and emerging markets driving growth in tissue diagnostics

Integration of AI and machine learning is improving diagnostic accuracy, reducing human error, and streamlining workflows. The increasing adoption of digital pathology and cloud-based diagnostics allows for real-time data sharing and remote consultations, opening new opportunities in underserved areas. Emerging markets in Asia-Pacific and Latin America are promising, driven by increased healthcare investments and rising cancer awareness. Non-invasive biopsy techniques like liquid biopsies, together with tissue diagnostics, are developing new pathways for personalized medicine. Companion diagnostics expanded in precision oncology and promoted collaborative work between pharmaceutical and diagnostic companies in the therapy area. On the other hand, automation and telepathology are increasing the efficiency and reach of pathologists to distant parts of the geography. In this context, focus on drug discovery driven by the biomarker-based process, besides streamlined regulatory clearances, aids in market growth.

Challenges

-

Overcoming challenges in tissue diagnostics with sample scarcity, technology, and standardization issues

One of the major challenges of the tissue diagnostics market is the lack of tissue samples, especially those that are rare or difficult to obtain, leading to delayed diagnosis and limited study. The advancement of technology at a rapid rate also poses a challenge, as it means that equipment gets outdated and the need for updating is constant, which incurs extra costs to healthcare facilities. Variations in tissue quality among samples can cause inconsistencies in diagnostic results, further complicating data reliability. The lack of global standardization in diagnostic practices and testing procedures complicates the interpretation and comparison of results across different regions and laboratories. Moreover, a lack of collaboration between healthcare professionals, researchers, and diagnostic companies impedes the development of better diagnostic tools. Public nervousness about adopting new technologies, especially AI-driven diagnostic systems, will also cause a slowdown because of accuracy and error concerns. Innovation, cooperation, and clarity in regulations would be the steps to overcome this.

Segmentation Analysis:

By Product

The consumable accounted for the share of 56.8% market share of tissue diagnostics in 2023 majorly because of its critical significance in the diagnostic process. Consumables encompassing reagents, slides, and stains have a vital use in tissue analysis and thus are more frequently replaced, which leads to steady demand. The consumables segment accounted for the largest share reflecting their critical position in routine diagnostics as well as hospital labs. The rising volume of tissue samples particularly in oncology expected to grow because these procedures are the mainstay of early cancer detection among patients.

The fastest-growing segment is instruments, with the increasing adoption of advanced diagnostic technologies, including digital pathology systems, AI-powered solutions, and automated diagnostic instruments. These technologies are gaining popularity for their ability to improve diagnostic accuracy, reduce turnaround times, and streamline lab workflows. As healthcare facilities upgrade their diagnostic tools to meet increasing demand, the instruments segment is witnessing rapid growth.

By Technology

Immunohistochemistry (IHC) held the largest market share in 2023 accounting for 32.4% of the market share in the tissue diagnostics industry. This method is widely practiced in oncology to detect antigens and play a crucial role in cancer diagnosis, especially with the identification of biomarkers. The popularity of IHC results from its precision, ability to distinguish between numerous types of cancer, and as part of precision medicine application. As cancer detection remains a central focus in tissue diagnostics, IHC continues to dominate the market.

Digital pathology and workflow management are the fastest-growing technologies in tissue diagnostics. The increasing shift toward digital solutions for data storage, remote access, and AI-powered image analysis is driving this growth. Digital pathology enhances the efficiency of pathology practices by enabling pathologists to work remotely, collaborate across distances, and leverage AI for faster and more accurate interpretations. This trend is particularly prominent in large healthcare networks and academic institutions, where digital solutions can scale across departments.

By Disease Type

Breast cancer was the largest segment in tissue diagnostics by disease type in 2023 with 48.3%. As the most common form of cancer across the globe, breast cancer diagnostic tools remain in the highest demand with tissue-based diagnostic tools. The trends in breast cancer are further also intensified by all the latest developments in molecular diagnostics and the growing importance of screening and early detection techniques both in developed and emerging markets.

The fastest-growing segment by disease type in the tissue diagnostics market is non-small cell lung cancer (NSCLC) because of the growing incidence of lung cancer worldwide. With improvements in immunotherapy and targeted therapies, there is a rising demand for accurate diagnostics to guide treatment plans. This growth is driven by the global push for better lung cancer screening methods, especially in high-risk populations. The increasing incidence of NSCLC and new biomarkers developed for personalized medicine are the prime factors driving the growth of this segment.

By End User

Hospitals accounted for a 37.6% market share in 2023 for tissue diagnostics. This is the primary location of tissue sample collection, testing, and diagnosis. Hospitals have steady demand for diagnostics, especially when it comes to cancer patients that require accurate diagnosis of tissues prior to treatment recommendations. The size of patient samples and the use of integrated diagnostics solutions have enabled hospitals to gain the highest level of market position.

Research laboratories are the fastest-growing end-user segment in tissue diagnostics. Research into personalized medicine, cancer biology, and regenerative medicine drives growth. Research labs need tissue diagnostics for molecular studies, drug development, and clinical trials. With more emphasis on understanding disease at the genetic or molecular level, advanced biotechnological tools are in the market, which pushes the requirement for tissue diagnostic tools in research setups.

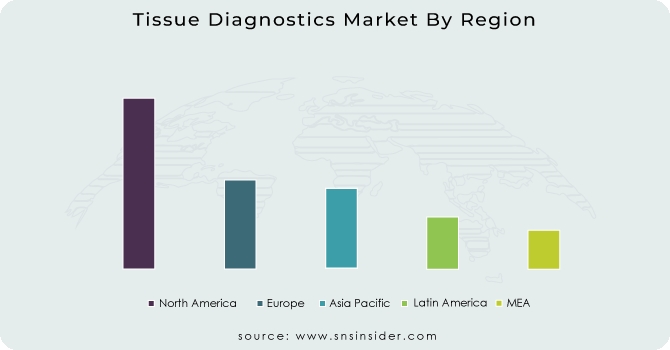

Regional Analysis:

In 2023, the market share is dominated by North America, holding 43.9% market share, based on the more developed healthcare infrastructure in the region, high acceptance of new innovative diagnostic technologies, and significant expenditure on healthcare. The United States leads this dominance, driven by a high prevalence of cancer, extensive cancer screening programs, and the presence of major diagnostic companies such as Roche Diagnostics and Thermo Fisher.

The Asia-Pacific region is expected to see the highest growth in the coming years, driven by improvements in healthcare infrastructure, increasing awareness of cancer screening, and rising investments in countries such as China, India, and Japan. As these nations become more health-conscious, the demand for tissue diagnostics is expanding, especially in the research and development sectors.

Need any customization research on Tissue Diagnostics Market - Enquiry Now

Key Players:

-

F. Hoffmann-La Roche Ltd - Ventana Diagnostic System, Cobas PCR System

-

Abbott Laboratories - RealTime PCR, Alinity m

-

Thermo Fisher Scientific Inc. - Oncomine Assays, Invitrogen Antibodies

-

Siemens - Atellica Solution, ADVIA Centaur XPT

-

Danaher - Leica Biosystems, Cepheid GeneXpert System

-

bioMérieux SA - VIDAS, BIOFIRE Diagnostics

-

QIAGEN - QIAamp DNA FFPE Kits, QIAcube

-

BD - BD SurePath, BD FACS

-

Merck KGaA - Sigma-Aldrich Reagents, Millicell Cell Culture Inserts

-

GE Healthcare - Centricity Imaging, Vivid Ultrasound Systems

-

BioGenex - i6000 Immunohistochemistry System, Xpress DAB

-

Cell Signaling Technology, Inc. - PathScan Antibodies, Cell Signaling Kits

-

Bio SB - IHC Antibodies, Automated Staining Systems

-

DiaGenic ASA - Genomic Assays

-

Agilent Technologies - Dako Autostainer Link 48, SureSelectXT

Recent Developments:

-

In Jan 2024, QIAGEN expanded its presence in the Middle East by opening a regional headquarters in Riyadh, Saudi Arabia, in early 2024. The company signed a Memorandum of Understanding with Saudi Arabia's Ministry of Health to support public health initiatives and assisted Oman’s nationwide tuberculosis screening program for expatriates by providing QuantiFERON-TB Gold Plus tests.

-

In Feb 2024, Roche entered into a collaboration agreement with PathAI to enhance its digital pathology capabilities, specifically focusing on the development of companion diagnostics. This partnership aims to leverage advanced AI-driven technology to improve diagnostic accuracy and support personalized treatment strategies.

-

In Jan 2023, Thermo Fisher Scientific partnered with AstraZeneca to develop a companion diagnostic test for Tagrisso, focusing on both solid tissue and blood-based samples. The collaboration aims to deliver next-generation sequencing results in as little as 24 hours, enhancing precision oncology and accelerating treatment decisions.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 6.83 Billion |

|

Market Size by 2032 |

USD 14.18 Billion |

|

CAGR |

CAGR of 8.47% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product [Consumables (Antibodies, Kits, Reagents, Probes), Instruments (Slide-staining Systems, Scanners, Tissue-processing Systems, Other Instruments) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

F. Hoffmann-La Roche Ltd, Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens, Danaher, bioMérieux SA, QIAGEN, BD, Merck KGaA, GE Healthcare, BioGenex, Cell Signaling Technology, Inc., Bio SB, DiaGenic ASA, Agilent Technologies. |