Aerosol Drug Delivery Devices Market Report Scope & Overview:

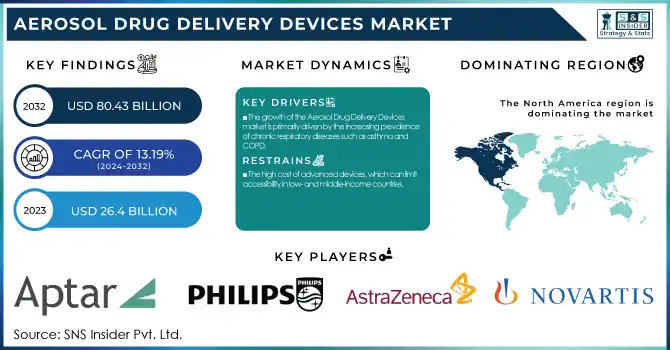

The Aerosol Drug Delivery Devices Market was valued at USD 29.9 billion in 2024 and is expected to reach USD 80.43 billion by 2032, growing at a 13.19% CAGR during the forecast period of 2025-2032.

This report highlights the increasing adoption rates of aerosol-based drug delivery technologies, with a focus on the growing demand for respiratory treatments and patient-friendly solutions. The study examines trends in regulatory approvals and how market penetration is being influenced by the approval of new devices and expanding treatment indications. Additionally, it looks at healthcare expenditure and reimbursement patterns, revealing how insurance coverage and government policies impact consumer access to aerosol drug delivery devices.

To get more information onAerosol Drug Delivery Devices Market - Request Free Sample Report

Key Aerosol Drug Delivery Devices Market Trends:

-

Increasing prevalence of chronic respiratory diseases such as asthma and COPD driving device demand.

-

Growing adoption of Smart Inhalers & Digital Health Integration (real-time monitoring, adherence tracking, telemedicine compatibility).

-

Rising shift toward Eco-Friendly & Low-Emission Propellants in inhalers, aligning with environmental regulations.

-

Advancements in Biologic Aerosol Formulations and personalized therapies enhancing treatment effectiveness.

-

Expansion of E-commerce & Online Pharmacies as major distribution channels post-pandemic.

-

Increasing focus on Patient Training & Education Programs to address inhaler misuse and improve outcomes.

Aerosol Drug Delivery Devices Market Drivers

-

The growth of the Aerosol Drug Delivery Devices market is primarily driven by the increasing prevalence of chronic respiratory diseases such as asthma and COPD.

The main driving force behind the global demand for non-invasive, efficient drug delivery systems is the aging population, as chronic respiratory conditions such as asthma and COPD are more prevalent. By 2050, the population aged 60 years or older is expected to double, further intensifying the need for accessible medical devices. Smart inhalers, for example, now come equipped with features like trackable dosing and real-time feedback. These advancements help work on issues regarding medication adherence, such a common issue during the treatment of asthma as 50-70% of the patients misuse the inhaler. Moreover, increased consciousness of respiratory disorders and their treatment together with increasing expenditure for healthcare is facilitating the increased use of aerosol drug delivery systems wherein patients increasingly look for easier alternate effective treatment for respiratory disorders.

Aerosol Drug Delivery Devices Market Restraints

-

The high cost of advanced devices, which can limit accessibility in low- and middle-income countries.

For instance, the cost of inhalers and related treatments can be prohibitive, limiting their widespread use. In some regions, inhalers may be priced 10-20 times higher than essential medicines, making them inaccessible to the most vulnerable populations. Another challenge lies in patient adherence to aerosol therapy. Studies show that up to 50% of patients with asthma or COPD do not use inhalers properly, which can diminish the therapeutic benefits. Misuse of proper inhalation technique, for instance, leading to wrongful timing or force may lead to suboptimal administration of drugs in the lungs and, therefore to poor treatment delivery. Also, patients may not comply due to forgetfulness or lack of understanding instructions meant for them. Regulatory issues also face innovation and adoption of new aerosol devices. The process of approval for inhalers is very lengthy and expensive because the device and its medication are tested to ensure that they are safe and effective. Moreover, aerosolized medications have to pass through strict quality control to meet regulatory standards. This makes the process complicated and delays market entry and limits innovation in new solutions, especially in regions with different regulatory frameworks. All of the above factors together have drastically limited the applications of aerosol-advanced drug delivery technologies, limiting their capacity to enhance patient safety and care.

Aerosol Drug Delivery Devices Market Opportunities

-

The rise of telemedicine and digital health technologies presents a major opportunity for the integration of smart inhalers in aerosol drug delivery.

Advanced devices can monitor medication adherence, share real-time feedback with the patient and healthcare provider, and improve the outcomes of treatment. Some smart inhalers may come equipped with sensors to track how and when a patient uses their inhaler and provide insight into optimizing therapy based on that insight. Personalized medicine also plays a very important role, further employing customized aerosol therapies designed for individual patient needs, which proves effective. Additionally, biologic aerosol formulations, such as monoclonal antibodies like Dupixent, are revolutionizing the treatment landscape for conditions like asthma and COPD, unlocking new growth drivers for the industry and expanding treatment options for other respiratory diseases.

Aerosol Drug Delivery Devices Market Challenges

-

The Aerosol Drug Delivery Devices market faces challenges due to regulatory hurdles and the complexities involved in obtaining approval for new inhalers.

The education of patients still represents a crucial barrier to the effective use of aerosol drug delivery devices. Improper inhalation technique represents one of the most common reasons for the failure of therapy, and nearly 30% of patients using inhalers do not demonstrate the proper technique, significantly reducing the effectiveness of treatment. More issues include the environmental concerns raised in the use of hydrofluoroalkane (HFA) propellants in metered-dose inhalers (MDIs). Shift towards more environmentally friendly options led to the creation of more eco-friendly, environmentally friendly, inhaler products. However, full change over to such products has proven challenging. The aerosol-based treatments are also under increasing competition from oral and injectable drug delivery systems, which are perceived as easier to use and more reliable. For example, the rising use of biologics in injection form for respiratory diseases presents a significant challenge to aerosol therapies, since patients may prefer the convenience and perceived efficacy of injectable options. To address these challenges, improved patient training programs, innovation in device design, and continued research into environmentally friendly and patient-friendly drug delivery technologies will be necessary.

Aerosol Drug Delivery Devices Market Segment Insights:

-

By Type: Inhalers accounted for 86.3% share in 2024, dominating due to portability, cost-effectiveness, and wide usage in asthma and COPD; Nebulizers are the fastest growing segment, supported by rising adoption in homecare and severe respiratory treatments.

-

By Application: COPD held the largest share in 2024, driven by chronic patient base, long-term management needs, and innovation in inhalation therapies; Asthma represents a strong demand sector, supported by increasing patient awareness and advanced treatment solutions; Other Respiratory Diseases are steadily expanding with new biologic aerosol treatments.

-

By Distribution Channel: Institutional Pharmacies captured the highest share in 2024, supported by hospital and clinic demand; Online Pharmacies are the fastest growing segment, driven by digital healthcare adoption and patient convenience.

Aerosol Drug Delivery Devices Market Segmentation Analysis

By Type

The Inhaler segment accounted for 86.3% of total revenue in 2024. It is a popular choice as it is portable, convenient, and delivers drugs directly to the lungs. In this regard, inhalers are more effective for conditions such as asthma, COPD, and other pulmonary diseases. Patients prefer inhalers, including MDIs and DPIs, due to their user-friendliness and quick onset of action. The dominance of inhalers in the market is due to factors such as their accessibility, cost-effectiveness, and established usage in the treatment of respiratory diseases. With advanced technology, like smart inhalers that track usage and ensure adherence, the market for inhalers is expected to continue its leadership position. Although it is a relatively smaller segment, the Nebulizer segment is expected to grow rapidly because of its increased use in severe respiratory conditions both in hospitals and at home.

By Application

COPD accounted for the largest revenue share in the Aerosol Drug Delivery Devices market in 2024. It is one of the major causes of morbidity and mortality worldwide and represents a chronic nature, leading to long-term treatment needs, thereby driving the demand for effective drug delivery devices, such as inhalers and nebulizers. COPD also enjoys a wide patient population, rising health consciousness, and ongoing innovation in the treatment of respiratory conditions. Additionally, aging populations are also increasingly being driven up by growth as the elderly have a higher likelihood of COPD. The importance of preventive care and long-term management of COPD is yet another aspect that fuels the market demand and hence, ensures dominance in the market during the entire forecast period. Moreover, the development of more biologics and advanced inhalation therapies is only going to open up treatment avenues for patients with COPD.

By Distribution

In 2024, Institutional Pharmacies captured the highest market share in aerosol drug delivery device distribution. This is mainly due to institutional pharmacies, hospitals, clinics, and healthcare centers. These act as primary sources for patients, given that regular and immediate treatment requirements are frequently obtained from them. These parameters enable the usage of aerosol devices for diseases such as asthma and COPD, and these are contributing factors to high volume sales of aerosol devices. However, the Online Pharmacies segment is the fastest-growing as patients increasingly seek convenience, more so after the pandemic. Patients are opting for home delivery services, which will allow them access to medications like inhalers and nebulizers without having to visit physical pharmacies. This is being driven by the rise of e-commerce platforms that provide quick, reliable services, as well as the ease with which prescriptions and over-the-counter aerosol drug delivery devices can be accessed. The expansion of online pharmacies is part of the larger digital health solutions trend, as patients increasingly seek convenient options to manage their respiratory health at home.

Aerosol Drug Delivery Devices Market Regional Analysis:

North America Aerosol Drug Delivery Devices Market Insights:

North America accounted for the largest market share of nearly 38% in 2024, anchored by the United States, which alone represents the most lucrative market for inhalers and nebulizers. The region’s dominance stems from a combination of high asthma and COPD prevalence, advanced healthcare systems, and strong insurance coverage for respiratory therapies. The U.S. Food and Drug Administration’s (FDA) emphasis on both device safety and environmental compliance has accelerated the shift toward eco-friendly inhalers and digital smart inhalers. Canada contributes steadily, with rising government spending on chronic disease management and elderly care. With the rapid uptake of connected health technologies, North America will continue to lead, although growth rates will be moderate compared to Asia.

Asia Pacific Aerosol Drug Delivery Devices Market Insights:

Asia Pacific is emerging as the fastest-growing region, with a market share of approximately 21% in 2024, but expected to expand rapidly through 2032. The growth is primarily fueled by urbanization, increasing pollution, and a rising burden of asthma and COPD in densely populated countries such as China and India. Japan remains an innovation hub, adopting advanced biologic inhalers and telehealth integration, while China and India focus on expanding accessibility through affordable generics and government-led healthcare schemes. Growing disposable incomes, healthcare reforms, and local manufacturing initiatives in Asia Pacific are accelerating adoption. This region is forecast to gain the most additional market share over the next decade, potentially narrowing the gap with North America.

Europe Aerosol Drug Delivery Devices Market Insights:

Europe held around 27% share in 2024, reflecting its mature but highly regulated market. Demand is strongest in Germany, France, and the U.K., where public health systems emphasize sustainable and cost-effective drug delivery methods. The European Union’s stringent environmental directives are driving investment in propellant-free or low-VOC inhalers, creating opportunities for innovation. Germany remains a frontrunner due to its advanced pharmaceutical manufacturing base and adherence to quality standards. Meanwhile, Southern Europe, particularly Italy and Spain, is witnessing growth through hospital upgrades and a rise in home-based respiratory care. Europe is also seeing consolidation among major players to comply with green building initiatives and healthcare modernization, which will support stable mid-single-digit growth.

Latin America (LATAM) and Middle East & Africa (MEA) Aerosol Drug Delivery Devices Market Insights:

Latin America represented about 6% of global revenues in 2024, with Brazil and Mexico leading regional adoption. Rising urban populations, coupled with government-backed infrastructure projects, are boosting demand for inhalers and nebulizers. However, affordability challenges and unequal access to healthcare limit penetration outside major urban centers. Multinational companies are increasingly setting up local production facilities to overcome import costs, which should gradually increase adoption rates.

Middle East & Africa (MEA) accounted for around 4% in 2024, but shows long-term potential due to improving healthcare systems in the Gulf Cooperation Council (GCC) countries and South Africa. Wealthier nations such as Saudi Arabia and the UAE are investing heavily in advanced hospital infrastructure and specialty respiratory clinics. In contrast, Sub-Saharan Africa still faces challenges with affordability and access, with generic devices being the dominant option. Over time, as healthcare access improves and urbanization accelerates, MEA is expected to register steady but modest growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Competitive Landscape for Aerosol Drug Delivery Devices Market:

GlaxoSmithKline (GSK)

GlaxoSmithKline is a leading global manufacturer of respiratory drug delivery devices, with a strong portfolio of metered-dose inhalers (MDIs) and dry powder inhalers (DPIs). The company emphasizes innovations in smart inhalers and eco-friendly propellant technologies to meet evolving patient and regulatory demands.

-

In March 2024, GSK launched its next-generation smart inhaler with integrated adherence-tracking technology in the U.S. and U.K., strengthening its leadership in connected respiratory care.

AstraZeneca

AstraZeneca is a prominent player in the aerosol drug delivery devices market, focusing on biologic inhalation therapies and advanced inhaler systems for asthma and COPD management. The company leverages digital health solutions to enhance patient outcomes.

-

In May 2024, AstraZeneca announced a partnership with a leading digital health platform to integrate smart inhaler usage data into telemedicine applications, expanding patient monitoring capabilities across North America and Europe.

Teva Pharmaceuticals

Teva is a major supplier of generic and branded aerosol drug delivery devices, including cost-effective inhalers and nebulizers. The company focuses on improving affordability and accessibility, especially in emerging economies.

-

In February 2024, Teva expanded its generic inhaler production facility in India to address rising demand in Asia Pacific and Africa, aligning with its mission to improve global respiratory healthcare access.

Novartis AG

Novartis offers a wide range of advanced inhalation products and is investing heavily in smart inhaler platforms connected to healthcare data systems. The company focuses on R&D to bring eco-friendly inhaler solutions to market.

-

In July 2024, Novartis introduced a digital platform in Germany to support healthcare providers with real-time inhaler adherence data, improving patient engagement and treatment outcomes.

Cipla Ltd.

Cipla is recognized for its affordable inhalers and strong market presence in Asia, Africa, and other emerging regions. The company emphasizes cost-effective respiratory solutions while expanding its global footprint.

-

In October 2023, Cipla launched a new line of eco-friendly MDIs in India, reducing environmental impact while catering to the rising patient demand for sustainable aerosol drug delivery solutions.

Aerosol Drug Delivery Devices Market Key Players:

-

3M Company

-

GlaxoSmithKline plc (GSK)

-

Johnson & Johnson

-

Vectura Group plc

-

Koninklijke Philips N.V.

-

Merck & Co. Inc.

-

Metall Zug AG

-

Recipharm AB

-

AptarGroup, Inc.

-

Sanofi

-

OMRON Corporation

-

Medline Industries, LP.

-

GF Health Products, Inc.

-

DRIVE MEDICAL GMBH & CO. KG

-

Sensirion AG

-

PARI Respiratory Equipment, Inc.

-

Pfizer Inc.

-

Abbott Laboratories

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 29.9 Billion |

|

Market Size by 2032 |

USD 80.43 Billion |

|

CAGR |

CAGR of 13.19 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type [Nebulizers (Jet, Mesh, Active, Passive, Ultrasonic), Inhaler (Pressurized Metered-Dose Inhaler (pMDI), Dry-Powder Inhaler (DPI))] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

3M Company, Aerogen, GlaxoSmithKline plc (GSK), Johnson & Johnson, Vectura Group plc, Koninklijke Philips N.V., Merck & Co. Inc., Metall Zug AG, Recipharm AB, Teva Pharmaceutical Industries Ltd., AptarGroup, Inc., Sanofi, OMRON Corporation, Medline Industries, LP., GF Health Products, Inc., DRIVE MEDICAL GMBH & CO. KG, Sensirion AG, PARI Respiratory Equipment, Inc., Pfizer Inc., Abbott Laboratories |