Tobacco Packaging Market Key Insights:

Get More Information on Tobacco Packaging Market - Request Sample Report

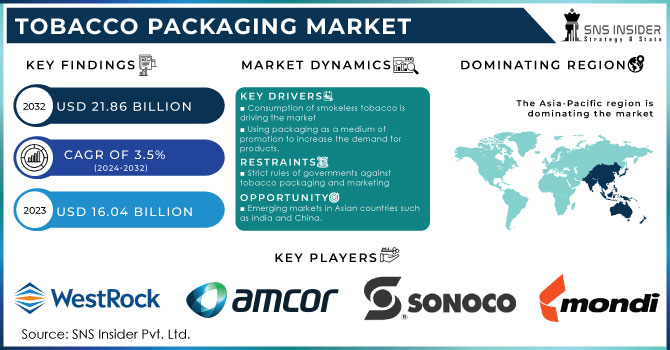

The Tobacco Packaging Market size was valued at USD 16.04 billion in 2023 and is expected to Reach USD 21.86 billion by 2032 and grow at a CAGR of 3.5 % over the forecast period of 2024-2032.

Over the forecast period, the demand for cigarettes is anticipated to rise due to the rise in global cigarette consumption. The development of smokeless tobacco for dipping or chewing and the rising use of e-cigarettes are key factors driving the global market. Therefore, the market is being driven by an increase in female smokers' cigarette demand. Another factor driving the market's expansion is an increase in workload, particularly in urban areas. Antidepressants like cigarettes are becoming more and more popular among people as a way to relieve stress.

The tobacco market has been driven by rising per capita income and rising tobacco use in many developing nations. Furthermore, smoking is one of the biggest draws for the younger generation, which could increase consumption.

Young people especially are drawn to offset printing and stamping, which will fuel market expansion in the years to come. Tobacco use, however, is extremely carcinogenic and is a major contributor to the rising cancer incidence seen in the world. Because of this, governments are taking preventive action by enacting strict tax and sales regulations, which will slow the market's growth over the forecast period.

For the consumer's convenience, manufacturers are concentrating on creative packaging. Flip-flop packaging is the most important type of packaging used in tobacco packaging in most Western markets, this type of packaging help in protecting cigarettes from getting damaged.

The WHO estimates that there are approximately 1.3 billion smokers worldwide, the majority of the, are found in nations with low- and middle-income ranges, which have higher rates of tobacco-related diseases. Manufacturers are combining green tea leaves and cloves to create herbal cigarettes, which are expected to increase the consumption of tobacco products and fuel the market demand over the course of the forecast period in an effort to reduce the diseases associated with tobacco use.

MARKET DYNAMICS

KEY DRIVERS:

-

Consumption of smokeless tobacco is driving the market

Due to the harmful effects of smoking consumers are moving towards the consumption of smokeless tobacco. Gutka, gum, or chewing tobacco are some forms of smokeless goods that can be used as an alternative to cigarettes. Smokeless tobacco packaging needs to be very special to safeguard the product from getting damaged. So, increasing demand for smokeless tobacco products is giving a boost to the tobacco packaging market.

-

Using packaging as a medium of promotion to increase the demand for products.

RESTRAIN:

-

Strict rules of governments against tobacco packaging and marketing

ASEAN Countries, India, China, and others have strict rules for tobacco product packaging and marketing. The product needs to be packaged with 60 % to 90 % area covered with warnings, which makes the packaging look less attractive. Also, government initiatives regarding the harmful effects of smoking are reducing sales. This is restraining the growth of the tobacco packaging market.

-

Counterfeiting tobacco products is also a major restrain in the tobacco packaging market.

OPPORTUNITY:

-

Use of tobacco packaging as a medium of promotion for increasing demand in the market

Packaging is the medium of promotion for any product, packaging acts as an advertisement tool, and it can help build a brand. Due to the increase in strict rules against tobacco, packaging is the only tool for the promotion of tobacco products. Hence, the tobacco packaging market has a great opportunity.

-

Emerging markets in Asian countries such as India and China.

-

Increasing stress and workload in urban cities are increasing demand for the tobacco products.

CHALLENGES:

-

Anti-smoking campaigns against tobacco industries

Anti-smoking campaigns conducted by many NGOs are a challenge affecting the demand for tobacco products. The role of campaigns is to make people aware of the ill-effects of tobacco, affecting the growth of the tobacco packaging market.

IMPACT OF RUSSIA-UKRAINE WAR

Due to the Russia-Ukraine war, many industries stopped their investments in the lands of Russia. Japan Tobacco stopped its Russia Operations, due to the war between Russia and Ukraine. Japan tobacco holds Russia’s of about 40-45% cigarette market. About 18% of Japan Tobacco's operating revenue comes from Russia. The launch of a heated tobacco device in Russia, which had been planned for the first half of 2022, was postponed after the company announced on March 10 that it would stop making new investments and engaging in marketing efforts there. There, it runs four factories and employs more than 3500 people.

After Russia's military invaded Ukraine in late February, major cigarette manufacturers started preparing to leave the country. One of them is the world's largest tobacco company, Philip Morris International, affecting the overall tobacco packaging market.

IMPACT OF ONGOING RECESSION

Investments made by players in the tobacco packaging market will go toward acquiring new technologies, securing raw materials, effective procurement and inventory management, strengthening product portfolios, and utilizing capabilities to sustain growth in difficult economic times. Tobacco Packaging manufacturers and related players are concentrating on country-specific strategies due to the economic and social challenges being highly variable across different markets and countries.

Fuel and chemical prices are having an effect on many other market segments, the $60/barrel swings in crude oil prices in a single year will pose a serious threat to the tobacco packaging industry.

Compared to last year's prices, the cost of energy has increased by 40%, while the cost of food, alcohol, and tobacco increased by 12 % in September, up from the 11% seen in August 2022.

KEY MARKET SEGMENTATION

By Raw Material

-

Plastic

-

Film

-

Paperbox

-

Jute

-

Others

By Distribution

-

Online

-

Offline

By Packaging Type

-

Bags & Sacks

-

Pouches

-

Boxes

-

Others

By End-use

-

Raw Tobacco

-

Smoking Tobacco

-

Smokeless Tobacco

REGIONAL ANALYSIS

With a share of 40% in 2023, Asia Pacific became the largest market and is anticipated to grow at the fastest rate during the forecast period. The biggest manufacturer and exporter of tobacco are both found to be Chinese companies. Due to rising cigarette and chewing tobacco consumption, the nation is likely to hold the top spot in the global market for tobacco packaging by the year 2031.

China's growth is anticipated to be mirrored by that of other countries in the Asia-Pacific region like Japan and India. Additionally, the market for e-cigarettes is expanding because have fewer health risks than tobacco use.

Due to the use of water pipes or shishas, other regions like the Middle East and Africa are probably going to experience an increase in market demand during the forecast period. Because of the expanding trend of smoking a variety of cigarettes, this region is anticipated to experience consistent growth over the course of the forecast period.

A few Middle Eastern and African nations where tobacco production is the main industry for revenue are Zimbabwe and South Africa. Consequently, the demand for tobacco products is likely to fuel the expansion of the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

Key Players

Some major players in the Tobacco packaging are ITC Limited, Amcor Limited, Sonoco, International Paper, British American Tobacco, Innovia Films, WestRock, Philip Morris International Inc, Reynolds American Corporation, Mondi Group, and other players.

RECENT DEVELOPMENTS

-

Canada, Individual cigarette warning labels will be adopted by Canada as the first nation. Smoking causes cancer and impotence, among other messages will be included in the warnings.

-

Imperial Tobacco, A number of modifications to the Lambert and Butler brand have been announced by Imperial Tobacco and are currently being implemented. To make a more recognizable presence for retailers in wholesale depots and on shelves, Lambert & Butler Blue Real Blue and Blue Bright Air Filter will be renamed to Blue Original and Blue Bright as part of the developments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.04 Bn |

| Market Size by 2032 | US$ 21.86 Bn |

| CAGR | CAGR of 3.5 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Plastic, Film, Paperbox, Jute, Others) • By Distribution (Online, Offline) • By Packaging Type (Bags & Sacks, Pouches, Boxes, Others) • By End Use (Raw Tobacco, Smoking Tobacco, Smokeless Tobacco) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ITC Limited, Amcor Limited, Sonoco, International Paper, British American Tobacco, Innovia Films, WestRock, Philip Morris International Inc, Reynolds American Corporation, Mondi Group |

| Key Drivers | • Consumption of smokeless tobacco is driving the market |

| Market Opportunities | • Use of tobacco packaging as a medium of promotion for increasing demand in the market. |