Paper & Paperboard Packaging Market Key Insights:

Get More Information on Paper & Paperboard Packaging Market - Request Sample Report

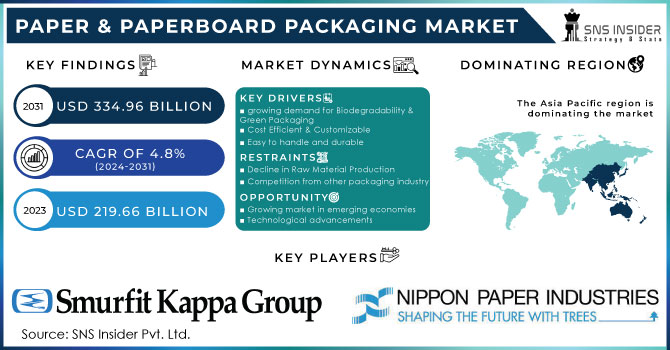

The Paper & Paperboard Packaging Market size was valued at USD 219.66 billion in 2023. It is expected to reach USD 334.96 billion by 2032 and grow at a CAGR of 4.8% over the forecast period 2024-2032.

Paper & Paperboard packaging material is made of pulp, pulp is obtained from wood as well as non-wood sources. Wood pulp is a widely used raw material for packaging as it is obtained from wood and also generated from the recycling of paper. This material is widely used because it is cost-efficient and easily obtained hence largely preferred by industries. The use of paper board is widely used in packaging in the food industry and pharmaceuticals. Paper boards can also be recycled resulting in less deforestation.

It is lightweight and it is covered with plastic and other polymers to maintain hygiene. It is a good substitute for plastic packaging. Nearly about 40 percent of the raw material required for paperboard packaging is generated from the recycling of paper. This is a positive impact on rising concerns about deforestation.

Various countries have also banned single-use of plastic as they were causing pollution to the environment, so there has been a shift towards paperboard type of packaging due to its sustainability. Paper and paper board packaging is in large demand in the e-commerce industry. The food industry is seeing rising growth over the years, this will have a positive impact on the paper and paper board packaging market.

MARKET DYNAMICS

KEY DRIVERS:

-

growing demand for Biodegradability & Green Packaging

Raw materials used in the production of packaging can be recycled, this helps to prevent raw disposal of waste material generated. There is less need for waste management as waste material is less generated. It is also helping the environment by generating less pollution. An increase in consumer awareness about eco-friendliness is also increasing demand for this market.

-

Cost Efficient & Customizable

-

Growth of the e-commerce packaging Industry

-

Easy to handle and durable

RESTRAIN:

-

Decline in Raw Material Production

During a decade there has been less demand for wood due to less availability of resources. The day-by-day depletion of forests is forcing the industry to shift to alternative solutions to raw materials.

-

Competition from other packaging industry

OPPORTUNITY:

-

Growing market in emerging economies

Emerging economies such as India and China are giving fresh markets to this packaging industry. Since there is a huge customer base in these countries it will also lead to a rise in this market.

-

Research and development activities in this industry are pushing the growth of the packaging market.

-

Government rules and regulations in emerging economies are giving a boost to the growth of the paper bag market.

-

Technological advancements

CHALLENGES:

-

Declining sources of Raw Materials

Raw materials are declining which is affecting the overall production of packaging materials. To overcome this challenge there is a need, to find alternate sources of raw materials.

-

High consumption of energy

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has created an impact on commodities, the economy, and also on the environment. Disruption of the global supply chain market is also the impact of Russia Ukraine war. The transportation of goods which was earlier done in huge amounts was reduced and this led to an increase in the prices of raw materials. The Indian Paper industry imports its raw materials majorly from Russia, but due to war, there was a delay in the import of raw materials. The war led to an increase of around 40 percent rise in the prices of raw materials. Before the war started the price of paper was 70000 Rupees per ton, this price after the war was increased to around 100000 Rupees per ton.

IMPACT OF ONGOING RECESSION

The price of waste paper talking about India has reached its lowest in five months, due to overcapacity of production and global damage caused by the recession. There is no hope for the increase of the market which is declining day by day in the recession period.

Small vendors have stopped the collection of waste paper due to decreased price of waste paper. Despite the fall in demand in the recessionary period, the demand is likely to go up in upcoming years as India is slowly becoming a global publishing and printing industry.

IMPACT OF COVID-19:

Covid 19 has impacted on Price, Demand, and Supply Chain of the paper and paperboard packaging market. Heavy competition was seen amongst small and big companies on pricing, because OF COVID-19. Demand for raw materials also fell resulting in the downfall of the overall market. The rise in the price of raw materials, also the low stock available with the wholesalers for the production has affected many small- and large-scale industries, which affected the overall paper and paperboard packaging market. The food industry and e-commerce industries have more demand for paper packaging boxes. Also, the restaurants and offices were shut down during Covid-19 due to which the need for canteens and food products was minimized which affected the paper and paperboard packaging market.

The entire supply chain was stopped due to the spread of coronavirus. This led to late production, and low production due to less demand in the market. There was also a shortage of labor due to the manufacturing capacity decreased. The supply chain disruption also increased the cost of production. Due to the late availability of raw materials.

KEY MARKET SEGMENTATION

By Raw Material:

-

Wood Pulp

-

Recycled Waste Paper

By Product type:

-

Folding Boxboard

-

Solid Bleached Sulfate

-

Label Paper

-

White Lined Chipboard

-

Glassline & Grease Paper

-

Others

By Application:

-

Durable Goods

-

Food & Beverages

-

Medical

-

Non-Durable Goods

-

Others

REGIONAL ANALYSIS

Based on our forecast period, the Asia Pacific region will grow with a high CAGR. This is because of the high population, increasing literacy rate, and increase in market size for the paper and paperboard packaging market.

Europe is the second largest in the growth of the paper and paper board packaging market due to stringent government regulation of ban on single-use plastic.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

RECENT DEVELOPMENTs

-

According to the news in May 2023, JMC Paper Tech Private Limited has started construction of their recycled fiber-based Kraft paper mill with a capacity of 150 TPD In the North American Region and is likely to start its production in mid-2024.

-

Mesta Board has planned a paperboard mill at Kaskinen, Finland. The investment decision is estimated to be made in 2024.

-

Liansheng Pulp & Paper Company Limited, has successfully started two ANDRITZ tissue machines at its China mill.

Key Players:

The major key players in the paper and packaging market are, Smurfit Kappa Group plc, DS Smith plc, Packaging Corporation of America, International Paper Company, Nippon Paper Industries Company Ltd, ITC Ltd, Sappi Limited, Metsa Group, Stora Enso Oyj, Svenska Cellulosa Aktiebolget, and other players

| Report Attributes | Details |

| Market Size in 2023 | US$ 219.66 Bn |

| Market Size by 2032 | US$ 334.96 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Wood Pulp, Recycled Waste Paper) • By Product Type (Folding Boxboard, Solid Bleached Sulfate, Label Paper, White Lined Chipboard, Glassline & Grease Paper, Others) • By Application (Durable Goods, Food & Beverages, Medical, Non -Durable Goods, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Smurfit Kappa Group plc, DS Smith plc, Packaging Corporation of America, International Paper Company, Nippon Paper Industries Company Ltd, ITC Ltd, Sappi Limited, Metsa Group, Stora Enso Oyj, Svenska Cellulosa Aktiebolget |

| Key Drivers | • Biodegradability & Sustainability of Paper and Paper Board |

| Market Opportunities | • Growing market in emerging economies |