Torpedo Market Report Scope & Overview:

To get more information on Torpedo Market - Request Free Sample Report

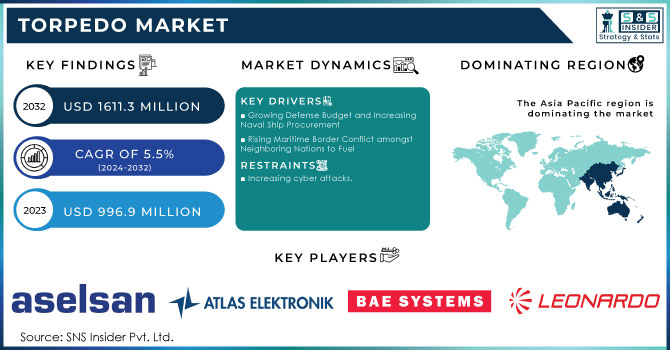

The Torpedo Market size was valued at USD 996.9 million in 2023 and is expected to reach USD 1611.3 million by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032.

The increased manufacture of light weight torpedoes that can be transported in large numbers on a warship or an aircraft is the main driver driving the torpedo market. The requirement for precise guidance equipment is minimized because the torpedoes are launched close to the targets, lowering total expenses. Torpedo market expansion is projected to be aided by the growing use of lightweight torpedoes.

The development of underwater warfare technologies is another significant factor driving the demand for torpedoes. Torpedoes are essential weapons in modern underwater warfare since it has developed significantly since the early days. Market expansion has been spurred by technological developments. The development of computerized systems and propulsion technologies has led to a rise in the demand for torpedoes that are more accurate and effective. These improvements make torpedoes more adaptable and enable them to perform a variety of tasks, including anti-submarine warfare, minefield protection, and long-range strikes. Unmanned Underwater Vehicles (UUVs) are in greater demand, which is driving growth in the torpedo sector. Applications in the military and business, like as reconnaissance and environmental surveillance, are using UUVs more and more. Torpedoes are also mounted on UUVs, creating powerful weaponry. Additionally, the use of nonethal torpedoes in maritime law enforcement operations has grown in popularity. These torpedoes are made to destroy ships without endangering crew members or causing any damage. These torpedoes are used by international maritime agencies to apprehend criminals for marine offenses in international waterways such drug trafficking, smuggling of guns and ammunition, and human trafficking.

KEY DRIVERS

-

Growing Defense Budget and Increasing Naval Ship Procurement

-

Rising Maritime Border Conflict amongst Neighboring Nations to Fuel

-

Growing use of torpedo

Unmanned Underwater Vehicles (UUVs) are in greater demand, which is driving growth in the torpedo sector. UUVs are being employed more frequently in commercial and military applications like environmental surveillance and reconnaissance. Torpedoes are also mounted aboard UUVS, creating powerful weaponry. Non-lethal torpedoes have also grown in favor for use in maritime law enforcement operations. These torpedoes are made to destroy ships without endangering crew members or causing any damage. These torpedoes are used by international maritime agencies to apprehend criminals engaged in marine offenses like drug trafficking, smuggling of weapons and artillery, and human trafficking in international waters.

RESTRAIN

-

Increasing cyber attacks

OPPORTUNITY

-

Growing budgets for R and D initiatives

-

Increasing programs for naval modernization

The world is seeing a lot of navy modernization efforts because maritime security is one of the most important defense units. A vast variety of ships, planes, wire-guided torpedoes, and wake-homing torpedoes are all part of China's navy modernization effort, which also includes improvements in maintenance & logistics, personnel education, and training. China's navy modernization efforts aim to strengthen capabilities for managing any unfortunate series of events or for gaining more control over China's near-seas region, protecting China's commercial sea lines of communication (SLOCs).

CHALLENGES

-

The delay in purchasing orders and slow production rate

-

Invention of new hybrid torpedo

Future torpedo sales are predicted to increase due to the introduction of new hybrid torpedoes. The development of hybrid torpedoes is a continuing emphasis for torpedo producers, and it will have a good effect on air and naval forces all over the world. The next generation of stealth torpedoes, known as hybrid torpedoes, combine the two primary capabilities into a single weapon to make it difficult for the adversaries to respond with defenses. The range and movement speed of the torpedo systems are increased, which is the main benefit of these hybrid torpedoes. Another benefit is that until they reach their target, opposing submarines or warships cannot detect the hybrid torpedoes or next-generation stealth torpedoes.

IMPACT ANALYSIS

IMPACT OF RUSSIAN UKRAINE WAR

The Poseidon was inspired by Soviet designs under Josef Stalin for a nuclear torpedo that could annihilate American coastlines. Putin stated in his address from that the torpedo's range will be limitless and that it could operate at severe depths at a rate that is many times faster than a submarine or conventional torpedoes. They are extremely quiet, highly manoeuvrable, and nearly indestructible to the enemy. There is now no weapon in existence that can defeat them, according to Putin. The K-329 Belgorod, a nuclear submarine with specialized use, will transport the Poseidon the Shipyard in Sevmash.

In its Nuclear Posture Review in 2022, the US stated that Russia and China "continue to expand" their nuclear arsenals to incorporate new, unstable systems. "Russia is developing a number of innovative nuclear-capable systems intended to defend the American homeland or its allies."The Posture Review states that this puts both parties at danger. According to the U.S. Naval Institute, Russia's development of Poseidon last year changed perceptions about nuclear weapons launched from submarines inverted. The possibility for autonomous functioning of this nuclear weapon is perhaps the most terrifying aspect, according to the institute. It stated in an article that a fully functional Kanyon "would have an incredible strategic impact." "As a fresh present nuclear weapons treaties do not include it as a delivery platform. In its Nuclear Posture Review from 2022, the US claimed that Russia and Russia and China "continue to expand and diversify their nuclear capabilities, to include novel and destabilizing systems, The U.S. Naval Institute, turned preconceived notions about nuclear weapons deployed from submarines on their head. The possibility for autonomous functioning of this nuclear weapon is perhaps the most terrifying aspect, according to the institute. It stated in an article that a fully functional Kanyon "would have an incredible strategic impact." Current nuclear arms treaties do not apply to it as a new delivery platform.

IMPACT OF ONGOING RECESSION

The Air Force are promoting fighter jets as an employer. Congressmen are being reminded by the Army of how many House districts will be involved in producing its new, networked tanks. The Navy won't be pushed away from the economic stimulus trough by ship and sub builders. Common Dynamics John Casey, the president of Electric Boat, for one, is promoting his Virginia-class submarines as employment gold mines.

KEY MARKET SEGMENTATION

By Weight

-

Heavyweight Torpedoes

-

Lightweight Torpedoes

By Launch Platform

-

Air-Launched

-

Surface-Launched

-

Underwater-Launched

By Propulsion

-

Electric Propulsion

-

Conventional Propulsion

REGIONAL ANALYSIS

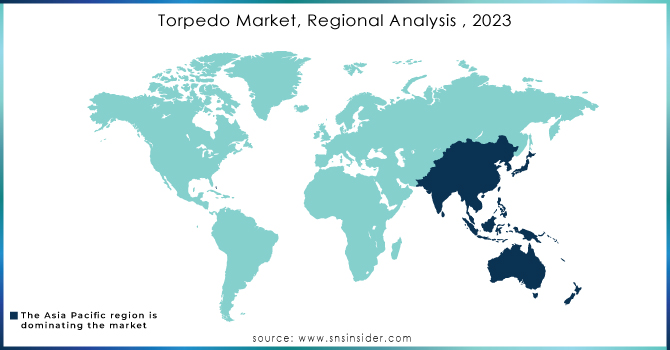

The market is anticipated to grow most quickly in Asia Pacific during the anticipated timeframe. This increase can be attributed to the increased attention being paid to China's and India's naval force capabilities. The Indian Shipyards revealed in February 2021 that they were in discussions with Naval Group over next surface ship and submarine developments.

The second-largest market share in 2021 was held by the European market. The growing conflict between Russia and Ukraine has accelerated the development of cutting-edge weaponry, which propels market expansion during the projection period. For instance, work has begun on a long-range, nuclear-powered torpedo by the Russian Navy. This nuclear-armed torpedo is now undergoing testing, and delivery is expected to happen in 2027.

Need any customization research on Torpedo Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The Major Players are ASELSAN AS, Atlas Elektronik GmbH, BAE Systems PLC, Bharat Dynamics Limited, Honeywell International Inc., Leonardo S.P.A., Lockheed Martin Corporation, Naval Group, Northrop Grumman Corporation, Raytheon Technologies Corporation and other players

RECENT DEVELOPMENT

July 2022, according to the Polish Armed Forces (PAF), the ambitious technical modernization plan (TMP) 2021–35 will be modified. About 2,000 modernization programs are part of this programme.

September 2022, for example The Russian Poseidon Nuclear Torpedo is a nuclear weapon designed to destroy significant port cities that have a significant economic impact. significant significance in business and trade. On the ocean floor, Poseidon is a massive torpedo that might be hard to thwart. Additionally, it switches out a conventional high-explosive warhead with a nuclear payload.

January 2021, A 14-meter-long robotic vehicle for the Russian Navy was being developed, according to the Russian defense industry, bolster and enhance its ASW (anti-submarine warfare) capabilities.

October 2022, according to India's Defense Research and Development Organization (DRDO), the Supersonic Missile Assisted Torpedo System (SMAT) was successfully launched from Abdul Kalam Island. The operation successfully showed the complete range of the proposed distance. The system's purpose is to improve the ability to combat submarines that travel farther than usual.

| Report Attributes | Details |

| Market Size in 2023 | US$ 996.9 Million |

| Market Size by 2032 | US$ 1611.3 Million |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2023-2032 |

| Historical Data | 2010-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Weight (Heavyweight Torpedoes, Lightweight Torpedoes) • By Launch Platform (Air-Launched, Surface-Launched, Underwater-Launched) • By Propulsion (Electric Propulsion, Conventional Propulsion)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ASELSAN AS (Turkey), Atlas Elektronik GmbH (Germany), BAE Systems PLC (U.K.), Bharat Dynamics Limited (India), Honeywell International Inc. (U.S.), Leonardo S.P.A. (Italy), Lockheed Martin Corporation (U.S.), Naval Group (France), Northrop Grumman Corporation (U.S.), Raytheon Technologies Corporation (U.S.) |

| Key Drivers | • Growing Defense Budget and Increasing Naval Ship Procurement • Rising Maritime Border Conflict amongst Neighboring Nations to Fuel • Growing use of torpedo |

| Market Opportunity | • Growing budgets for R and D initiatives • Increasing programs for naval modernization |