Trade Management Software Market Report Scope & Overview:

Get More Information on Trade Management Software Market - Request Sample Report

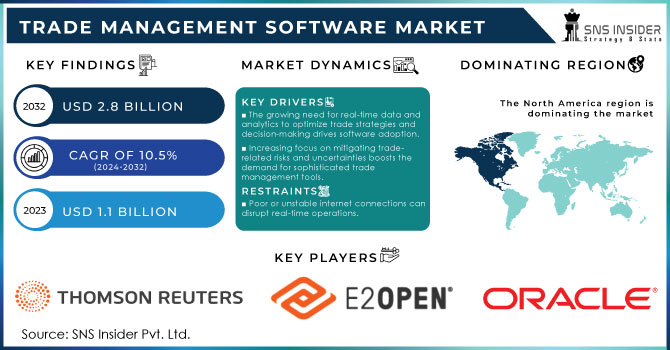

Trade Management Software Market was valued at USD 1.1 billion in 2023 and is expected to reach USD 2.8 billion by 2032, growing at a CAGR of 10.5% from 2024-2032.

The Trade Management Software market has seen robust growth, driven by the increasing need for efficient trade operations and risk management. This software helps businesses streamline their trade processes, manage compliance, and optimize trading strategies. The market's expansion is supported by global trade's growing complexity and financial regulations necessitating advanced trade management solutions. The growth is fueled by the need for businesses to navigate regulatory requirements and mitigate trade-related risks effectively. Second, the rising adoption of digital technologies and automation in trade processes is enhancing market growth. Businesses are increasingly investing in software solutions to automate routine tasks, improve accuracy, and reduce operational costs. The expansion of international trade and globalization is also driving demand for sophisticated trade management tools. Companies engaged in cross-border trade require robust software to handle diverse regulatory environments and optimize supply chains. According to the World Trade Organization, global merchandise trade volumes grew by 6.7% in 2022, highlighting the increasing need for effective trade management solutions.

Additionally, the growing focus on data analytics and real-time insights is propelling the market. Trade management software often includes advanced analytics features that provide valuable insights into trade performance, enabling businesses to make informed decisions and enhance profitability.

Market Dynamics

Drivers

-

The growing need for real-time data and analytics to optimize trade strategies and decision-making drives software adoption.

-

Increasing focus on mitigating trade-related risks and uncertainties boosts the demand for sophisticated trade management tools.

-

The overall shift towards digital solutions and automation in business processes supports the growth of trade management software.

The increasing shift towards digital solutions and automation in business processes is significantly boosting the growth of the trade management software market. As companies seek to streamline their operations and improve efficiency, there is a rising demand for software that can automate and optimize trade management tasks. This includes everything from trade execution and compliance to risk management and reporting. In recent years, businesses have been adopting digital technologies to enhance their operational efficiency and reduce manual errors. Trade management software provides a comprehensive solution by automating complex trade processes, integrating various systems, and ensuring compliance with regulatory requirements.

The growing emphasis on data-driven decision-making and real-time analytics further drives the need for advanced trade management solutions. These tools help businesses manage trade operations more effectively, track performance, and make informed decisions, leading to increased adoption and market growth. The trend towards digitalization and automation is thus a key factor propelling the expansion of the trade management software market.

Restraints

-

Companies may resist transitioning from traditional methods to new software solutions.

-

Poor or unstable internet connections can disrupt real-time operations.

-

Frequent changes in trade regulations make it hard for software to stay up-to-date.

In the trade management software market, frequent changes in trade regulations present a significant challenge. Governments and regulatory bodies worldwide constantly update trade laws, tariffs, import-export restrictions, and compliance requirements in response to economic shifts, geopolitical tensions, and policy changes. These frequent updates demand that trade management software continuously evolve to ensure compliance, which can be complex and time-consuming for software providers. Keeping the software up-to-date requires regular updates, patches, and adjustments, which not only increase development and maintenance costs but also disrupt normal operations for businesses using the software. For companies relying on these systems, failure to comply with the latest regulations can lead to penalties, delays, and financial losses. Moreover, managing these changes manually or through outdated software can overwhelm trade teams, leading to errors and inefficiencies. The constant need to adapt to regulatory changes places a heavy burden on both software developers and users, making it a critical restraint factor in the market, particularly for businesses with cross-border trade activities.

Segment Analysis

By Function

Trade compliance held the highest revenue share of more than 35% in 2023. The increasing complexity and stringent enforcement of international trade regulations have made trade compliance a top priority for businesses engaged in cross-border transactions. This heightened focus on compliance has fueled the demand for robust trade compliance solutions within the Trade Management Software (TMS) market. TMS platforms with strong trade compliance features enable businesses to proactively identify and mitigate risks, protecting their bottom line and brand image. Governments and regulatory bodies are increasingly scrutinizing cross-border transactions, requiring businesses to provide detailed documentation and demonstrate compliance. Trade compliance software automates many of these processes, saving time and reducing errors.

Companies with complex supply chains are likely to drive the demand for software equipped with features like trade compliance and customs management, aiming to cut costs, manage risks, identify savings opportunities, and streamline cross-border clearance processes. Evolving customs requirements across different countries for imports and exports are expected to boost the demand for customs management solutions in the coming years. The incorporation of advanced technologies like analytics and artificial intelligence is propelling the market toward accelerated growth.

By Deployment

The cloud segment dominated the Market with the highest revenue share of more than 60% in 2023 due to its scalability, cost-effectiveness, accessibility, and automatic updates. Cloud-based solutions eliminate the need for upfront infrastructure investment and offer flexible pay-as-you-go models, making them attractive to businesses of all sizes. The ability to access the platform from anywhere and collaborate in real-time is crucial for global supply chains.

By Organization Size

In 2023, The large enterprise segment dominated the market and represented over 53.75% of the market share. This is driven by the growing need for efficient solutions in trade management, compliance management, import/export management, and financial management to effectively oversee and track complex supply chains. Large enterprises engaged in international trade must adhere to global trade regulations, which is expected to increase the demand for trade management software.

The small and medium enterprises segment is anticipated to grow with the highest CAGR during the forecast period. The market growth is fueled by increasing investments and funding aimed at expanding businesses internationally. Small and medium-sized enterprises (SMEs) are increasingly adopting cost-effective cloud-based software due to its affordability and pay-per-use pricing model, which is expected to boost market growth.

By Industry

The healthcare & life sciences segment is expected to grow at the highest CAGR during the forecast period from 2024-2032. For instance, GE Healthcare, a leading global medical technology company, manages a complex supply chain across 145 locations, multiple time zones, regulatory frameworks, and international borders. To streamline its operations, the company implemented the E2open trade compliance platform to automate compliance processes and reduce operational costs. The rising import and export of consumer goods, petroleum oils, automobiles, raw materials, and capital goods are anticipated to drive the adoption of this software across various industries.

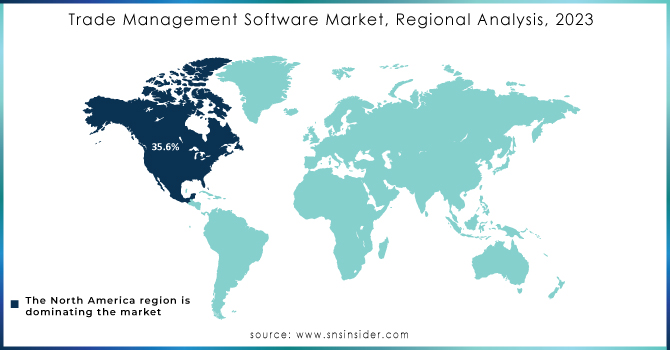

Regional Analysis

North America led the Trade Management Software Market with the highest revenue share of more than 35.6% in 2023. The region's high volume of cross-border trade creates a complex environment that demands efficient TMS solutions to comply with regulations and optimize operations. Additionally, the flourishing e-commerce sector in North America has intensified the need for TMS to streamline order processing, inventory management, and logistics, further propelling market growth. The increasing adoption of cloud-based TMS solutions in the region, offering scalability, cost-effectiveness, and ease of deployment, has also attracted a wide range of businesses. Finally, the stringent regulatory compliance requirements in North America necessitate the use of TMS to ensure adherence and avoid penalties, driving the demand for such solutions.

Need any customization research on Trade Management Software Market - Enquiry Now

Key Players:

The Major players in the Market are Thomson Reuters, E2open Parent Holdings, Inc., Amber Road, Inc., Livingston International, The Descartes Systems Group, Inc, Oracle Corporation, MIQ Logistics, LLC, SAP SE, Integration Point, Inc., Expeditors International of Washington, Inc., Bamboo Rose LLC, QAD Inc., and others in the final report.

Recent Development:

-

In April 2024, Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, announced its acquisition of Aerospace Software Developments (“ASD”), a leading provider of customs and regulatory compliance solutions.

-

In February 2024, Oracle introduced new logistics capabilities within Oracle Fusion Cloud Supply Chain and Manufacturing (SCM) to help organizations enhance the efficiency of their global supply chains.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.1 Bn |

| Market Size by 2032 | USD 2.8 Bn |

| CAGR | CAGR of 10.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Finance Management, Trade Compliance, Custom Management, Trade Analytics and Others) • By Deployment (On-premises, Cloud) • By Organization Size (Large Enterprises, SMEs ) • By Industry (Healthcare & Life Sciences, Manufacturing, Automotive, IT & Telecom, Retail & Consumer Goods and Products, Transportation & Logistics and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thomson Reuters, E2open Parent Holdings, Inc., Amber Road, Inc., Livingston International, The Descartes Systems Group, Inc., Oracle Corporation, MIQ Logistics, LLC, SAP SE, Integration Point, Inc., Expeditors International of Washington, Inc., Bamboo Rose LLC, QAD Inc. |

| Key Drivers | • Increasing focus on mitigating trade-related risks and uncertainties boosts the demand for sophisticated trade management tools. • The overall shift towards digital solutions and automation in business processes supports the growth of trade management software. |

| Key Restraints | • Poor or unstable internet connections can disrupt real-time operations. • Frequent changes in trade regulations make it hard for software to stay up-to-date. |