Wireless Mesh Network Market Report Scope & Overview:

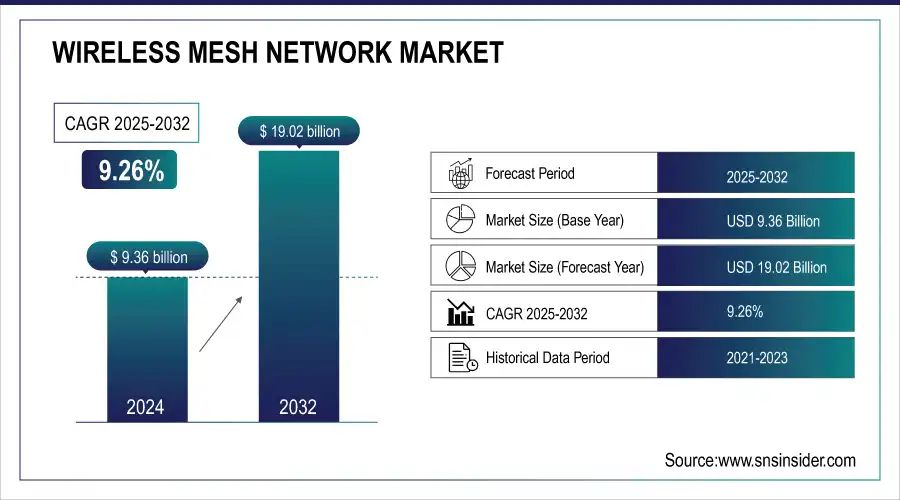

The Wireless Mesh Network Market was valued at USD 9.36 billion in 2024 and is expected to reach USD 19.02 billion by 2032, growing at a CAGR of 9.26% from 2025-2032.

To Get more information on Wireless Mesh Network Market - Request Free Sample Report

This report includes a comprehensive analysis covering Return on Investment (ROI) and cost-effectiveness, frequency and impact of security incidents, average time to deployment, evolving data traffic trends, and the network’s capacity to handle high user density. The market growth is driven by the rising demand for seamless, scalable, and resilient connectivity across smart cities, industrial automation, and remote area communications. Organizations are increasingly prioritizing efficient deployment and network resilience, with wireless mesh technology enabling adaptive routing and minimal downtime. As data consumption surges and security threats evolve, the ability of mesh networks to manage dense user environments while optimizing performance and cost further positions them as a critical component of next-gen connectivity infrastructure.

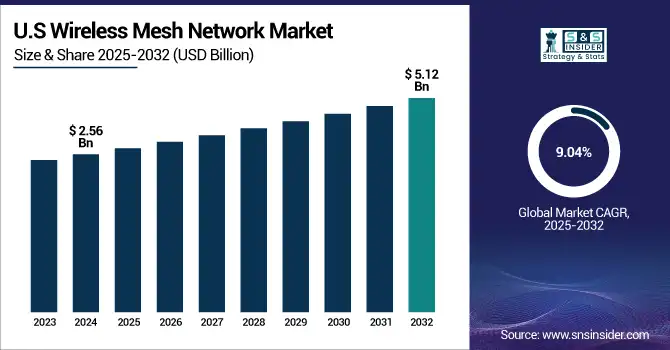

U.S. Wireless Mesh Network Market was valued at USD 2.56 billion in 2024 and is expected to reach USD 5.12 billion by 2032, growing at a CAGR of 9.04% from 2025-2032.

This growth is primarily driven by the increasing demand for high-reliability, low-latency connectivity in smart city initiatives, defense communications, and industrial automation. The rising adoption of IoT devices, coupled with expanding smart infrastructure projects, is fueling the need for flexible, self-healing wireless networks. Additionally, advancements in edge computing and the push for nationwide broadband expansion are reinforcing market momentum. Government investments and public-private partnerships to improve digital infrastructure also contribute to the market's upward trajectory, as wireless mesh networks offer scalable and cost-efficient connectivity solutions for diverse urban and rural applications.

Wireless Mesh Network Market Trends

-

Rising demand for reliable, scalable, and self-healing network connectivity is driving wireless mesh network adoption.

-

Growth of smart cities, IoT devices, and industrial automation is boosting market expansion.

-

Integration with 5G, Wi-Fi 6, and LPWAN technologies is enhancing network performance and coverage.

-

Increasing need for robust communication in military, healthcare, and enterprise sectors is shaping market growth.

-

Advancements in low-power, high-throughput mesh solutions are improving efficiency and deployment flexibility.

-

Adoption in remote and rural areas is expanding connectivity and bridging digital gaps.

-

Collaborations between telecom providers, IoT companies, and network equipment manufacturers are accelerating innovation.

Wireless Mesh Network Market Growth Drivers:

-

Growing adoption of Industrial IoT (IIoT) applications fuels demand for highly reliable wireless mesh communication frameworks.

The growing adoption of Industrial Internet of Things (IIoT) technologies in industries like manufacturing, oil & gas, mining, and logistics is driving the adoption of wireless mesh networks. Wireless mesh networks enable seamless communication among hundreds of industrial devices and sensors, even in extreme or large environments. Wireless mesh architectures provide redundancy, self-healing, and assured multi-hop connectivity, which is essential for IIoT installations that require low-latency, high-reliability data exchange. Unlike the conventional point-to-point or hub-based architectures, wireless mesh networks can easily adapt to changes in the network or node failure, providing operational continuity. With industries looking to monitor in real time, maintain in advance, and operate automatically, the scalability and reliability of wireless mesh solutions make them prime candidates as key infrastructure elements for digital transformation.

Wireless Mesh Network Market Restraints:

-

High initial deployment costs and complex integration with legacy systems hinder widespread adoption of wireless mesh networks.

Although wireless mesh networks provide far-reaching long-term advantages, their initial deployment costs are still a major hurdle for most organizations, particularly SMEs. Creating a solid mesh infrastructure requires investment in several nodes, sophisticated routers, software, and trained staff. Furthermore, connecting these networks to existing legacy systems can be technically complicated, involving bespoke interfaces or network upgrades. In highly established operational industries, compatibility challenges and the necessity for retraining employees further add costs and complexity. The absence of mesh platforms' universal standards also adds longer implementation periods and greater consultancy requirements. All these combine to discourage certain organizations from switching to wireless mesh solutions, despite their possibilities, hence decelerating the general market penetration and expansion.

Wireless Mesh Network Market Opportunities:

-

Proliferation of connected public safety systems creates emerging prospects for wireless mesh networks in mission-critical communications.

While urban and rural areas invest in public safety infrastructure, demand for robust communications systems is growing—fueling significant demand for wireless mesh networks. They enable real-time data sharing between surveillance cameras, emergency services, and public warning systems, particularly in places where other connectivity solutions do not work. Their dynamic and decentralized routing abilities allow them to keep operating even if a node is lost, an important factor during emergencies or disasters. Mesh networks also facilitate easy rapid deployment, making them the best choice for temporary installations at large public events or in recovery from crises. With smart policing and disaster management becoming key aspects of civic planning, wireless mesh technologies will become key to enabling real-time fail-safe communication infrastructure across jurisdictions.

Wireless Mesh Network Market Challenges:

-

Scalability and performance degradation in dense deployments pose critical challenges for wireless mesh network reliability.

Although wireless mesh networks are scalable in theory, in practice, performance can significantly degrade as more nodes are added. Each hop in a mesh network introduces latency and potential interference, affecting throughput and communication speed. In dense deployments, overlapping signals and congestion further reduce efficiency, undermining the network’s ability to deliver low-latency, high-reliability communication. Managing node synchronization and optimizing routing paths in real time becomes increasingly complex as the network grows. Without advanced traffic management protocols or intelligent routing algorithms, the system may suffer from bottlenecks and frequent data collisions. This limitation hampers the network's ability to scale cost-effectively while maintaining the performance levels required for industrial or smart city applications.

Wireless Mesh Network Market Segment Analysis

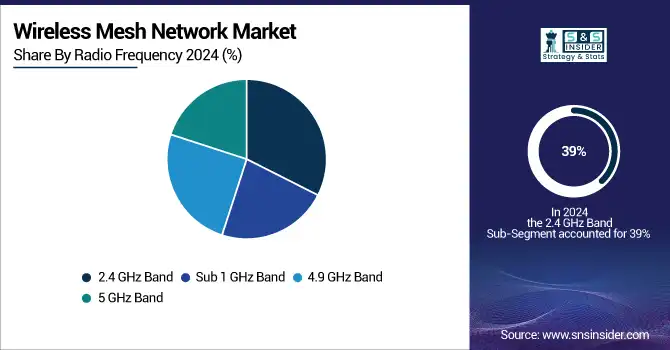

By Radio Frequency, 2.4 GHz Band dominated, 5 GHz Band is expected to grow fastest.

The 2.4 GHz Band segment dominated the Wireless Mesh Network Market with the highest revenue share of about 39% in 2024 due to its long-range coverage and strong signal penetration through obstacles like walls and trees. This band supports a wide variety of devices and is ideal for outdoor and large-area deployments. Its widespread adoption across commercial, industrial, and public safety applications has cemented its leadership in the market, especially in environments requiring consistent and broad coverage with fewer access points.

The 5 GHz Band segment is expected to grow at the fastest CAGR of about 10.38% from 2025 to 2032 due to increasing demand for high-speed, low-latency wireless communication. It offers wider channels, less interference, and higher data transfer rates, making it suitable for bandwidth-intensive applications. As smart city projects and enterprise-grade IoT deployments expand, the need for more robust and faster wireless connectivity is accelerating the adoption of 5 GHz wireless mesh networks in dense and performance-critical environments.

By Application, Disaster Management & Rescue Operations dominated, Medical Device Connectivity is expected to grow fastest.

Disaster Management & Rescue Operations held the largest revenue share of about 28% in the Wireless Mesh Network Market in 2024 due to the critical need for uninterrupted communication in emergency situations. These networks offer rapid deployment, self-healing capabilities, and reliable connectivity in remote or damaged areas, making them ideal for real-time coordination among responders. The increasing frequency of natural disasters and global emphasis on emergency preparedness have further driven the demand for wireless mesh networks in this segment.

The Medical Device Connectivity segment is projected to grow at the fastest CAGR of about 11.14% from 2025 to 2032, driven by the rapid digitalization of healthcare infrastructure. The growing need for real-time data sharing between medical devices, electronic health records, and hospital systems enhances patient monitoring and clinical workflows. Wireless mesh networks offer reliable, scalable connectivity in complex medical environments, supporting mobility and reducing wiring complexity, thereby improving operational efficiency and patient care outcomes in modern healthcare settings.

By End-use, Smart Cities & Smart Warehouses dominated, Oil & Gas is expected to grow fastest.

Smart Cities & Smart Warehouses dominated the Wireless Mesh Network Market with the highest revenue share of about 24% in 2024 due to their high reliance on continuous, decentralized communication systems. These environments demand real-time monitoring, automation, and data exchange across a wide geographic area. Wireless mesh networks provide scalability, redundancy, and seamless connectivity for managing infrastructure, logistics, and public utilities, making them essential for smart urban development and efficient warehouse management, where constant connectivity and adaptability are paramount.

The Oil & Gas segment is projected to grow at the fastest CAGR of about 12.53% from 2025 to 2032, driven by the increasing need for real-time data transmission and remote monitoring across exploration and production sites. Wireless mesh networks enable reliable connectivity in harsh, remote, or hazardous environments, where traditional wired infrastructure is impractical. As safety, automation, and predictive maintenance become priorities in the sector, the adoption of wireless mesh networks is accelerating to enhance operational efficiency and minimize downtime.

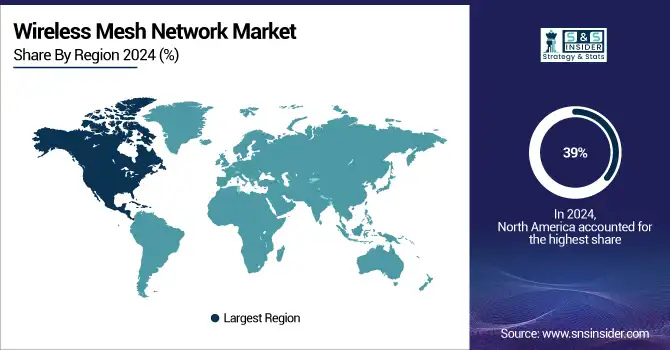

Wireless Mesh Network Market Regional Analysis

North America Wireless Mesh Network Market Insights

North America accounted for the highest revenue share of about 39% in the Wireless Mesh Network Market in 2024 due to early adoption of advanced wireless technologies and strong infrastructure across sectors like public safety, defense, smart cities, and industrial automation. The presence of key market players, robust R&D investments, and increasing demand for high-performance communication networks in critical operations further supported the region's dominance. Government initiatives and funding for smart infrastructure projects also contributed to widespread deployment of wireless mesh networks.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Wireless Mesh Network Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 10.85% from 2025 to 2032, driven by rapid urbanization, industrial expansion, and growing investment in smart infrastructure across emerging economies. Increasing adoption of IoT, smart city initiatives, and rising demand for seamless connectivity in sectors such as manufacturing, energy, and transportation are fueling market growth. Government support and digital transformation efforts in countries like China, India, and Southeast Asian nations are accelerating the adoption of wireless mesh networks in the region.

Europe Wireless Mesh Network Market Insights

Europe holds a significant share in the Wireless Mesh Network Market, driven by advanced telecommunications infrastructure, strong industrial adoption, and government support for smart city initiatives. Countries like Germany, the UK, and France are investing in mesh networking for public safety, utilities, and enterprise applications. Rising demand for reliable, high-speed connectivity, IoT integration, and industrial automation further propels market growth across the region.

Middle East & Africa and Latin America Wireless Mesh Network Market Insights

The Middle East & Africa and Latin America are emerging markets for the Wireless Mesh Network Market, supported by increasing investments in smart infrastructure, growing adoption of IoT and industrial automation, and rising demand for reliable connectivity in enterprises and public services. Although limited infrastructure and higher deployment costs pose challenges, government initiatives, private sector funding, and expanding network projects are gradually driving market growth in these regions.

Wireless Mesh Network Market Competitive Landscape:

HPE Aruba Networks

HPE Aruba Networks is advancing the Wireless Mesh Network Market with its innovative agentic mesh technology. Integrated within Aruba Networking Central, this solution leverages AI agents for root-cause analysis and automated remediation, enhancing network reliability, performance, and operational efficiency. By enabling autonomous monitoring and management, it supports enterprise and industrial applications, reduces downtime, and strengthens overall connectivity, positioning HPE Aruba Networks as a leader in intelligent mesh networking solutions.

-

2025: HPE Aruba Networks introduced agentic mesh technology within Aruba Networking Central, enabling AI agents to handle root-cause analysis and remediation via a multimodal "network copilot," boosting autonomous operations and efficiency.

Rajant Corporation

Rajant Corporation is a key player in the Wireless Mesh Network Market, offering its Kinetic Mesh technology for reliable, autonomous, and continuously adaptive wireless connectivity. Its solutions support industrial, mining, and enterprise applications, delivering high performance, low latency, and resilient communication in challenging environments. With a focus on global expansion and strategic partnerships, Rajant strengthens mesh networking adoption, enabling precise data transmission and seamless operations across diverse sectors.

-

2024: Rajant Corporation partnered with Macnica to distribute its Kinetic Mesh networks across Asia, enhancing industrial clients' access to robust, autonomous, and continuously adaptive mesh wireless solutions.

-

2024: Rajant Corporation successfully completed Precision Time Protocol (PTP) testing in underground mining scenarios at NORCAT (Canada) using Kinetic Mesh with ESG, enabling microsecond-accurate seismic data transmission to the surface without fiber.

-

2024: Rajant Corporation opened new offices in Italy (IoT/data bridging) and Ukraine (AI development), strengthening its global infrastructure to support expanded Kinetic Mesh deployments.

Cisco Systems, Inc.

Cisco Systems, Inc. is a prominent player in the Wireless Mesh Network Market, offering advanced mesh networking solutions for enterprise, industrial, and public sector applications. Its technologies provide high scalability, robust connectivity, and seamless integration with existing network infrastructure. By enhancing performance in high-density environments and supporting IoT and smart applications, Cisco strengthens network reliability, reduces downtime, and enables efficient, secure, and adaptive wireless communication across diverse sectors.

-

2024: Cisco Systems, Inc. introduced the next-generation Catalyst 9100 Series access points with advanced mesh networking features, providing improved scalability, reliability, and seamless connectivity in high-density enterprise environments.

Firetide, Inc.

Firetide, Inc. is a leading provider in the Wireless Mesh Network Market, specializing in high-performance mesh networking solutions for transportation, smart cities, and enterprise applications. Its technologies deliver reliable, low-latency, and scalable wireless connectivity, supporting real-time monitoring, IoT integration, and critical communications. Firetide’s solutions enhance operational efficiency, safety, and data-driven decision-making, making it a key player in enabling resilient and adaptive wireless networks across urban and industrial environments.

-

2024: Firetide deployed its HotPort 7000 Series mesh nodes in a major metropolitan transit system, providing robust wireless connectivity to support real-time operations.

Key Players

-

Aruba Networks, Inc.

-

BelAir Network Inc.

-

Cisco Systems, Inc.

-

Rajant Corp.

-

Ruckus Wireless, Inc.

-

Strix Wireless Systems Private Ltd.

-

Tropos Networks, Inc.

-

ZIH Corp.

-

Qualcomm

-

ABB

-

Qorvo

-

Wirepas

-

Cambium Networks

-

Motorola Solutions Inc.

-

Unicom Systems

-

Zebra Technologies Corporation

-

View Profile

-

Qorvo Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 9.36 Billion |

| Market Size by 2032 | US$ 19.02 Billion |

| CAGR | CAGR of 9.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Radio Frequency (sub 1 ghz band, 2.4 ghz band, 4.9 ghz band, 5 ghz band) • By Application (home networking, video surveillance, disaster management & rescue operations, medical device connectivity, traffic management) • By End-use (education, government, healthcare, hospitality, mining, oil & gas, transportation & logistics, smart cities & smart warehouses, others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aruba Networks, Inc., BelAir Network Inc., Cisco Systems, Inc., Firetide, Inc., Rajant Corp., Ruckus Wireless, Inc., Strix Wireless Systems Private Ltd., Synapse Wireless, Inc., Tropos Networks, Inc., ZIH Corp., Qualcomm, ABB, Qorvo, Wirepas, Cambium Networks |