Childcare Management Software Market Reprot Scope & Overview:

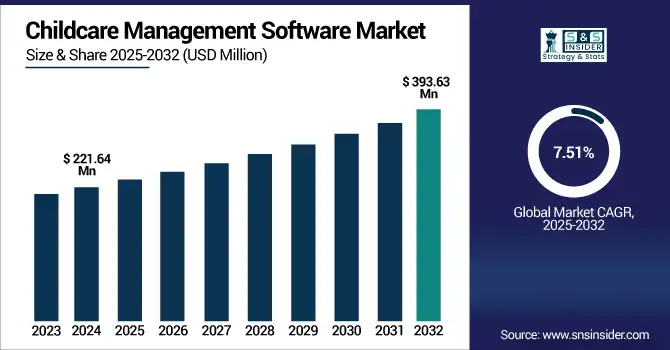

The Childcare Management Software Market, valued at USD 221.64 million in 2024, is projected to grow to USD 393.63 million by 2032, at a CAGR of 7.51% from 2025–2032.

This growth reflects the increasing recognition of CMS platforms as essential tools for operating modern childcare environments. Key drivers include the shift to cloud-based systems, which enable real-time access to data, better security, and easier scalability especially valuable for providers managing large and distributed child populations.

To Get more information on Childcare Management Software Market - Request Free Sample Report

Childcare Management Software (CMS) addresses these challenges by streamlining operations such as attendance tracking, billing, enrollment, and parent communication. By improving efficiency, transparency, and accountability, CMS ensures that limited resources are better managed and that children receive consistent, high-quality care. In low-resource settings with growing young populations, CMS is not optional it is a vital tool for sustainable childcare delivery.

- Government Support: The U.S. GSA promotes secure cloud adoption in childcare, while ACF ensures CMS platforms meet safety and compliance standards.

- Workforce Demand: With 80.1% of U.S. families having at least one employed member in 2024, there's a growing need for reliable, tech-driven childcare solutions.

- Proven Success: Indiana’s state-run CMS supports over 3,000 providers with tools for attendance tracking, payment processing, and compliance reporting.

This model illustrates how digital platforms can improve operational control, parental trust, and service delivery. As child populations expand and family dynamics evolve, CMS is becoming essential infrastructure for effective, future-ready childcare systems worldwide.

Driving the Childcare Software Boom Exploring the Forces Behind Market Acceleration and Innovation

-

Rising parental expectations and demand for streamlined childcare operations are fueling rapid adoption of childcare management software globally.

Rising parental expectations for safety, communication, and transparency are driving rapid adoption of childcare management software worldwide. Parents today want real-time updates on their child’s activities, attendance, and learning progress, pushing childcare providers to digitize daily operations for greater visibility and trust.

Platforms like Brightwheel are leading this shift. According to its official website, 95% of administrators report improved parent communication, while providers save up to 20 hours monthly on admin tasks. Additionally, 90% of preschools using Brightwheel say more families pay on time through its digital billing tools.

This aligns with broader trends, the U.S. Bureau of Labor Statistics reports that 62% of mothers with children under 6 were employed in 2023. As dual-income households grow, working parents prioritize centers offering reliable, tech-enabled engagement and efficient management.

-

Accelerated digital transformation in early childhood education is boosting demand for cloud-based and mobile-friendly childcare software platforms.

Childcare providers are increasingly adopting digital platforms to modernize operations, enhance efficiency, and meet compliance standards. Cloud-based tools now offer mobile check-ins, secure data storage, and integrated communication all critical for today’s fast paced childcare environments.

Notable examples include:

- Indiana’s CCMS supports 3,600+ CCDF-funded providers, streamlining attendance, child-staff ratios, and billing digitally.

- HiMama users report savings of:

- 980 hours of educator documentation time annually

- Over USD 1,800 in printing costs per year

- Procare Solutions is trusted by 37,000+ centers, enabling mobile-based staff scheduling, timecard management, and parent communication.

These platforms provide the scalability, efficiency, and transparency required to meet increasing parental expectations and strict regulatory demands, making digital tools not just convenient additions but critical components for delivering high-quality, compliant, and competitive childcare services today.

Barriers Slowing the Childcare Software Market Exploring the Challenges to Widespread Digital Adoption

-

High implementation costs and limited IT expertise among small providers constrain adoption of advanced childcare management solutions.

Many small and independent childcare providers encounter financial and technical challenges when adopting childcare management software. High setup costs, ongoing subscription fees, and the need for staff training often discourage investment. In rural and underserved areas, limited access to reliable internet makes cloud-based solutions difficult to implement. As of June 2023, over 14% of rural and nearly 12% of Tribal households still lacked broadband, compared to just 3% in metro areas. Without adequate IT support, many centers stick to manual systems, slowing digital transformation across the sector.

Childcare Software Cost Comparison

| Software Provider | Subscription Cost | Pricing Basis |

|

Childcare Application Suite |

USD 8.88 per user/month |

Per staff user |

|

Connect Childcare (UK) |

USD 95 per month |

Flat monthly fee |

|

DaycareTech (US) |

USD 199.99 per location/month |

Per center |

|

Childcare Software (generic) |

USD 1.05–USD 1.40 per child/month |

Per enrolled child |

|

HiMama |

USD 9–USD 12 per classroom/month |

Per classroom |

These costs, while reasonable for large organizations, can quickly become prohibitive for small providers especially when paired with extra charges for onboarding, data migration, and training. As a result, many centers delay or avoid adopting digital systems, slowing the industry's broader modernization.

-

Regulatory complexities and frequent compliance updates create uncertainty around long-term system sustainability and investment confidence.

Childcare providers navigate complex, changing regulations on safety, staffing, and curriculum. Frequent policy shifts require constant software updates and investments, raising concerns about system longevity and upgrade costs. Data privacy issues add complexity, discouraging long-term commitments and limiting adoption particularly among risk-averse or budget-constrained providers slowing digital transformation in the sector.

Regulatory Impact on Childcare Software Adoption

|

Region/Country |

Key Regulation |

Compliance Requirement |

Implication for Software Providers |

|---|---|---|---|

|

United States |

COPPA |

Fines up to USD 53,088 per violation |

Must ensure secure child data handling and strict privacy controls |

|

United States |

Child Care Regulation Index |

Every 1-point increase adds USD 774/year in infant care costs |

Software must constantly adapt to cost-driving policy updates |

|

European Union |

GDPR |

Fines up to USD 21.5or 4% of global turnover; 72-hr breach notice |

Requires privacy by design, default settings, and audit readiness |

|

Canada (Quebec) |

Provincial Child Ratio Laws |

Infant ratio of 1:5 (under 17 months) |

Software must support detailed staff–child ratio tracking |

|

Australia |

ACECQA Staffing Standards |

Infant ratio as strict as 1:4 |

Frequent updates needed to track qualifications and ratios |

Expanding Horizons Growing Demand in Emerging Markets Fuels Adoption of Childcare Management Software

-

Growing urbanization and working parent populations in emerging markets are expanding the addressable base for childcare management software adoption.

Rapid urbanization and rising female workforce participation in developing economies are increasing the need for formal childcare services. This growing demand pressures providers to streamline operations and comply with evolving regulations. It presents strong opportunities for scalable, multilingual, mobile-first software solutions that enable real-time communication, digital payments, and policy compliance across urban centers in Asia-Pacific, Latin America, and Africa.

Segments Analysis Reveals How Digital Innovation and User Expectations Are Driving Transformation Through 2032

-

Play Schools, Centralized Data, and Cloud Deployment Drive the Digital Transformation of the Childcare Software Market in 2024

In 2024, Play Schools led the Childcare Management Software Market with 52% revenue share due to their adoption of digital tools for administrative efficiency, enrollment management, and parent communication. Real-time updates, attendance tracking, and compliance needs have made software integration essential in delivering high-quality, structured early education services.

In 2024, Family and Child Data Management segment led with a 23% market share, driven by the growing need for centralized records on health, enrollment, and emergency contacts. These modules support compliance, personalized care, and efficient documentation. Rising regulatory scrutiny makes secure child profile management critical for operational accountability and improved provider performance.

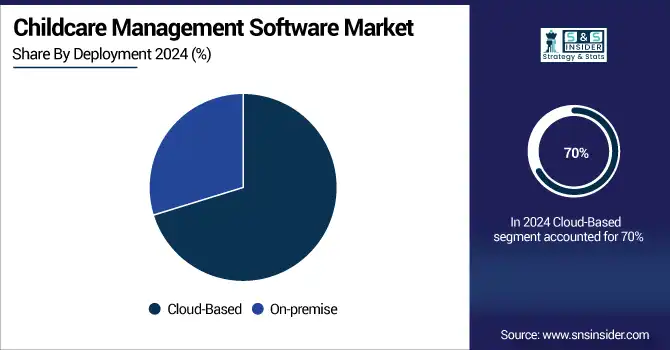

In 2024, the Cloud-Based segment dominated the Childcare Management Software Market with a 70% share. Its success is attributed to remote access, scalability, and mobile compatibility. Offering real-time updates and automated backups, cloud platforms empower providers with efficient, secure, and future-ready solutions aligned with rising mobile-first childcare trends.

-

Emerging Growth Segments in Childcare Software Parental Engagement Smart Scheduling and Cloud Innovation to 2032

From 2025–2032, the Parents segment is projected to grow at a CAGR of 9.85%, driven by rising demand for real-time child updates, digital communication, and safety alerts. As tech-savvy parents seek transparency, platforms offering mobile apps and digital tools are becoming essential for enhancing engagement and caregiver-parent interaction.

Expected to grow at a 9.55% CAGR from 2025–2032, Time and Activity Management segment benefits from increasing demand for structured scheduling and real-time tracking. Digital tools help childcare centers manage routines, optimize staff time, and track learning progress. The focus on personalized activity insights is accelerating adoption of these performance-focused software modules.

The Cloud-Based segment of the Childcare Management Software Market is projected to grow at a CAGR of 8.23% from 2025 to 2032. This growth is driven by rising demand for flexible, scalable, and mobile-compatible platforms that offer real-time updates, secure data access, and seamless management for providers and parents alike.

Uncovering Regional Dynamics Driving the Global Growth of Childcare Management Software Market Through 2032

Key Players

Procare Software, Jackrabbit Technologies, Smartcare, ECCE Software, Cirrus Group, Eleyo Inc., Himama Pvt Ltd, Bloomz Inc., Childcare Sage, EZChildTrack, Kangarootime, Kids Note Inc., KidReports LLC, KINDERLIME, Kindertales

Recent Developments:

-

In 2025, Procare Solutions launched Procare Professional Development accredited online training for child care providers with instant certification and compliance tracking via interactive dashboard.

-

In 2023, Procare introduced major enhancements supporting ECE providers, covering software improvements and advocacy effort.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 221.64 Million |

| Market Size by 2032 | USD 393.63 Million |

| CAGR | CAGR of 7.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premise, Cloud-Based) • By Solution (Family and Child Data Management, Time and Activity Management, Nutrition Management, Attendance Tracker, Employee Data Management, Payroll, Accounting, Others) • By End-user (Parents, Daycare Centers, Play Schools) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Procare Software, Jackrabbit Technologies, Smartcare, ECCE Software, Cirrus Group, Eleyo Inc., Himama Pvt Ltd, Bloomz Inc., Childcare Sage, EZChildTrack, Kangarootime, Kids Note Inc., KidReports LLC, KINDERLIME, Kindertales |