Trade Surveillance System Market Report Scope & Overview:

Trade Surveillance System Market is valued at USD 2.53 billion in 2025E and is expected to reach USD 9.31 billion by 2033, growing at a CAGR of 17.75% from 2026-2033.

The Trade Surveillance System market is expanding strongly as financial institutions face increasing regulatory pressure to detect market abuse, insider trading, and fraudulent activities in real time. The rapid growth of electronic trading, rising transaction volumes, and the complexity of multi-asset markets are driving the need for advanced surveillance tools. Additionally, AI- and analytics-driven monitoring solutions are becoming essential for ensuring compliance, reducing operational risks, and improving transparency across global trading environments, fueling sustained market growth.

In 2025, global adoption of trade surveillance systems rose by 49%, driven by a 55% increase in electronic trading volumes 70% of firms leveraged AI and behavioral analytics to enhance real-time detection of insider trading, and cross-asset manipulation, strengthening regulatory compliance and risk mitigation.

Trade Surveillance System Market Size and Forecast

-

Market Size in 2025E: USD 2.53 Billion

-

Market Size by 2033: USD 9.31 Billion

-

CAGR: 17.75% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Trade Surveillance System Market - Request Free Sample Report

Trade Surveillance System Market Trends

-

Rising adoption of AI and ML algorithms to detect complex market manipulation patterns across trading platforms

-

Increasing demand for real-time surveillance as high-frequency and algorithmic trading volumes accelerate globally

-

Expansion of integrated cross-asset monitoring systems to manage risks across equities, derivatives, FX, and commodities

-

Growing focus on cloud-based surveillance platforms offering scalability, faster deployment, and reduced infrastructure costs

-

Strengthening regulatory requirements driving investment in advanced compliance automation and audit-ready reporting capabilities

U.S. Trade Surveillance System Market is valued at USD 0.76 billion in 2025E and is expected to reach USD 2.73 billion by 2033, growing at a CAGR of 17.40% from 2026-2033.

The U.S. Trade Surveillance System market is growing due to stricter regulatory enforcement, the rise of high-frequency and algorithmic trading, and increasing pressure on financial institutions to detect market manipulation in real time. Greater adoption of AI-driven compliance tools and expanding digital trading volumes further support strong market demand.

Trade Surveillance System Market Growth Drivers:

-

Growing regulatory pressure to detect market abuse and ensure compliance is driving rapid adoption of advanced trade surveillance systems across global financial institutions

Financial authorities worldwide continue strengthening regulations to curb insider trading, market manipulation, spoofing, and other illicit activities. This growing regulatory scrutiny compels banks, brokerage firms, and trading platforms to implement sophisticated surveillance technologies capable of real-time monitoring and automated reporting. Organizations increasingly rely on AI-enabled systems to ensure compliance, reduce penalties, and maintain transparent trading environments. As global markets evolve and regulatory bodies tighten enforcement, the demand for robust, scalable trade surveillance solutions continues to rise, accelerating market growth across major financial hubs.

In 2025, 75% of global financial institutions upgraded to advanced trade surveillance systems in response to tightening regulations, with real-time monitoring deployments rising by 48% to combat market manipulation and ensure compliance with MiFID II, SEC, and other global mandates.

-

Increasing complexity of trading environments, including algorithmic and high-frequency trading, boosts demand for real-time monitoring tools to identify anomalies and prevent illicit activities

Modern financial markets are increasingly dominated by algorithmic and high-frequency trading, generating massive volumes of fast, complex transactions. This environment significantly heightens the risk of manipulative patterns that traditional surveillance tools struggle to detect. Institutions are adopting advanced analytics platforms capable of analyzing multi-asset trades in real time to identify suspicious behaviors. These systems improve detection accuracy, support automated alerting, and reduce compliance challenges. As trading environments become more sophisticated and fragmented across global exchanges, the need for advanced real-time surveillance technologies continues to grow rapidly.

In 2025, 70% of financial regulators mandated real-time surveillance for algorithmic and high-frequency trading, driving a 50% increase in demand for AI-powered monitoring tools to detect market abuse and anomalies within milliseconds.

Trade Surveillance System Market Restraints:

-

High implementation and integration costs of advanced surveillance platforms limit adoption among smaller financial firms with constrained technology budgets

Trade surveillance systems require substantial investments in hardware, software, data integration, and ongoing maintenance. Smaller financial institutions often lack the budget and IT infrastructure needed to deploy complex surveillance solutions effectively. Integrating these systems with legacy platforms further increases costs and creates technical challenges. As regulatory demands intensify, smaller firms face difficulty keeping pace due to financial constraints, slowing adoption rates. These barriers hinder market penetration among small and mid-sized firms, creating growth limitations for vendors targeting highly fragmented financial ecosystems.

In 2025, over 65% of smaller financial institutions deferred advanced surveillance adoption due to implementation costs averaging USD250,000+ and integration complexities, severely limiting their ability to meet evolving regulatory and cybersecurity requirements.

-

Data privacy concerns and stringent regulations on data sharing create challenges for deploying surveillance systems that rely heavily on cross-platform information analytics

Trade surveillance solutions depend on extensive data collection, cross-system integration, and real-time analytics. However, strict data privacy laws and confidentiality requirements restrict how firms store, share, and process sensitive transaction information. Compliance with regional data protection frameworks complicates deployment, particularly for multinational institutions operating across jurisdictions. These limitations reduce data availability, impacting the effectiveness of surveillance tools. Financial firms must invest in secure, compliant infrastructure, increasing operational complexity. Consequently, privacy concerns continue to pose significant challenges to broader adoption of advanced surveillance platforms.

In 2025, 65% of financial institutions delayed cloud-based surveillance deployments due to GDPR, CCPA, and similar data privacy mandates, with cross-platform analytics restricted in over 40 countries hindering real-time monitoring and threat detection capabilities.

Trade Surveillance System Market Opportunities:

-

Growing adoption of AI and machine learning enhances detection accuracy, creating significant opportunities for intelligent, automated surveillance platforms globally

AI and machine learning technologies are transforming trade surveillance capabilities by enabling systems to detect subtle anomalies, behavioral patterns, and emerging market manipulation techniques with high precision. Automated learning models continuously improve detection accuracy, reduce false positives, and accelerate compliance workflows. As financial institutions seek smarter, more efficient ways to manage growing data volumes, demand for AI-driven surveillance solutions increases significantly. Vendors offering intelligent platforms can capitalize on this shift, expanding into regulated markets where compliance efficiency and real-time risk mitigation are becoming critical operational priorities.

In 2025, 70% of financial institutions deployed AI-powered surveillance platforms, improving anomaly detection accuracy by 40% and reducing false positives by 30%, fueling a 45% global increase in adoption of intelligent, automated compliance solutions.

-

Expansion of digital trading channels and rising cross-border transactions increases demand for scalable cloud-based surveillance solutions across emerging financial markets

Digital trading adoption has surged across asset classes, including equities, commodities, and crypto assets, expanding market complexity and transaction risk. Financial firms increasingly operate across borders, requiring unified platforms that monitor diverse markets in real time. Cloud-based surveillance solutions offer scalability, faster deployment, and cost efficiency, making them attractive for both established institutions and emerging market participants. As more trading activity shifts to digital and cross-border channels, demand for cloud-enabled surveillance systems grows, creating significant opportunities for vendors to expand globally and support evolving compliance needs.

In 2025, digital trading and cross-border transaction volumes in emerging markets grew by 38%, driving a 45% increase in demand for cloud-based surveillance solutions to ensure compliance, detect anomalies, and mitigate financial crime risks.

Trade Surveillance System Market Segment Highlights

-

By Component: Solutions led with 41.8% share, while Analytics & Reporting Tools is the fastest-growing segment with a CAGR of 21.4%.

-

By Deployment Type: Cloud-Based led with 47.6% share, while Hybrid Deployment is the fastest-growing segment with a CAGR of 20.2%.

-

By Organization Size: Large Enterprises led with 45.2% share, while SMEs are the fastest-growing segment with a CAGR of 18.7%.

-

By End-User Industry: BFSI led with 38.9% share, while Capital Markets & Trading Firms is the fastest-growing segment with a CAGR of 20.9%

Trade Surveillance System Market Segment Analysis

By Component: Solutions led, while Analytics & Reporting Tools is the fastest-growing segment.

Solutions dominate the Trade Surveillance System Market because organizations rely heavily on advanced, integrated platforms for detecting market manipulation, insider trading, and regulatory violations. These solutions offer real-time monitoring, automated alerts, and scalable architecture that supports high-volume trading environments. Financial institutions prefer comprehensive solutions that consolidate analytics, reporting, and compliance functionality. The growing complexity of global regulations and multichannel trading has further strengthened the demand for unified surveillance solutions, making this segment the largest contributor to overall market revenue.

Analytics & Reporting Tools are the fastest-growing segment due to the rising need for deep trade behavior insights, anomaly detection, and automated compliance reporting. Institutions increasingly rely on AI-driven analytics for predictive risk identification and pattern recognition across complex trading ecosystems. Regulatory bodies demand more transparent and detailed reporting, pushing firms to adopt advanced analytics platforms. The shift toward real-time compliance dashboards, machine learning engines, and audit-ready reporting features is accelerating rapid adoption of these tools across global trading environments.

By Deployment Type: Cloud-Based led, while Hybrid Deployment is the fastest-growing segment.

Cloud-Based deployment leads the market as financial institutions prioritize scalability, lower infrastructure costs, and faster deployment timelines. Cloud models support high-volume data ingestion, real-time processing, and seamless integration with multiple trading platforms. They also enable continuous upgrades, global accessibility, and flexible compliance management. As trading becomes increasingly digital and distributed, cloud-based solutions offer operational agility and cost-efficiency, making them the preferred choice for both large institutions and modern market participants seeking robust trade surveillance capabilities.

Hybrid Deployment is the fastest-growing model as organizations seek a balance between on-premise security and cloud scalability. This architecture allows firms to maintain sensitive trade data internally while leveraging cloud capabilities for analytics, alerting, and high-speed processing. Hybrid models appeal to institutions operating in strict regulatory environments that still require modern surveillance technologies. The need for customization, interoperability, and data sovereignty compliance is driving rapid adoption of hybrid deployments across global financial markets.

By Organization Size: Large Enterprises led, while SMEs are the fastest-growing segment.

Large Enterprises dominate this segment as they manage massive trade volumes across multiple platforms, asset classes, and geographies. The complexity of their operations requires advanced surveillance technologies capable of real-time monitoring, cross-market analytics, and automated compliance oversight. Large enterprises also face stringent regulatory scrutiny, prompting heavy investment in sophisticated systems. Their robust IT budgets, global footprints, and focus on minimizing reputational and financial risks reinforce their leadership position in adopting comprehensive trade surveillance systems.

SMEs are the fastest-growing segment due to increasing regulatory expectations, expanding digital trading activity, and rising adoption of cloud surveillance solutions. Smaller firms are increasingly exposed to compliance risks as they scale operations, prompting the need for cost-efficient and automated monitoring tools. Cloud-based deployments, modular pricing models, and AI-driven surveillance have made these technologies more accessible to SMEs. This rapid digital transformation and regulatory catch-up among smaller trading entities drive accelerated growth in this segment.

By End-User Industry: BFSI led, while Capital Markets & Trading Firms is the fastest-growing segment.

BFSI dominates the end-user landscape because banks, brokers, and financial institutions conduct high-value, high-frequency trades that demand stringent surveillance. They face the strictest compliance standards globally, making advanced monitoring essential to detect insider trading, spoofing, and fraudulent behavior. BFSI institutions invest heavily in real-time analytics, cross-asset surveillance, and automated reporting. Their large customer bases, regulatory exposure, and reliance on digital trading platforms reinforce BFSI as the largest and most influential segment in this market.

Capital Markets & Trading Firms are the fastest-growing segment as these organizations require sophisticated tools to monitor high-speed trades, algorithmic activity, and cross-platform transactions. The surge in electronic and automated trading increases manipulation risks, driving firms to adopt advanced AI-driven surveillance. Regulatory reforms targeting hedge funds, proprietary traders, and brokerage firms further accelerate adoption. The need for precise anomaly detection, auditability, and real-time compliance is rapidly pushing this segment toward more aggressive technology implementation.

Trade Surveillance System Market Regional Analysis

North America Trade Surveillance System Market Insights:

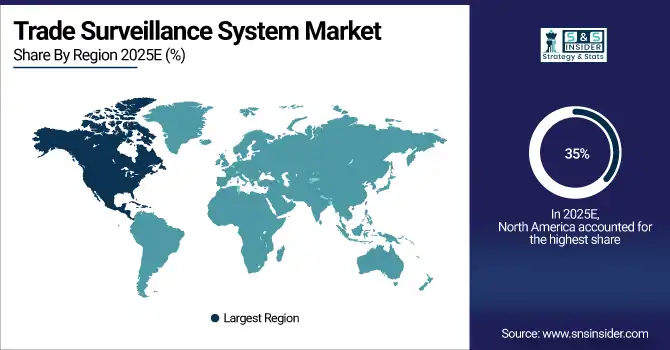

North America dominated the Trade Surveillance System Market with about 35% revenue share in 2025 due to its highly regulated financial ecosystem, strict compliance obligations, and early adoption of advanced monitoring technologies by major exchanges and investment firms. The region’s strong presence of leading technology providers and continuous upgrades in surveillance infrastructure further strengthened its market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Trade Surveillance System Market Insights

Asia Pacific is projected to grow at the fastest CAGR of about 19.56% from 2026–2033, driven by rapid expansion of digital trading platforms, increasing cross-border investment flows, and tightening regulatory requirements across emerging markets. Rising fintech participation, market liberalization, and accelerated adoption of AI-enabled surveillance tools also fuel the region’s strong growth trajectory.

Europe Trade Surveillance System Market Insights

Europe sustained strong growth in the Trade Surveillance System Market in 2025, supported by stringent regulations such as MiFID II, MAR, and GDPR that enforce advanced monitoring, data transparency, and strict reporting standards. The region’s mature financial markets, high institutional adoption of AI-driven analytics, and focus on preventing market abuse strengthened its continued demand for sophisticated surveillance platforms

Middle East & Africa and Latin America Trade Surveillance System Market Insights

Middle East & Africa and Latin America together showed steady progress in 2025, driven by modernization of financial markets, growing digital trading participation, and rising regulatory attention toward fraud, insider trading, and cross-market manipulation. Increasing investments in exchange infrastructure, broader fintech penetration, and initiatives to enhance market transparency supported gradual but promising adoption of trade surveillance solutions across both regions.

Trade Surveillance System Market Competitive Landscape:

Nasdaq Inc.

Nasdaq Inc. is a leading global exchange operator and technology provider offering advanced trade surveillance, market monitoring, and regulatory compliance solutions. Its SMARTS Trade Surveillance platform is widely adopted by exchanges, regulators, and financial institutions worldwide. Nasdaq focuses on detecting market abuse, insider trading, and manipulative behaviors in real time. With strong innovation capabilities and a broad global presence, the company delivers scalable, AI-driven surveillance tools that enhance transparency, market integrity, and operational efficiency across multiple asset classes.

-

2024, Nasdaq launched Surveillance AI, an advanced trade surveillance platform powered by generative AI and behavioral analytics to detect complex market manipulation (e.g., layering, spoofing, wash trades) across equities, fixed income, and crypto.

NICE Actimize

NICE Actimize is a global leader in financial crime, risk, and compliance solutions, specializing in trade surveillance, communications monitoring, and behavioral analytics. Its surveillance platform helps institutions detect insider trading, market manipulation, and regulatory breaches using AI, automation, and advanced analytics. NICE Actimize serves banks, brokers, exchanges, and regulators across global markets. With strong domain expertise, real-time monitoring, and integrated case-management tools, it supports efficient compliance operations while helping firms meet evolving regulatory requirements across multiple jurisdictions.

-

2025, NICE Actimize introduced X-Sight, a unified surveillance platform that correlates trading activity across equities, FX, derivatives, and crypto to identify cross-asset manipulation schemes.

Aquis Technologies

Aquis Technologies, the technology division of Aquis Exchange, provides advanced trading, surveillance, and market-infrastructure solutions to exchanges, banks, and trading venues worldwide. Its trade surveillance platform focuses on real-time monitoring, alerting, and pattern detection to identify market manipulation and compliance risks. The company is known for its modular, cloud-ready systems and high-performance trading technologies. Aquis combines regulatory expertise with modern architecture, enabling financial institutions to enhance market integrity, reduce operational complexity, and adapt quickly to changing compliance demands.

-

2023, Aquis Technologies launched Sentinel, a high-performance trade surveillance system designed specifically for exchange members and trading firms requiring sub-millisecond monitoring.

Trade Surveillance System Market Key Players

Some of the Trade Surveillance System Market Companies

-

Nasdaq Inc.

-

NICE Actimize

-

Aquis Technologies

-

IPC Systems Inc.

-

SIA S.p.A.

-

SteelEye

-

BAE Systems

-

FIS

-

Cinnober Financial Technology

-

Trapets AB

-

Bloomberg L.P.

-

OneMarketData LLC

-

ACA Group

-

Scila AB

-

Trading Technologies International

-

Refinitiv

-

Software AG

-

CCL Compliance

-

Eventus Systems

-

Behavox

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.53 Billion |

| Market Size by 2033 | USD 9.31 Billion |

| CAGR | CAGR of 17.75% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services, Analytics & Reporting Tools, Monitoring Platforms, Alert Management Systems) • By Deployment Type (On-Premises, Cloud-Based, Hybrid Deployment) • By Organization Size (Small & Medium-Sized Enterprises, Large Enterprises, Multinational Corporations) • By End-User Industry (BFSI, Capital Markets & Trading Firms, Retail & E-Commerce, Healthcare & Pharma, Government & Public Sector, Energy & Utilities) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nasdaq Inc., NICE Actimize, Aquis Technologies, IPC Systems Inc., SIA S.p.A., SteelEye, BAE Systems, FIS, Cinnober Financial Technology, Trapets AB, Bloomberg L.P., OneMarketData LLC, ACA Group, Scila AB, Trading Technologies International, Refinitiv, Software AG, CCL Compliance, Eventus Systems, Behavox |