Transaction Monitoring in Fintech Market Report Scope & Overview:

The Transaction Monitoring in Fintech Market is valued at USD 6.22 billion in 2025E and is expected to reach USD 21.72 billion by 2033, growing at a CAGR of 16.97% from 2026-2033.

Transaction Monitoring in Fintech Market is growing due to increasing regulatory compliance requirements, rising instances of financial fraud, and the growing adoption of digital payment solutions. Fintech companies are investing in AI- and machine learning–driven monitoring systems to detect suspicious activities, ensure real-time transaction analysis, and reduce financial crime. Additionally, the expansion of online banking, mobile wallets, and cross-border payments is driving demand for advanced transaction monitoring solutions that enhance security and operational efficiency.

82% of fintech’s used AI-driven monitoring for real-time fraud detection and compliance across digital and cross-border payments.

Transaction Monitoring in Fintech Market Size and Forecast

-

Market Size in 2025E: USD 6.22 Billion

-

Market Size by 2033: USD 21.72 Billion

-

CAGR: 16.97% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Transaction Monitoring in Fintech Market - Request Free Sample Report

Transaction Monitoring in Fintech Market Trends

-

Rising adoption of AI-driven transaction monitoring to detect fraud, AML risks, and suspicious activities in real time

-

Increasing regulatory scrutiny driving fintech’s to strengthen compliance automation and continuous transaction surveillance capabilities

-

Growing use of machine learning models to reduce false positives and improve accuracy of transaction risk assessments

-

Expansion of real-time payment systems increasing demand for high-speed, scalable transaction monitoring solutions

-

Integration of transaction monitoring platforms with KYC, customer risk scoring, and case management tools

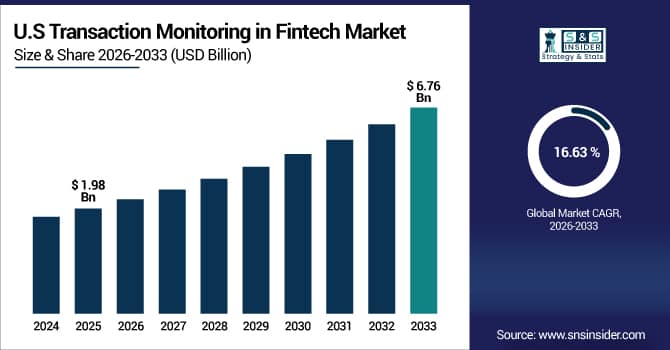

The U.S. Transaction Monitoring in Fintech Market is valued at USD 1.98 billion in 2025E and is expected to reach USD 6.76 billion by 2033, growing at a CAGR of 16.63 % from 2026-2033.

U.S. Transaction Monitoring in Fintech Market is growing due to rising digital payment adoption, stricter regulatory compliance, and increasing financial fraud risks. Fintech companies are leveraging AI and machine learning solutions for real-time transaction analysis, enhanced security, and efficient detection of suspicious activities across banking and payment platforms.

Transaction Monitoring in Fintech Market Growth Drivers:

-

Rising digital payments, online banking, and fintech adoption are increasing demand for real-time transaction monitoring solutions to detect fraud and ensure regulatory compliance

The rapid growth of digital financial services, including mobile banking, e-wallets, and online transactions, has significantly increased the volume and complexity of financial data. Fintech companies require robust transaction monitoring solutions to detect suspicious activities, prevent fraud, and maintain trust with customers. Real-time monitoring helps identify anomalies promptly, reducing financial losses and operational risks. Additionally, the increasing adoption of cashless transactions worldwide and the integration of digital payment channels by SMEs and large enterprises are further driving demand for efficient, automated transaction monitoring systems in the fintech ecosystem.

80% of financial institutions and fintech’s prioritized real-time transaction monitoring driven by the surge in digital payments and online banking to instantly flag suspicious activity, reduce fraud losses, and maintain compliance across evolving regulatory landscapes.

-

Growing regulatory pressure for AML, KYC, and fraud prevention is compelling fintech companies to invest in advanced transaction monitoring platforms

Regulatory authorities across the globe are imposing strict anti-money laundering (AML), know-your-customer (KYC), and fraud prevention guidelines. Fintech firms must comply with these standards to avoid penalties, reputational damage, and legal risks. This has accelerated investments in advanced monitoring platforms capable of tracking suspicious activities, ensuring regulatory compliance, and maintaining audit trails. Automated solutions help streamline reporting, enhance accuracy, and reduce manual intervention. As regulatory frameworks evolve and enforcement tightens, fintech companies are increasingly adopting scalable and intelligent transaction monitoring systems to meet compliance requirements while safeguarding their operations and customers.

78% of fintech companies upgraded to advanced transaction monitoring platforms in response to tightening global AML and KYC regulations embedding real-time screening and audit-ready reporting to meet compliance mandates and reduce enforcement risks.

Transaction Monitoring in Fintech Market Restraints:

-

High implementation costs, complex system integration, and shortage of skilled compliance professionals limit adoption of advanced transaction monitoring solutions among smaller fintech firms

Implementing sophisticated transaction monitoring systems involves significant investment in software, hardware, and IT infrastructure. Integration with existing fintech platforms can be complex, requiring technical expertise and ongoing maintenance. Smaller fintech companies often face budget constraints and lack access to skilled professionals capable of managing these systems effectively. This limits the adoption of advanced solutions, leaving some companies reliant on manual or less efficient monitoring methods. High costs, resource requirements, and technical challenges can slow the growth of transaction monitoring adoption, particularly among startups and smaller players in emerging fintech markets.

60% of smaller fintech firms delayed or avoided deploying advanced transaction monitoring solutions due to high implementation costs, complex integration with existing infrastructure, and a persistent shortage of skilled compliance personnel leaving many exposed to regulatory and fraud risks.

-

High false-positive rates in traditional monitoring systems increase operational workload, compliance costs, and customer friction, reducing overall efficiency

Legacy transaction monitoring systems often generate a high number of false-positive alerts, requiring extensive manual review by compliance teams. This increases operational workload and costs while slowing the detection of actual fraudulent activities. Excessive alerts can also frustrate customers through unnecessary transaction delays, impacting user experience. These inefficiencies limit the effectiveness and scalability of monitoring systems, particularly for rapidly growing fintech companies handling high transaction volumes. Consequently, organizations must invest in smarter, AI-powered solutions to reduce false positives, enhance accuracy, and maintain customer trust while managing operational costs.

legacy transaction monitoring systems generated false positives in over 65% of alerts forcing compliance teams to expend significant resources on manual reviews, increasing operational costs, and causing delays that degraded customer experience.

Transaction Monitoring in Fintech Market Opportunities:

-

Adoption of AI, machine learning, and behavioral analytics enables more accurate, real-time transaction monitoring with reduced false positives and improved risk detection

Artificial intelligence and machine learning technologies allow fintech companies to analyze transaction patterns, detect anomalies, and predict potentially fraudulent activities in real time. Behavioral analytics helps identify unusual account activities and risky transactions with higher accuracy, reducing false-positive alerts and improving operational efficiency. AI-driven monitoring also supports compliance reporting, automated alerts, and faster decision-making. The integration of these technologies presents significant growth opportunities for fintech firms to enhance their risk management capabilities, improve customer experience, and strengthen trust, while enabling scalable and cost-efficient transaction monitoring across digital financial ecosystems globally.

74% of financial institutions integrated AI, machine learning, and behavioral analytics into transaction monitoring cutting false positives by 40% and improving real-time detection of suspicious activity across high-volume, cross-border payment flows.

-

Expansion of cross-border payments and open banking ecosystems creates opportunities for scalable, cloud-based transaction monitoring solutions tailored for global fintech operations

The growth of international remittances, cross-border trade, and open banking initiatives has increased the complexity and volume of financial transactions. Fintech companies need scalable, cloud-based transaction monitoring solutions capable of handling multiple currencies, jurisdictions, and regulatory requirements. Cloud technology provides real-time monitoring, centralized data access, and enhanced collaboration for compliance teams. Additionally, global fintech integration offers opportunities to serve multinational clients, expand into emerging markets, and provide comprehensive risk management solutions. This trend supports innovation and adoption of next-generation monitoring systems, driving growth in the transaction monitoring market for fintech worldwide.

70% of global fintech’s deployed cloud-based transaction monitoring solutions leveraging open banking APIs and real-time analytics to detect anomalies, comply with cross-border regulations, and scale fraud prevention across diverse payment corridors.

Transaction Monitoring in Fintech Market Segment Highlights

-

By Solution Type: Fraud Detection & Prevention led with 35.7% share, while Risk Scoring & Behavior Analytics is the fastest-growing segment with CAGR of 20.2%.

-

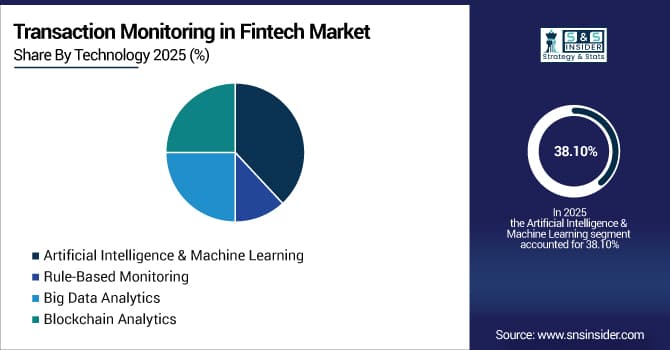

By Technology: Artificial Intelligence & Machine Learning led with 38.1% share, while Blockchain Analytics is the fastest-growing segment with CAGR of 21.5%.

-

By Application: Real-Time Transaction Monitoring led with 36.4% share, while Cross-Border Transaction Monitoring is the fastest-growing segment with CAGR of 22.0%.

-

By End User: Banks & Financial Institutions led with 37.0% share, while Digital Wallet Providers is the fastest-growing segment with CAGR of 23.1%.

Transaction Monitoring in Fintech Market Segment Analysis

By Solution Type: Fraud Detection & Prevention led, while Risk Scoring & Behavior Analytics is the fastest-growing segment.

Fraud Detection & Prevention dominates due to the increasing sophistication of financial fraud and growing regulatory mandates for secure transaction processing. FinTech companies and banks rely on robust detection systems to identify suspicious patterns in real time, reduce financial losses, and maintain customer trust. The integration of AI, machine learning, and advanced analytics ensures high accuracy and minimal false positives. Its broad applicability across payments, cross-border transfers, and digital banking platforms reinforces consistent adoption, making it the leading solution segment in transaction monitoring.

Risk Scoring & Behavior Analytics is the fastest-growing solution segment as financial institutions and Fintech’s increasingly adopt predictive models to assess user behavior, transaction risk, and potential fraud. These tools leverage AI, big data, and behavioral modeling to provide dynamic risk assessments in real time. Rapid growth is driven by digital banking expansion, stricter AML regulations, and rising demand for proactive monitoring systems. Its ability to enhance decision-making, minimize fraud exposure, and integrate with existing platforms supports accelerated adoption globally.

By Technology: Artificial Intelligence & Machine Learning led, while Blockchain Analytics is the fastest-growing segment.

Artificial Intelligence & Machine Learning dominate the technology segment due to their capability to process vast transaction data, detect anomalies, and predict fraudulent behavior with high accuracy. These technologies allow real-time monitoring, adaptive learning from emerging fraud patterns, and automated compliance reporting. Financial institutions and Fintech’s increasingly rely on AI/ML to optimize operational efficiency, reduce human error, and improve fraud detection rates. The combination of predictive modeling, pattern recognition, and scalability reinforces its leadership position in the transaction monitoring market.

Blockchain Analytics is the fastest-growing technology segment as blockchain adoption expands in cross-border payments, cryptocurrencies, and decentralized finance. It provides transparency, traceability, and immutable transaction records, enabling institutions to detect suspicious activity efficiently. Integration with AI and big data platforms enhances anomaly detection and regulatory reporting capabilities. The rising adoption of digital assets, DeFi platforms, and tokenized financial instruments, combined with regulatory pressure for secure transaction monitoring, drives rapid growth for blockchain analytics solutions across both traditional and digital financial ecosystems.

By Application: Real-Time Transaction Monitoring led, while Cross-Border Transaction Monitoring is the fastest-growing segment.

Real-Time Transaction Monitoring leads the application segment due to its ability to detect suspicious activity instantly and prevent potential fraud or AML violations. Banks, Fintech’s, and payment processors implement these systems to continuously evaluate transactions, identify anomalies, and flag high-risk activity. Its integration with AI, big data, and rule-based monitoring ensures timely alerts, improved compliance, and minimal operational losses. Widespread adoption in digital payments, cross-border remittances, and online banking makes real-time monitoring the primary application driving market dominance.

Cross-Border Transaction Monitoring is the fastest-growing application as globalization and international digital payments increase the complexity and risk of financial crime. Institutions require advanced monitoring systems to detect fraud, money laundering, and sanction violations across multiple jurisdictions. Adoption is accelerated by stringent regulatory requirements, increased cross-border transactions, and the need for real-time risk assessment. AI-driven analytics and blockchain integration further enhance detection capabilities, supporting rapid market growth. Its rising importance in global payments makes it a key driver for the transaction monitoring market.

By End User: Banks & Financial Institutions led, while Digital Wallet Providers is the fastest-growing segment.

Banks & Financial Institutions dominate because they handle high transaction volumes and are highly regulated, necessitating robust transaction monitoring systems. These organizations invest heavily in fraud detection, AML compliance, and risk management to maintain regulatory adherence and protect customer trust. The integration of AI, machine learning, and real-time analytics into banking operations ensures high efficiency and reliability. Continuous monitoring of accounts, payment systems, and internal controls reinforces their dominant position as the largest end-user segment in the transaction monitoring market.

Digital Wallet Providers are the fastest-growing end-user segment as mobile payments, e-wallets, and peer-to-peer transfers expand rapidly. They face rising risks of fraud and cyberattacks due to increased digital adoption, driving demand for advanced transaction monitoring solutions. AI, behavioral analytics, and real-time monitoring tools help detect suspicious activity, reduce financial losses, and ensure regulatory compliance. Growth is further supported by increasing e-commerce adoption, contactless payments, and integration with banking networks, making digital wallet providers a rapidly emerging end-user segment in the fintech transaction monitoring ecosystem.

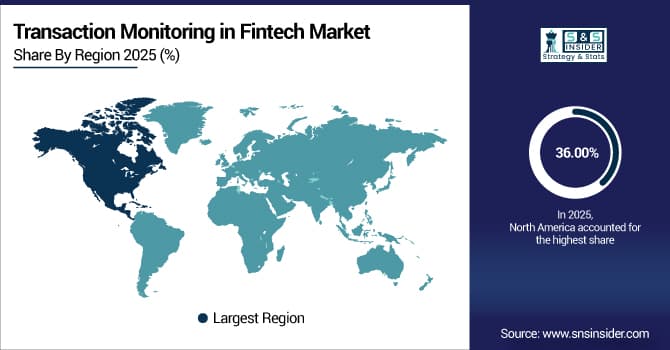

Transaction Monitoring in Fintech Market Regional Analysis

North America Transaction Monitoring in Fintech Market Insights:

North America dominated the Transaction Monitoring in Fintech Market with a 37.44% share in 2025 due to the strong presence of fintech leaders, advanced digital payment ecosystems, and stringent regulatory requirements for AML and fraud prevention. High adoption of AI-driven monitoring solutions, robust compliance frameworks, and significant investments in financial cybersecurity further reinforced regional dominance.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Transaction Monitoring in Fintech Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 18.81% from 2026–2033, driven by rapid fintech expansion, increasing digital payment adoption, and rising online transaction volumes. Strengthening regulatory oversight, growing use of AI-based fraud detection, expanding mobile banking, and accelerating financial inclusion initiatives are fueling strong demand for transaction monitoring solutions across the region.

Europe Transaction Monitoring in Fintech Market Insights

Europe held a strong share in the Transaction Monitoring in Fintech Market in 2025, supported by strict regulatory frameworks such as AMLD and PSD2, high adoption of digital banking, and widespread use of advanced fraud detection technologies. Strong fintech ecosystems, increasing cross-border transactions, and growing investments in AI-based compliance solutions reinforced Europe’s market position.

Middle East & Africa and Latin America Transaction Monitoring in Fintech Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Transaction Monitoring in Fintech Market in 2025, driven by rising digital payment adoption, expanding fintech startups, and increasing regulatory focus on fraud prevention. Growing mobile banking usage, improving financial infrastructure, and investments in real-time transaction monitoring and compliance technologies supported regional market expansion.

Transaction Monitoring in Fintech Market Competitive Landscape:

FICO

FICO, formerly Fair Isaac Corporation, is a leading analytics and software company specializing in risk management and fraud prevention solutions for the financial sector. Its transaction monitoring tools help fintech’s and banks detect suspicious activities, prevent money laundering, and manage regulatory compliance. FICO leverages advanced analytics, artificial intelligence, and machine learning to provide real-time insights, enhancing accuracy and reducing false positives. With a global presence, FICO serves financial institutions of all sizes, offering scalable, efficient, and secure solutions for transaction monitoring and fraud prevention.

-

March 2024, FICO launched FICO Falcon Fraud Manager with Adaptive AI, a next-generation platform for real-time payment fraud prevention across cards, real-time payments (RTP), and digital wallets.

NICE Actimize

NICE Actimize is a global leader in financial crime, risk, and compliance solutions, offering advanced transaction monitoring systems for banks and fintech companies. Its platform combines AI, machine learning, and analytics to detect fraud, money laundering, and other suspicious activities in real-time. NICE Actimize focuses on regulatory compliance, operational efficiency, and minimizing false positives. Trusted by leading financial institutions worldwide, its solutions provide comprehensive monitoring, reporting, and risk management capabilities to ensure secure, efficient, and compliant financial operations.

-

January 2025, NICE Actimize expanded its X-Sight platform to support instant payment systems (e.g., FedNow, SEPA Instant, UPI, Pix), enabling real-time AML and fraud monitoring on 24/7 payment rails.

Fiserv

Fiserv is a global provider of financial services technology solutions, including payment processing, risk management, and transaction monitoring platforms. Its systems help fintech’s, banks, and credit unions identify suspicious activity, prevent fraud, and comply with AML regulations. Fiserv leverages AI-driven analytics, machine learning, and real-time monitoring to detect anomalies and reduce false alerts. Serving clients worldwide, Fiserv focuses on delivering secure, scalable, and efficient solutions that enhance operational performance while ensuring regulatory compliance in the rapidly evolving financial ecosystem.

-

November 2023, Fiserv enhanced its Decide Advanced Risk platform with real-time payment intelligence for debit, credit, and P2P transactions, including Zelle, RTP, and international schemes.

Transaction Monitoring in Fintech Market Key Players

Some of the Transaction Monitoring in Fintech Market Companies

-

FICO

-

NICE Actimize

-

Fiserv

-

Experian

-

Oracle

-

FIS Global

-

LexisNexis Risk Solutions

-

Feedzai

-

Featurespace

-

ComplyAdvantage

-

Stripe

-

Mastercard

-

Visa

-

Moody’s Analytics

-

Temenos

-

SAP

-

Actico Group

-

NetGuardians

-

Refinitiv

-

Sift

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.22 Billion |

| Market Size by 2033 | USD 21.72 Billion |

| CAGR | CAGR of 16.97 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution Type (Fraud Detection & Prevention, Anti-Money Laundering (AML) Monitoring, Know Your Customer (KYC) & Customer Due Diligence, Risk Scoring & Behavior Analytics, Compliance Reporting & Case Management) • By Technology (Artificial Intelligence & Machine Learning, Rule-Based Monitoring, Big Data Analytics, Blockchain Analytics) • By Application (Real-Time Transaction Monitoring, Payment Fraud Detection, Account Takeover Detection, Suspicious Activity Reporting, Cross-Border Transaction Monitoring) • By End User (FinTech Companies, Banks & Financial Institutions, Payment Service Providers, Digital Wallet Providers, E-commerce Platforms) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | FICO, NICE Actimize, Fiserv, Experian, Oracle, FIS Global, LexisNexis Risk Solutions, Feedzai, Featurespace, ComplyAdvantage, Stripe, Mastercard, Visa, Moody’s Analytics, Temenos, SAP, Actico Group, NetGuardians, Refinitiv, Sift |