Pet Diapers Market Report Scope & Overview:

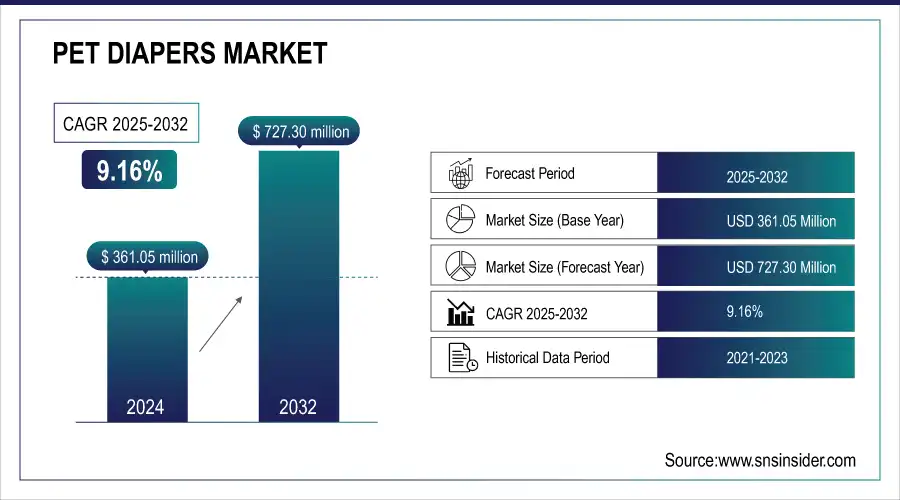

The Pet Diapers Market was valued at USD 361.05 million in 2024 and is expected to reach USD 727.30 million by 2032, growing at a CAGR of 9.16% over the forecast period of 2025-2032.

The global pet diapers market is expanding on the back of growing clinical requirements in veterinary clinics and pet care clinics, owing to higher instances of post-surgery convalescence, aging-driven issues, and urinary incontinence. Demand is being driven by a rise in pet adoptions, particularly among older pets. Prominent in the pet diapers market trend are advanced, leak-proof, eco-friendly, and reusable designs, gaining popularity. Furthermore, urbanization, hygienic concentration, and social acceptance of pet diapers are driving the broader acceptance, positioning it as a must-have product for clinical and household purposes.

To Get more information on Pet Diapers Market - Request Free Sample Report

For instance, in November 2024, 47% of urban pet care centers adopted reusable pet diapers due to rising demand for eco-friendly, cost-effective solutions in hygiene management.

For February 2025, the U.S. captured 81% of North America’s pet diapers revenue in 2024, driven by strong e-commerce platforms and high spending on pet hygiene.

Key Pet Diapers Market Trends

-

Ultra-absorbent multilayer polymers, breathable leak-guards, and ergonomic fasteners enhance wearer comfort, prevent accidents, and prolong daily usability.

-

Biodegradable liners, compostable wraps, and plant-derived adhesives align with eco-conscious households and address rising environmental concerns.

-

Automated high-speed production integrating defect detection, size calibration, and hygienic sealing ensures consistent quality, minimizes waste, and accelerates throughput.

-

Data-driven segmentation analyzing breed profiles, weight ranges, and mobility patterns enables tailored fit, optimized absorbency, and personalized solutions.

-

Moisture-locking cores with odor-neutralizing infusions, humidity indicators, and antimicrobial coatings extend freshness, reduce irritation, and safeguard hygiene.

Pet Diapers Market Growth Drivers:

-

Pet Humanization is Driving the Pet Diapers Market Growth

Humanization has become an important trend in the pet market, including pet diapers, as pet owners are inclined to take care of their pets, including family members, by focusing on their comfort and cleanliness. This bodes well for the sale of premium, health-specific diapers for incontinence, post-surgery, and training purposes. Owing to this, the pet diaper market share is increasing globally, and more so, in the developed and urbanizing regions with increasing disposable incomes and pet adoptions.

For instance, in May 2024, 72% of U.S. pet owners treated pets as family, driving increased spending on premium care products, including pet diapers to enhance comfort and hygiene.

Pet Diapers Market Restraints:

-

High Cost of Premium Products is a Significant Restraint on the Pet Diapers Market Growth

A major factor restricting the pet diapers market is the high expense of premium products, which are highly absorbent and can prevent leakage along the skin. The price of these particular diapers is beyond the reach of cost-conscious consumers in most parts of the world, particularly in the developing world. The high cost curtails frequent purchases and mass marketing despite increasing demand. Need for Affordable Solutions with Quality. Anticipating the current pet diapers market scenario, manufacturers need to invest in cost-effective solutions to make pet diapers accessible to a broader customer base in order to develop and maintain a healthy pet diapers market growth.

For instance, in April 2025, A NielsenIQ survey found that 59% of pet owners in emerging markets avoid buying pet diapers due to high costs, limiting regular usage.

Pet Diapers Market Segment Analysis

-

By Product

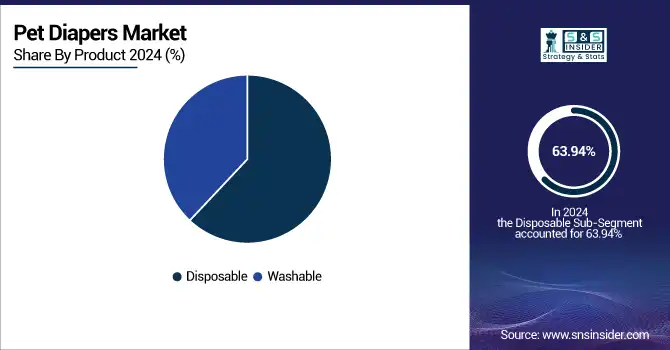

The disposable segment is the dominant segment in the global pet diapers market, with a 63.94% market share in 2024, owing to its convenience, comfort, and clean, no-mess disposal. They're preferred among pet owners and clinics for quick changes when a pet has incontinence or is recovering over surgery or traveling. Increasing consciousness regarding pet hygiene and increasing demand for convenient solutions continue to provide an impetus to the disposable diaper market in developed and developing regions.

The Washable segment is emerging as the fastest growing with a CAGR of 9.46% in the pet diapers market, as they are increasing customer demand for green, low-cost alternatives. Caring for the environment and for their wallets, eco-conscious pet parents are choosing reusable diapering for their fur babies! Fabric innovations that result in increased comfort, absorbency, and lasting power only add to this trend, and as such, washable alternatives have become that much more attractive for everyday pet and hygiene control.

-

By Pet

In 2024, the Dogs dominated the pet diapers industry with a 78.80% market share, as a result of increased global dog ownership and incontinence, aging, and post-surgical care in dogs. Dog owners are more hygiene-conscious now, particularly in urban areas, so diapers are more prevalent. Furthermore, increasing awareness, emotional attachment, and humanization of dogs are some of the factors likely to propel the growth of the market for easy and healthful diapering options.

The Cats segment is the fastest growing segment of the pet diapers market analysis, as cats are becoming more popular and there is a growing acceptance of the fact that they have to be clean to have a healthy life. With an increasing number of indoor cats, owners are also looking for solutions for problems including heat cycles, incontinence, and post-surgical recovery. The pet humanization and premium hygiene care also drove the demand.

-

By Application

The Urinary Incontinence segment held a dominant pet diapers market share in 2024 and is emerging as the fastest-growing segment over the forecast period. Driven by the high number of incontinent older or infirm pets, primarily dogs. Hygiene, cleanliness, and comfort are pet owners’ top priorities to take the best and easiest care of their pets during these troubles. There will also always be more than enough demand for Trusty Pet diapers! And the trend of humanized concept of pets also reinforces this idea, pets need high-quality products for better care and protection, for better maintain their dignity, health, and home clean and tidy home, and for that reason, the market will have more than 10 percent market share shortly.

-

By Distribution Channel

Pet specialty stores are the largest segment of the pet diapers industry, owing to the high incidence of incontinence, primarily in the aging and infirm in pets, particularly dogs. To control these problems, pet owners value cleanliness, comfort, and convenience, all of which contribute to steady demand for trustworthy diapering solutions. The pet humanization trend lends additional support to this segment, with pet owners looking for high-quality care products in consideration of the dignity, health, and sanitation of their pets, hence expanding its presence on the market.

The e-commerce segment is witnessing the highest growth in the global pet diapers market, owing to increasing internet penetration, doorstep delivery, and availability of variety of products. For the consumer, price comparisons, subscription models, and easy repeat orders all work in their favor. Growing ownership of pets by technically trending millennials is also contributing towards the online sales of pet diapers, and as such, e-commerce -an emerging distribution channel in the pet diapers market.

Pet Diapers Market Regional Analysis

North America Pet Diapers Market Insights

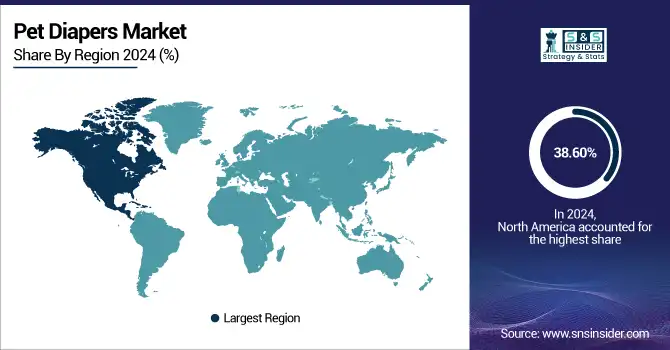

In 2024, the North American region holds the largest market share of the pet diapers Industry and dominates the market with a 38.60% market share, owing to the high pet ownership rate, powerful pet humanization trend, and the considerable disposable income. American and Canadian consumers are taking a cue over the message of pet ownership as family and investing in high-end hygiene products, including diapers. Higher levels of veterinary care, an older pet population, and awareness about incontinence or post-surgery needs fuel demand as well. Further, due to the strong distribution network in the area, including pet specialty shops and e-commerce, people can avail it at ease, securing the dominance of North America in the global pet diapers market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Pet Diapers Market Insights

The U.S. pet diapers market was valued at USD 114.58 million in 2024 and is expected to reach USD 227.62 million by 2032, growing at a CAGR of 8.97% over 2025-2032. The U.S. is the leader in the pet diapers market with strong brand innovations, wide product portfolios, and strong retail competencies, including Chewy, PetSmart, and Petco. The pet diapers market analysis in leading companies is based on premiumization, pet humanization, and geographical expansions. Consumer awareness and marketing also drive adoption, and convenient product availability and solutions designed specifically for older pets keep the U.S. a market trendsetter globally.

Europe Pet Diapers Market Insights

Europe holds a significant and ever-growing market for pet diapers due to the growing trend of pet adoption, surging awareness about pet hygiene, and the rising trend of pet humanization in the region. Countries including Germany, the UK, and France are observing greater expenditures on pet care products, including diapers. Rising inclination towards sustainable and environmentally friendly pet products, presence of premium brands, and an increase in penetration of e-commerce bolster the growth of the market across the European region.

Asia-Pacific Pet Diapers Market Insights

Asia-Pacific emerges as the fastest-growing region with the highest CAGR of 9.86%, fueled by the growth in pet ownership, fast urbanization, and growing disposable incomes in China, India, Japan, and South Korea. Pet humanization is driving an increased spending on premium hygiene & care products, including pet diapers, backed by a rising middle-class population. An increasing number of urban populations, particularly residing in apartments, are looking for easy indoor hygiene management, spurring the demand for diapers. Besides, the increasing consciousness of pet health, social media appeal, and development of pet e-commerce platforms are driving pet care choices. Local vendors are also offering price-sensitive, even quirky products to the market. On the whole, the convergence of lifestyle changes, modernization, and cultural interest in treating pets as part of the family is driving the region’s high market growth.

Middle East & Africa Pet Diapers Market Insights

The pet diapers market in the Middle East & Africa has the least share due to the low rate of pet ownership, low awareness about pet hygiene products, and cultural differences in pet care. Furthermore, economic inconsistencies and the absence of well-developed pet specialty retail structures create obstacles to mass consumption. Although metros are growing slowly, concerns about affordability and a lack of product are holding back expansion in many parts of the region.

Latin America Pet Diapers Market Insights

The Latin American breast prosthetic industry is witnessing a steady rise in growth, fueled by a growing pet population, urbanization, and increasing awareness towards pet hygiene. Nations including Brazil, Mexico, and Argentina are seeing increased expenditures as pets are humanized and premium pet care supplants standard feeding and lodging. But economic uncertainty, affordability challenges, and limited access to products in rural areas continue to restrict market expansion. Growth is on pace but lags behind the Asia-Pacific.

Pet Diapers Companies are:

Some of the Pet Diapers Market Companies

-

Petco Animal Supplies, Inc.

-

PetSmart Inc.

-

Amazon

-

Walmart Inc.

-

Chewy, Inc.

-

Paw Inspired

-

Simple Solution

-

PetCare

-

Vet’s Best

-

Four Paws

-

All-Absorb

-

Pet Magasin

-

Wegreeco

-

Hartz Mountain Corporation

-

Unicharm Corporation

-

IRIS USA, Inc.

-

Mednet Direct

-

Rocket & Rex

-

Pogi’s Pet Supplies

-

Honey Care

Recent Developments:

Animal Supplies, Inc., headquartered in Durham, North Carolina, and founded in 1987, is a leading pet products distributor in the U.S., specializing in wholesale distribution of pet food, hygiene, and supplies. It partners with independent retailers and regional outlets, focusing on expanding access to specialty products and strengthening retail partnerships nationwide.

-

In February 2025, Animal Supplies expanded regional retail partnerships across the U.S. Midwest to boost distribution of specialty pet hygiene products, including high-demand disposable and washable pet diapers.Top of Form

Chewy, Inc., headquartered in Plantation, Florida, founded in 2011, is a leading online pet product retailer, offering pet food, health, wellness, and supplies through e-commerce and subscription services. Known for customer-centric innovation, Chewy provides auto-ship programs, personalized care solutions, and pharmacy services, positioning itself as a trusted digital platform for pet parents.

-

In May 2024, Chewy launched a subscription service for pet diapers, offering automatic deliveries, loyalty perks, and cost-saving bundles to enhance convenience for pet parents managing incontinence.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2024 |

USD 361.05 million |

|

Market Size by 2032 |

USD 727.30 million |

|

CAGR |

CAGR of 9.16% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Disposable, Washable) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

Petco Animal Supplies, Inc., PetSmart Inc., Amazon, Walmart Inc., Chewy, Inc., Paw Inspired, Simple Solution, PetCare, Vet’s Best, Four Paws, All-Absorb, Pet Magasin, Wegreeco, Hartz Mountain Corporation, Unicharm Corporation, IRIS USA, Inc., Mednet Direct, Rocket & Rex, Pogi’s Pet Supplies, Honey Care and other players. |