Medical Supplies and Labware Market Report Scope & Overview:

Get More Information on Medical Supplies and Labware Market - Request Sample Report

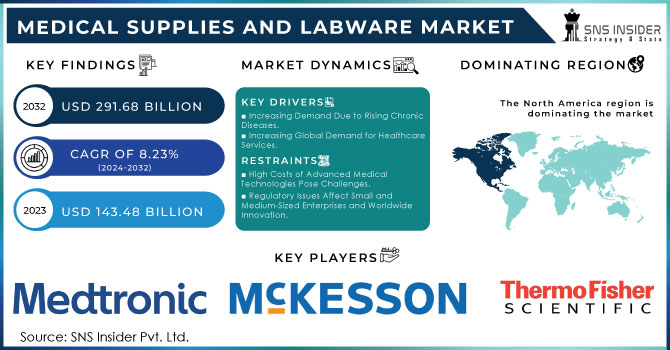

The Medical Supplies and Labware Market size is valued at USD 143.48 Billion in 2023 & it is estimated to reach USD 291.68 Billion by 2032, growing at a CAGR of 8.23% during 2024-2032.

The medical supplies and labware market has seen significant growth due to improvements in healthcare, growing research efforts, and increased focus on cleanliness and safety. This market includes a wide variety of products utilized in medical and laboratory settings, such as disposable medical supplies, diagnostic tools, and laboratory equipment. The market's growth trend shows the healthcare infrastructure expanding and constant innovation in medical and laboratory technologies. The healthcare industry is seeing an increase in the need for medical supplies like surgical Infusion & Injectable Supplies, wound care products, and diagnostic Disposables. This rise is a result of the growing number of chronic diseases, an aging population, and the continued necessity for preventive care. Hospitals and clinics depend significantly on these resources to provide effective patient care with high quality. The need for dependable medical supplies in addressing global health crises was underscored by the COVID-19 pandemic, which increased this demand even more. This has resulted in higher levels of investments in supply chain management and the creation of more sophisticated medical products.

Biotechnology benefits greatly from the use of medical supplies and labware. Biotechnology firms employ sophisticated laboratory equipment for genetic studies, drug creation, and medical testing. The U.S. biotechnology sector set a new financing record of USD 115.3 billion in 2022, largely due to the COVID-19 pandemic boosting support for biotech advancements such as mRNA technology. This increase in funding was one of the largest investment amounts ever seen in the industry, making up 79% of the total global biotech fundraising for that year. For example, automated pipetting systems and high-throughput screening devices are now essential for accelerating research and enhancing the precision of experimental outcomes. Furthermore, essential medical items like specialized Disposables and culture media play a critical role in growing cells and researching their actions, potentially resulting in advancements in personalized medicine and targeted treatments.

Market Dynamics

Drivers

-

Increasing Demand Due to Rising Chronic Diseases.

The rise in chronic illnesses like diabetes, cancer, and cardiovascular diseases is a major factor influencing the Medical Supplies and Labware Market. Since these conditions often need continuous care, regular observation, and testing for diagnosis, they increase the need for medical equipment like diagnostic tools, surgical tools, and laboratory containers. For example, patients with cancer often need specialized medical supplies for diagnostic tests, biopsies, and surgeries. In the same way, managing diabetes depends greatly on monitoring tools such as glucose meters and syringes. As chronic diseases continue to increase worldwide, particularly in developed and emerging markets, there is also a growing need for medical supplies and labware. The WHO expects an ongoing increase in the number of individuals impacted by chronic illnesses, driving the market to cater to the expanding requirements of medical facilities, research facilities, and ambulatory care centers. The continuous creation of diagnostic tools specific to these diseases will also enhance the demand for labware and medical equipment in hospitals and clinics around the globe.

-

Increasing Global Demand for Healthcare Services.

The healthcare sector worldwide is expanding significantly because of various reasons, including aging populations, the increase in chronic illnesses, and the rising health consciousness among people. With people experiencing increased lifespans, the need for healthcare services is rising, creating a strain on medical facilities to deliver more advanced treatment. This has a direct impact on the Medical Supplies and Labware Market, which is crucial for daily healthcare operations.

For instance, the older demographic, especially in advanced countries, has increased significantly compared to earlier years. Due to needing medical care more often, this group's demand for various medical supplies, including syringes, bandages, and diagnostic labware, naturally increases. Healthcare infrastructure advancements in developing areas, as a result of investments from both the government and private sector, are also leading to an increased need for medical supplies.

Restraints

-

High Costs of Advanced Medical Technologies Pose Challenges.

A major obstacle encountered by the medical supplies and labware market is the expensive nature of advanced medical technologies. Even though advancements in technology are essential for enhancing healthcare results, they frequently have a high cost associated with them. This could hinder the use of these resources, particularly in emerging countries or smaller medical centers that may lack the funds to purchase high-tech technology. Sophisticated diagnostic machines and IoT-enabled devices utilized in laboratory and hospital settings demand a significant amount of financial investment. Additionally, healthcare providers face increased financial burden due to the maintenance and training expenses related to these technologies. In developing countries, limited budgets often lead healthcare facilities to choose cheaper, lower-quality supplies, which limits the expansion of the market. Markets that are sensitive to pricing delays adopting new technologies because of the high costs involved, leading to a slowdown in the growth of the worldwide medical supplies and labware market.

-

Regulatory Issues Affect Small and Medium-Sized Enterprises and Worldwide Innovation.

The medical supplies and labware industry faces strict regulations because of its crucial role in maintaining patient safety and ensuring accurate diagnostic results. Adhering to strict regulations from agencies like the FDA and EMA can pose challenges for global companies. These guidelines frequently necessitate thorough testing and approval procedures prior to the sale of medical supplies in specific markets. This could lead to postponed product releases, higher expenses, and restricted adaptability for companies seeking fast innovation. Small and medium-sized businesses (SMEs) frequently encounter major difficulties in understanding these regulatory systems, which hinders their capacity to rival larger, more established companies.

Key Market Segmentation

By Type

Personal Protective Equipment (PPE) dominated with 26% market share in 2023, due to its critical role in ensuring the safety of healthcare workers and patients. The COVID-19 pandemic significantly boosted the demand for PPE, including masks, gloves, gowns, and face shields. This segment remains crucial as healthcare facilities prioritize infection control and safety protocols. Companies like 3M and Honeywell have led the market by providing a wide range of PPE products. 3M's N95 respirators and Honeywell's protective face shields are prime examples of innovations that meet the stringent safety standards required in healthcare settings.

Diagnostic Supplies are the fastest-growing segment during the forecast period in the Medical Supplies and Labware Market, driven by advancements in technology and increased focus on early disease detection. This segment includes Disposables, test kits, and diagnostic imaging products. The rising prevalence of chronic diseases and the growing need for rapid, accurate diagnostics fuel this growth. Companies like Abbott Laboratories and Roche are leading innovations in this space. Abbott's rapid COVID-19 test kits and Roche's diagnostic assays are examples of cutting-edge products that enhance diagnostic capabilities and contribute to the segment's expansion.

By Product

Pipettes captured a 38% market share in 2023 because of their essential function in accurate liquid manipulation for a variety of lab tasks. Their dominant position has been solidified by their extensive usage in clinical diagnostics, pharmaceutical research, and biotechnology laboratories. The development of sophisticated electronic and automated pipettes has enhanced their standing, meeting the increasing need for high-throughput screening and laboratory automation. Eppendorf's electronic pipettes are commonly utilized in genomic research laboratories, such as for preparing PCR, demonstrating their broad usage and market leadership.

The test tubes are expected to have a faster CAGR during the forecast period due to the increased need for diagnostic testing and research activities, especially during global health crises such as the COVID-19 pandemic. The growing emphasis on molecular diagnostics and personalized medicine has caused a rise in the need for premium test tubes that guarantee sample integrity and work well with automated systems. Corning and Thermo Fisher Scientific are among the top companies in pioneering new test tube solutions.

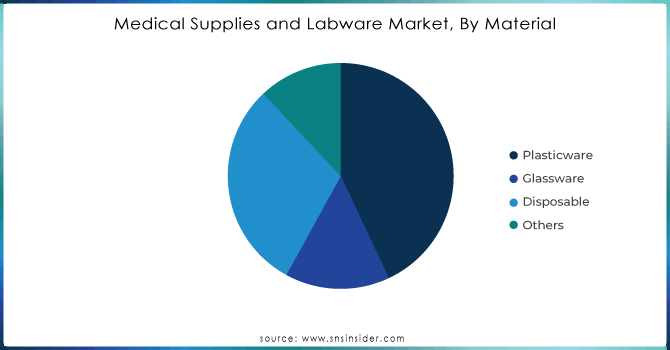

By Material

Plasticware dominated in 2023 with a 43% market share because it is extensively utilized in a variety of medical and laboratory settings. Plastic utensils provide numerous benefits such as affordability, strength, and flexibility. The lightweight quality and durability of the material make it perfect for use in healthcare settings for handling and transportation purposes. Moreover, the versatility of plastic utensils in being able to withstand different sterilization techniques increases their practicality in environments requiring sterility. Thermo Fisher Scientific and Corning Inc. provide a variety of plastic products such as pipettes, Petri dishes, and centrifuge tubes that are commonly used in hospitals, research laboratories, and diagnostic facilities.

The disposable sector is expected to have rapid growth in 2023-2032, due to the growing focus on infection prevention and the increasing need for one-time-use items. Disposable medical equipment like needles, gloves, and masks play a vital role in minimizing cross-contamination and safeguarding patient well-being. Healthcare facilities and labs are more and more using disposable products to meet cleanliness standards and follow regulations. 3M and BD are top suppliers of disposable medical supplies that serve hospitals, clinics, and research organizations with a diverse product selection.

Need any customization research on Medical Supplies and Labware Market - Enquiry Now

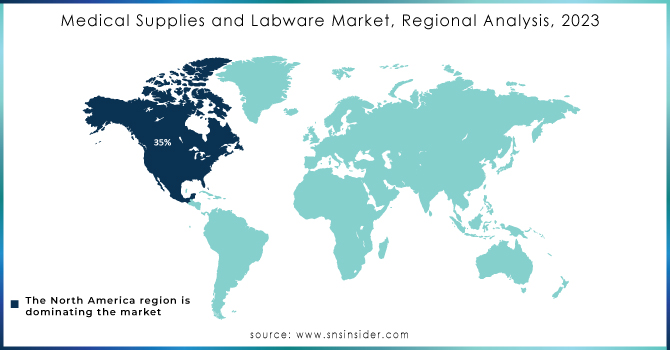

Regional Analysis

North America led the market in 2023 with more than 35% market share, mainly due to the advanced healthcare system, substantial research and development spending, and significant healthcare expenses in the United States. The area is advantaged by a strong system of hospitals, research organizations, and a robust regulatory structure that encourages innovation and high standards. Moreover, the rise in chronic illnesses and an older population leads to a higher need for medical supplies and laboratory equipment. Large corporations such as Medtronic and Thermo Fisher Scientific have a significant footprint in North America, providing a diverse selection of medical devices, diagnostic equipment, and laboratory solutions.

The Asia-Pacific region is accounted to experience rapid growth due to economic expansion, growing healthcare spending, and improved healthcare facilities, particularly in countries such as China, India, and Southeast Asian nations. The increasing middle class and growing healthcare awareness are fueling the need for sophisticated medical products and laboratory equipment. APAC governments are focusing on the development of the healthcare sector, which involves improving medical facilities and advancing medical research. Siemens Healthineers is increasing its presence in APAC by setting up manufacturing facilities, research and development hubs, and distribution channels to meet the rising need.

Key Players

The key players are Fisher Scientific, VWR International, 3M Health Care, Becton Dickinson and Company, Cardinal Health, Thermo Fisher Scientific, Abbott Laboratories, Medtronic, Henry Schein, McKesson Corporation, Siemens Healthineers, GE Healthcare, Johnson & Johnson, Danaher Corporation, PerkinElmer, & Other Players.

Recent Development

-

In August 2024, Thermo Fisher Scientific presented a new type of labware designed to increase the precision and efficiency of scientific research. The presented goods included extended pipette tips and centrifuge tubes that are clearer as well as less prone to chemical interaction.

-

In July 2024, Medline Industries introduced a new line of ultra-comfort surgical gloves that give better tactile sensitivity and less fatigue to hands during long operations. They are created with a special application to ensure a better grip and less chance of contamination.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 143.48 Billion |

| Market Size by 2032 | USD 291.68 Billion |

| CAGR | CAGR of 8.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diagnostic Supplies, Infusion & Injectable Supplies, Intubation & Ventilation Supplies, Disinfectants, Personal Protective Equipment, Sterilization Consumables, Wound Care Consumables, Dialysis Consumables, Radiology Consumables, Catheters, Sleep Apnea Consumables, Others) • By Product (Pipettes, Burettes, Beakers, Flasks, Test Tubes, Others) • By Material (Plasticware, Glassware, Disposable, Others) • By Application (Urology, Wound Care, Radiology, Respiratory, Infection Control, Cardiology, IVD, Other) • By End User (Hospitals, Clinics/Physician Offices, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fisher Scientific, VWR International, 3M Health Care, Becton Dickinson and Company, Cardinal Health, Thermo Fisher Scientific, Abbott Laboratories, Medtronic, Henry Schein, McKesson Corporation, Siemens Healthineers, GE Healthcare, Johnson & Johnson, Danaher Corporation, PerkinElmer |

| Key Drivers | • Increasing Demand Due to Rising Chronic Diseases. • Increasing Global Demand for Healthcare Services. |

| RESTRAINTS | • High Costs of Advanced Medical Technologies Pose Challenges. • Regulatory Issues Affect Small and Medium-Sized Enterprises and Worldwide Innovation. |