Biodegradable Medical Plastics Market Report Scope & Overview:

Get More Information on Biodegradable Medical Plastics Market - Request Sample Report

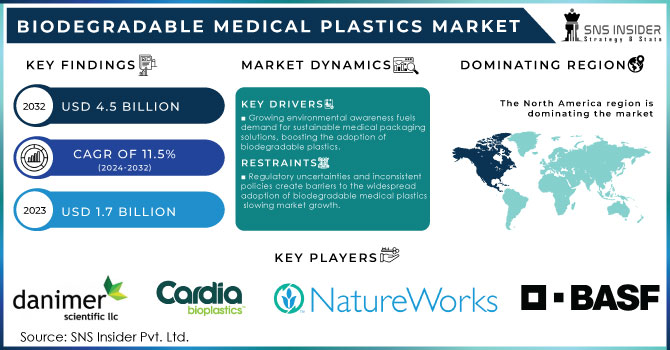

The Biodegradable Medical Plastics Market Size was valued at USD 1.7 Bn in 2023 and will reach USD 4.5 Bn by 2032 and grow at a CAGR of 11.5% Over the Forecast Period of 2024-2032.

The Biodegradable Medical Plastics Market has significantly changed with the advances in green material development and enhanced environmental awareness. Recent biodegradable plastic developments indicate a trend toward greener plastics. With improvements, scientists could develop formulations of bio-based plastics that can be fully decomposed without leaving any residues of harmful microplastics. These innovations in plastic decomposition show the potential of biodegradable plastics in solving many environmental issues traditional plastics have created over the years.

University of New South Wales (UNSW) research demonstrates more commitment to sustainable healthcare packaging. There is, however, a lot of emphasis on materials that meet the most stringent medical standards but maintain less impact on the environmental conditions. This undoubtedly emanates from the broad reliance on single-use plastics within the medical industry. Recent investments in bioplastics, however, indicate a growing acknowledgment of biodegradable materials such as PHA-polyhydroxyalkanoates and PLA-polylactic acid as credible alternatives, though, in a limited sense. Due to this, these materials should break down more nicely in natural environments, making them a promising solution to the challenge associated with medical plastic waste. These uncertainties and inconsistencies in the policy are holding the mass market from penetrating biodegradable plastics. The debate over the effectiveness of these products and their true benefits is still ongoing, beclouding their integration into mainstream medical practices, which is the growing market. The biodegradable medical plastics market will open with every technological advance and supportive policy.

With the increased research on the subject indicating the potential of these materials in reducing the medical applications environmental footprint but also in addressing the medical applications plastics waste, the contribution of biodegradable materials in this context is continuously underlined. The properties and performance of bioplastics develop continuously, therefore the use in medical applications is increasingly possible in the future The market's evolution is thus expected to include a broader adoption of biodegradable plastics, mainly under the market's environmental concern but also under the market's technological advancement.

Biodegradable Medical Plastics Market Dynamics:

Drivers

-

Growing environmental awareness fuels demand for sustainable medical packaging solutions, boosting the adoption of biodegradable plastics.

The rapid growth in environmental awareness significantly fuels the demand for sustainable solutions for medical packaging, thus increasing the demand for biodegradable plastics. This increased ecological awareness has shifted the focus to ecological footprint reduction from medical products and forced enterprises to look for and implement environmentally friendly alternatives. For instance, in June 2023, German-based Greiner Bio-One launched its new line of medical containers manufactured from biodegradable materials that could degrade, provided the industrial composting conditions are met, within a year. This has been due to increasing pressure on the regulatory front and also from consumers who expect more 'green' practices. Similarly, in September 2023, Danaher Corporation, a global science and technology company, announced a collaboration with Bioplastics International to develop a line of biodegradable plastics used in laboratory equipment, aligned with their corporate sustainability goals. This has come on the heels of a wider trend where medical manufacturing companies invest in biodegradable materials to reduce their impact on the environment. Another indication is the general sustainability push that has been demonstrated through regulatory trends. For instance, the Green Deal of the European Union has driven more stringent requirements on medical packaging material. Therefore, companies have been trying to put in place biodegradable plastics into their product offering to meet the increase in demand from consumers and also to meet regulatory standards hence driving the market towards a more sustainable solution.

-

Technological advancements in biodegradable materials enhance their performance and viability, expanding their use in medical applications.

Biodegradable material technologies have significantly improved, offering better performances and viability to extend their application in medical fields. For instance, in March 2024, NatureWorks LLC, a leading company in bioplastics, introduced a new formulation of PLA with enhanced mechanical properties and faster degradation rates. This innovation renders PLA suitable for more medically demanding applications requiring durability and a reliable breakdown under stringent and controlled conditions, such as surgical instruments and drug delivery devices. Similarly, in July 2023, BASF introduced a new variant of PHA resin that brings improved flexibility and strength as a result of its collaborations with Biome Technologies. Currently, this PHA resin is being tested for use in medical implants and packaging applications that resolve critical performance-related issues and further extend its use in applications. In November 2023, Cardia Bioplastics also introduced a new biodegradable polymer blend by incorporating natural fibers into it, enhancing the strength and degradability of the final product. This has presented very promising results in producing medical packaging that decomposes effectively in composting conditions, with very good strength retention during application. These improvements are representative of a general trend within the entire field, which has seen sustained investigative and developmental efforts molding biodegradable materials into becoming suitable materials for medical applications. These technological advances increase the properties of degradable plastics as potential alternative materials for traditional ones, so their use in medical fields is widespread.

Restrain

-

Regulatory uncertainties and inconsistent policies create barriers to the widespread adoption of biodegradable medical plastics, slowing market growth.

Increased regulatory uncertainties and fluid policies remain key constraints to the deeper market penetration of biodegradable medical plastics, thus delaying market growth. For example, in February 2024, Ecovia Renewables experienced delays in the rollout of new biodegradable packaging for medical devices due to unclear guidance from the U.S. Food and Drug Administration on the approval of new materials. On the same note, Trinity Bioplastics faced some challenges in Europe around October 2023. Because different countries in the European Union applied different standards to biodegradable materials, markets were fragmented into pieces, hindering the efforts of the company to improve and smoothen production and distribution. Such regulatory challenges create uncertainty for manufacturers, complicate the approval process, and impede the integration of biodegradable plastics within medical applications, eventually affecting their adoption and market expansion.

Opportunities

-

Increasing investment in bioplastics research offers opportunities for innovation, leading to more effective and cost-efficient biodegradable medical products.

Higher investment in bioplastics research leads to an abundance of opportunities for innovation, which can eventually result in more effective and economic development of biodegradable medical products. For example, in April 2024, Avantium secured €50 million to further its research on next-generation biodegradable polymers, designed to enhance performance and lower cost in medical packaging solutions. In a parallel manner, in January 2024, the energy major announced another strategic collaboration with Green Bioplastics Inc., in which the two will jointly invest in research work focused on improving the properties of polyhydroxyalkanoates for use in medical implants and sutures. These strategic investments, which are helping drive breakthroughs in material science, provide the development of high-performance bioplastics, and environmental and economic advantages that promote rapid growth in the material within the medical sector.

Challenges

-

Ensuring the performance and safety of biodegradable plastics in medical applications remains a significant challenge, impacting market acceptance and growth.

Performance and safety considerations in these biodegradable plastics in medical applications remain some of the major challenges that influence market acceptance and, hence, growth. Biomaterials Inc. faced problems in its new product line of biodegradable surgical sutures because, in May 2024, several questions were raised about their strength and dependability in high-stress conditions, thus causing delays in launching products and further testing. Similarly, delays in market entry and development costs that arise from the failure of biodegradable drug delivery devices developed by MedBioTech Solutions in August 2023 can be attributed to not meeting the strict regulatory standards concerning safety. These challenges further point to the issue of complexity regarding the assurance that medical applications can be met with biodegradable plastics, considering the growth implications this factor has for the market.

Biodegradable Medical Plastics Market Segment Analysis

By Type

The Polylactic Acid (PLA) segment dominated and accounted for a revenue share of 45% in the Biodegradable Medical Plastics Market in 2023. This is because PLA dominated due to its very positive properties in mechanical strength and biocompatibility, adding to being relatively cost-effective compared to most other biodegradable plastics. For example, NatureWorks LLC announced as far back as March 2023 products based on PLA that were widely used for medical packaging and disposable medical items due to an established performance record and compliance with regulatory use. This dominance in the market is supported by the fact that PLA has versatility and, consequently, an increase in investment in the production technology makes it preferred in a range of medical applications.

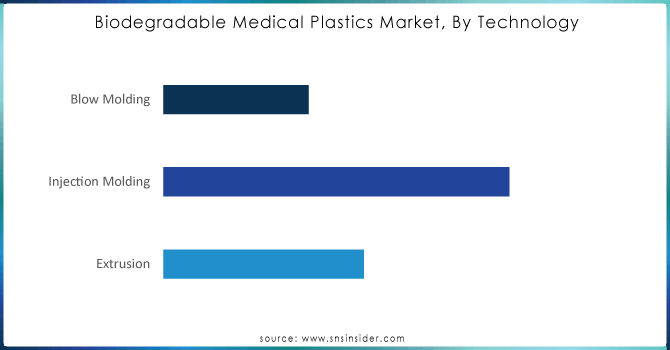

By Technology

The Injection Molding technology segment dominated with a market share of 50% in the Biodegradable Medical Plastics Market in 2023. It is one of the major leading segments because of the potential that this technology has to manufacture complex and high-precision medical components with great consistency and efficiency. For instance, Flexan LLC mentioned in July 2023 that the company's injection-molded biodegradable medical devices, such as catheters and surgical instruments, are showing better performance and reliability compared to products manufactured with other technologies. Its versatility, regarding making various shapes and dimensions, added to development concerning biodegradable material, makes it a first choice for medical applications in the sector.

Need any customization research on Biodegradable Medical Plastics Market - Enquiry Now

By Application

The Medical Devices segment dominated and accounted for the market share of 40% in the Biodegradable Medical Plastics Market. This depicts the importance of the segment given a strong regulatory environment and increased spotlight on sustainability in healthcare. This high share testifies to the demand of the sector for advanced, environmentally friendly materials, which at the same time meet both performance and environmental criteria. The trend will hold because medical device manufacturing badly needs high-performance and eco-friendly material processing. For instance, in February 2023, Medtronic announced that the usage of biodegradable plastics in products, such as surgical tools and diagnostic machinery, was accomplished to reduce the environmental footprint of the organization by setting strong standards for safety and efficacy.

By End-user

The Hospitals segment dominated the Biodegradable Medical Plastics Market in 2023 with the largest market share of about 55% due to the high usage of medical plastics in hospitals for different purposes, including disposable medical equipment and packaging. The share is high enough to indicate that hospitals are key players in the adoption and benefitting from sustainable medical plastics solutions. For example, Johnson & Johnson recently reported, in March 2023, that its biodegradable plastics are increasingly adopted in surgical tool and packaging applications within hospitals, partly because of the strong push for sustainable practices.

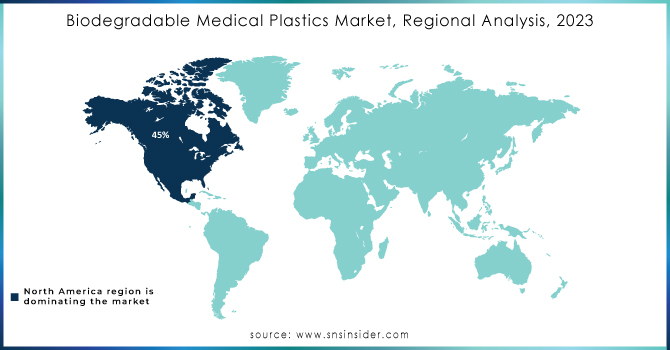

Biodegradable Medical Plastics Market Regional Overview

In 2023, North America dominated the Biodegradable Medical Plastics Market with a maximum share of 45%. This is due to the efforts inspired by medical institutions and manufacturers from regulatory incentives, putting together the fast pace of technological development that made it possible. Advanced health infrastructure in the region, immense support from regulatory bodies for sustainability, and substantial R&D investments being made in bioplastics are the major drivers for growth in the region. For instance, in April 2023, 3M announced that its newest line of biodegradable medical packaging solutions had been widely adopted by hospitals and clinics throughout the United States and was a witness to the greener material adaptation of the region.

Moreover, the Asia-Pacific emerged as the fastest-growing region in the Biodegradable Medical Plastics Market, growing at a CAGR of about 12%. Due to the rising demand for healthcare, increasing environmental awareness, and major investments in sustainable technologies, such growth factors can be attributed. For example, in May 2023, LG Chem announced its planned significant expansion of the production capacity of a biodegradable plastic production facility in South Korea to meet the high demand for environmentally friendly medical packaging solutions across the Asia-Pacific region. Furthermore, Sumitomo Chemical has invested in new research and development projects in Japan, including the development and commercialization of biodegradable material applications in medical fields, reflecting the region's buoyant role in accelerating market growth.

Key Players

Some of the major players in the Biodegradable Medical Plastics Market are BASF SE, NatureWorks LLC, Cardia Bioplastics, Danimer Scientific, TotalEnergies, Green Dot Bioplastics, Novamont S.p.A, Biomerics, Medline Industries, Inc., Evonik Industries AG and other key players

Recent Developments

-

May 2024-University of Cambridge, UK Scientists are working on developing a new biodegradable plastic that degrades much quicker and better than the existing bioplastics in effort to reduce plastic-derived microplastic pollution.

-

October 2023: UNSW announces advanced biodegradable plastics for packaging medical products that are designed to decompose safely and support sustainable medical practices with minimal environmental impact.

Biodegradable Medical Plastics Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 1.7 Billion Market Size by 2032 US$ 4.5 Billion CAGR CAGR of 11.5% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Type (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Polycaprolactone (PCL), Others)

•By Technology (Extrusion, Injection Molding, Blow Molding)

•By Application (Medical Devices, Packaging, Drug Delivery Systems, Wound Care, Others)

•By End-user (Hospitals, Clinics, Research Institutions, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles BASF SE, NatureWorks LLC, Cardia Bioplastics, Danimer Scientific, TotalEnergies, Green Dot Bioplastics, Novamont S.p.A, Biomerics, Medline Industries, Inc., Evonik Industries AG and other key players Key Drivers • Growing environmental awareness fuels demand for sustainable medical packaging solutions

• Technological advancements in biodegradable materials enhance their performance and viability, expanding their use in medical applicationsRESTRAINTS • Regulatory uncertainties and inconsistent policies create barriers to widespread adoption of biodegradable medical plastics, slowing market growth