Geothermal Energy Market Report Scope & Overview:

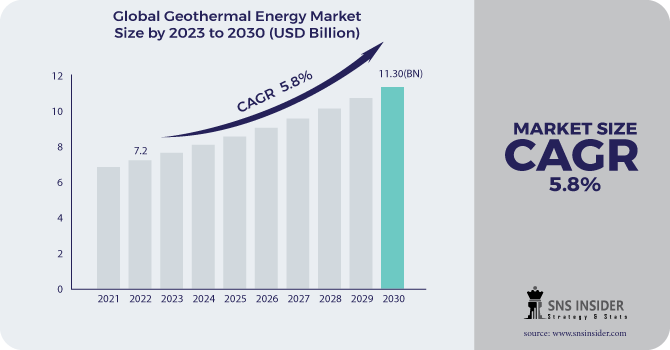

The Geothermal Energy Market size was valued at USD 7.62 billion in 2023 and is expected to grow to USD 12.15 billion by 2031 and grow at a CAGR of 5.97% over the forecast period of 2024-2031.

Geothermal energy is a type of renewable source of energy that is derived from the earth's core heat. This energy is harnessed through the use of geothermal power plants, which utilize the natural heat of the earth to generate electricity. Geothermal energy is a clean and sustainable source of energy that has the potential to provide a significant portion of the world's energy needs. Geothermal energy is a promising alternative to traditional fossil fuels, as it is both renewable and environmentally friendly. Unlike fossil fuels, which emit harmful greenhouse gases when burned, geothermal energy produces no emissions and has a minimal impact on the environment. Additionally, geothermal energy is available 24/7, making it a reliable source of energy that can be used to power homes, businesses, and entire communities. Geothermal power plants work by drilling deep into the earth's crust to access the natural heat of the earth. This heat is then used to generate steam, which is used to power turbines and generate electricity. The steam is then condensed back into water and returned to the earth, where it is reheated and used again.

To Get More Information on Geothermal Energy Market - Request Sample Report

While geothermal energy has many benefits, there are also some challenges associated with its use. One of the main challenges is the high upfront cost of building geothermal power plants. Additionally, geothermal energy is only available in certain areas of the world, which limits its potential as a global energy source. As technology continues to improve and costs decrease, geothermal energy is likely to become an increasingly important part of the global energy mix. The market for geothermal energy is expected to continue to grow as more countries and companies invest in renewable energy sources. In addition, advancements in technology and exploration techniques are making it easier and more cost-effective to extract geothermal energy.

Market Dynamics

Drivers

-

Growing demand for clean energy sources

-

Increasing government initiatives to reduce greenhouse gas emission

Restrain

-

Limited availability of suitable geothermal resources

-

High upfront cost associated with geothermal energy production

The high initial investment required for geothermal energy production serves as a significant obstacle to the growth of the geothermal energy market. This cost includes the drilling and installation of geothermal wells, as well as the construction of power plants and transmission lines. Furthermore, the exploration and assessment of potential geothermal sites can also be a costly and time-consuming process. These expenses can discourage potential investors and limit the development of geothermal energy projects.

Opportunities

-

Expansion of geothermal energy production into new regions.

-

Potential for geothermal energy to be used in conjunction with other renewable energy sources

The potential for geothermal energy to be utilized in conjunction with other renewable energy sources presents a promising opportunity for the geothermal energy market. This integration allows for a more diverse and reliable energy portfolio, reducing the dependence on a single source of energy. Furthermore, the combination of geothermal energy with other renewables such as solar and wind power can lead to a more efficient and cost-effective energy system. This is because geothermal energy can provide a stable base load of energy, while solar and wind power can supplement the energy supply during peak demand periods. In addition, the use of geothermal energy can also contribute to the reduction of greenhouse gas emissions, as it is a clean and sustainable energy source. This aligns with the global effort to combat climate change and transition towards a low-carbon economy.

Challenges

-

Presence of alternative renewable energy sources

-

Increasing need for regulatory frameworks to support geothermal energy production

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine has disrupted the supply chain of geothermal equipment and materials, causing delays and increased costs for companies operating in the region. The political instability has also made it difficult for investors to commit to long-term projects, leading to a slowdown in the development of geothermal energy infrastructure. Furthermore, the conflict has led to a decrease in demand for energy in the region, as many businesses and households have been forced to shut down or reduce their operations. This has resulted in a surplus of energy, which has further impacted the growth of the geothermal energy market. More details are included in the final report.

Impact of Recession:

As economic activity slows down, the demand for energy decreases due to increases in the prices of the energy which further reduced the growth of the geothermal energy market. This has resulted in a decrease in investment in geothermal energy projects, which has slowed down the growth of the industry. Furthermore, the recession has made it more difficult for companies to secure financing for geothermal energy projects. Banks and other financial institutions are more cautious about lending money, and this has made it harder for companies to raise the capital they need to develop new projects. More details are included in the final report.

Key Market Segmentation

By Technology

-

Dry Steam Plants

-

Flash Steam Plants

-

Binary Cycle Plants

-

Direct Systems

-

Ground Source Heat Pumps

-

Others

By Temperature

-

High Temperature

-

Medium Temperature

-

Low Temperature

By Application

-

Residential

-

Industrial

-

Commercial

.png)

Do You Need any Customization Research on Geothermal Energy Market - Enquire Now

Regional Analysis

The Asia-Pacific region dominated the geothermal market generating the highest revenue share in 2022. This growth is attributed to favorable government policies, technological advancements, and a growing demand for renewable energy sources. One of the key drivers of the Asia-Pacific region's success in the geothermal market is the support of government policies. Many countries in the region have implemented policies that incentivize the development of geothermal energy, such as feed-in tariffs and tax credits. These policies have encouraged investment in the sector and have helped to create a favorable business environment for geothermal companies. In addition, the Asia-Pacific region has seen significant technological advancements in the geothermal industry. This has led to increased efficiency and reduced costs, making geothermal energy more competitive with other forms of renewable energy. As a result, more companies are investing in geothermal projects in the region, further driving growth and revenue. Moreover, the growing demand for renewable energy sources has also contributed to the Asia-Pacific region's dominance in the geothermal market. As concerns about climate change continue to mount, many countries are looking to reduce their reliance on fossil fuels and transition to cleaner energy sources. Geothermal energy offers a reliable and sustainable alternative, and this trend drives the growth of the geothermal energy market during the forecast period.

North America is projected to grow with the highest CAGR during the forecast period of 2023-2030. One of the key drivers of growth in North America is the region's abundant geothermal resources. The United States, in particular, has a vast array of geothermal reservoirs that are best for development. These resources are spread out across the country, with hotspots in California, Nevada, and other western states. In addition to its natural resources, North America also has a well-established regulatory framework that supports the development of geothermal energy. Governments at the federal, state, and local levels have implemented policies and incentives that encourage the growth of the industry. This includes tax credits, grants, and loan guarantees that help to offset the high upfront costs of geothermal development. Furthermore, North America is home to a number of innovative companies that are driving the growth of the geothermal energy market. These firms are developing new technologies and techniques that make it easier and more cost-effective to extract energy from geothermal reservoirs. As a result, the industry is becoming more competitive and attractive to investors.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Baker Hughes Company, Ormat Technologies, NIBE Group, Mitsubishi Heavy Industries, SLB, EthosEnergy, Reykjavik Geothermal, Turboden S.p.A., Calpine, Toshiba International Corporation, and other key players will be included in the final report.

Ormat Technologies-Company Financial Analysis

Recent Developments:

-

In December 2022, Baker Hughes launched the Consortium Exploring Technologies to Transform Abandoned Wells for Geothermal Energy Production. This initiative aims to repurpose abandoned wells for geothermal energy production, providing a sustainable and cost-effective solution for energy production.

-

In Dec 2022, Mitsubishi Power, a leading power solution brand under Mitsubishi Heavy Industries, Ltd. (MHI), received an order from PT Pertamina Geothermal Energy (PGE), the geothermal energy subsidiary of Indonesia's state-owned oil and natural gas corporation, PT Pertamina. The order was for a 55 MW power generating unit comprising a steam turbine, generator, and related equipment for the Lumut Balai Unit 2 geothermal power plant. This project will contribute to Indonesia's goal of increasing its renewable energy capacity.

-

In Nov. 2022, Schlumberger (SLB) collaborated with Oman’s Ministry of Energy and Minerals and the Oman Investment Authority to develop a national strategy for the potential of Oman’s geothermal resources.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.62 Bn |

| Market Size by 2031 | US$ 12.15 Bn |

| CAGR | CAGR of 5.97% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Dry Steam Plants, Flash Steam Plants, Binary Cycle Plants, Direct Systems, Ground Source Heat Pumps, and Others) • By Temperature (High Temperature, Medium Temperature, and Low Temperature) • By Application (Residential, Industrial, and Commercial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Baker Hughes Company, Ormat Technologies, NIBE Group, Mitsubishi Heavy Industries, SLB, EthosEnergy, Reykjavik Geothermal, Turboden S.p.A., Calpine, Toshiba International Corporation |

| Key Drivers | • Growing demand for clean energy sources • Increasing government initiatives to reduce greenhouse gas emission |

| Market Opportunities | • Expansion of geothermal energy production into new regions • Potential for geothermal energy to be used in conjunction with other renewable energy sources |