Transimpedance Amplifiers Market Report Scope & Overview:

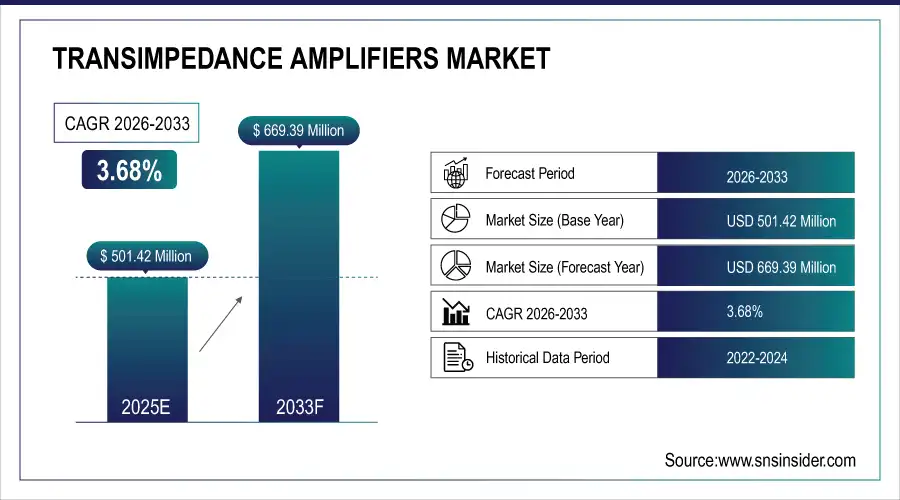

The Transimpedance Amplifiers Market Size was valued at USD 501.42 Million in 2025E and is expected to reach USD 669.39 Million by 2033, growing at a CAGR of 3.68% over the forecast period of 2026-2033.

The Transimpedance Amplifiers Market is witnessing robust growth, fueled by rising demand for high-speed optical communication, LiDAR systems, and precision sensor applications. TIAs convert photodiode currents into usable voltage signals, enabling accurate detection in telecom, automotive, medical, and industrial systems. Technological advancements improve speed, gain, and integration, supporting diverse application needs.

Market Size and Forecast:

-

Transimpedance Amplifiers Market Size in 2025E: USD 501.42 Million

-

Transimpedance Amplifiers Market Size by 2033: USD 669.39 Million

-

CAGR: 3.68% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Transimpedance Amplifiers Market - Request Free Sample Report

Key Transimpedance Amplifiers Market Trends

-

Growing demand for high-speed optical communication networks is driving adoption of advanced TIAs.

-

Increasing use of LiDAR systems in automotive and industrial applications is boosting multi-channel TIA deployment.

-

Integration of TIAs with photodiodes and optical transceivers is improving signal accuracy and system efficiency.

-

Rising adoption of precision medical imaging and instrumentation systems is expanding TIA applications.

-

Technological advancements in low-noise, high-gain, and programmable TIAs are enhancing performance and reliability.

U.S. Transimpedance Amplifiers Market Insights

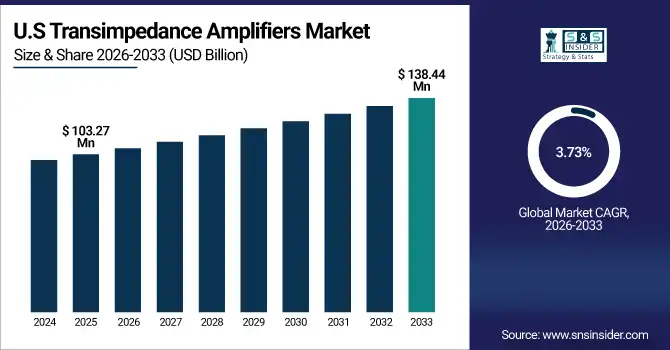

The U.S. Transimpedance Amplifiers Market size was USD 103.27 million in 2025 and is expected to reach USD 138.44 million by 2033 growing at a CAGR of 3.73% over the forecast period of 2026-2033. The growth is driven by increasing deployment of high-speed optical communication networks, which boosts demand for precise current-to-voltage conversion. The rising adoption of LiDAR systems in automotive and industrial sectors is creating additional opportunities. Technological advancements in low-noise, high-gain, and programmable TIAs are enhancing performance, while expansion of data centers and telecom infrastructure supports overall market growth.

Transimpedance Amplifiers Market Growth Driver

-

Growing Adoption of Advanced Testing Solutions in 5G Infrastructure Development Boosts Transimpedance Amplifiers Market

The Transimpedance Amplifiers Market is primarily driven by the increasing deployment of high-speed optical communication networks, which creates a direct need for precise current-to-voltage conversion in photodetector systems. As telecommunications and data centers expand to accommodate growing data traffic, industries are increasingly relying on TIAs to enhance signal integrity and reduce noise in optical receivers. This technological requirement leads to higher adoption of low-noise and high-gain TIA modules. Moreover, the growing implementation of LiDAR systems in automotive, industrial, and aerospace applications further accelerates the market, as multi-channel and programmable TIAs are essential for accurate, real-time detection. The continuous evolution of telecommunication standards and the deployment of advanced 5G and beyond networks amplify the demand for reliable TIA solutions. Consequently, manufacturers are investing in R&D to develop next-generation TIAs with higher bandwidth, enhanced integration, and improved thermal stability, ensuring optimal performance across diverse application environments. This interconnected effect between infrastructure growth and technological adoption is a key driver for sustained market expansion.

For instance, in March 2025, several North American telecom providers expanded fiber-optic infrastructure in metropolitan areas, leading to an immediate increase in procurement of medium- and high-gain TIAs for optical receivers, highlighting the direct link between network growth and amplifier demand.

Transimpedance Amplifiers Market Restraint

-

High Component Costs and Complex Integration Challenges Hinder Widespread Adoption of Transimpedance Amplifiers in Emerging Applications

The growth of the Transimpedance Amplifiers Market faces significant restraint due to the high cost of advanced TIA components and the technical complexity involved in integrating these amplifiers with photodiodes and optical transceivers. High-precision, low-noise TIAs require sophisticated semiconductor fabrication, specialized packaging, and rigorous testing, which increases the overall system cost and limits adoption in cost-sensitive markets such as consumer electronics and smaller industrial installations. Furthermore, multi-channel and programmable TIAs add design complexity, necessitating extensive calibration and integration efforts. These challenges discourage new entrants and small-scale manufacturers from adopting TIA solutions, particularly in emerging regions where budget constraints and limited technical expertise restrict deployment. As a result, the market’s potential growth is curtailed despite increasing demand in high-performance applications. Companies must balance cost reduction strategies with technological innovation to overcome these barriers, ensuring that TIA solutions remain accessible and scalable across diverse industries.

For example, several small automotive sensor manufacturers in 2024 delayed LiDAR module production due to high procurement costs of programmable TIAs and integration difficulties, directly affecting market penetration in emerging segments.

Transimpedance Amplifiers Market Opportunity

-

Expansion of Automotive LiDAR Systems and Advanced Industrial Sensors Presents Lucrative Growth Opportunities for Transimpedance Amplifiers

The Transimpedance Amplifiers Market presents significant opportunities with the rapid adoption of LiDAR technology in autonomous vehicles and advanced industrial sensor systems. As automotive manufacturers invest in self-driving and advanced driver-assistance systems, the need for high-speed, multi-channel, and low-noise TIAs grows, enabling precise detection and real-time data processing. Similarly, industrial applications, including robotics and automated inspection systems, are increasingly adopting optical sensing solutions that rely on accurate current-to-voltage conversion provided by TIAs. These developments encourage manufacturers to expand product portfolios, focus on innovation in high-gain and programmable TIAs, and collaborate with automotive and industrial solution providers. The resulting effect is not only increased TIA sales but also accelerated technological advancements that improve performance, reduce noise, and enhance integration efficiency. Companies that strategically capitalize on these expanding application areas can establish leadership positions and capture substantial market share across emerging high-value segments.

In January 2025, a leading European automaker deployed LiDAR systems with integrated multi-channel TIAs in their new autonomous vehicle fleet, demonstrating the critical role of advanced TIAs in enabling high-precision sensing and creating significant market opportunities.

Transimpedance Amplifiers Market Segment Highlights:

-

By Type: Low-Gain TIAs – 25%, Medium-Gain TIAs – 30% (largest), High-Gain TIAs – 20%, Very High-Speed TIAs – 15%, Programmable / Variable-Gain TIAs – 10%

-

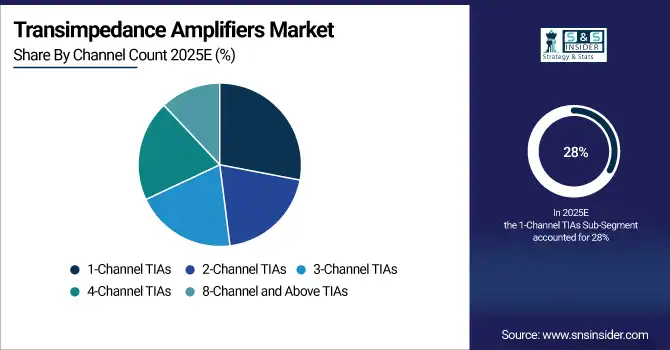

By Channel Count: 1-Channel TIAs – 28% (largest), 2-Channel TIAs – 24%, 3-Channel TIAs – 18%, 4-Channel TIAs – 16%, 8-Channel and Above TIAs – 14%

-

By Application: Photodiode Monitoring – 22%, Optical Communication / Optical Receivers – 30% (largest), LiDAR Systems – 18%, CT-Scanner Front-End – 10%, Precision I/V Conversion – 8%, Industrial Sensors – 7%, Other Applications – 5%

-

By End-User Industry: Telecommunications & Data Centers – 30% (largest), Medical Devices & Healthcare – 20%, Industrial & Automation – 18%, Consumer Electronics – 12%, Automotive (LiDAR, ADAS) – 15%, Aerospace & Defense – 5%

Transimpedance Amplifiers Market Segment Analysis

By Type

The Medium-Gain TIAs segment dominates the market with a 30% share, driven by their extensive use in optical communication, LiDAR, and precision instrumentation systems. Rising deployment of high-speed data centers and automotive sensing applications continues to strengthen demand. Their balance of gain, noise reduction, and cost-effectiveness further boosts adoption across industrial, telecom, and medical applications. The Low-Gain TIAs segment ranks second with 25%, supported by widespread use in consumer electronics and general photodiode monitoring. Increasing integration in multi-channel systems and compact devices is fueling segment growth.

By Channel Count

The 1-Channel TIAs segment leads with a 28% share, primarily due to its use in single-photodiode optical receivers, instrumentation, and basic industrial sensors. This configuration remains ideal for cost-sensitive applications requiring moderate performance. The 2-Channel TIAs segment follows with 24%, driven by growing adoption in automotive LiDAR modules and multi-sensor arrays. Expanding applications in optical communication, medical imaging, and industrial automation are enhancing demand for multi-channel solutions.

By Application

Optical Communication / Optical Receivers dominate with a 30% share, driven by growing high-speed fiber-optic network deployments and increasing demand for low-noise signal amplification. Expanding 5G infrastructure, data center upgrades, and telecom equipment testing are further stimulating market demand. Photodiode Monitoring holds 22%, as precision sensing in industrial, medical, and laboratory setups fuels adoption. LiDAR Systems account for 18%, benefiting from rising autonomous vehicle deployment and industrial automation initiatives.

By End-User Industry

Telecommunications & Data Centers lead with a 30% share, driven by the need for reliable signal conversion in high-speed networks, optical transceivers, and data transmission systems. Expanding infrastructure, network modernization, and increasing bandwidth requirements are supporting segment growth. Medical Devices & Healthcare rank second with 20%, as precise detection in imaging equipment and diagnostic tools continues to fuel TIA adoption. Automotive (LiDAR, ADAS) and Industrial & Automation segments are also witnessing steady growth due to sensor integration and automation trends.

Transimpedance Amplifiers Market Regional Analysis

North America Transimpedance Amplifiers Market Insights

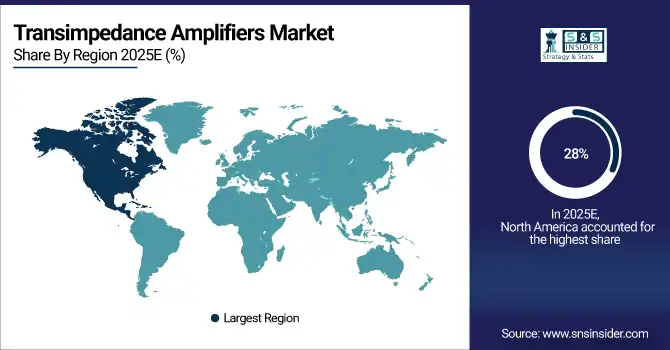

North America dominates the Transimpedance Amplifiers Market with a 28% share in 2025, supported by the presence of leading semiconductor and optical component manufacturers in the U.S. and Canada. The region’s leadership in high-speed optical networks, data centers, and aerospace R&D drives demand for precise current-to-voltage conversion solutions. Widespread adoption of advanced electronics, coupled with government-backed initiatives in telecom and sensor technology, further boosts market growth. Collaborations between OEMs, universities, and defense agencies enhance TIA design accuracy, integration efficiency, and signal reliability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Transimpedance Amplifiers Market Insights

Europe accounts for a 20% share in 2025, fueled by advancements in precision electronics, industrial automation, and high-end manufacturing across Germany, the U.K., and France. The region’s focus on quality standards, sustainability, and innovation continues to drive TIA adoption in optical communication, medical imaging, and industrial sensing. Growing investments in automotive electronics, 5G infrastructure, and aerospace R&D expand the need for reliable transimpedance amplifiers. Government programs supporting digital innovation strengthen Europe’s position as a key hub for electronic measurement technologies.

Asia-Pacific Transimpedance Amplifiers Market Insights

The Asia-Pacific region holds a 38% share in 2025, driven by rapid growth in electronics manufacturing, semiconductor innovation, and telecom expansion. Countries such as China, Japan, South Korea, and India are investing heavily in 5G networks, autonomous vehicles, and industrial sensing solutions. Increasing production of smartphones, automotive electronics, and optical devices boosts demand for cost-efficient, high-accuracy TIAs. Regional partnerships and government initiatives promoting semiconductor self-reliance enhance domestic capabilities, positioning Asia-Pacific as a major growth engine for the global TIA market.

Middle East & Africa (MEA) Transimpedance Amplifiers Market Insights

The Middle East & Africa region represents 8% of the global market in 2025, showing gradual growth due to rising investments in telecommunications, defense modernization, and smart infrastructure. Countries like the UAE, Saudi Arabia, and South Africa are adopting advanced optical sensing and TIA-based systems to support 5G rollouts and industrial automation. Collaborations between regional distributors and global technology providers improve market accessibility. Continued economic diversification and digital transformation initiatives are expected to create new opportunities for TIA solutions in MEA.

Latin America Transimpedance Amplifiers Market Insights

Latin America captures a 6% share in 2025, supported by growing demand for consumer electronics, automotive testing systems, and optical communication solutions in Brazil, Mexico, and Argentina. Expansion of telecommunication networks and adoption of digital broadcast technologies are driving market growth. Regional governments are investing in innovation hubs and offering incentives to attract semiconductor and electronics manufacturing. Partnerships with global TIA and optical component suppliers strengthen local expertise, ensuring steady growth in signal amplification and calibration technologies across the region.

Competitive Landscape for Transimpedance Amplifiers Market:

Analog Devices, Inc.

Analog Devices is a global leader in high-performance analog, mixed-signal, and digital signal processing technologies, providing solutions across communications, automotive, and industrial sectors.

-

In March 2025, Analog Devices launched its ADTI-HighSpeed TIA Series, offering low-noise, high-gain transimpedance amplifiers optimized for LiDAR, optical communication, and precision sensor applications. The new series improves signal fidelity and integration efficiency for multi-channel systems.

Texas Instruments Incorporated

Texas Instruments specializes in analog and embedded processing solutions, delivering reliable components for automotive, industrial, and consumer electronics.

-

In January 2025, TI introduced the TIAx700 Programmable Gain Transimpedance Amplifier, featuring adjustable gain, low input noise, and enhanced thermal stability, aimed at automotive LiDAR and high-speed optical receivers.

MaxLinear, Inc.

MaxLinear focuses on broadband, optical, and RF solutions for communications infrastructure and industrial applications.

-

In February 2025, MaxLinear unveiled the OptiTIA Multi-Channel Amplifier Module, integrating high-speed, low-noise TIAs for optical communication systems and next-generation data center interconnects.

Qorvo, Inc.

Qorvo provides RF solutions and advanced semiconductor technologies for communications, aerospace, and defense applications.

-

In April 2025, Qorvo released the Q-TIA Ultra-High-Speed Module, supporting multi-channel LiDAR and optical sensing applications, with improved bandwidth and signal-to-noise performance.

Transimpedance Amplifiers Market Key Players

Some of the Transimpedance Amplifiers Companies

-

Analog Devices, Inc.

-

Texas Instruments Incorporated

-

Maxim Integrated Products, Inc. (now part of Analog Devices)

-

Semtech Corporation

-

MACOM Technology Solutions Holdings, Inc.

-

Qorvo, Inc.

-

Cypress Semiconductor Corporation

-

Marvell Technology, Inc. (includes TIA-capable sub-units)

-

Renesas Electronics Corporation

-

MaxLinear, Inc.

-

HiLight Semiconductor Technology Co., Ltd.

-

Silicon Line GmbH

-

Xiamen Rilextec Innovation Co., Ltd.

-

Fujian EOCHIP Semiconductor Co., Ltd.

-

Gamma Scientific, Inc.

-

Artifex Engineering e.K.

-

GIGAHERTZ Optik GmbH

-

Analog Modules Inc.

-

ams Sensors Germany GmbH

-

Newton Fourth Ltd

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD501.42 Million |

| Market Size by 2033 | USD 669.39 Million |

| CAGR | CAGR of3.68% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Low-Gain TIAs, Medium-Gain TIAs, High-Gain TIAs, Very High-Speed TIAs, Programmable / Variable-Gain TIAs) • By Channel Count (1-Channel TIAs, 2-Channel TIAs, 3-Channel TIAs, 4-Channel TIAs, 8-Channel and Above TIAs) • By Application (Photodiode Monitoring, Optical Communication / Optical Receivers, LiDAR Systems, CT-Scanner Front-End, Precision I/V Conversion, Industrial Sensors, Other Applications) • By End-User Industry (Telecommunications & Data Centers, Medical Devices & Healthcare, Industrial & Automation, Consumer Electronics, Automotive (LiDAR, ADAS), Aerospace & Defens |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Analog Devices, Inc., Texas Instruments Incorporated, Maxim Integrated Products, Inc. (now part of Analog Devices), Semtech Corporation, MACOM Technology Solutions Holdings, Inc., Qorvo, Inc., Cypress Semiconductor Corporation, Marvell Technology, Inc., Renesas Electronics Corporation, MaxLinear, Inc., HiLight Semiconductor Technology Co., Ltd., Silicon Line GmbH, Xiamen Rilextec Innovation Co., Ltd., Fujian EOCHIP Semiconductor Co., Ltd., Gamma Scientific, Inc., Artifex Engineering e.K., GIGAHERTZ Optik GmbH, Analog Modules Inc., ams Sensors Germany GmbH, Newton Fourth Ltd. |