Photoresist Market Size & Growth:

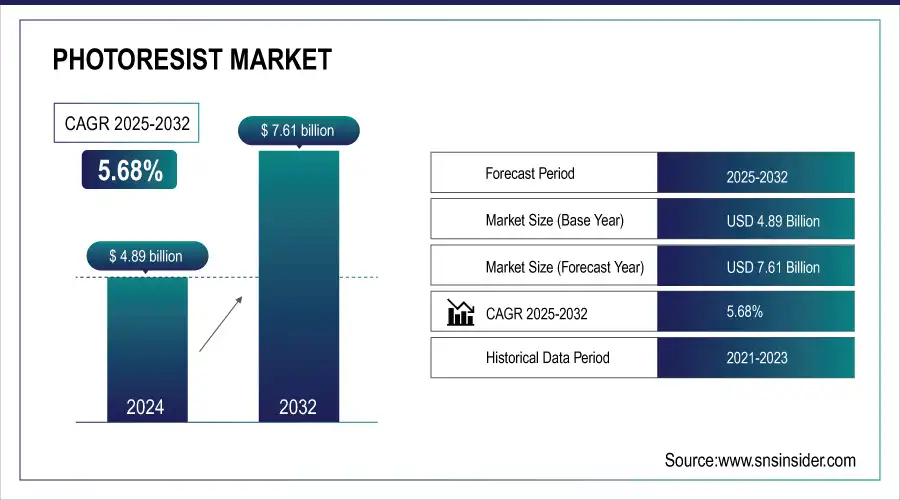

The Photoresist Market size was valued at USD 4.89 billion in 2024 and is projected to reach USD 7.61 billion by 2032, growing at a CAGR of 5.68% during 2025 to 2032. The photoresist market encompasses the global includes the worldwide manufacturing, distribution, and related consumption of materials that are essential in photolithography, a fundamental process for the manufacture of semiconductor and microelectronic devices.

To Get more information On Photoresist Market - Request Free Sample Report

Photoresists are used for patterning in the manufacture of integrated circuits (ICs), PCBs, flat panel displays, LED, MEMS, and other electronic components. Such materials can be formulated to be sensitive to ultraviolet (UV) or extreme ultraviolet (EUV) light such that they enable ultrafine or nanoscopic etching and patterning. The market for different types of photoresists, e.g., positive and negative resists, and their use for specific applications and technologies is well known. With the development of the semiconductor technology, the miniaturization, and the demand for high-performance electronics, the photoresist market is ruled by the next generation of electronic devices.

Wuhan Taiziwei Optoelectronics achieved a major breakthrough by mass-producing T150A photoresist with 120nm resolution, high stability, and full proprietary IP, marking a first for China. This innovation boosts domestic semiconductor self-reliance, supports post-etching performance, and rivals global leaders like KrF.

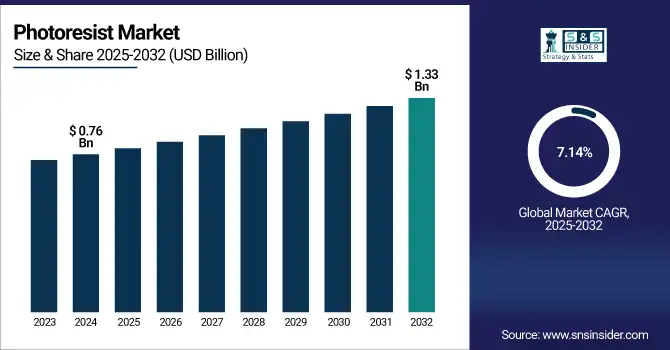

The U.S. Photoresist market size was valued at USD 0.76 billion in 2024 and projected to reach USD 1.33 billion by 2032 expanding at a CAGR of 7.14%. This expansion is driven by the growing demand for semiconductors, progress in lithography (including such technologies as EUV) and state-supported efforts to ramp up domestic production of semiconductors and cut dependence on import.

Photoresist Market Dynamics:

Drivers:

-

Technological innovation in high-performance photoresists drives next-generation semiconductor manufacturing.

A key driver of the photoresist market is growing technological developments and innovation in development of high-performing photo resists, including KrF, ArF and EUV that are necessary for advanced semiconductors manufacturing. The materials are used to ensure more accurate lithography, which can in turn be used to make smaller and more powerful chips. Research and development efforts are being continuingly investigated in the development of photoresists that provide higher resolution properties, thermal stable properties and etch performances that are required for next generational electronics. industry partnerships with academic institutions and supportive policies in different places are also driving innovation and scale. These developments are addressing the increasing worldwide demand for semiconductors, which in turn is furthering development of a secure, diversified supply chain and driving the photoresist market forward.

Hubei Dinglong has received large orders for ArF and KrF photoresists from domestic wafer manufacturers, achieving a breakthrough in the localization of semiconductor materials. And Shenzhen Rongda's RMB 244 million financing will enhance its high-end photoresist projects research and development and expedite the development of China's semiconductor photoresist industry.

Opportunities:

-

Advancements in Photoresist Technology Fueling Semiconductor Manufacturing

Increasing need of high-end semiconductors due to development in AI, 5G, and automobile industries generate substantial forces in the photoresist market, especially for DUV and EUV. With the trend toward production of semiconductors on smaller, more powerful chips, an optimized photoresist will be expected that provides for such lithography to be more precise and faster. Novel photoresists that have improved resolution, stability, and etch resistance are imperative for fabricating the next generation of chips. These enhancements facilitate advancement of more complex semiconductor devices. R&D oriented companies in photoresist technologies are better placed to address the growing demand, and the sector is growing. The ongoing advancements in the photoresist industry will contribute to the improvement of chip manufacturing performance and expand the global market.

Terminal production line verification of Taiwan-made DUV photoresist is anticipated to be finalized by the end of 2024, a key milestone accomplishment. Although US, Dutch and Japanese lithography vendors are all banned to sell and service EUV and DUV lithography equipment in China, currently Taiwan is not impacted by these bans.

Challenges:

-

Heavy reliance on a limited number of suppliers for critical materials creates vulnerabilities in the photoresist supply chain.

The photoresist market faces significant challenges due to reliance on a limited number of suppliers for critical materials. This reliance makes the industry vulnerable to disruptions due to political conflicts, trade barriers or natural catastrophes. Such areas of supply chain vulnerability contribute to production delays, price instability and the inability to satisfy rising requirements for advanced semiconductor manufacturing. To tackle these challenges, it is necessary to have supplier diversification, to invest in local manufacturing and to have alternative materials available to create greater resilience and stability in the supply chain.

Photoresist Market Segment Analysis:

By Type

The ArF Immersion segment held a dominant Photoresist market share, of around 38% in 2024, driven by the increasing demand for advanced semiconductor manufacturing processes. As technology advances, the need for higher resolution and precision in chip production escalates, making ArF Immersion photoresists essential for enabling smaller, more powerful semiconductors. The rising adoption of cutting-edge technologies like 5G, AI, and IoT further fuels demand, driving market growth and innovation in this segment.

The ArF Dry Film segment is projected to experience fastest growth in the market during 2025-2032, at a CAGR of 6.85%, driven by the increasing demand for advanced packaging and high-performance semiconductor applications. As chip complexity grows, ArF Dry Film photoresists offer superior resolution and precision, enabling more efficient production of multi-layered integrated circuits. The rising adoption of technologies like 5G and AI fuels the need for advanced packaging, driving this segment’s expansion.

By Application

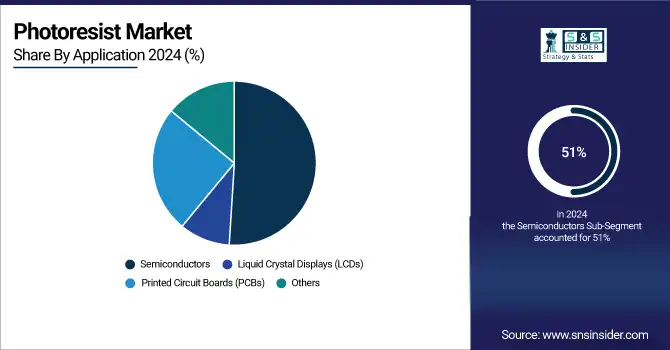

Semiconductors segment held a dominant Photoresist market share of around 51% in 2024 and is projected to experience fastest growth in the market during 2025-2032, at a CAGR of 6.73%. This growth is being pushed by the demand for smaller, more powerful chips utilized in leading-edge technologies, including AI, 5G and IoT. With the development of the semiconductor manufacturing technology to correspond to the increasing integration of circuits, the requirement for the high-performance photoresist becomes an important issue. Advances in photoresist product enablement, improved resolution and stability, as well as precision will continue to contribute to the Fast-growing, according to market guidance segment, which is expected to expand its reach.

By End User Industry

The Electricals and Electronics segment held a dominant Photoresist market share, of around 49% in 2024, due to the growing requirement of sophisticated electronics devices such as smartphones, wearables, and other consumer electronics. The reduction in the size of electronic devices demand photoresists which are stable and have good resolution and sensitivity. Moreover, the increase in smart devices and demand for automation in end-use industries, such as automotive and home appliances, drives the demand for advanced photoresist technologies, adding to the strong market position and growth of the segment.

The Automobiles segment is projected to experience fastest growth in the market during 2025-2032, at a CAGR of 6.45%, accelerating rapidly because of the rapid incorporation of advanced electronics in cars, e.g. electric vehicles (EVs) and autonomous driving systems. Growing need for high-performance photoresists due to the need for smaller, more efficient chips in sensors, control units, and infotainment systems is likely to boost the growth of the sector in automotive applications and technological improvements.

Photoresist Market Regional Overview:

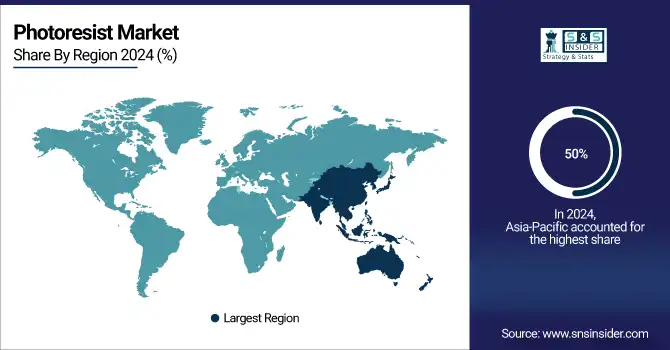

Asia-Pacific dominated the Photoresist market share of approximately 50% in 2024. Driven by the region's strong semiconductor manufacturing base, particularly in countries like China, Japan, South Korea, and Taiwan. The increasing demand for high-performance semiconductors for applications in 5G, AI, and consumer electronics fuels the growth of the photoresist market. Additionally, substantial investments in research and development, coupled with government support for the semiconductor sector, further drive the region's market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, China dominated the Photoresist market, fueled by the growth of semiconductor industry, government's technology advancement support, and surge in demand for high-performance semiconductors in AI, 5G, and electronics.

North America is the fastest-growing region in the Photoresist market, projected to grow at a CAGR of 7.55% from 2025 to 2032. This expansion is due to the rising requirement for advanced semiconductors, especially in AI, automotive, and telecom industries. Moreover, high spending on R&D, the existence of leading semiconductor companies and government projects promoting regional production houses drives the market growth. North America is quickly emerging as the U.S darling child, which in the process results in Americas becoming the most powerful country in the North American market.

In 2024, Europe emerged as a promising region in the Photoresist market, due to increased semiconductors demand in automotive, healthcare and consumer electronics industries. Higher penetration rates for EVs, the rapid development of 5G technology and a pick-up in semiconductor plants are driving the region. Moreover, the European government initiatives to boost the semiconductor self-reliance is expected to increase the market growth.

LATAM and MEA is experiencing steady growth in the Photoresist market, increasing growth due to increase in demand for electronics, telecommunications, and automotive applications. Rising industry for semiconductor manufacturing and technological advancement in different industry sectors in these regions has been driving the market's growth and promising the future growth prospects for these markets.

Photoresist Companies are:

The Photoresist market companies JSR Corporation, Tokyo Ohka Kogyo, Shin-Etsu Chemical, Fujifilm, Sumitomo Chemical, Merck KGaA, DuPont, Rohm and Haas, Allresist GmbH,, MicroChem Corp. and Others

Recent Development

-

Nov 2024, JSR Corporation has begun constructing its first semiconductor photoresist plant in Korea, set to start operations by 2026. The facility will supply advanced metal oxide resist (MOR) materials to leading chipmakers.

-

Sept 2024, Fujifilm is expanding its semiconductor materials business in India and will participate in SEMICON India 2024 to showcase its advanced solutions. The company aims to strengthen its presence amid India's growing semiconductor market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.89 Billion |

| Market Size by 2032 | USD 7.61 Billion |

| CAGR | CAGR of 5.68% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ArF Immersion, ArF Dry Film, KrF, G-Line & I-line, Other) • By Application (Semiconductors, Liquid Crystal Displays (LCDs), Printed Circuit Boards (PCBs), Other), • By End User Industry (Electricals and Electronics, Automobiles, Packaging, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Photoresist market companies JSR Corporation, Tokyo Ohka Kogyo, Shin-Etsu Chemical, Fujifilm, Sumitomo Chemical, Merck KGaA, DuPont, Rohm and Haas, Allresist GmbH,, MicroChem Corp. and Others |