Transmission Repair Market Report Scope & Overview:

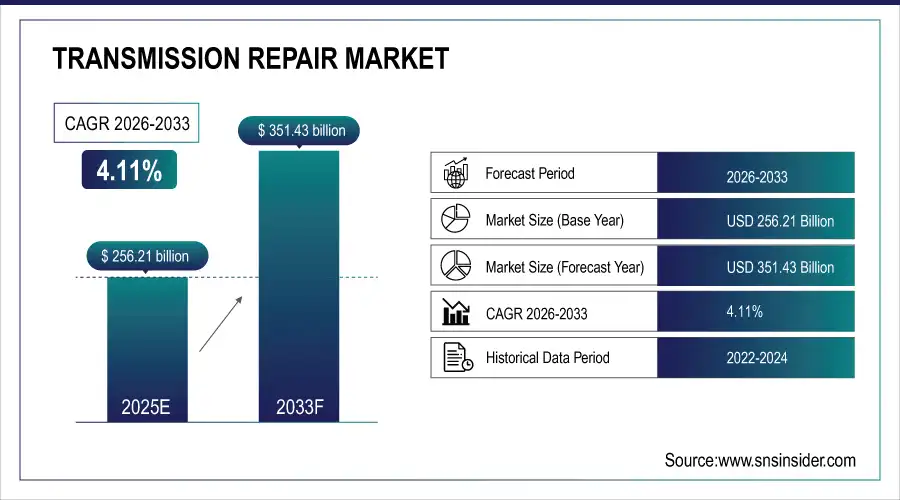

Transmission Repair Market is valued at USD 256.21 billion in 2025E and is expected to reach USD 351.43 billion by 2033, growing at a CAGR of 4.11% from 2026-2033.

The Transmission Repair Market is growing due to the increasing number of vehicles on the road and rising average vehicle age, which drives demand for maintenance and repair services. Growing adoption of automatic and hybrid transmissions, combined with advancements in transmission technologies, is fueling service requirements. Additionally, rising awareness of vehicle performance optimization, preventive maintenance, and the expansion of automotive service centers are supporting market growth. Increasing fleet operations and commercial vehicle usage further contribute to steady demand.

In 2024, over 65% of vehicles on the road exceeded 10 years of age, driving a 24% increase in transmission repairs; automatic and hybrid systems accounted for 55% of service demand, supported by a 30% rise in preventive maintenance uptake globally.

Transmission Repair Market Size and Forecast

-

Market Size in 2025E: USD 256.21 Billion

-

Market Size by 2033: USD 351.43 Billion

-

CAGR: 4.11% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Transmission Repair Market - Request Free Sample Report

Transmission Repair Market Trends

-

Emerging demand for preventive and routine maintenance services as vehicle owners prioritize longevity and avoidance of costly breakdowns

-

Rapid adoption of advanced diagnostic tools and software increasing accuracy, speed, and efficiency of transmission issue detection and repair

-

Growing shift from complete transmission replacement to component-level repairs driven by cost savings and availability of remanufactured parts

-

Rising popularity of automatic and CVT transmission vehicles expanding repair complexity and increasing technician training and specialization requirements

-

Expansion of aftermarket service networks and independent repair shops offering competitive pricing compared with authorized dealership service centers

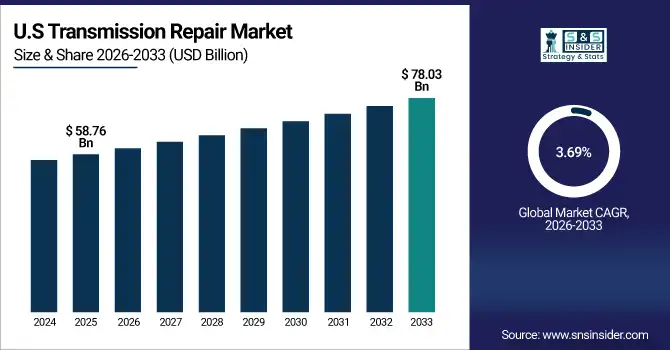

U.S. Transmission Repair Market is valued at USD 58.76 billion in 2025E and is expected to reach USD 78.03 billion by 2033, growing at a CAGR of 3.69% from 2026-2033.

Growth in the U.S. Transmission Repair Market is driven by the increasing number of vehicles, rising average vehicle age, and growing adoption of automatic and hybrid transmissions. Expanding automotive service networks and heightened focus on preventive maintenance and performance optimization are further supporting steady market demand.

Transmission Repair Market Growth Drivers:

-

Growing vehicle parc and increasing average age of automobiles are driving demand for transmission repair services to ensure long-term performance and reliability

The global on-road vehicle fleet continues to expand, and the average age of automobiles is rising due to improved vehicle durability and longer ownership cycles. As vehicles accumulate higher mileage, transmission components experience wear and require maintenance, overhaul, or replacement to prevent breakdowns and efficiency loss. Older vehicles typically represent a higher service demand, particularly in aftermarket and independent repair centers. This trend significantly boosts the need for transmission repair services, driving continuous market growth among both passenger and commercial vehicle segments in developed and emerging economies.

In 2024, the global vehicle parc exceeded 1.5 billion units, with average vehicle age surpassing 12 years sparking a 20% rise in transmission repair demand as aging fleets required more frequent maintenance and component overhauls.

-

Rising adoption of preventive maintenance and routine servicing to reduce breakdown risks is fueling market growth for transmission repair and component replacement

Vehicle owners and fleet operators are increasingly prioritizing preventive maintenance strategies to avoid costly breakdowns and downtime. Regular maintenance activities, including fluid replacement, filter changes, clutch adjustments, and seal checks, help extend transmission life and improve performance. Service providers are offering preventive packages to attract customers and reduce failure rates. As awareness of maintenance cost savings increases, more consumers engage in routine servicing rather than reactive repairs, supporting sustained demand for transmission repair and replacement components. This transition toward proactive maintenance behavior continues to accelerate market expansion across vehicle categories.

In 2024, 60% of vehicle owners prioritized preventive transmission servicing, driving a 22% increase in component replacements and boosting repair shop revenue from routine maintenance by 28% globally.

Transmission Repair Market Restraints:

-

High cost of transmission repair and replacement parts discourages timely service, especially among cost-sensitive customers in developing and price-conscious markets

Transmission repairs are often among the most expensive vehicle service procedures due to labor-intensive processes and costly components such as clutches, shafts, torque converters, and valve bodies. For many vehicle owners—particularly in emerging economies—the high expense leads to deferred maintenance or opting for low-quality parts that further increase failure risks. Limited availability of affordable aftermarket components and expensive OEM replacements contribute to additional financial burden. As a result, cost-sensitive consumers frequently delay repairs, slowing market growth and limit revenue potential for service providers in budget-oriented regions.

In 2024, over 50% of vehicle owners in price-sensitive regions opted to delay or forgo transmission repairs due to costs averaging 35% of their vehicle’s value, exacerbating long term reliability issues and reducing workshop utilization.

-

Shortage of skilled technicians for advanced transmission technologies delays repair turnaround time and affects service quality across independent workshops

Modern transmission systems—such as dual-clutch, continuously variable, and electronically controlled automatic transmissions—require specialized training and diagnostic expertise. However, many independent workshops lack certified technicians and access to advanced tools necessary for accurate diagnostics and efficient repair. This results in longer turnaround times, reduced service quality, and customer dissatisfaction. Shortages in technician availability also limit the ability of repair providers to scale operations and serve growing demand. The skills gap remains a major challenge as vehicle manufacturers continue transitioning toward more complex transmission architectures requiring specialized knowledge.

In 2024, 65% of independent repair workshops reported delays in transmission repairs due to a shortage of certified technicians, with average turnaround times increasing by 30% and customer satisfaction declining by 20%.

Transmission Repair Market Opportunities:

-

Increasing penetration of electric and hybrid vehicles creates opportunities for specialized transmission diagnostics and repair services, boosting demand for advanced skill-based service providers

As electric and hybrid vehicles become mainstream, transmission configurations and drivetrain technology are rapidly evolving. Although EVs have fewer mechanical components, they require specialized servicing for reducers, e-axles, power transmission modules, and software-driven control systems. Hybrid vehicles further require maintenance across both electric and combustion-based systems, creating demand for multi-disciplinary repair expertise. Workshops that invest in advanced diagnostic tools, EV-safe equipment, and certified technician training can gain a competitive edge. The shift toward electrified mobility opens new revenue streams for transmission repair providers willing to adapt to changing service needs.

In 2024, EV and hybrid vehicle sales drove a 40% rise in demand for specialized transmission diagnostics, with 60% of repair shops investing in advanced training to support high-voltage and integrated drivetrain systems.

-

Growing integration of digital diagnostics and predictive maintenance solutions enables repair centers to expand service offerings and capture recurring revenue opportunities

Advancements in telematics, onboard sensors, and digital diagnostic platforms have transformed vehicle maintenance from reactive to predictive management. Real-time health monitoring and fault detection enable early identification of transmission issues, reducing repair severity and costs. Repair centers equipped with advanced digital diagnostic systems can streamline troubleshooting, improve accuracy, and offer subscription-based predictive maintenance services. This data-driven approach strengthens customer relationships through continuous service engagement and increases recurring revenue potential. Workshops embracing digital technology can enhance operational efficiency, improve customer retention, and expand their market presence in the evolving aftermarket landscape.

In 2024, 55% of automotive repair centers adopted digital diagnostics and predictive maintenance tools, leading to a 30% increase in service retention and 25% higher recurring revenue from proactive vehicle care plans.

Transmission Repair Market Segment Highlights

-

By Repair Type: Transmission General Repair led with 38.4% share, while Rebuilt Transmission Services is the fastest-growing segment with CAGR of 6.12%.

-

By Vehicle Type: Passenger Cars led with 48.9% share, while Electric & Hybrid Vehicles is the fastest-growing segment with CAGR of 7.45%.

-

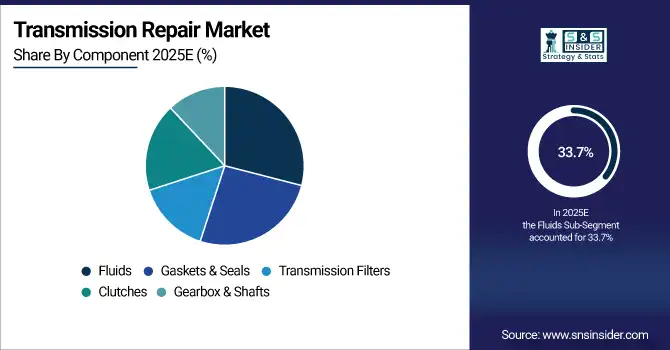

By Component: Fluids led with 33.7% share, while Transmission Filters is the fastest-growing segment with CAGR of 6.31%.

-

By Service Provider: Independent Repair Shops led with 41.6% share, while Mobile / On-Site Repair Services is the fastest-growing segment with CAGR of 7.12%.

Transmission Repair Market Segment Analysis

By Repair Type: Transmission General Repair segment led in 2025; Rebuilt Transmission Services segment expected fastest growth 2026–2033

Transmission General Repair holds the dominant share in the repair type segment due to its high frequency across both aging and new vehicle fleets. Wear-and-tear issues such as fluid leaks, minor clutch faults, and shifting irregularities require routine corrective repairs, making this service the most common and economically preferred option for vehicle owners. Commercial fleets and passenger cars visit repair centers more often for general repairs than for complete overhauls, ensuring consistent revenue generation for service providers.

Rebuilt Transmission Services is the fastest-growing segment as consumers increasingly favor cost-effective restoration over full system replacement. Rising prices of new transmissions, combined with improved availability of certified rebuilt components, have strengthened demand. This service eliminates major defects while retaining usable parts, ensuring strong performance reliability at lower cost. Environmental sustainability benefits from reusing components also support adoption, particularly among fleet operators, off-road vehicle users, and budget-conscious consumers seeking long-term durability without the expense of brand-new units.

By Vehicle Type: Passenger Cars segment led in 2025; Electric & Hybrid Vehicles segment expected fastest growth 2026–2033

Passenger Cars command the largest share in the vehicle type segment owing to their massive global fleet size and high annual vehicle-kilometer usage. Automatic and CVT transmission adoption in daily-driven cars has increased maintenance requirements, driving consistent repair demand. Urban congestion, start-stop driving patterns, and aging cars in both developed and emerging markets create heavy wear on transmission systems. With rising vehicle ownership per household worldwide, repair and maintenance revenue from passenger cars continues to significantly outpace all other vehicle categories.

Electric & Hybrid Vehicles are the fastest-growing segment, driven by accelerating EV adoption and the need for specialized transmission-related components such as reduction gearboxes and powertrain fluid systems. Although EVs have fewer moving parts than ICE vehicles, heat management and lubrication system failures require highly skilled repair services. As EV fleets expand, independent repair shops and OEM-authorized service centers are investing in EV-specific diagnostic tools, supporting remarkable growth. Government incentives and rapid charging infrastructure expansion further reinforce segment momentum.

By Component: Fluids segment led in 2025; Transmission Filters segment expected fastest growth 2026–2033

Fluids hold the dominant share in the component segment due to mandatory and recurring transmission fluid replacement cycles across automatic, DCT, CVT, and hybrid vehicles. Heat generation, friction, and contamination gradually degrade fluid properties, making fluid flushes and top-ups essential preventive maintenance services. Incorrect or delayed fluid servicing remains one of the leading causes of transmission malfunction, ensuring consistent revenue flow for service providers. Growing consumer awareness and OEM-specified service intervals continue to reinforce the high demand for transmission fluids.

Transmission Filters represent the fastest-growing component segment as improved diagnostics highlight the role of filtration in extending transmission life. Increasing adoption of CVT and automatic transmissions, which are sensitive to metal debris and contaminants, drives accelerated replacement demand. Modern filters are engineered for higher durability and efficiency, prompting preventive replacements during general servicing. Fleet operators and performance-vehicle users additionally prioritize filter upgrades to reduce thermal stress and mechanical erosion, fueling rapid growth within both aftermarket and OEM repair ecosystems.

By Service Provider: Independent Repair Shops segment led in 2025; Mobile / On-Site Repair Services segment expected fastest growth 2026–2033

Independent Repair Shops dominate the service provider segment thanks to competitive pricing, quicker turnaround times, and widespread availability across urban and rural regions. These centers handle a large share of routine and mid-level transmission repairs for both private owners and commercial fleets. Their flexibility in sourcing aftermarket and rebuilt components helps reduce service costs, attracting budget-conscious customers. Skilled technicians with multi-brand expertise further improve market penetration, making independent shops the most preferred and accessible option for transmission repair.

Mobile / On-Site Repair Services is the fastest-growing segment as consumers increasingly prefer convenience-driven repairs that minimize vehicle downtime. Advancements in portable diagnostic tools and compact repair equipment enable technicians to service clutches, fluids, seals, and sensor systems without visiting a workshop. Commercial fleets especially value on-site services to avoid productivity losses associated with vehicle transport. Subscription-based maintenance plans and digital booking platforms also stimulate adoption, creating rapid growth among urban drivers and fleet operators seeking hassle-free transmission servicing.

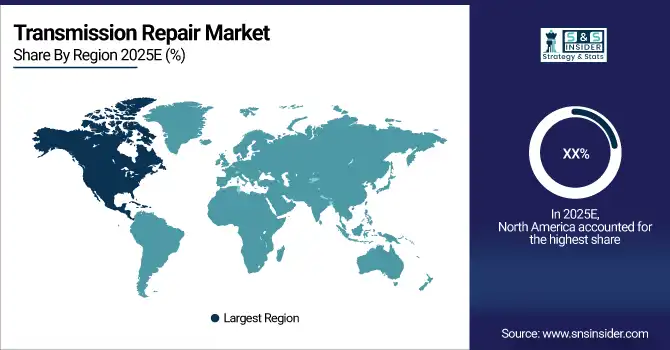

Transmission Repair Market Regional Analysis

North America Transmission Repair Market Insights

North America held a significant share in the Transmission Repair Market in 2025 due to its mature automotive industry, high vehicle ownership rates, and strong presence of aftermarket service providers. Advanced repair technologies, well-established service networks, and high consumer awareness about preventive maintenance further strengthened the region’s market position.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Transmission Repair Market Insights

Asia Pacific dominated the Transmission Repair Market with a 35.52% share in 2025 due to the region’s large automotive population, rapid vehicle production, and growing demand for aftermarket services. High adoption of advanced repair technologies, increasing number of workshops, and rising awareness about vehicle maintenance further strengthened market leadership. The region is also expected to grow at the fastest CAGR of about 5.54% from 2026–2033, driven by expanding vehicle sales, urbanization, rising disposable income, and growing demand for efficient and timely transmission repair services across passenger and commercial vehicles.

Europe Transmission Repair Market Insights

Europe maintained a notable share in the Transmission Repair Market in 2025, supported by a developed automotive sector, stringent vehicle maintenance regulations, and widespread adoption of advanced repair solutions. Growing demand for high-quality aftermarket services, rising vehicle longevity, and strong service infrastructure contributed to Europe’s steady market presence.

Middle East & Africa and Latin America Transmission Repair Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Transmission Repair Market in 2025, driven by increasing vehicle sales, expanding automotive aftermarket services, and rising awareness of preventive maintenance. Investments in service infrastructure, growing urbanization, and adoption of modern repair technologies further strengthened the regions’ emerging presence in the market.

Transmission Repair Market Competitive Landscape:

Schaeffler Group

Schaeffler Group is a global automotive and industrial supplier headquartered in Germany, specializing in precision components and systems for engines, transmissions, and chassis. Its products support vehicle efficiency, durability, and performance, with extensive solutions for both conventional and electric drivetrains. Schaeffler’s transmission components, including bearings, clutches, and mechatronic systems, are critical in aftermarket repair and OEM production. With a strong R&D focus and international manufacturing footprint, the company serves automotive OEMs, independent workshops, and industrial clients worldwide, making it a key player in the transmission repair market.

-

2024, Schaeffler expanded its “REPX” remanufacturing program for dual-clutch transmissions (DCTs) and hybrid drivetrain components, offering certified remanufactured mechatronic units with full warranty and 30% cost savings versus new parts.

Allison Transmission Holdings Inc.

Allison Transmission Holdings Inc., based in the United States, is a leading manufacturer of fully automatic transmissions for commercial vehicles, buses, and military applications. The company provides durable, high-performance transmissions along with repair, remanufacturing, and aftermarket support services. Allison’s global service network ensures quick parts availability and technical assistance, making it a preferred partner for fleet operators and repair facilities. By focusing on innovation, efficiency, and sustainability, Allison Transmission remains a top contributor to the worldwide automotive transmission repair and maintenance market.

-

2025, Allison Transmission launched “Allison Certified Rebuild Plus”, a global transmission remanufacturing and repair program for its 1000/2000 Series and eGen Power electric axle transmissions

ZF Friedrichshafen AG

ZF Friedrichshafen AG, based in Germany, is a global leader in automotive driveline and chassis technology, offering advanced transmission systems, mechatronics, and components for passenger and commercial vehicles. Its product portfolio includes automatic and manual transmissions, torque converters, and transmission control units. ZF supports OEMs and independent repair networks with training, parts supply, and remanufacturing programs. With a focus on innovation, electrification, and digital solutions, ZF Friedrichshafen plays a central role in improving vehicle performance, reliability, and efficiency, solidifying its position in the global transmission repair market.

-

2024, ZF rolled out “ZF Pro Repair Transmission”, a comprehensive repair and diagnostic ecosystem for its 8HP and 9-speed automatic transmissions, including cloud-connected diagnostic tools, technical webinars, and a global network of “ZF Pro Repair Certified” workshops.

Transmission Repair Market Key Players

Some of the Transmission Repair Market Companies are:

-

Schaeffler Group

-

Allison Transmission Holdings Inc.

-

BorgWarner Inc.

-

ZF Friedrichshafen AG

-

Continental AG

-

Mister Transmission Ltd.

-

Amco Transmission

-

Lee Myles Autocare & Transmission

-

Firestone Complete Auto Care

-

Cottman Transmission and Total Auto Care

-

AAMCO Transmissions, Inc.

-

Monro, Inc.

-

Bridgestone Americas, Inc.

-

Jiffy Lube International, LLC

-

Midas International Corporation

-

Meineke Car Care Centers, LLC

-

CARSTAR Franchise Systems

-

Asbury Automotive Group Inc.

-

Halfords Group Plc

-

Driven Brands Holdings, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 256.21 Billion |

| Market Size by 2033 | USD 351.43 Billion |

| CAGR | CAGR of 4.11% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Repair Type (Transmission General Repair, Transmission Overhaul, Replacement of Transmission Components, Rebuilt Transmission Services, Preventive / Routine Maintenance) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Off-Highway Vehicles, Electric & Hybrid Vehicles) • By Component (Gaskets & Seals, Clutches, Transmission Filters, Fluids, Gearbox & Shafts) • By Service Provider (Authorized Dealerships, Independent Repair Shops, Transmission Specialty Repair Centers, Fleet Maintenance Providers, Mobile / On-Site Repair Services) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Schaeffler Group, Allison Transmission Holdings Inc., BorgWarner Inc., ZF Friedrichshafen AG, Continental AG, Mister Transmission Ltd., Amco Transmission, Lee Myles Autocare & Transmission, Firestone Complete Auto Care, Cottman Transmission and Total Auto Care, AAMCO Transmissions, Inc., Monro, Inc., Bridgestone Americas, Inc., Jiffy Lube International, LLC, Midas International Corporation, Meineke Car Care Centers, LLC, CARSTAR Franchise Systems, Asbury Automotive Group Inc., Halfords Group Plc, Driven Brands Holdings, Inc. |