Transplant Diagnostics Market Size Analysis

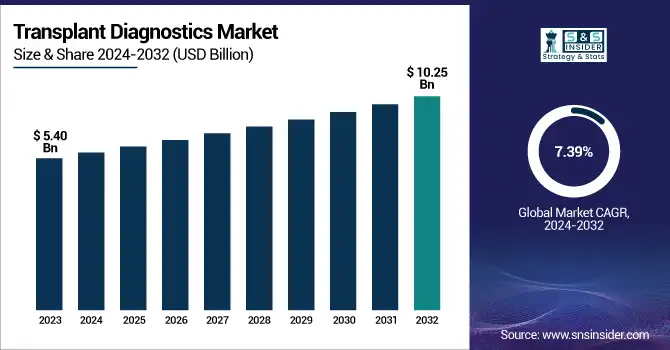

The Transplant Diagnostics Market Size was valued at USD 5.40 billion in 2023 and is expected to reach USD 10.25 billion by 2032 and grow at a CAGR of 7.39% over the forecast period 2024-2032. this report brings to the forefront the increasing prevalence and incidence of organ transplants, which have resulted in the need for more sophisticated diagnostic solutions. The research discusses regional diagnostic testing trends, with examples of differences in the adoption and availability of these tests within various healthcare systems. It also delves into new technologies and innovations in transplant diagnostics, including molecular tests and AI-based analysis, which have improved accuracy and efficiency. It also evaluates the laboratory and hospital uptake of transplant diagnostic equipment by regions, driven by developments in healthcare infrastructure. In addition, it evaluates healthcare expenditure on transplant diagnostics, including government, commercial, private, and out-of-pocket expenses, which have a significant influence on market growth and availability.

To Get more information on Transplant Diagnostics Market - Request Free Sample Report

The U.S. Transplant Diagnostics Market Size was valued at USD 1.41 billion in 2023 and is expected to reach USD 2.28 billion by 2032 and grow at a CAGR of 5.46% over the forecast period 2024-2032. In the United States, the market for transplant diagnostics is fueled by excessive healthcare expenditure, robust research funding, and a well-developed organ transplant system, favoring the use of advanced diagnostic technology.

Transplant Diagnostics Market Dynamics

Drivers

-

The growing number of organ transplant procedures worldwide is a key driver of the transplant diagnostics market.

With more cases of kidney, liver, heart, and lung failures on the rise, there has been a huge need for precise and effective diagnostic tests. For example, more than 144,000 solid organ transplants took place worldwide in 2023, which underscores the requirement for both pre- and post-transplant surveillance. The development of molecular diagnostics like Next-Generation Sequencing (NGS) and donor-derived cell-free DNA (dd-cfDNA) testing has greatly enhanced transplant success through accurate donor-recipient matching and early rejection identification. The increasing use of non-invasive testing technologies is also driving market growth, as these technologies reduce complications associated with biopsies. Moreover, regulatory clearances and technological advancements in transplant diagnostics, including FDA-approved cfDNA-based monitoring tests, are broadening market availability. In addition, the increased investment in precision medicine and customized transplant diagnostics is improving clinical decision-making. The increasing number of cases of chronic kidney disease (which covers more than 850 million people worldwide) as well as higher awareness and state support for organ transplantation initiatives continue to boost the market's growth. As more healthcare institutions embrace AI-driven systems for transplant diagnostics, accuracy and automation are gaining ground, increasing industry growth.

Restraints

-

The high cost of transplant diagnostics remains a significant barrier to market growth, particularly in developing regions.

Advanced diagnostic methods like NGS-based HLA typing and cfDNA monitoring are costly and, hence not easily accessible in cost-conscious healthcare systems. For instance, NGS-based HLA typing tests can range from USD 1,500 to USD 3,000 per test, thus limiting their general use. Furthermore, the absence of standard reimbursement policies adds to this limitation. Health insurance in most nations does not cover pre- and post-transplant diagnostics fully, so patients and medical staff must shoulder the costs. This incurs early rejection monitoring, a key to successful transplantation. The need for advanced laboratory facilities and trained staff further elevates operating costs, adding to accessibility limitations. Hospitals and diagnostic centers in low- and middle-income economies are unable to finance high-end transplant testing machinery, thereby constraining market penetration. Regulatory barriers to new diagnostics approvals also retard innovation uptake. Cost restraints and reimbursement inefficiencies continue to be significant challenges even after technological developments, and they can deter extensive use of high-technology transplant diagnostic solutions. Unless cost-effectiveness and reimbursement coverage increase, market expansion could be inhibited, particularly in economies with limited healthcare spending.

Opportunities

-

The rising adoption of non-invasive transplant diagnostics presents a major opportunity for market expansion.

Historically, biopsies have been the reference standard for transplant rejection surveillance, but they are invasive, expensive, and risk-prone. New non-invasive methods, including cfDNA-based rejection surveillance, are transforming post-transplant management. For instance, cfDNA assays have demonstrated more than 85% sensitivity in the detection of early rejection in kidney transplants, providing a safer and more cost-effective option. The increasing use of liquid biopsy-based monitoring is likely to spur market growth in a big way. Furthermore, AI and machine learning are revolutionizing transplant diagnostics by facilitating predictive analysis and automated interpretation. AI-based platforms are being created to evaluate transplant rejection risk and customize immunosuppressive therapy, enhancing patient outcomes. The other significant opportunity is the growth of transplant registries and genetic databases that improve donor-recipient matching accuracy. Additionally, the growing application of blockchain technology for transplant diagnosis to enhance data protection and cross-organizational connectivity of healthcare systems is building momentum. Cross-company partnerships among biotechnology firms and healthcare institutions are spurring innovation, with governmental programs for promoting organ donation and transplant facilities building additional market potential. Expanding cloud-based diagnostics, tele-monitoring of transplant recipients becomes more practical, accelerating additional growth opportunities.

Challenges

-

One of the biggest challenges in the transplant diagnostics market is the global shortage of organ donors.

Despite technology advances in diagnostic technology, organ demand outstrips supply, creating lengthy waiting lists and higher mortality rates. In 2023, more than 1.5 million individuals were on organ transplant waiting lists globally, but few received transplants. The scarcity of viable donors limits the demand for diagnostic tests, holding back overall market growth. An equally critical issue is the ethics of genetic testing in transplant diagnostics. The application of genome sequencing to donor-recipient compatibility creates genetic privacy, consent, and discrimination issues. Most countries still do not have specific guidelines on the use of genetic information, which causes uncertainty in the market. Furthermore, differences in transplant diagnostic access create a challenge, especially in low-income areas where there are no specialized laboratories and trained staff in hospitals. The greater complexity of transplant diagnostics also demands constant technological innovations, which pose challenges for smaller healthcare institutions to implement state-of-the-art solutions. In addition, fear of false positives and test unreliability can result in transplant compatibility misinterpretation, which impacts patient outcomes. Overcoming these obstacles necessitates global policymaking improvement, greater education on organ donation, and better access to transplant diagnostics for all healthcare systems.

Transplant Diagnostics Market Segmentation Insights

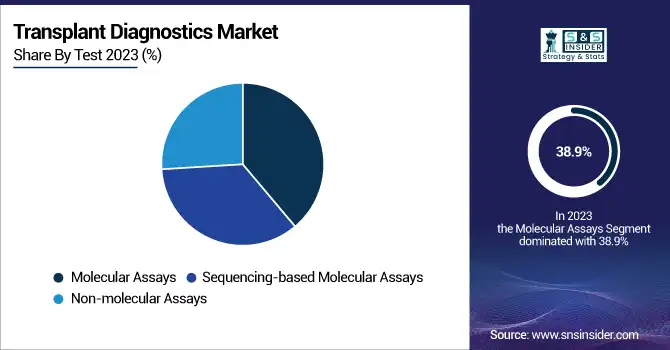

By Test

In 2023, the molecular assay segment led the transplant diagnostics market with a revenue share of 38.9%. The lead of molecular assays is due to their high sensitivity, precision, and accuracy in detecting donor-recipient compatibility. The tests are commonly applied for pre-transplant HLA typing, post-transplant surveillance, and graft rejection testing, and thus they are the most favored option in transplant diagnostics.

The sequencing-based molecular assay segment is projected to experience the most rapid growth rate during the forecast period. Growing usage of Next-Generation Sequencing (NGS) and other sophisticated sequencing methods has helped drastically raise the capacity to identify minor genetic variations, raising transplant success rates. The segment is gaining traction from increased demand for high-resolution HLA typing and non-invasive monitoring offerings, leading to its strong growth.

By Product

In 2023, the reagents and consumables segment dominated the market with the largest revenue share. The repetitive requirement of reagents, kits, and consumables in transplant diagnostics fuels repeated demand, especially for PCR-based and sequencing-based tests. The growing number of diagnostic tests in hospitals, research centers, and transplant facilities further enhances this segment's market leadership.

The software and services market is expected to be the growth leader in the coming years. The emergence of AI-driven analytics, cloud-based data management, and digital solutions for transplant diagnostics has hugely improved workflow efficiency. These solutions enable real-time monitoring, computer-aided test interpretation, and integration with electronic health records (EHRs), and thus are becoming essential for contemporary transplant centers.

By Application

The diagnostic application segment was the leader in the transplant diagnostics market in 2023 with a revenue share of 68.9%. The critical function of diagnostic testing in HLA typing, crossmatching, and post-transplant monitoring has positioned it as a vital component of transplant procedures. The increase in the incidence of organ failure, the growing number of transplant procedures, and heightened awareness about early detection of graft rejection have supported the strong market presence of the segment.

The research application area is expected to grow at the fastest rate owing to growing investments in R&D for transplant-related activities, improvements in precision medicine, and the expanding use of genomic technologies for transplant compatibility testing. The creation of novel biomarker-based tests and customized transplant solutions is also driving research work in this area.

By Transplant Area

The solid organ transplantation segment led the market in 2023, holding 44.2% revenue share. The high frequency of kidney, liver, heart, and lung transplants has fueled the demand for precise diagnostic testing, specifically for pre-transplant compatibility tests and post-transplant rejection surveillance. The increasing volume of transplant procedures combined with developing diagnostic technologies has supported the segment's market dominance.

The stem cell transplantation market is anticipated to grow at the fastest pace during the forecast period. Its growth is fueled by the rising incidence of hematological conditions, progress in stem cell therapy, and the growing use of personalized medicine and regenerative therapies. In addition, the growth in the use of molecular diagnostics for donor typing and graft-versus-host disease (GVHD) surveillance expedites the growth of the segment.

By End-Use

Hospitals and transplant centers dominated the market in 2023, commanding the highest share of revenue. They undertake the largest number of transplant surgeries and depend heavily on sophisticated diagnostic equipment for donor-recipient compatibility screening, pre-transplant testing, and post-transplant observation. Well-equipped laboratory facilities, a rise in organ transplant procedures, and better healthcare infrastructure drive them to dominate the market.

The research and academic institutes segment is expected to expand at the highest rate in the coming years. Growing funding for transplant research, improvements in molecular diagnostics, and growing emphasis on personalized transplant medicine are major drivers. The use of AI, machine learning, and biomarker discovery in transplant diagnostics research is also driving growth in this segment.

Transplant Diagnostics Market Regional Outlook

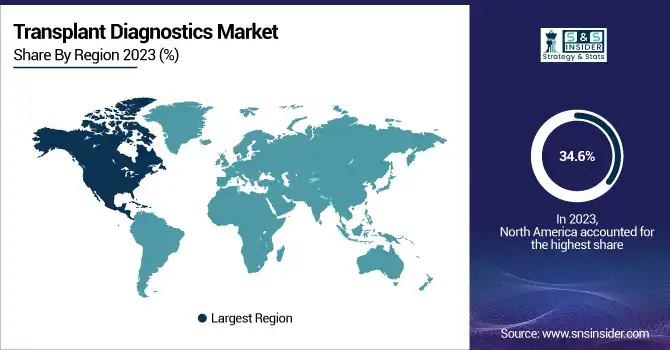

North America led the transplant diagnostics market in 2023 with a 34.6% share, fueled by the well-developed healthcare infrastructure, high rates of organ transplants, and sophisticated diagnostic technologies. The United States contributed the maximum share, bolstered by rising rates of chronic diseases resulting in organ failure, robust reimbursement systems, and widespread use of molecular and sequencing-based tests. The dominance of premier market players, along with ongoing R&D investments, further enhances North America's leadership.

Europe accounted for the second-largest market share, led mainly by increasing government efforts, growing transplant registries, and advances in precision medicine. Germany, the UK, and France are leaders in this region, with more organ transplant procedures on the rise and a strong demand for high-throughput diagnostic solutions.

The Asia-Pacific region is poised to be the fastest-growing in the coming years. The high growth rate is fueled by a rising incidence of organ failure, enhanced healthcare infrastructure, and government initiatives to encourage organ donation and transplantation. China, India, and Japan are experiencing high volumes of transplant procedures, as well as an increased demand for cost-effective and sophisticated diagnostic solutions. Moreover, the expanding presence of domestic biotech firms and partnerships with international industry leaders is driving market growth in this market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Transplant Diagnostics Companies & thier Products

-

Thermo Fisher Scientific, Inc. – AllType NGS HLA Typing, TypeStream Visual NGS Software, One Lambda HLA Typing Kits

-

Illumina, Inc. – TruSight HLA Sequencing Panel, MiSeq System for HLA Typing, NovaSeq for High-Throughput Sequencing

-

F. Hoffmann-La Roche Ltd – cobas CMV Test, cobas EBV Test, LightCycler Multiplex DNA Assays

-

Abbott – RealTime CMV Assay, RealTime EBV Assay, Alinity m System for Transplant Monitoring

-

QIAGEN – QIAseq HLA Typing Solution, artus CMV QS-RGQ Kit, QIAstat-Dx Multiplex Panels

-

Bruker – MALDI Biotyper for HLA Typing, HLA MassARRAY System

-

BD (Becton, Dickinson, and Company) – BD MAX CMV Assay, BD FACSCanto II for Immune Monitoring

-

Werfen (Immucor, Inc.) – LIFECODES HLA Typing, LIFECODES Donor-Specific Antibody Assays

-

Bio-Rad Laboratories, Inc. – BioPlex 2200 HLA Antibody Assay, Luminex-based Transplant Testing Solutions

-

Omixon Inc. – Holotype HLA NGS Assay, OmniType Assay for HLA Genotyping

Recent Developments

-

In Feb 2025, OncoCyte Corp. (OCX) secured USD 29.1 million in funding, led by its top five shareholders, including strategic partner Bio-Rad Laboratories (BIO), through a registered direct offering and private placement at USD 2.05 per share. Two company executives also participated in the private placement to support advancements in transplant diagnostics.

-

In May 2024, Thermo Fisher Scientific launched the CXCL10 test for kidney transplant patients. The test helps detect elevated urinary CXCL10 levels, which are linked to inflammation and early kidney transplant rejection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.40 billion |

| Market Size by 2032 | USD 10.25 billion |

| CAGR | CAGR of 7.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test [Molecular Assays, Sequencing-based Molecular Assays, Non-molecular Assays] • By Product [Reagents & Consumables, Instruments, Software and Services] • By Application [Diagnostic Application, Research Application] • By Transplant Area [Solid Area Transplantation, Stem Cell Transplantation, Soft Tissue Transplantation, Bone Marrow Transplantation] • By End-Use [Hospitals and Transplant Centers, Research and Academic Institutes, Independent Reference Laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, Bruker, BD (Becton, Dickinson, and Company), Werfen (Immucor, Inc.), Bio-Rad Laboratories, Inc., Omixon Inc. |