HLA Typing Market Size Analysis

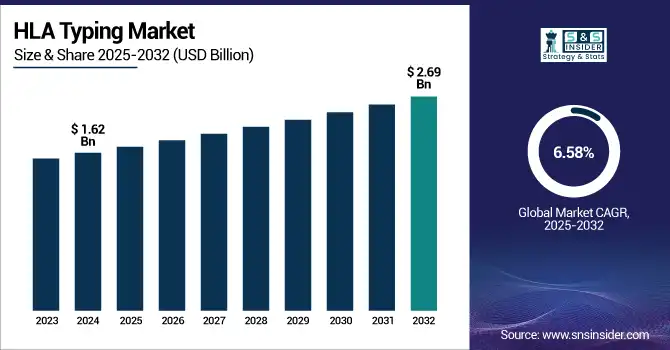

The HLA Typing Market size was estimated at USD 1.62 billion in 2024 and is expected to reach USD 2.69 billion by 2032 at a CAGR of 6.58% during the forecast period of 2025-2032.

To Get more information on HLA Typing Market - Request Free Sample Report

Demand for organ and stem cell transplantation remains high globally, and this is having a marked effect on the HLA typing market, with the growing incidence of end-stage organ disease and hematological malignancies, as well as rare genetic diseases. According to the Global Observatory on Donation and Transplantation, over 144,302 organ transplants took place in the world last year, and more than 90,000 of these involved kidney transplants. This volume is expected to result in the ongoing requirement for precise HLA match to avoid transplant rejection and GVHD, which will serve as a high-impact rendering fact for the market of HLA typing market. Incorporation of next-generation sequencing (NGS) and real-time PCR systems into clinical use has increased the accuracy, throughput, and turnaround time of tests and has been instrumental in the increase in HLA typing market share in advanced testing labs and hospitals.

Advances of HLA typing by NGS Recent reports showed in the studies of PubMed, new progressions in NGS-based HLA typing, which can resolve HLA-specific alleles and also can refine HSCT. In addition, the National Marrow Donor Program (NMDP) reports that more than 22 million volunteer donors are HLA-typed in the NMDP, greatly improving the pool of potential donors. Additionally, in 2022, Hematology writes that securing a true 10/10 HLA match in bone marrow transplant is the current benchmark for optimal outcomes, a trend that reflects a move towards more advanced typing technologies in clinical settings.

For instance, AI and machine learning models by companies and research institutes are being incorporated for better allele prediction and error reduction in ambiguous HLA regions, resulting in greater efficiency and accuracy.

Spending on R&D has been climbing too. For instance, the NIH invested USD 90 million in immunogenetics and transplant biology in 2023; this federal investment is on the rise. At the same time, rules are changing; there are now FDA-approved HLA typing kits and CE-IVD-marked tests for Europe, making it easier for people all over the world to use them. Moreover, strict guidelines mandated by organizations such as UNOS and Eurotransplant for high-resolution typing in transplant procedures have been contributing to HLA typing market growth across the globe.

For instance, some pilot programs underway in Europe and the U.S. are assessing blockchain technologies to enhance the security and traceability of transplant data and HLA documenting, changing how data is shared and regulatory compliance within HLA Typing.

HLA Typing Market Dynamics

Drivers:

-

Increasing Demand for Precision Transplantation and Technological Innovation

The HLA typing market is driven by the demand for precision medicine and advancements in transplantation compatibility tools. More than 30,000 hematopoietic stem cell transplants (HSCTs) are conducted worldwide every year (WBMT), and the importance of proper HLA matching cannot be overemphasized. With the development of more and more complex transplant cases, particularly in UD transplant, the majority of the testing has also transitioned to high-resolution HLA genotyping by NGS and real-time PCR. Moreover, both government and private sector investments are booming.

In 2023, the NIH awarded USD 112 million toward immunogenetics and transplant biology, which includes HLA research. Regulatory bodies like the FDA and EMA are approving the new HLA typing platforms like AlloSeq and QIAstat that speed up market reach. In addition, transplant programs are growing the number of donors on registries. For instance, recent clinical guidelines from groups such as the American Society for Transplantation and Cellular Therapy (ASTCT) now suggest HLA testing for unrelated donor transplantation at high-resolution, representing an emerging clinical best practice, unlocking sales. On the whole, increasing transplant volume, favorable regulations, and innovation are translating into growth for the HLA typing market.

Restraints:

-

High Costs, Limited Infrastructure, and Donor Diversity Challenges

NGS-based HLA high-resolution typing is still costly, and the cost is between USD 300 and USD 2,000 per sample, depending on the sample complexity and the NGS platform used. This restricted access in low- to middle-income settings imposes a financial burden on hospital budgets, particularly in publicly financed health systems.

Furthermore, some advanced genotyping technologies can only be performed by skilled human technicians with bioinformatics support and suitable laboratory resources, which may not be available in developing countries. Disparities in the underrepresentation of racial and ethnic minorities in databases of potential donors is another important issue; for instance, African American patients have only a 29% likelihood of finding an acceptable unrelated donor through the National Marrow Donor Program (NMDP) compared with 79% of Caucasians, thereby restricting the potential transplant pool for minority communities as well.

Supply-side issues remain, in part because manufacturing at scale on a high-end typing platform globally during the time of a pandemic (or whatever) is difficult. In addition, despite quality assurances through FDA and CAP regulations, smaller labs may find compliance costs and time prohibitive for market entry. These systemic issues illustrate the dissonance between technological innovation and market entry, which is constraining the robust expansion expected of the HLA typing market.

HLA Typing Market Segmentation Insights

By Product

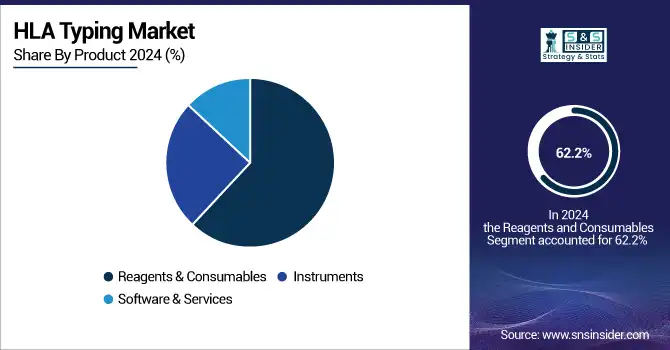

Reagents and consumables accounted for the largest share, 62.2% of the HLA typing market in 2024. Reagents and consumables form an essential component required for every diagnostic and research-based HLA test. These are essential for molecular assays, like PCR and NGS, which are widely employed for their high sensitivity and accuracy. Unlike instruments or software, where we purchase once and use, reagents are a consumable item, and so they provide that recurring revenue stream. Their call is heightened further by a growing number of organ and stem cell transplants and expanding use in donor registries and hospital-based typing services.

Advances in reagent functionality, sensitivity, and convenience (e.g., lyophilized, user-friendly kits) are indicators of the increased performance of labs. Furthermore, with the movement of labs towards high automation and high-throughput testing, the compatibility and integration of these consumables with automated platforms has become essential and has already established this segment as the largest and fastest-growing segment in the HLA typing market.

By Application

The diagnosis segment is expected to be the fastest-growing application in the HLA Typing market based on application, with the rising number of transplant procedures and growing clinical significance of pre-transplant recipient/donor matching. HLA typing is important for diagnosis and crossmatching to avoid rejection and achieve long-term successful outcomes of transplantation, especially for kidney, liver, and hematopoietic stem cell transplantation. The increase is also underpinned by the most recent transplant guidelines of the world´s leading regulatory and clinical organizations, which establish high-resolution HLA typing as the standard for unrelated donor matching.

Hospitals and transplant centers are continuing to support more sophisticated molecular diagnostics, allowing for quicker and more accurate results and reduced waiting times, a benefit to everyone involved in transplantation planning. Moreover, the increasing prevalence of autoimmune diseases and cancer immunotherapies, in which HLA profiling is applied for evaluating therapy eligibility, supports the need for diagnostics. As transplant recipients and donor registries grow, diagnostic uses are increasingly at the forefront of personalized medicine in immunogenetics.

By Technique

Molecular assays held the largest revenue share in the HLA typing market in 2024 at 61.0%, as they offer higher accuracy and resolution as compared to non-molecular methods. These assays, such as PCR-based methods and real-time quantitative assays, have enabled accurate HLA allele types for transplant matching and disease linkage studies to be determined. Molecular assays have been increasingly incorporated into the clinical setting because they have shorter turnaround times and higher throughput, particularly within transplant centers and on the donor registry.

NGS technique is the fastest-growing technique in the HLA typing market due to the increasing penetration of next-generation sequencing (NGS) and the Sanger Sequencing method for high-resolution genotyping. These methods offer single allele specificity required in complex graft situations, where the donor and host are fully or partially matched, unrelated. As both precision medicine and donor markets grow with the broader investments in point-of-care solutions, demand is rising for more accurate, scalable testing solutions. The increase is further supported by the cost-saving and increasingly more available NGS technique, allowing the analysis of multiple loci simultaneously and more accurately.

By End-User

In 2024, hospitals and transplant centers were the leading end-users of the HLA Typing market, and this segment held 63.5% of the market share, due to their pivotal role played in the organ and stem cell transplantation. These centers are primarily responsible for the pre-transplantation testing, in particular the HLA typing, that is necessary to determine the compatibility between donor and recipient. With an increasing number of transplant surgeries worldwide and the need for accurate and rapid matching, hospitals are the main users of HLA typing technologies. There are currently many high-volume transplant centers with molecular labs on site that have PCR and/or NGS platforms to increase efficiency and time to result.

Research labs and academic institutions are projected as the fastest-growing end-user segment in the HLA Typing market, led by the rising research on immunogenetics, autoimmune diseases, and transplantation immunology. These banks also support innovation in HLA typing and are frequently early adopters of high-resolution technology (e.g., NGS, CRISPR) for molecular testing. Large amounts of public and private R&D funding, including more than USD 3 billion per year in NIH spending in immunology, are driving this movement.

Regional Outlook

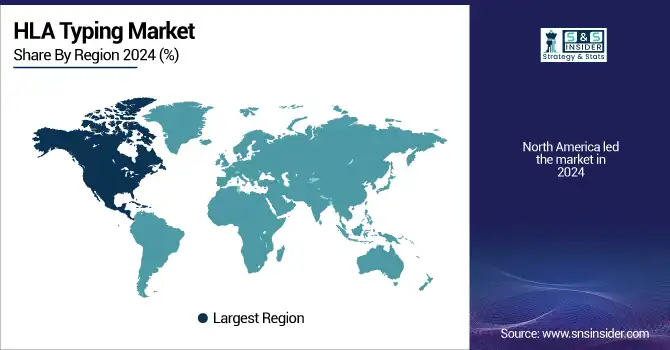

The North American region accounted for the largest share of the HLA typing market in 2024, due to the established healthcare system, a high volume of organ transplants, and an early uptake of molecular diagnostic tests. The U.S. HLA typing market size was valued at USD 0.64 billion in 2024 and is expected to reach USD 0.98 billion by 2032, growing at a CAGR of 5.59% over the forecast period of 2025-2032. The U.S. is the primary country as a result of adequate financing of government programs for organ donation and robust implementation of high-resolution typing in transplant centers. Moreover, the FDA’s regulatory backing, including new 510(k) clearances for typing kits, promotes innovation and fast roll-out. Canada is becoming the fastest-growing country in the region on account of increasing awareness of organ transplant, rising both public and private funds for investment in R&D and personal medicine.

Europe is the second largest market for HLA Typing due to the established infrastructure of HLA typing concepts for transplant, universal health coverage, and a rise in focus on high diagnostic tests. The regional market in Germany is the largest, given its advanced lab infrastructure, favorable organ donation policies, and investment in precision medicine and immunogenetics research. The UK and France are also important contributors, with increasing use of next-generation sequencing for donor selection and the programme of national health services to standardize HLA testing in a clinical setting. In addition, a common transplantation approach in the EU, together with harmonized rules and regulations for diagnostics, facilitates access and implementation of novel technologies.

Asia Pacific is the HLA typing market is fastest-growing HLA typing market, due to the increased organ transplant procedures, more government support for the healthcare sector & large population. China is the main source of organs, where hospital networks and organ donation awareness continue to grow, and the government supports transplant registries. India, on the other hand, is expanding rapidly on the back of the increasing burden of chronic diseases, government-supported transplant policies, and availability of low-cost, high-resolution HLA typing tests. Japan and South Korea are also showing good growth, and both have established biotech industries and high levels of use of the high-throughput sequencing platforms for research and diagnostics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the HLA Typing Market

Leading HLA typing companies in the market comprise Thermo Fisher Scientific, Bio-Rad Laboratories, Qiagen, Omixon, GenDx, Illumina, TBG Diagnostics, Becton Dickinson, Takara Bio, F. Hoffmann-La Roche, and Pacific Biosciences.

Recent Developments in the HLA Typing Industry

In April 2025, Thermo Fisher Scientific launched the One Lambda HybriType Flex Kit, which aims to streamline HLA typing workflows by cutting total processing time to under 5.5 hours and hands-on time to less than 2.5 hours.

In August 2024, Thermo Fisher Scientific received FDA 510(k) clearance for its SeCore CDx HLA A Sequencing System, approved as a companion diagnostic for TECELRA (afamitresgene autoleucel), a T-cell receptor therapy targeting synovial sarcoma.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.62 Billion |

| Market Size by 2032 | USD 2.69 Billion |

| CAGR | CAGR of 6.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Reagents & Consumables, Software & Services) • By Application (Diagnosis, Research) • By Technique (Molecular Assay, Sequence-Based Molecular Assay, Non-Molecular Assay) • By End-User (Commercial Service Providers, Hospitals, and Transplant Centers, Research Labs & Academic Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Bio-Rad Laboratories, Qiagen, Omixon, GenDx, Illumina, TBG Diagnostics, Becton Dickinson, Takara Bio, F. Hoffmann-La Roche, and Pacific Biosciences. |