Sickle Cell Disease Treatment Market Size Analysis:

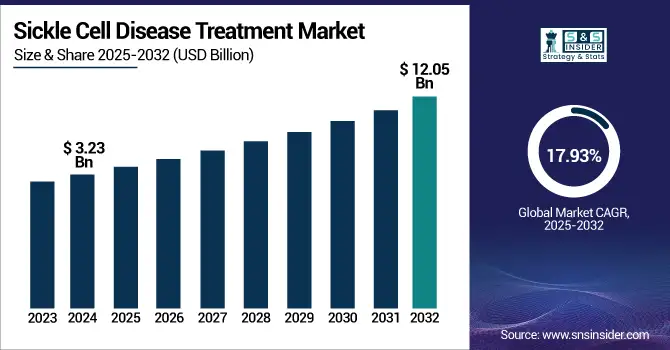

The Sickle Cell Disease Treatment Market size was valued at USD 3.23 billion in 2024 and is expected to reach USD 12.05 billion by 2032, growing at a CAGR of 17.93% over the forecast period 2025-2032.

To Get more information on Sickle Cell Disease Treatment Market - Request Free Sample Report

The growth of the sickle cell disease (SCD) treatment market is being propelled by strong government initiatives, increased disease prevalence, and important regulatory advancements. According to the Centers for Disease Control and Prevention (CDC), nearly 100,000 Americans, mostly of African or Hispanic heritage, have sickle cell disease (SCD).

For instance, a new era in the treatment of sickle cell disease (SCD) management occurred in December 2023 when the U.S. Food and Drug Administration (FDA) approved two innovative gene therapies, Lyfgenia (lovotibeglogene autotemcel) and Casgevy (exagamglogene autotemcel).

Important contributions have been made by the National Institutes of Health (NIH) and its National Heart, Lung, and Blood Institute (NHLBI), which has funded studies and started the Cure Sickle Cell Initiative to hasten the development of gene therapies. These initiatives have improved disease management and patient access to cutting-edge treatments, especially when combined with the CDC's active surveillance and data collection.

The U.S. led the world in research, regulatory support, and healthcare infrastructure. The U.S. market was valued for USD 0.92 billion of the global SCD treatment market in 2024 and is growing at a 17.76% CAGR over the forecast period.

Sickle cell disease is a hereditary blood disorder characterized by abnormal hemoglobin, leading to chronic anemia, pain crises, and organ damage. The CDC emphasizes that while over 20 million people are affected by SCD globally, with a higher prevalence in sub-Saharan Africa, India, and the Middle East. The disease primarily affects African American and Hispanic populations in the U.S. The U.S. government has made SCD a priority by supporting research, increasing newborn screening, and approving advanced treatments through organizations including the NIH, FDA, and CDC.

In India, with a focus on high-prevalence tribal areas, the Ministry of Health's National Sickle Cell Anaemia Elimination Mission, which is part of the National Health Mission (NHM), intends to screen 7 crore people in India in 3.5 years.

These coordinated strategies underscore a global dedication to early detection, all-encompassing care, and fair access to advanced treatments.

Sickle Cell Disease Treatment Market Dynamics:

Drivers:

-

Growing Sickle Cell Disease Mortality and Prevalence Increases Need for Novel and Efficient Treatments

The demand for novel and efficient treatments is rapidly rising due to sickle cell disease's (SCD) increasing global prevalence and mortality burden drive the Sickle Cell Disease Treatment Market. Children under five were disproportionately affected, and SCD was ranked as the leading cause of childhood mortality in high-burden regions, accounting for 376,000 of the estimated 34,400 cause-specific all-age deaths globally. Governments in the U.S., India, and several African countries have responded to this concerning increase by launching screening programs, awareness campaigns, and assistance for early diagnosis and intervention.

The number of people with sickle cell disease (SCD) increased by 41.4% from 5.46 million in 2000 to 7.74 million in 2021, with the highest prevalence in sub-Saharan Africa, the Caribbean, and parts of India, according to The Lancet Haematology and the Institute for Health Metrics and Evaluation (IHME).

SCD has also been given priority in the rare disease strategies of the World Health Organization (WHO) and the National Institutes of Health (NIH) of the U.S. This has led to funding and policy initiatives that promote pharmaceutical innovation and increased access to advanced therapies. The global SCD treatment market is expected to expand at a significant compound annual growth rate (CAGR) through 2032 due to the growing need for scalable and efficient solutions.

Restraints:

-

Inadequate Healthcare Infrastructure, Delayed Diagnosis, and Low Disease Awareness Prevent Market Growth

The efficient management and sickle cell disease treatment, particularly in high-prevalence areas, is still hampered by a lack of knowledge about the condition, delayed diagnosis, and inadequate healthcare infrastructure. Persistent gaps in disease education have affected many communities, especially in sub-Saharan Africa, the Middle East, and parts of India. This results in late presentation, poor treatment adherence, and avoidable complications.

These areas' healthcare systems frequently lack the funding, skilled staff, and specialized facilities needed to provide complete SCD care, including access to advanced diagnostics and new treatments. In order to improve outcomes and lower mortality, the Bill & Melinda Gates Foundation and international health agencies have emphasized the critical need for increased newborn screening, regular surveillance, and ongoing investment in healthcare infrastructure.

The American Society of Hematology estimates that every year in Sub-Saharan Africa, approximately 300,000 babies are born with sickle cell disease. Even though the WHO has classified hydroxyurea as an essential medicine, it is still mainly unavailable in the area.

National governments and organizations, such as the NIH and WHO are working to bridge these gaps through public health campaigns, training programs, and funding for infrastructure development, but progress remains uneven and represents a significant restraint on sickle cell disease treatment market growth.

Opportunities:

-

Growing Gene Therapy and Personalized Medicine Presents Opportunities for Long-Term Treatments Globally

A revolutionary chance for long-lasting cures and competitive advantage is presented by the growing use of gene therapy and personalized medicine in the sickle cell disease treatment. Since the FDA and EMA approved the first gene-editing treatments for sickle cell disease (SCD), the focus of treatment is changing from managing symptoms for the rest of one's life to one-time treatments that could eradicate the disease at its genetic root. Additional gene-editing and gene-addition techniques are being investigated in ongoing clinical trials funded by the NIH and top pharmaceutical companies, which could increase the number of curative options accessible to patients.

Personalized medicine, including therapies tailored to individual genetic profiles and disease severity, is expected to further improve outcomes and reduce adverse effects. These developments are being aided by governments and regulatory bodies through funding for translational research, orphan drug incentives, and fast-track designations. These Advanced treatments have the potential to significantly expand the market, draw in investment, and enhance the lives of millions of SCD patients globally as they become more widely available.

Sickle Cell Disease Treatment Market Segmentation Analysis:

By Treatment

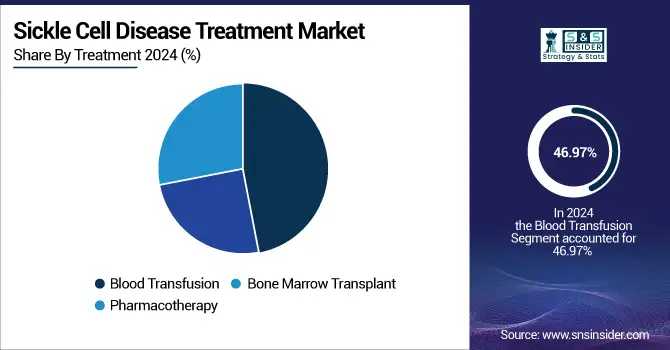

The blood transfusion segment held the largest share, 46.97% of the sickle cell disease treatment market in 2024, due to its well-established role in managing acute SCD complications and preventing stroke, particularly in pediatric population. National and international clinical guidelines, including those from the American Society of Hematology and the CDC, recommend blood transfusions for patients who are at risk of stroke or who experience recurrent pain crises. It has been essential for the government to support the infrastructure for blood transfusions, including investments in supply chains and blood safety.

For instance, the mission-mode approach of the Indian government aims to provide universal screening and access to transfusion services in 278 districts throughout 17 states. In order to inform national policy and resource allocation, the CDC's Sickle Cell Data Collection program in the U.S. offers vital insights into transfusion utilization and outcomes.

The pharmacotherapy segment is anticipated to grow with the fastest CAGR over the forecast period of 2025–2032, due to the approval and uptake of gene therapies and disease-modifying medications. Several SCD drugs, such as hydroxyurea, L-glutamine (ENDARI®), and crizanlizumab (ADAKVEO®), have been approved by the U.S. FDA and are now standard treatments for lowering pain crises and enhancing quality of life. The addition of hydroxyurea to India's NHM Essential Medicines List has increased SCD patients' access to efficient medication. New treatments have been developed more quickly due to the government-funded research. Public investment in next-generation treatments is best demonstrated by the CSIR's gene-editing projects in India and the NIH's Cure Sickle Cell Initiative.

By End-use

The hospitals segment held the largest share of 61% in 2024 of the global sickle cell disease treatment market and is expected to grow at the fastest rate during the forecast period, due to their crucial role in providing comprehensive SCD care. Hospitals offer access to sophisticated treatments, such as bone marrow transplants, gene therapies, and blood transfusions, along with multidisciplinary teams and sophisticated diagnostics.

With the FDA's approval of gene therapies in December 2023, hospitals are now the main locations in the U.S. where these advanced treatments are administered. To provide eligible patients with curative options, the U.K.'s NHS and MHRA approved the use of CRISPR-based gene therapies in major hospitals.

To improve access to innovative treatments and clinical trials, the CDC and NIH have backed the creation of dedicated sickle cell centers inside hospitals. Sickle cell disease affects 20 to 25 million people globally, according to WHO estimates, and this number is predicted to rise sharply, which will probably lead to a rise in the need for hospital-based care. Hospitals are being used as referral centers for advanced interventions as part of India's National Sickle Cell Anaemia Elimination Mission, which is fortifying primary, secondary, and tertiary healthcare networks to include SCD management.

Sickle Cell Disease Treatment Market Regional Analysis:

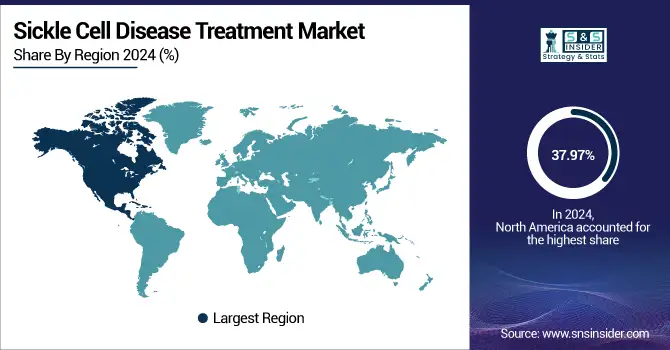

With 37.97% of the sickle cell disease treatment market share in 2024, the North American region led the industry. The region's sophisticated healthcare system, high level of disease awareness, and strong government support drive the region’s expansion in the market. The development and approval of novel therapies, including gene-editing treatments, have been driven by the establishment of strong regulatory policies by organizations, such as the U.S. Food and Drug Administration (FDA), and the presence of major pharmaceutical companies, such as Pfizer Inc. providing sickle cell disease treatment.

For instance, about 100,000 Americans, mostly African Americans, suffer from sickle cell disease, with a lower prevalence among Hispanic Americans, according to the U.S. FDA.

Significant investments in R&D, extensive insurance coverage, and reimbursement systems that improve patient access to advanced care are especially advantageous for the US. The region is dedicated to developing novel treatment approaches, as evidenced by recent achievements such as the FDA's Regenerative Medicine Advanced Therapy (RMAT) designation for Editas Medicine's EDIT-301 gene-editing therapy in October 2023.

Over the forecast period, the Asia Pacific is projected to grow at the fastest CAGR. This growth is driven by rising healthcare expenditures, expanding patient awareness, and proactive government initiatives, especially in countries, including India and China. Through extensive screening initiatives, improved healthcare facilities, and the creation of domestic treatments, India is driving regional change.

Over 1 crore people have been screened for sickle cell anemia under the National Sickle Cell Anaemia Elimination Mission, according to a January 2024 announcement from India's Ministry of Health. Hospital-based management services are still being expanded.

The government’s focus on improving accessibility in rural and tribal areas, coupled with collaborations with international research bodies, is rapidly expanding treatment reach. The modernization of healthcare is also being funded by China and Southeast Asian countries, which is driving the expansion of the regional market.

Europe is growing significantly in the SCD therapeutics market. High disease prevalence, robust regulatory support, and extensive reimbursement policies are driving the region's growth. Leading markets with notable CAGRs are Germany, the U.K., and France. Key factors in Europe are the rising incidence and severity of SCD cases as well as the use of cutting-edge treatments.

Due to the highest prevalence of SCD globally, especially in sub-Saharan Africa, Latin America, and the Middle East & Africa (LAMEA) region offers special opportunities. Programs for screening, education, and treatment are being stepped up by governments and international organizations. While South Africa and other countries are enhancing infrastructure and access to care, the GCC countries, with their sophisticated healthcare systems, are driving regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Sickle Cell Disease Treatment Market Key Players

The key sickle cell disease treatment companies are Novartis AG, Bluebird Bio, Inc., Emmaus Medical, Inc., Bristol-Myers Squibb Company, CRISPR Therapeutics, GlycoMimetics, Graphite Bio, Inc., Addmedica, Global Blood Therapeutics, Inc. (Pfizer Inc.), Agios Pharmaceuticals, Inc., and others.

Recent Developments in the Sickle Cell Disease Treatment Market

-

The Bristol-Myers Squibb Company announced in December 2024 that Phase 1/2 clinical trials for sickle cell disease had begun using its targeted protein degrader BMS-986470, which increases fetal hemoglobin. This innovative method represents a new disease treatment modality and makes use of molecular glue degraders.

-

AddMedica and Abacus Medicine Pharma Services partnered in March 2023 to distribute Siklos (hydroxyurea) to patients two years of age and up in Belgium, the Netherlands, and Luxembourg.

| Report Attributes | Details |

| Market Size in 2024 | USD 3.23 Billion |

| Market Size by 2032 | USD 12.05 Billion |

| CAGR | CAGR of 17.93% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment (Blood Transfusion, Bone Marrow Transplant, Pharmacotherapy) • By End-use (Specialty Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Novartis AG, Bluebird Bio, Inc., Emmaus Medical, Inc., Bristol-Myers Squibb Company, CRISPR Therapeutics, GlycoMimetics, Graphite Bio, Inc., Addmedica, Global Blood Therapeutics, Inc. (Pfizer Inc.), Agios Pharmaceuticals, Inc. |