Trauma Product Market Key Insights:

Get More Information on Trauma Product Market - Request Sample Report

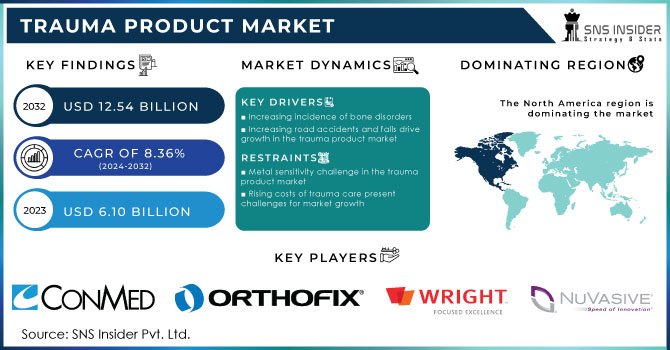

The Trauma Product Market size was valued at USD 6.10 billion in 2023 and is expected to reach USD 12.54 billion by 2032, growing at a CAGR of 8.36% from 2024-2032.

The scope of the trauma product market is enormous, due to the rising number of cases with a physical injury, including fractured bones, sprains, and dislocations. The aging of the world's population has increased, with projections suggesting that populations aged 60 years and above will reach 1.7 billion by 2070, creating a sharp surge in demand for effective treatment measures for trauma. Such demographic shift is also associated with an increasing prevalence of orthopedic diseases, such as rheumatoid arthritis and osteoarthritis, thus demanding new innovative trauma care solutions. In addition, an increase in sports injuries and road traffic accidents leads to an ever-growing demand for advanced trauma products.

The opportunities for the trauma products market are experiencing a spurt as patients increasingly realize the benefits of modern treatment options. The drift toward minimally invasive surgical procedures and the adoption of orthopedic biodegradable products typify the industry's progress toward more effective and patient-friendly solutions. Moreover, further research and development of trauma devices will provide manufacturers with a competitive advantage. This way, collaboration on the part of trauma product manufacturers and healthcare providers facilitates innovation safety, and effectiveness of products.

The lifetime cost of traumatic injuries is estimated to be around $406 billion, with healthcare expenses at $80 billion, while lost productivity accounts for $326 billion. This significant financial load has underlined the huge demand for the effective management products of trauma especially in the developing regions with immense growth prospects. Healthcare expenditure, growth in medical technology, and growing health coverage are on the rise, and so is the trauma market which will bloom exponentially. In addition, government efforts to enhance healthcare systems create an easy environment for trauma product manufacturers. New technologies in ortho biologics and other biological materials will further make the treatment methods better. Altogether, these factors show a high priority to tackling challenges related to trauma thus creating a robust responsive marketplace.

| Disorder | Description |

|

Post-Traumatic Stress Disorder (PTSD) |

A mental health condition triggered by experiencing or witnessing a traumatic event causes symptoms like flashbacks, anxiety, and emotional distress. |

|

Acute Stress Disorder (ASD) |

A short-term condition that occurs within three days to four weeks after a traumatic event, is characterized by anxiety, dissociation, and avoidance symptoms. |

|

Secondhand Trauma |

Psychological distress is experienced by individuals who have not directly experienced a traumatic event but are affected by the trauma of someone close to them. |

|

Reactive Attachment Disorder (RAD) |

A condition in children characterized by difficulties in forming healthy emotional attachments due to inadequate caregiving or trauma in early childhood. |

|

Disinhibited Social Engagement Disorder (DSED) |

A childhood disorder where a child shows overly familiar behavior with strangers, often resulting from inconsistent caregiving or trauma. |

|

Adjustment Disorders |

A group of conditions where individuals experience emotional or behavioral symptoms in response to a specific stressor, affecting daily functioning. |

|

Other and Unspecified Trauma- and Stressor-Related Disorders |

A category for trauma-related issues that do not fit neatly into other specified disorders, encompassing a range of symptoms and stress reactions. |

Market Dynamics

DRIVERS

Increasing incidence of bone disorders

Osteoporosis affects approximately 200 million women worldwide, with significant prevalence in the aged; one-tenth of women aged 60, one-fifth of those aged 70, two-fifths of women aged 80, and two-thirds of women aged 90 suffer from it. Approximately 10 million people have osteoporosis in the United States; however, around 44 million more are at risk of a greater fracture risk due to low bone density. This increasing prevalence is one of the major growth drivers in the trauma products market, which holds a great deal of expansion scope. The demand for advanced treatment options such as surgical implants and fixation devices would increase with the aging population. With increasing awareness about osteoporosis, preventive measures would also be encouraged, stimulating further market growth. As the disease progresses to osteoporosis, markets in the line of such trauma-related products are most likely to continue the same trend, for which a market is being contemplated.

Increasing road accidents and falls drive growth in the trauma product market

The rising incidence of road accidents and falls is a significant driver for the trauma product market, creating ample growth opportunities. According to the World Health Organization, every year, over 1.25 million people die from road traffic crashes, while an additional 20 to 50 million people sustain non-fatal injuries, often leading to long-term disabilities. This increased number of casualties underscores the growing demand for better trauma products, including orthopedic implants and rehabilitation devices. With the trend for effective treatment and recovery solutions growing by leaps and bounds, the trauma product market is ready to witness vigorous growth.

RESTRAINTS

Metal sensitivity challenge in the trauma product market

Metal sensitivity represents an important challenge for the trauma product market since most implants are made of metals or their alloys, like nickel, chromium, cobalt, and titanium. These materials are liable to cause significant allergic reactions, including conditions of eczema, dermatitis, and vasculitis. In patients suffering from failed or malfunctioning implants, metal hypersensitivity may be seen in as many as 60% of cases. In addition, one study pointed out that 4.9% of 840 patients reported a metal allergy, and 83% of all patients were positive for at least one metal, mostly nickel. Moreover, 40% of the patients with failing implants had hypersensitivity to the materials. Therefore, this emergent allergy to metals leads not only to pain and infections but also prevents market growth and adoption of trauma products.

Rising costs of trauma care present challenges for market growth

The trauma product market faces significant restraints due to the high costs associated with trauma surgeries. According to NIH data, the national cost estimates for trauma care reach approximately $37 billion, closely aligning with Weir et al.'s estimate of $27 billion when adjusted for inflation. These substantial expenses stem from advanced technologies, specialized surgical expertise, and prolonged recovery times, which can limit access to necessary treatments for patients. Consequently, the financial burden associated with trauma care can hinder market growth and patient acceptance of trauma products.

SEGMENT ANALYSIS

BY PRODUCT

Internal fixators dominated the Trauma Product Market in 2023, based on an impressive revenue share of around 64.20%. This is because their applications are considered vital for stabilizing bone fractures and correcting deformities and are forecasted to rise with a growing population and orthopedic injuries at any age level. The trend in surgeries toward minimally invasive surgery and innovation with smart implants further boosts the demand for internal fixators.

On the contrary, external fixators are likely to witness the highest growth CAGR of approximately 8.59% over the forecast period 2024-2032 due to the escalating incidences of trauma cases and the requirement for effective fracture management. Innovations in materials and customized options make them more and more alluring, hence providing strong growth opportunities in this area.

BY SURGICAL SITE

The segment of lower extremities acquired the largest share of the revenue for the Trauma Product Market in the year 2023 at 53.22%. This strong stand can mostly be attributed to the increasingly aging population who are haunted by osteoarthritis and fractures and an increase in sports injuries that require surgical treatment. Their immediate need for effective solutions like intramedullary nails and advanced external fixators accelerates the demand in this area.

In comparison, the upper extremities segment is likely to emerge with the highest CAGR of about 8.70% in the estimated period, 2024-2032. The market has been driven by the rising requirement for minimally invasive surgical procedures and a rise in the incidence of sports injuries. Also, the emphasis on the designing of ergonomic, patient-specific products has opened vast opportunities for companies in this segment.

BY END USER

Hospitals and trauma centers have accounted for a significant market share of the Trauma Product Market, with a share of about 65.23% in 2023. This is primarily because trauma and orthopedic surgeries are becoming increasingly common within these facilities, which act as the ultimate treatment centers for complex injuries. The demand is likely to increase with the increasing incidences of road accidents, sports injuries, and falls among the aged.

The ASC segment is expected to garner the highest CAGR at around 9.07% over the forecast period, from 2024 to 2032, based on the trend of outpatient procedures. Here, the comfort and rapid recovery offered by the settings of ASCs, along with technologically advanced minimally invasive techniques, provide a huge scope for the manufacturers working in this domain.

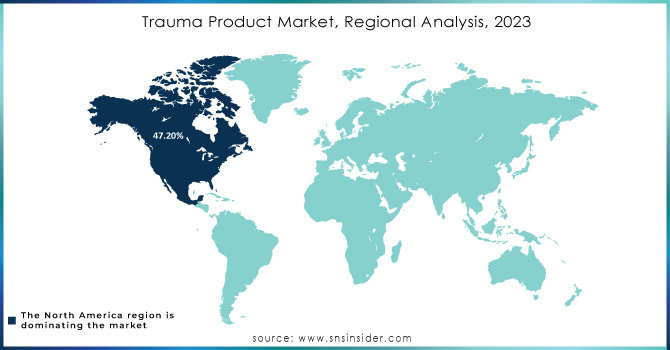

REGIONAL ANALYSIS

The North American trauma devices market accounted for 47.20% of the market share in 2023. This is mainly due to favorable reimbursement policies, easy accessibility to advanced technologies, and high rates of accidents necessitating trauma care. Well-structured healthcare systems within the region enable faster recovery of patients and thus increase demand for such products. In the United States in 2022, 42,514 persons died in motor vehicle crashes with an average of 12.8 deaths per 100,000, showing the urgent need for new trauma solutions. Besides, constant research and development of novel medical technologies with conducive regulatory backing are also driving the acceptance of modern trauma devices.

On the other hand, the Asia Pacific region is likely to witness a substantial compound annual growth rate of around 6.56% during 2024 and 2032. This is because of improved awareness about trauma care, immense development of healthcare infrastructure, and improved access to medical services across countries. Moreover, the growing population, rising disposable income, and the elevated rate of road accidents also increase the demand for trauma devices. Apart from this, cooperative efforts among governments and private sectors toward strengthening emergency care also provide further scope for manufacturers to expand their portfolios within this dynamic market.

Need Any Customization Research On Trauma Product Market - Inquiry Now

LATEST NEWS-

The U.S. Food and Drug Administration (FDA) has recently approved a groundbreaking product, TRAUMAGEL, designed to halt severe bleeding almost instantly. Developed by Brooklyn-based Cresilon Inc., this plant-based hydrogel comes in a pre-filled syringe, offering a quick and effective treatment option for critical situations.

In September 2023, a Texas-based orthofix company has recently come up with a new Galaxy product that offers stable external fixation. Available in several configurations, sterile procedure kits can be used as a convenient, readily available solution for medical professionals.

Corin Group has received the confirmation that the Apollo robotic-assisted surgical system, along with the software application, ApolloKnee was approved for CE marking. The news was announced in April 2024 from Cirencester, UNITED KINGDOM, and is considered to be a key advance in orthopedic technology.

KEY PLAYERS

-

CONMED Corporation (U.S.) (Grapevine Compression System, AquaCare Fluid Management System)

-

Orthofix US LLC (U.S.) (Limb Reconstruction System, Bone Growth Stimulators (Nexstim))

-

Wright Medical Group N.V. (U.S.) (Infinity Total Ankle System, T2 Ankle Plating System)

-

NuVasive, Inc (U.S.) (CoRoent Large Fragment System, MAGEC Spinal Bracing System)

-

Corin Group (U.S.) (Furlong Hip System, Cementless Knee System)

-

Enovis (U.S.) (DJO Post-Operative Brace, Simplicity Ankle System)

-

OsteoMed (U.S.) (Pedi-Plates Pediatric Trauma Plates, BioMed Bone Grafting Products)

-

Invibio Ltd. (U.S.) (PEEK-OPTIMA Biomaterial for Trauma Implants, PEEK-OPTIMA Ultra Bio Material)

-

gpcmedical.com (U.S.) (GPC Medical Locking Plate Systems, GPC Medical Bone Screws)

-

Medtronic (Ireland) (Medtronic Trauma Plates and Screws, StealthStation Surgical Navigation System)

-

Integra LifeSciences (U.S.) (Integra Silhouette Skin Graft System, Cranial Vault Remodeling Plates)

-

B. Braun SE (Germany) (Aesculap Locking Plate Systems, B. Braun Bone Screws)

-

Stryker (U.S.) (T2 Trauma System, Stryker Spine Trauma Products)

-

Zimmer Biomet (U.S.) (NexGen Complete Knee Solution, Trauma Locking Plates)

-

Smith+Nephew (U.K.) (Duo Trauma Plate System, Smith+Nephew Bone Graft Products)

-

Advanced Orthopaedic Solutions (India) (Intramedullary Nails, Locking Plate Systems)

-

Acumed LLC (U.S.) (Acumed Locking Compression Plates, Intramedullary Nail System)

-

Electramed Ltd (Ireland) (Electramed Bone Stimulators,Trauma Fixation Devices)

-

Implantate AG (Germany) (OSSTEM Trauma Systems, Implantate Bone Screws)

-

Bioretec Ltd. (Finland) (Rheos Absorbable Screws, Biofix Bone Repair Products)

-

citieffe s.r.l. (U.S.) (Citieffe Titanium Bone Plates, Citieffe External Fixation Systems)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.10 Billion |

| Market Size by 2032 | USD 12.54 Billion |

| CAGR | CAGR of 8.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Internal Fixators, External Fixators) • By Surgical Site(Upper Extremities, Lower Extremities) • By End User(Hospitals and Trauma Centers, Ambulatory Surgery Center) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CONMED Corporation, Orthofix US LLC, Wright Medical Group N.V., NuVasive, Inc, Corin Group, Enovis, OsteoMed, Invibio Ltd., gpcmedical.com, Medtronic, Integra LifeSciences, B. Braun SE, Stryker, Zimmer Biomet, Smith+Nephew, Advanced Orthopaedic Solutions, Acumed LLC, Electramed Ltd, Implantate AG, Bioretec Ltd, citieffe s.r.l |

| Key Drivers | • The increasing incidence of bone disorders, especially osteoporosis in older populations, is boosting demand for trauma products like surgical implants and fixation devices. • The increasing rate of road accidents and falls is driving growth in the trauma product market, highlighting the need for better orthopedic implants and rehabilitation devices. |

| RESTRAINTS | •High costs of trauma surgeries hinder market growth and limit patient access to necessary treatments. •Metal sensitivity challenges the trauma product market by causing allergic reactions that affect patient outcomes and product adoption. |