Artificial Hip Joint Market Report Scope & Overview:

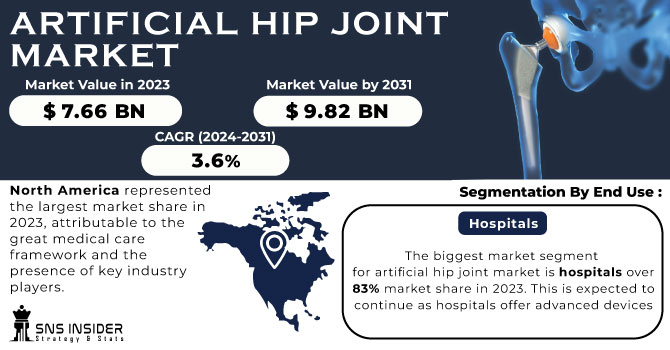

The Artificial Hip Joint Market size was escalated to USD 7.66 billion by the end of 2023 and is projected to reach at USD 9.82 billion by 2031 with a growing healthy CAGR of 3.6% during the forecast period 2024-2031.

The Artificial hip joint market is fueled by growing health concerns as more people are becoming obese, injuring their hips, and developing osteoarthritis. A 2021 WHO study found a staggering 528 million people worldwide with osteoarthritis, a number projected to double by 2050.

Get more information on Artificial Hip Joint Market - Request Sample Report

This rise in osteoarthritis translates to more artificial hip joint surgeries needing implants, driving significant market growth. In other words, as more people struggle with hip issues, the demand for Artificial hip joint market will surge. Reimbursement rules that make it easier for patients to get reimbursed for medical care can boost a market. By requiring insurers to cover a wider range of treatments, like orthopedic devices, the ACA increased the number of patients who could get them. This growth applies to both public insurance (like Medicare) and private insurance. In recent years, both types of insurance have gotten better at covering prosthetics and orthotics.

Market Dynamics

Drivers:

-

Rising Demand for Hip Replacement Surgery

An aging population and increasing prevalence of conditions like osteoarthritis are leading to more hip replacement surgeries, which directly translates to a demand for artificial hip joints.

-

Favourable reimbursement Policies reforms in health insurance coverage for joint replacements make these procedures more accessible, further propelling the market.

Restraints:

-

Surgical Risks and Recovery Time limits the market growth

Hip joint surgery is a major procedure with inherent risks. Some patients might opt for conservative treatments for as long as possible to delay surgery.

-

The potential for complications associated with artificial hip implants.

Opportunities:

-

Technological Advancements is always a major factor as an opportunity

Innovation in materials and design is creating more durable, longer-lasting artificial hip joints. This includes advancements in new materials that better integrate with the body and reduce wear and tear are being developed, Surgery with smaller incisions and faster recovery times is becoming more prevalent, increasing patient adoption and Customizable implants tailored to individual anatomy could improve fit and function.

-

Growing healthcare access and rising disposable income in developing countries create new markets for artificial hip joints.

Challenges:

-

High Costs even with insurance, patients might face significant out-of-pocket expenses for surgery and the implant itself.

Artificial hip implants can be very expensive, with prices varying depending on the material, design, and manufacturer. Even with insurance coverage, patients may be responsible for a portion of the implant cost.

-

Artificial hips can last a long time, but some may require revision surgery due to wear and tear, leading to patient hesitation.

KEY MARKET SEGMENTATION:

By Product

The Primary hip replacement devices segment is the largest, valued at over USD 5.49 billion in 2023. This dominance stems from several factors such as improved patient outcomes like pain relief and better mobility, technologically advanced devices tailored to individual needs, and successful surgical methods that minimize risks. These factors are expected to drive continued growth in this segment.

By Material

Metal-on-plastic is the leading material segment in artificial hip joint, valued at over USD 4.22 billion in 2023. This popularity is due to its affordability, durability, and reliable outcomes. These implants are ideal for less active patients and are the most commonly used. Advancements are further boosting adoption by reducing wear particles and complications. Surgeons often favor this combination (e.g., stainless steel or titanium with polyethylene) due to its overall benefits. Studies even suggest positive long-term results for elderly patients with metal-on-plastic hip resurfacing.

By Fixation Material

The cemented fixation segment is expected to be a major player, reaching over USD 762 million by 2031. This growth is driven by its advantages like high implant survival rates, a strong bond between bone and implant, and potential for bone growth onto the implant over time. Cemented fixation boasts a 96% survival rate at 10 years for patients over 75 years old. The procedure uses fast-curing bone cement with optional antibiotics to minimize infection risk.

By Inserts

Cross-linked polyethylene inserts are the largest segment in artificial hip joint inserts, projected to reach over USD 3.43 billion by 2031. This dominance is due to their ability to reduce wear and tear, leading to better clinical outcomes and longer implant lifespans. Studies have shown high success rates in hip replacements using these inserts.

By End Use

The biggest market segment for artificial hip joint market is hospitals over 83% market share in 2023. This is expected to continue as hospitals offer advanced devices, trained staff, post-surgery care, and physical therapy, making them the preferred choice for patients undergoing hip replacement surgery.

Regional Analysis

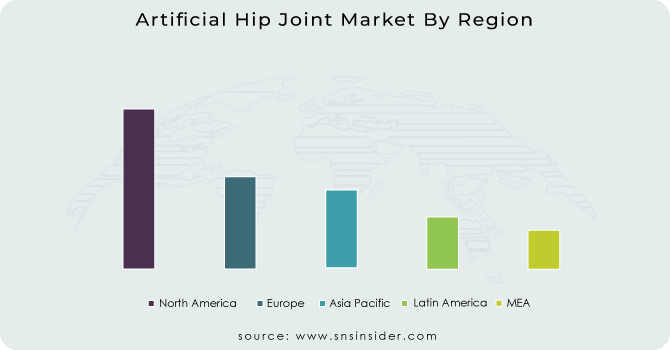

North America represented the largest market share in 2023, attributable to the great medical care framework and the presence of key industry players. Besides, the developing rate of osteoporosis and osteoarthritis and the rising number of sports and street wounds are a few main considerations helping the development of the territorial market. Great repayment arrangements for patients are expected to build the quantity of medical procedures, which thus is supposed to help development soon.

Asia Pacific is supposed to observe worthwhile development over the estimated time frame. For example, developing medical services spending in arising Asian commercial centers and developing older populace, which have a higher gamble of creating osteoarthritis, osteoporosis, and bone wounds, and rising frequency of heftiness will add to the development more than quite a while. Likewise, quickly creating medical care framework because of the roaring clinical the travel industry is actuating market interest in the area.

Need any customization research on Artificial Hip Joint Market - Enquiry Now

Key Players:

The Major players in the Artificial Hip Joint market are Johnson and Johnson, Medacta International, Stryker Corporation, B. Braun, Zimmer Biomet Holdings, Microport Orthopedics, Smith and Nephew, DJO Global, Exactech and other players.

Recent Development Of The Artificial Hip Joint Market:

-

In January 2023, a company called Hip Innovation Technology (HIT) began testing a new type of hip replacement in the United States. This device, called the HIT Reverse Hip Replacement System (Reverse HRS), is still under investigation.

-

In March 2022, DePuy Synthes acquired a new tool called CUPTIMIZE Hip-Spine Analysis. This technology helps surgeons precisely measure pelvic tilt in patients undergoing hip replacement surgery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.66 Billion |

| Market Size by 2031 | US$ 9.82 Billion |

| CAGR | CAGR of 3.6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson and Johnson, Medacta International, Stryker Corporation, B. Braun, Zimmer Biomet Holdings, Microport Orthopedics, Smith and Nephew, DJO Global, Exactech |

| DRIVING FACTORS |

|

| Restraints |

|