Off-highway Brake Oil Aftermarket Market Key Insights:

Get More Information on Off-highway Brake Oil Aftermarket Market - Request Sample Report

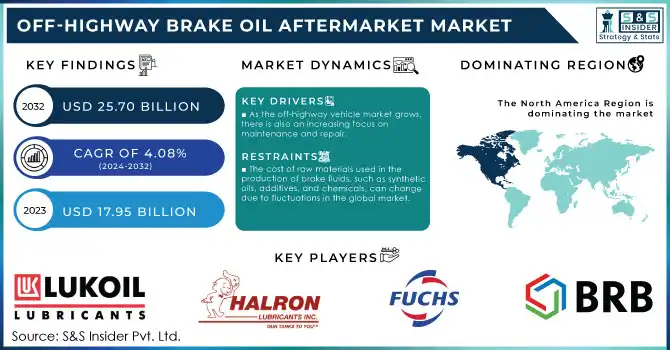

The Off-Highway Brake Oil Aftermarket Market size was valued at USD 17.95 billion in 2023 and will reach $25.70 billion by 2032, growing at a CAGR of 4.08% over the forecast period of 2024-2032.

The off-highway brake oil aftermarket market is primarily driven by the need for regular maintenance and fluid replacement to prevent system failures, extend vehicle lifespan, and maintain optimal braking performance. Key growth drivers in the off-highway brake oil aftermarket include the increasing demand for off-highway vehicles (OHVs) across industries such as construction, agriculture, and mining. In 2023, nearly 5 million off-highway vehicles were sold worldwide, fueling the demand for essential maintenance products like brake oil. As these industries expand, especially in developing economies, the need for reliable brake oil products intensifies, supported by the trend towards longer operating hours for machinery.

Additionally, the growing focus on safety within the transportation manufacturing sector is propelling the demand for high-quality brake oils in off-highway vehicles. The United States, home to the largest transportation equipment manufacturing industry, also saw around 498 OHV-related fatalities in 2023, with many involving ATVs. This underscores the importance of high-performance brake fluids in off-highway vehicles, ensuring safety and operational efficiency in harsh environments. As a result, there is an increasing preference for specialized brake oils, which deliver enhanced braking performance, reduce the risk of brake failure, and contribute to the market’s growth.

Off-Highway Brake Oil Aftermarket Market Dynamics

Drivers

-

As the off-highway vehicle market grows, there is also an increasing focus on maintenance and repair.

The cost of repairing or replacing an entire braking system in off-highway vehicles can be significant, leading many vehicle owners and fleet operators to invest in regular maintenance, including brake oil replacement, to extend the lifespan of their vehicles. Preventive maintenance, which involves replacing brake fluids at scheduled intervals, has gained popularity as a cost-effective way to ensure the vehicle’s smooth operation while avoiding expensive repairs or replacements. Moreover, off-highway vehicles are often used in environments where they are exposed to high levels of wear and tear, leading to increased demand for brake oil replacement. As vehicles age, the efficiency of the brake system may degrade, and replacing the brake oil regularly can help maintain the vehicle's performance and safety. This growing trend toward proactive maintenance continues to fuel the aftermarket for off-highway brake fluids, creating opportunities for suppliers to meet the demand for high-quality, reliable products.

-

The increasing focus on safety in the operation of off-highway vehicles has significantly contributed to the growth of the brake oil aftermarket market.

Off-highway vehicles often operate in hazardous conditions, where failure of critical components, like the braking system, can lead to catastrophic accidents. As such, operators and fleet owners are increasingly focused on maintaining high levels of safety by ensuring that brake oils are replaced at regular intervals to maintain optimal braking performance. The emphasis on safety is not only driven by regulatory standards but also by the industry's push for better operational efficiency. As businesses and contractors seek to minimize downtime and reduce accident rates, investing in high-quality, reliable brake fluids becomes essential. This has caused a rise in the frequency of brake oil replacements and maintenance checks, boosting the demand for market.

Restraints

-

The cost of raw materials used in the production of brake fluids, such as synthetic oils, additives, and chemicals, can change due to fluctuations in the global market.

When the prices of raw materials increase, brake oil manufacturers may have higher production costs, which could lead to higher prices for consumers. This could discourage buyers from replacing brake oils regularly, especially for fleet operators trying to reduce their operational costs. Moreover, the availability of raw materials can be affected by supply chain issues or geopolitical events, causing more uncertainty in the market's cost structure. This volatility in the prices of raw materials can strain the finances of manufacturers and suppliers, especially when there is high demand or low inventory levels. Smaller companies may find it even harder to manage these fluctuations, affecting their ability to stay competitive in pricing. For example, changes in the prices of crude oil can have a significant impact on the cost of manufacturing brake fluids.

Off-Highway Brake Oil Aftermarket Market Segmentation Analysis

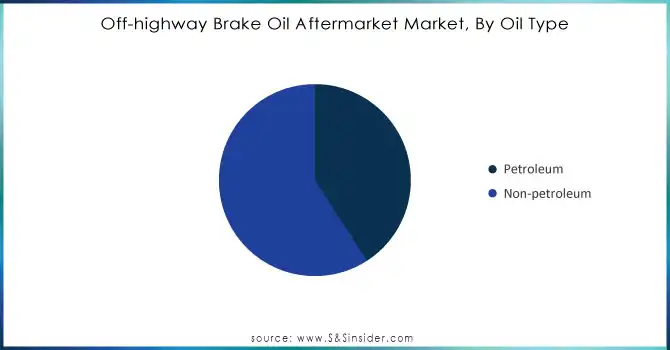

By Oil Type

Non-petroleum segment dominated in 2023, holding a 59% market share, due to their environmentally friendly characteristics, including biodegradability and low toxicity. Non-petroleum-based oils are derived from synthetic or renewable sources, making them more sustainable compared to traditional petroleum-based oils. Companies like Chevron, Castrol, and ExxonMobil offer synthetic brake fluids that cater to this growing demand for non-petroleum oils. The market for these oils is expected to grow rapidly due to increasing regulations for environmental protection and sustainability.

The petroleum segment is projected to become the fastest-growing during 2024-2032, due to their environmental impact. Petroleum-based brake fluids provide essential performance characteristics such as high stability and resistance to oxidation and corrosion. However, with growing environmental concerns, the shift toward non-petroleum oils is more pronounced. Major companies such as Shell and Mobil still dominate this market segment, offering petroleum-based brake fluids like Mobil Brake Fluid DOT 4 for industrial and off-highway applications.

Need Any Customization Research On Off-highway Brake Oil Aftermarket Market - Inquiry Now

By Vehicle Type

The mining segment led the market in 2023, capturing 49% of the market share. The brake oils used in mining vehicles must be able to withstand high pressures, extreme temperatures, and rough terrains. Companies like Caterpillar and Komatsu depend on specialized oils to ensure the safe and reliable operation of their large off-highway equipment, such as haul trucks, bulldozers, and excavators. These vehicles experience significant wear and tear, creating a continuous demand for high-quality brake oils that can maintain performance and protect the brake systems.

The construction segment is forecasted to be the fastest-growing industry from 2024 to 2032, with the rapid increase in infrastructure projects worldwide, construction companies are increasingly utilizing heavy-duty off-highway machinery. These vehicles, including cranes, graders, and excavators, require specific brake oils that can withstand the demanding conditions of construction sites, which often involve high loads, vibrations, and varied weather conditions. Construction giants like Volvo Construction Equipment and John Deere require efficient aftermarket brake oils to ensure the performance and longevity of their equipment.

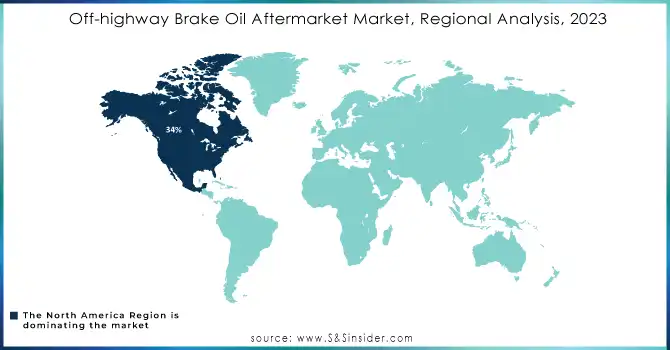

Off-Highway Brake Oil Aftermarket Market Regional Overview

North America dominated the off-highway brake oil aftermarket market with 34% of the market share in 2023, driven by the strong presence of industries like construction, mining, and agriculture, which require high-performance off-highway vehicles. The demand for advanced machinery and reliable braking systems in these sectors is substantial, supporting a continued market share. Furthermore, North America places a strong emphasis on sustainability, with companies developing bio-based and synthetic oils to meet environmental standards. Key players in this region include ExxonMobil, Shell, BP, and Chevron, who are investing heavily in R&D and product innovation.

Asia Pacific is anticipated to become the fastest-growing region for the off-highway brake oil market from 2024 to 2032, due to rapid industrialization in countries like China, India, and Japan, where construction, mining, and agriculture industries are expanding significantly. As demand for off-highway vehicles grows in these sectors, so does the need for high-quality brake oils. The APAC region is expected to see a surge in the adoption of synthetic oil and bio-based oils, driven by regulatory changes and technological advancements. Companies such as Sinopec, BP, and Shell are increasing their investments in the region, capitalizing on the growth of infrastructure and mining.

Key Players in Off-Highway Brake Oil Aftermarket Market

The major key players in the Off-highway Brake Oil Aftermarket Market are:

-

BRB International BV (BRB Brake Fluid DOT 4, BRB Brake Fluid DOT 5.1)

-

Fuchs Petrolub SE (Fuchs Titan Brake Fluid DOT 4, Fuchs Titan Brake Fluid DOT 5.1)

-

Halron Lubricants Inc. (Halron DOT 3 Brake Fluid, Halron DOT 4 Brake Fluid)

-

Lukoil Lubricants Inc. (Lukoil DOT 4 Brake Fluid, Lukoil DOT 5.1 Brake Fluid)

-

Phillips 66 Lubricants Inc. (Phillips 66 Shield Brake Fluid DOT 3, Phillips 66 Shield Brake Fluid DOT 4)

-

Royal Dutch Shell PLC (Shell Brake and Clutch Fluid DOT 4, Shell Advance Brake Fluid DOT 5.1)

-

Indian Oil Corporation Limited (Servo Brake Fluid DOT 3, Servo Brake Fluid DOT 4)

-

Topaz Energy Group Ltd. (Topaz DOT 4 Brake Fluid, Topaz DOT 5.1 Brake Fluid)

-

Castrol Ltd. (Castrol Brake Fluid DOT 4, Castrol React Performance DOT 4)

-

Chevron Corporation (Chevron Brake Fluid DOT 3, Chevron Brake Fluid DOT 4)

-

BP plc (BP Autran DOT 4 Brake Fluid, BP Autran DOT 5.1 Brake Fluid)

-

TotalEnergies SE (Total HBF 4 Brake Fluid, Total HBF 5.1 Brake Fluid)

-

Exxon Mobil Corporation (Mobil Brake Fluid DOT 3, Mobil Brake Fluid DOT 4)

-

Amsoil Inc. (Amsoil DOT 3 and DOT 4 Synthetic Brake Fluid, Amsoil DOT 5.1 Brake Fluid)

-

Valvoline Inc. (Valvoline Brake Fluid DOT 3, Valvoline Brake Fluid DOT 4)

-

Motul S.A. (Motul DOT 3&4 Brake Fluid, Motul DOT 5.1 Brake Fluid)

-

Petro-Canada Lubricants Inc. (Petro-Canada Supreme DOT 3 Brake Fluid, Petro-Canada Supreme DOT 4 Brake Fluid)

-

Gulf Oil International Ltd. (Gulf Brake Fluid DOT 3, Gulf Brake Fluid DOT 4)

-

Petronas Lubricants International (Petronas Tutela Brake Fluid DOT 4, Petronas Tutela Brake Fluid DOT 5.1)

-

Repsol S.A. (Repsol DOT 4 Brake Fluid, Repsol DOT 5.1 Brake Fluid)

Recent Developments

-

October 2024: Chevron introduced its Rykon grease product line to the Asia-Pacific market, building on the success of its launch in North America last year.

-

February 2024: Chevron announced the introduction of Rykon, a new overbased calcium sulfonate complex grease, to its recently refreshed line of products. Chevron says Rykon meets the demand for a high-performance grease that improves uptime and enhances durability for the next generation of equipment.

-

May 2023: Castrol announced that it is expanding its product line into the Auto Care sector with a range of new products. These products include Chain Cleaner, Chain Lube, 3-in-1 Shiner, 1-Step Polishing Compound, and Anti-Rust Lubricant Spray.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.95 Billion |

| Market Size by 2032 | USD 25.70 Billion |

| CAGR | CAGR of 4.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Oil Type (Petroleum, Non-petroleum) • By Product Type (DOT 3, DOT 4, DOT 5, DOT 5.1, Others) • By Vehicle Type (Construction & Mining Equipment, Agriculture, Material Handling Vehicles, Military Vehicles) • By Application (Mining, Construction, Agriculture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BRB International BV, Fuchs Petrolub SE, Halron Lubricants Inc., Lukoil Lubricants Inc., Phillips 66 Lubricants Inc., Royal Dutch Shell PLC, Indian Oil Corporation Limited, Topaz Energy Group Ltd., Castrol Ltd., Chevron Corporation, BP plc, TotalEnergies SE, Exxon Mobil Corporation, Amsoil Inc., Valvoline Inc., Motul S.A., Petro-Canada Lubricants Inc., Gulf Oil International Ltd., Petronas Lubricants International, Repsol S.A. |

| Key Drivers | • As the off-highway vehicle market grows, there is also an increasing focus on maintenance and repair. • The increasing focus on safety in the operation of off-highway vehicles has significantly contributed to the growth of the brake oil aftermarket market. |

| Restraints | • The cost of raw materials used in the production of brake fluids, such as synthetic oils, additives, and chemicals, can change due to fluctuations in the global market. |