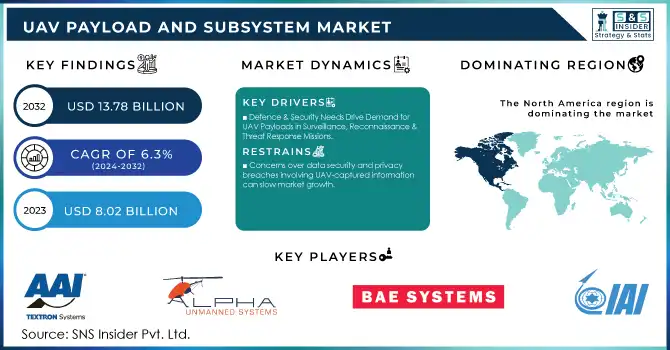

UAV Payload and Subsystem Market Size Analysis:

The UAV Payload and Subsystem Market size was USD 8.02 billion in 2023 and is expected to reach USD 13.78 billion by 2032, growing at a robust CAGR of 6.3% over the forecast period of 2024-2032. Unmanned aerial vehicles (UAVs), or drones, carry various equipment to perform specific tasks. Cameras and sensors capture high-quality images and data for surveillance, mapping, and inspections. Specialized payloads, like radars, enable operation in all weather conditions and gather communication signals. Additionally, subsystems like flight controls, propulsion systems, and data links ensure the drone's stability, flight capabilities, and data transmission. These advancements are driving growth in the UAV payload and subsystem market. Military use of drones for surveillance, combat, and communication is a major factor. Increased defence spending on advanced drones with specialized equipment is fueling this growth. Commercially, UAVs are becoming vital for tasks like monitoring, photography, and agriculture. Their versatility and cost-effectiveness are leading to wider adoption and relaxed regulations, creating a demand for customized payloads and supporting systems across various drone types and sizes.

To get more information on UAV Payload and Subsystem Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Commercial UAV Rise Drives Demand for Diverse Payloads in Agriculture, Infrastructure Inspection, Mining, Environmental Research, and Delivery Services

The commercial UAV market is growing due to its diverse applications. In agriculture, UAVs with multispectral cameras and LiDAR sensors help farmers optimize crop yields. Industries like construction use them for cost-effective and safe infrastructure inspections. Specialized payloads like 3D mapping systems and thermal cameras are used in mining and environmental research. Even delivery companies are exploring UAVs for package transport. This growing variety of commercial applications is driving demand for a wide range of specialized payloads, from high-resolution cameras to LiDAR sensors, to address the unique needs of each sector.

-

Defence & Security Needs Drive Demand for UAV Payloads in Surveillance, Reconnaissance & Threat Response Missions

RESTRAINTS:

-

High costs of advanced payloads, particularly for specialized military applications, can limit adoption.

-

Concerns over data security and privacy breaches involving UAV-captured information can slow market growth.

OPPORTUNITIES:

-

UAVs with multispectral cameras and LiDAR sensors are optimizing crop yields.

-

Cost-effective and safe inspections of pipelines, power lines, and oil rigs using specialized UAV payloads.

CHALLENGES:

-

Rapid Tech Advancements in UAV Payloads and Subsystems Create problems in Integration, Obsolescence, and Affordability

The UAV market thrives on innovation, but advancements come with hurdles. Faster development cycles for sensors, communication, and data processing mean quicker product obsolescence, forcing manufacturers to constantly adapt. Integrating these advancements into existing drones can be tricky due to compatibility issues, weight and balance changes, and software adjustments. Upgrading older UAVs is even more complex. Thus, ensuring different payloads and subsystems from various companies work seamlessly together is a challenge, often requiring custom solutions. This rapid evolution necessitates frequent upgrades, increasing operational costs and potentially straining budgets.

-

Increased Reliance on Digital Technology Makes UAVs Vulnerable to Cyberattacks and Data Breaches

IMPACT OF RUSSIA-UKRAINE WAR

The Russia and Ukraine war has disrupted the UAV Payload and Subsystems market, impacting it in several ways. There's a surge in demand for military-grade UAVs and their payloads. Countries are re-evaluating their defence capabilities and increasing investments in drones for reconnaissance, combat, and border security. This translates to a potential market growth of around 10-15% in the next two years for military-focused payloads like radar systems and precision-guided munitions. The war has also caused disruptions in the supply chain. Many crucial components for UAV payloads, like semiconductors and sensors, are manufactured in war-affected regions or by companies with ties to them. This can lead to production delays and price hikes of up to 5-8% for finished payloads. Sanctions imposed on Russia, a major player in the global arms market, may force countries to seek alternative suppliers, potentially creating new market opportunities for other manufacturers.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can slow-down the UAV Payload and Subsystems market, potentially causing a contraction of 20% to 30%. This impact is felt in several ways. The government austerity measures might lead to cuts in defence spending, impacting military UAV procurement and upgrades for payloads. The commercial sectors may limit their budgets during economic downturns, delaying or cancelling investments in UAV technology for applications like infrastructure inspection or precision agriculture. This commercial segment could also experience a similar disruption of 20% to 30%. The economic uncertainty can make investors cautious, hindering funding for innovative UAV payload and subsystem development. This could result in a slowdown in the introduction of new technologies and a dampening effect on overall market growth.

KEY MARKET SEGMENTS:

By Payload

-

C4I

-

Radar

-

Electronic Warfare (EW)

-

Electro-optic and Infrared Sensor (EO/IR)

-

Sonar

Electro-optic and Infrared Sensor (EO/IR) is the dominating sub-segment in the UAV Payload and Subsystem Market by payload holding about 45-50% of market share. EO/IR sensors offer a wide range of capabilities, including capturing high-resolution images and video in both visible and infrared light. This versatility makes them essential for various applications across military and civilian sectors, including surveillance, reconnaissance, search and rescue, and infrastructure inspection.

By Type

-

MALE UAVs

-

HALE UAVs

-

Man-portable UAVs

-

Others

MALE UAVs is the dominating sub-segment in the UAV Payload and Subsystem Market by type holding about 55-65% of market share. MALE UAVs offer a balance between flight time, payload capacity, and operational range. This makes them ideal for a wide range of missions, including surveillance, reconnaissance, border patrol, and environmental monitoring.

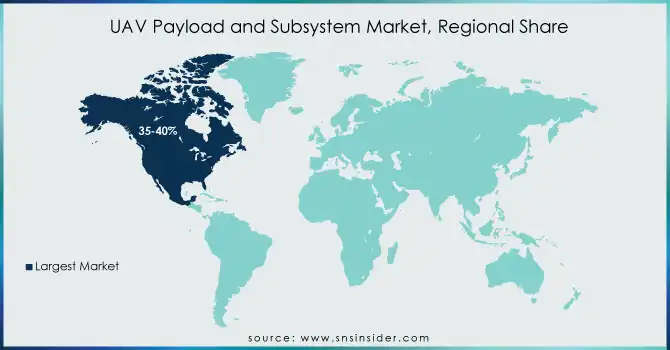

REGIONAL ANALYSES

North America is the dominating region in the UAV Payload and Subsystems Market with an estimated market share of 35-40%. This dominance stems from a powerful combination of factors: leading defence contractors like Lockheed Martin and Boeing, high military spending on advanced UAV technology, and a thriving commercial UAV sector in agriculture, infrastructure inspection, and even delivery services.

The Asia Pacific is the second highest region in this market with 25-30% of market share. Here, rapidly growing military budgets in China and India fuel demand for military UAVs, while commercial applications in agriculture, mining, and disaster management see significant investment.

Need any customization research on UAV Payload and Subsystem Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are AAI Corp, Alpha Unmanned Systems, BAE Systems, IAI, Insitu Pacific, AeroVironment,Boeing, Elbit Systems, Lockheed Martin, Northrop Grumman and other key players.

RECENT DEVELOPMENT

-

In March 2022: The British Army is acquiring Lockheed Martin's drones for £129 million to enhance ISTAR capabilities. These mini-drones, including the Stalker and Indago models, will be deployed for intelligence gathering on the front lines and beyond.

-

In Jan. 2022: YellowScan's Voyager LiDAR system brings high-precision scanning to drones. It captures detailed data on even vertical surfaces with cm accuracy, operating at an impressive 1800 kHz rate.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 8.02 Billion |

| Market Size by 2032 | US$ 13.78 Billion |

| CAGR | CAGR of 6.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload (C4I, Radar, Electronic Warfare, Electro-optic and Infrared Sensor, Sonar) • By Type (MALE UAVs, HALE UAVs, Man-portable UAVs, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AAI Corp, Alpha Unmanned Systems, BAE Systems, IAI, Insitu Pacific, AeroVironment, Boeing, Elbit Systems, Lockheed Martin, Northrop Grumman |

| Drivers | • Commercial UAV Rise Drives Demand for Diverse Payloads in Agriculture, Infrastructure Inspection, Mining, Environmental Research, and Delivery Services • Defence & Security Needs Drive Demand for UAV Payloads in Surveillance, Reconnaissance & Threat Response Missions |

| Restraints | • High costs of advanced payloads, particularly for specialized military applications, can limit adoption. • Concerns over data security and privacy breaches involving UAV-captured information can slow market growth. |