Aircraft Band Clamp Market Report Scope & Overview:

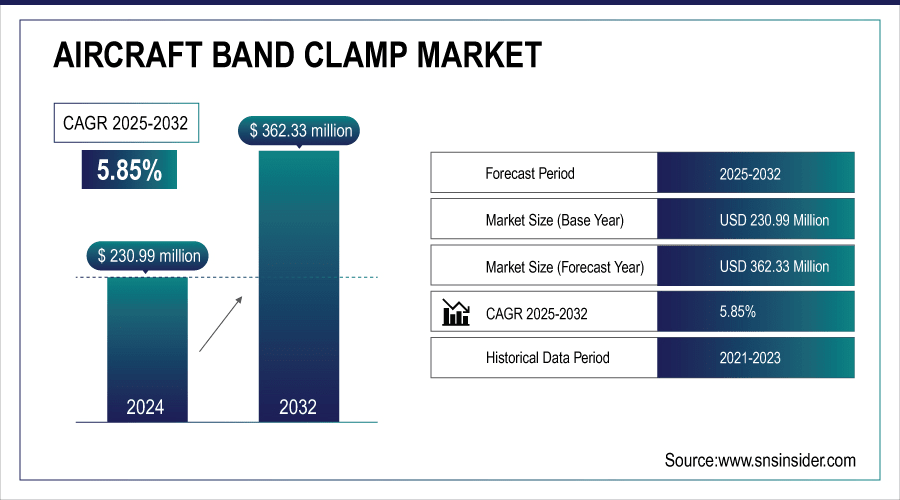

The Aircraft Band Clamp Market size was valued at USD 230.99 Million in 2024 and is projected to reach USD 362.33 Million by 2032, growing at a CAGR of 5.85% during 2025-2032.

The Aircraft Band Clamp Market is proliferating due to a growing demand for secure, high-performance fastening solutions for commercial, military, and UAV aircraft systems. The increase is fueled by rising air traffic, growing number of fleets, and safety regulations calling for ducting, engine and hydraulic connections to be reliable. The use of advanced materials such as titanium and stainless steel, paired with low-weight and vibration resistance, advances adoption in the engine, airframe and fuel systems that propel steady global growth.

In 2024, Airbus delivered 766 commercial aircraft, while Boeing delivered 318 jets, indicating a strong demand for new aircraft

To Get More Information On Aircraft Band Clamp Market - Request Free Sample Report

Key Aircraft Band Clamp Market Trends

• Rapid growth in commercial aviation and military aircraft fleets globally.

• Rising air passenger traffic and increasing defense spending boosting aircraft production and MRO activities.

• Stringent safety and quality regulations mandating reliable connections in engine, fuel, hydraulic, and airframe systems.

• Shift toward lightweight, corrosion-resistant materials such as titanium and stainless steel enhancing aircraft efficiency and longevity.

• Increasing adoption of UAVs and electric/hybrid aircraft, along with modernization and retrofitting programs, driving demand for advanced clamp solutions.

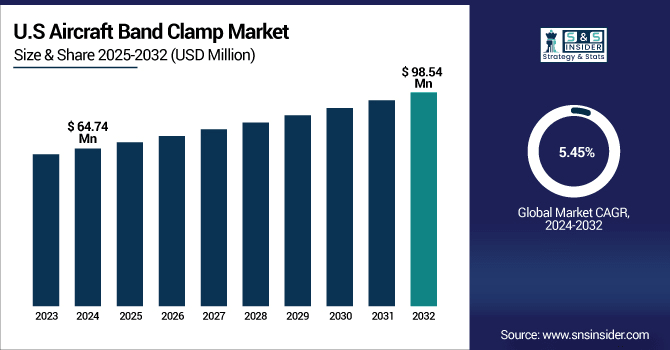

The U.S. Aircraft Band Clamp Market size was valued at USD 64.74 Million in 2024 and is projected to reach USD 98.54 Million by 2032, growing at a CAGR of 5.45% during 2025-2032. The U.S. Aircraft Band Clamp Market is growing due to increasing commercial and military aircraft deliveries, fleet expansions, and rising UAV adoption. Stringent FAA safety regulations, demand for lightweight and corrosion-resistant materials like titanium and stainless steel, and the need for reliable engine, airframe, and fuel system connections further drive market growth.

Aircraft Band Clamp Market Growth Drivers:

-

Commercial Aviation and Military Fleet Expansion Propel Global Demand for Advanced Lightweight Corrosion Resistant Aircraft Band Clamps

The global Aircraft Band Clamp Market is primarily driven by the rapid growth in commercial aviation and military aircraft fleets worldwide. Rising air passenger traffic and increasing defense spending are boosting aircraft production and MRO activities, creating higher demand for secure, high-performance fastening solutions. Stringent safety and quality regulations mandate reliable connections in engine, fuel, hydraulic, and airframe systems, further supporting market adoption. Additionally, the shift toward lightweight, corrosion-resistant materials such as titanium and stainless steel enhances aircraft efficiency and longevity, encouraging the integration of advanced band clamps across new and existing aircraft platforms.

With over 17,000 aircraft still waiting at the end of OEM order books, the demand for secure, high-performance fastening solutions is at an all-time high.

Aircraft Band Clamp Market Restraints:

-

Regulatory Compliance Installation Complexity and Material Availability Restrain Growth of Aircraft Band Clamp Market

The Aircraft Band Clamp Market faces restraints from strict regulatory compliance and certification requirements, which can delay product approvals and limit rapid adoption. Additionally, complex installation processes and the need for highly skilled technicians in specialized aircraft systems may hinder widespread deployment. Variability in material availability and long lead times for high-performance alloys also pose operational challenges.

Aircraft Band Clamp Market Opportunities:

-

UAVs and Electric Aircraft Drive Growth Opportunities for Advanced Lightweight Vibration Resistant Aircraft Band Clamps

Emerging trends in unmanned aerial vehicles (UAVs) and electric/hybrid aircraft present significant growth opportunities. The increasing focus on aircraft modernization and retrofitting programs in Asia-Pacific and the Middle East provides scope for advanced clamp solutions. Innovations in vibration-resistant and low-weight clamp designs can meet evolving aerospace requirements, expanding applications in engine, airframe, and fuel systems. Partnerships with OEMs, MRO providers, and defense agencies offer additional avenues for market penetration and global expansion.

In May 2025, India and Pakistan engaged in large-scale drone warfare during skirmishes, marking a shift towards unmanned systems in military operations.

Aircraft Band Clamp Market Segment Analysis

-

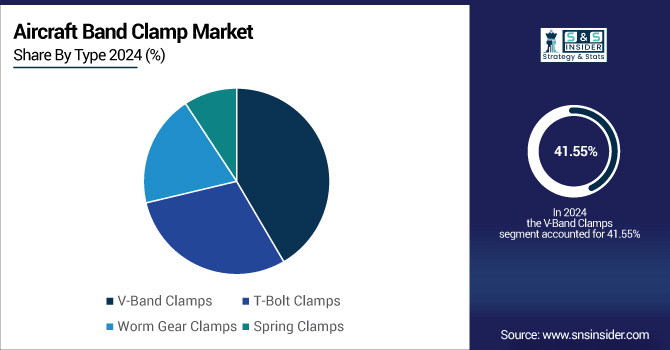

By Type, V-Band Clamps dominated the market in 2024 with a 41.55% share and are projected to register the highest growth rate of 6.24% CAGR from 2025 to 2032.

-

By Material, Stainless steel accounted for 46.35% of the market in 2024, while titanium is expected to register a growth rate of 6.69% CAGR over the forecast period.

-

By Application, Engine Systems held a 38.52% share in 2024, while Fuel & Hydraulic Systems are expected to grow at a CAGR of 6.77%.

-

By End User, Commercial Aviation accounted for 44.84% of the market in 2024, while Unmanned Aerial Vehicles (UAVs) are expected to grow at a CAGR of 6.89%.

By Type, V-Band Clamps Dominate Market and Drive Fastest Growth Across Engine Airframe and Fuel Systems

V-Band Clamps dominated the Aircraft Band Clamp Market in 2024 and are expected to register the fastest growth from 2025 to 2032. These clamps are widely used in engine exhaust, turbochargers, and high-temperature applications due to their superior strength, reliability, and ease of installation. Rising demand from commercial, military, and UAV aircraft, coupled with the adoption of lightweight, corrosion-resistant materials, is driving market expansion. Their versatility across engine, airframe, and fuel systems further supports steady global growth.

By Material, Stainless Steel Leads Market While Titanium Emerges as Fastest Growing Material in Aircraft Band Clamps

Stainless steel dominated the Aircraft Band Clamp Market in 2024 due to its corrosion resistance, durability, and cost-effectiveness in various aerospace applications. Meanwhile, titanium is expected to register the fastest growth from 2025 to 2032, driven by its lightweight, high-strength properties that enhance fuel efficiency and performance. Increasing adoption in engine, airframe, and fuel systems, along with advanced aircraft designs, is fueling the rising demand for titanium band clamps globally.

By Application, Engine Systems Lead Market While Fuel and Hydraulic Systems Propel Fastest Growth in Aircraft Band Clamps

Engine Systems dominated the Aircraft Band Clamp Market in 2024, owing to their critical role in exhaust, turbocharger, and high-temperature applications. Meanwhile, Fuel & Hydraulic Systems are expected to register the fastest growth, driven by increasing demand for secure, reliable connections in advanced aircraft fuel and hydraulic networks, as well as the adoption of lightweight and corrosion-resistant clamp materials across modern aerospace platforms.

By End User, Commercial Aviation Leads While UAVs Drive Rapid Growth in Aircraft Band Clamp Market

Commercial Aviation dominated the Aircraft Band Clamp Market in 2024 due to the large fleet size and continuous maintenance, repair, and overhaul (MRO) activities. Unmanned Aerial Vehicles (UAVs) are expected to register the fastest growth, driven by rising adoption in defense, surveillance, and commercial applications, along with the need for lightweight, high-performance fastening solutions in advanced drone and autonomous aircraft systems.

Aircraft Band Clamp Market Report Analysis

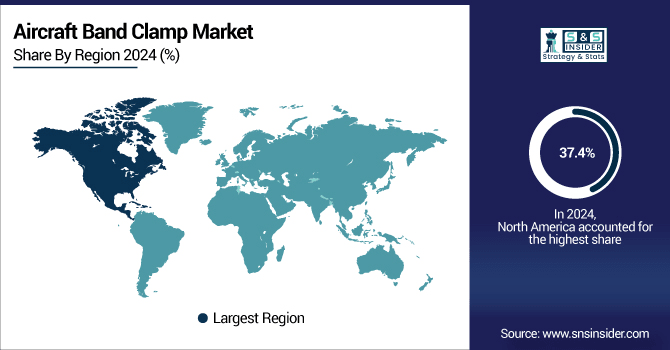

North America Aircraft Band Clamp Market Insights

North America dominated the Aircraft Band Clamp Market in 2024 with a 37.4% share, driven by high aircraft production, extensive MRO activities, and stringent safety regulations. Growing commercial and military fleets, coupled with the adoption of advanced materials like stainless steel and titanium, are boosting demand for reliable, high-performance clamps across engine, airframe, and fuel systems, supporting steady regional growth.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. America Aircraft Band Clamp Market Insights

The United States led the region, owing to its largest commercial and defense aircraft fleet, advanced aerospace infrastructure, and significant aircraft manufacturing and maintenance activities.

Asia Pacific Aircraft Band Clamp Market Insights

Asia-Pacific is expected to grow the fastest in the Aircraft Band Clamp Market from 2025 to 2032, registering a 6.52% CAGR, driven by rising aircraft production, fleet expansions, and increasing MRO activities. Rapid adoption of advanced materials and modern aircraft technologies in engine, airframe, and fuel systems further supports market growth, making the region a key focus for manufacturers and suppliers.

China Aircraft Band Clamp Market Insights

China dominated the region due to its expanding commercial aircraft fleet, growing defense aviation sector, large-scale aircraft manufacturing, and increasing investments in aerospace modernization and maintenance programs.

Europe Aircraft Band Clamp Market Insights

Europe accounted for a significant share of the Aircraft Band Clamp Market in 2024, driven by advanced aerospace manufacturing, stringent safety regulations, and continuous MRO activities. High adoption of corrosion-resistant and lightweight materials in engine, airframe, and fuel systems supports steady regional growth.

France Aircraft Band Clamp Market Insights

France dominated the region, owing to Airbus operations, a strong commercial and defense aircraft fleet, and well-established aerospace infrastructure and maintenance capabilities.

Latin America (LATAM) and Middle East & Africa (MEA) Aircraft Band Clamp Market Insights

Latin America (LATAM) and Middle East & Africa (MEA) hold emerging opportunities in the Aircraft Band Clamp Market, driven by growing commercial and military aircraft fleets and increasing MRO activities. Investments in aerospace infrastructure, adoption of lightweight and corrosion-resistant materials, and modernization of airframe, engine, and fuel systems are supporting steady regional growth, while defense procurement programs and expanding aviation sectors further boost demand for high-performance fastening solutions.

Competitive Landscape for Aircraft Band Clamp Market:

TransDigm Group is a leading U.S.-based aerospace manufacturer specializing in engineered components, including band clamps, for commercial and military aircraft. Their products are integral to various aircraft systems, ensuring secure and efficient connections in demanding environments. With a robust portfolio of proprietary products, TransDigm plays a pivotal role in the aerospace industry's supply chain.

-

In June 2025, TransDigm announced the acquisition of Simmonds Precision Products from RTX Corp for approximately USD 765 million. Simmonds specializes in advanced aerospace technologies, including fuel and proximity sensing systems, which are integral to aircraft systems where band clamps are used.

Mikalor is a Spanish manufacturer specializing in high-performance hose clamps, including the ASFA and Supra series, which are widely used in aerospace applications. Established in 1943 and headquartered in Sabadell, Barcelona, Mikalor offers a comprehensive range of clamps designed to meet stringent industry standards. Their products are engineered to ensure secure, leak-tight connections in demanding environments, making them integral components in various aircraft systems

-

In June 2024, Mikalor has introduced the ASFA Constant Tension Hose Clamps, designed to meet the highest standards of quality and efficiency. These clamps are particularly beneficial in applications where maintaining consistent pressure is crucial, such as in the aerospace industry.

Aircraft Band Clamp Market Key Players:

Some of the Aircraft Band Clamp Market Companies

-

Eaton Corporation

-

TransDigm Group

-

AmSafe Bridport

-

Caillau

-

Ideal Clamp Products (Ideal Tridon Group)

-

Clampco Products Inc.

-

Teconnex Ltd.

-

Normelemente (Norelem)

-

JCS Hi-Torque Ltd.

-

Rotor Clip Company Inc.

-

Mikalor Group

-

Breeze Industrial Products

-

Murray Corporation

-

Oetiker Group

-

Lisi Aerospace

-

Band-It (part of IDEX Corporation)

-

Sky Clamps Inc.

-

ABA (part of NORMA Group)

-

Kuriyama of America Inc.

-

HCL Clamping Solutions

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 230.99 Million |

| Market Size by 2032 | USD 362.33 Million |

| CAGR | CAGR of 5.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (V-Band Clamps, T-Bolt Clamps, Worm Gear Clamps, and Spring Clamps) • By Material (Stainless Steel, Aluminum, Titanium, and Others (Nickel Alloys, Composite Materials)) • By Application (Engine Systems, Airframe Systems, Fuel & Hydraulic Systems, and Avionics & Electrical Systems) • By End User (Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicles (UAVs)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Eaton Corporation, TransDigm Group, AmSafe Bridport, Caillau, Ideal Clamp Products, Clampco Products Inc., Teconnex Ltd., Norelem, JCS Hi-Torque Ltd., Rotor Clip Company Inc., Mikalor Group, Breeze Industrial Products, Murray Corporation, Oetiker Group, Lisi Aerospace, Band-It (IDEX Corporation), Sky Clamps Inc., ABA (NORMA Group), Kuriyama of America Inc., HCL Clamping Solutions. |