Underwater Communication System Market Report Scope & Overview:

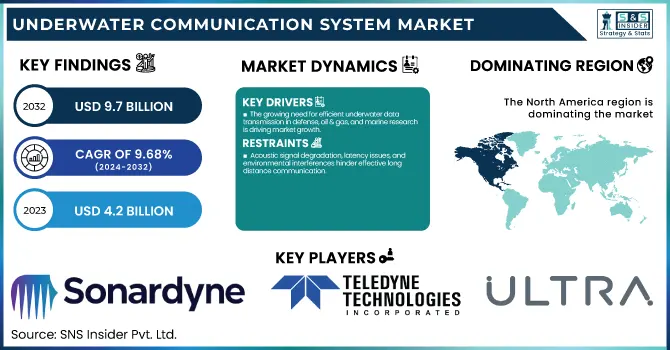

The Underwater Communication System Market was valued at USD 4.2 Billion in 2023 and is expected to reach USD 9.7 Billion by 2032, growing at a CAGR of 9.68% from 2024-2032.

To Get more information on Underwater Communication System Market - Request Free Sample Report

This report analyzes the Underwater Communication System Market, focusing on key trends, adoption rates, and technological advancements shaping the industry. The adoption of underwater communication technologies is rising across industries such as defense, oil & gas, and marine research, driven by the need for secure and efficient data transmission. The expansion of underwater network infrastructure varies by region, with significant investments in subsea communication cables and acoustic relay stations to support maritime security and offshore energy projects. Signal transmission efficiency differs across frequency bands, with Very Low Frequency, Low Frequency, and acoustic waves being evaluated for their performance in deep-sea environments, particularly in terms of latency and range. Military and commercial investments in underwater communication have surged between 2020 and 2023, fueling advancements in naval communication systems, autonomous underwater vehicles, and offshore monitoring technologies.

Underwater Communication System Market Dynamics

Drivers

-

The growing need for efficient underwater data transmission in defense, oil & gas, and marine research is driving market growth.

Market growth is primarily driven by the need for secure and efficient underwater communication for defense, oil & gas exploration, and marine research. Armed forces across the globe need advanced underwater communication systems for effective submarine-to-submarine and submarine-to-surface operations to maintain a strategic edge in maritime security. In addition, offshore energy firms utilize these technologies to monitor underwater assets such as oil rigs and pipelines in real time. The increasing use of AUVs and ROVs also drives the demand for continuous data transmission in the deep sea, which further stimulates the development and investment of underwater communication technologies.

Restraints

-

Acoustic signal degradation, latency issues, and environmental interferences hinder effective long-distance communication.

Signal attenuation and bandwidth limitation are a significant challenge for underwater communication systems that must transmit data effectively over long distances. Terrestrial communication is empowered but underwater communication signals are mostly limited to acoustic waves which suffer from many problems including high latency, strong interference, and low range. Signal quality further affects environmental factors like salinity, temperature, and ocean currents. It restricts real-time data transfer with mission-critical applications such as naval operations and deep-sea research. While there are optical and radio frequency communication solutions presently under investigation, it is limited in deep-sea environments, restricting the market growth opportunities considerably.

Opportunities

-

Innovations in acoustic modems, optical wireless systems, and AI-driven networks are enhancing underwater communication efficiency.

Large demand for underwater communication systems is opening new opportunities in architectural communication due to acoustic and optical communication technology. The evolution of ultra-low latency acoustic modems, and high-speed optical wireless communication, are pushing the limits of data transfer in the deep sea. In particular, optical communication is becoming popular for real-time underwater video communication for both research and defense as it enhances short-distance communication with high bandwidth. Moreover, AI and machine learning applications in underwater networks applications in adaptive signal processing, interference mitigation, and efficiency improvement. These developments are poised to fuel the demand for next-generation underwater communication products with wider military, offshore energy, and marine exploration applications.

Challenges

-

Expensive infrastructure installation, frequent maintenance, and harsh marine conditions limit market expansion.

The cost associated with the installation and maintenance of underwater communication systems is high which acts as a major restraint to the growth of the market. Setting up communication infrastructure underwater necessitates specialized gear, the right humans, in addition to stringent environmental evaluations. Further, underwater systems are susceptible to marine environments that result in regular maintenance requirements, in turn, incurring high operational costs. Expenses are added by the need to replace damaged cables, transceivers, and acoustic modems, which limits large-scale deployment by small organizations and developing economies. Though there are efforts towards wireless underwater networks and autonomous solutions for maintenance, the cost remains a major hurdle to widespread adoption, constraining the growth of the market in the short term.

Underwater Communication System Market Segmentation Analysis

By Component

The hardware segment dominated the market and accounted for the largest revenue share of 59% in 2023. Some common hardware components used in underwater communication are: LCD, capacitors, resistors, cables & connectors, transistors, PCB, Diodes, adapters/transformers, LEDs, and push buttons. These devices send messages over the water, and the electronic parts are assembled on special circuit boards. It has hardware implementations for reconstruction and amplification filters with a low cost and complexity while providing high flexibility.

The services segment is expected to register the fastest CAGR between 2024 and 2032. UCS offers engineering services and maritime solutions including systems engineering, maintenance, and technical support. SEASCAPE is a corporation that sells, produces, and services underwater equipment and gadgets.

By Connectivity

In 2023, the wireless segment dominated the market and accounted for the largest revenue share of 66%. This segment is expected to register the fastest CAGR over the forecast period. A method called Wireless data transmission transportation uses water as a medium. Underwater wireless communications can currently be simplified, despite the unique and extreme conditions that characterize underwater channels, which are used in the fields of environmental monitoring, underwater exploration, and scientific data collection.

The hardwired communication segment is expected to register a significant CAGR throughout the forecast period. In the case of hardwired communication, a cable is used to carry data. However, even if many divers would much rather dive where they want with the option to communicate without a cable, for professional divers this is not necessarily the best option given the environment, scenario, and function of the job needing to be carried out.

By Application

The environmental monitoring segment dominated the market in 2023 with a significant revenue share. These methods can also be used to assess and control environmental contamination. Evidence of climate change is also arguably visible. It can predict natural catastrophes by identifying warning signs of risks. This makes the chances of it happening a lesser evil.

The oceanography segment is projected to register the fastest CAGR during the forecast period. They are often used to explore oceans and collect data which helps UCS to study oceanography. Such underwater findings can benefit the health industry and facilitate the evolution of existing technologies.

By End-User

The scientific research & development segment dominated the market and accounted for a significant revenue share in 2023. A UCS also helps scientific research. Wrecked planes have also been found using autonomous underwater vehicles, and used to study the causes of their crashes. When communication systems came about, they discovered the wreckage of the Titanic and hydrothermal vent systems in the deep ocean.

The military & defense segment is expected to register the fastest CAGR during the forecast period, It is used by the military for underwater observance and incursion detection also. Opposing states might root sabotage through the water, conversely, mounting a treatment system can notify the nation that there is an impending danger.

Regional Landscape

In 2023, North America dominated the market and accounted for the largest revenue share in the global market at 34%. North America is expected to have the largest share of underwater acoustic communication. The U.S. has started to deploy those unmanned underwater vehicles— which will be used in these countries for different air, anti-air, and anti-submarine warfare, security and surveillance purposes, due to growing security concerns in these nations.

The Asia Pacific region is expected to register the fastest CAGR during the forecast period. Driven by multiple application applications for ecological tracking, contamination surveillance, environment recording, hydrography, oceanography, aquaculture fisheries, and diving. The increased research and development activities for the development of novel and advanced underwater communication technologies in the region are stimulating the market growth of the underwater communication system market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Sonardyne International Ltd. – BlueComm Optical Modem

-

Teledyne Technologies Incorporated – Teledyne Benthos Acoustic Modems

-

Ultra Electronics Holdings plc – UnderSea Acoustic Communication System

-

EvoLogics GmbH – S2C Acoustic Modems

-

Kongsberg Gruppen ASA – cNODE Modems

-

Thales Group – BlueScan Acoustic System

-

L3Harris Technologies, Inc. – UUV Acoustic Communication System

-

Sea and Land Technologies Pte Ltd – Seatext Underwater Modems

-

Aquatec Group Ltd. – AQUAmod Acoustic Modems

-

DSIT Solutions Ltd. – PointShield Diver Detection System

-

Hydroacoustic Inc. – HLF-5000 Underwater Acoustic Transceiver

-

Ocean Technology Systems (OTS) – Aquacom SSB-2010 Wireless Communicator

-

Zebra-Tech Ltd. – Hydro-Wireless Acoustic Modems

-

Mistral Solutions Pvt. Ltd. – Tactical Underwater Communication System

-

Japan Radio Co., Ltd. – JHS-800S Submarine Communication System

Recent Developments

-

In December 2024, Italy's Fincantieri and Telecom Italia's submarine cables unit, Sparkle, agreed to develop solutions for the surveillance and protection of submarine telecommunications cables.

-

In May 2024, CSignum introduced the EM-2 wireless platform, designed for IoT sensor data transmission and control, enabling seamless communication between underwater sensors and surface or land-based systems, enhancing underwater data networking across multiple applications.

-

In January 2024, WSense, a deep-tech spinoff from Sapienza University, and Alcatel Submarine Networks (ASN), part of Nokia, signed an MOU to develop next-generation underwater wireless communication systems combining their monitoring and transmission technologies.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 4.2 Billion |

|

Market Size by 2032 |

US$ 9.7 Billion |

|

CAGR |

CAGR of 9.68 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Sonardyne International Ltd., Teledyne Technologies Incorporated, Ultra Electronics Holdings plc, EvoLogics GmbH, Kongsberg Gruppen ASA, Thales Group, L3Harris Technologies, Inc., Sea and Land Technologies Pte Ltd, Aquatec Group Ltd., DSIT Solutions Ltd., Hydroacoustic Inc., Ocean Technology Systems (OTS), Zebra-Tech Ltd., Mistral Solutions Pvt. Ltd., Japan Radio Co., Ltd. |