Intrusion Detection System Market Report Scope & Overview:

To Get More Information on Intrusion Detection System Market - Request Sample Report

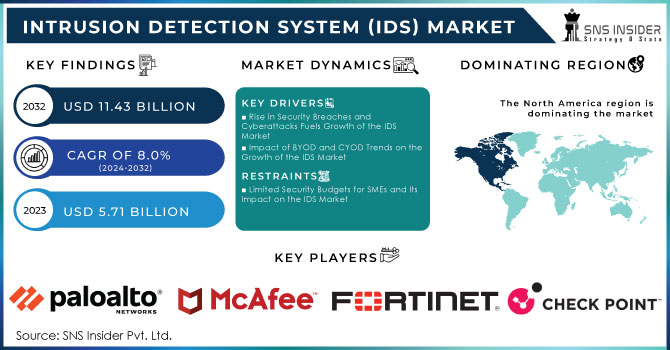

The Intrusion Detection System (IDS) Market Size was valued at USD 5.71 Billion in 2023 and is expected to reach USD 11.43 Billion by 2032 and grow at a CAGR of 8.0% over the forecast period 2024-2032.

An emerging IDS market exists as a result of the growing need for efficient solutions to robust cybersecurity in a world where digital threats are rising to high levels day after day. IDS plays an integral role in identifying malicious activities or policy violations within a network, hence making them an important part of a defence strategy within an organization. The monitoring systems track network traffic, which means they detect suspicious activities that may define potential cyber-attacks. With more and more markets embracing advanced security measures to protect sensitive information, and critical infrastructures, and to comply with government regulations, market IDS is on a steep growth curve. The following is an overview of the major growth drivers in the IDS market.

The increasing sophistication and virulence of cyberattacks is, however, one of the major driving factors behind the IDS market. Cybercriminals are continually evolving more sophisticated methods such as Distributed Denial of Service (DDoS), ransomware, and pushing attacks targeting organizations irrespective of sectors. For this reason, companies have begun using IDS solutions to strengthen their defences by real-time monitoring and threat detection. According to Cybersecurity Ventures, cybercrime costs are expected to grow to USD 10.5 trillion annually by 2025, and thus, investment in such strong security systems as IDS is crucial in preventing financial loss and reputational damage. This can also be seen in the initiatives of the U.S. Department of Homeland Security (DHS), where national cybersecurity has been reinforced with programs such as the EINSTEIN program an IDS-based system that detects and prevents cyber threats across federal networks. These government initiatives underscore the utmost importance of IDS in securing national infrastructure. Growing cyber threats and the emergence of increasingly sophisticated attack methodologies, like zero-day vulnerabilities and APTs, demonstrate the pressing need for IDS technologies that detect known and new threats. Therefore, a tremendous increase in the IDS market is expected, as it simply mirrors the increasing threat landscape.

MARKET DYNAMICS

KEY DRIVERS:

• Rise in Security Breaches and Cyberattacks Fuels Growth of the IDS Market

The rising phenomenon of intense cyberattacks on a global level is a very compelling factor in installing Intrusion Detection Systems. Such attacks most often relate to sophisticated politically motivated or financially driven attacks on endpoints, networks, and IT infrastructures with consequent attrition of tremendous data loss among individuals, corporations, and government entities. The Identity Theft Resource Centre reports data breaches in the U.S. alone affected over 422 million individuals during 2022, a 41.5 percent increase over 2021, further highlighting the rising threat landscape. Increased dependency on digital transactions across finance, healthcare, and e-commerce continues to amplify the risk of security breaches. With much sensitive data now being processed and stored online, the risk of data leaks or theft increases and calls for more advanced systems of detection and prevention.

• Impact of BYOD and CYOD Trends on the Growth of the IDS Market

The BYOD and CYOD models in organizations have grown rapidly to increase the implementation of intrusion detection and prevention systems as a form of protection from cyber-attacks. In addition to growing reliance on the BYOD and CYOD model, people in an organization use personal or company-selected devices such as smartphones, laptops, or tablets to access corporate networks remotely. This change has increased the attack surface for potential cyber threats because those devices can become vulnerable entry points for malicious actors. What is more, workers access corporate data from diverse locations and devices, so there is a great urge to make the devices and networks more secure.

In light of this trend of mobile and remote working, organizations have had to adopt the most updated security solutions such as IDPS, which monitor and detect anomalies in the connected devices and ensure secure access to the corporate networks. The global IDPS market will quite be promising because companies are still looking to invest in the solutions that secure their growing digital infrastructure. The U.S. The National Institute of Standards and Technology says "As BYOD becomes more pervasive, companies will have to balance the trend with the need for cybersecurity, since there is an associated security risk when personal devices are used for business functions."

RESTRAIN:

• Limited Security Budgets for SMEs and Its Impact on the IDS Market

SMEs face great challenges in cyber security because of small budgets which may prohibit them from installing advanced security solutions that entail more than just the point solutions, for example, Intrusion Detection Systems. Large corporations can allocate large sums of money towards establishing strong information security infrastructure whilst SME needs to split their budget across several IT investments which in most cases hold priorities to issues in immediate operational needs rather than in cyber security. There is also the high R&D expenditure when designing such next-generation cybersecurity solutions as IDS, which contributes to why these technologies come at a cost. Such high prices mean that smaller organizations cannot hope to achieve even a fraction of the security levels enjoyed by their more prominent counterparts, thus becoming easy targets for cyberattacks. According to the survey, by the Ponemon Institute, nearly 60% of small businesses have been victims of a cyberattack. As such, there's an urgent need for at least decent affordability in cybersecurity solutions. For most SMEs, however, such a well-rounded IDS solution needed to detect and neutralize such attacks would prove unaffordable. Furthermore, the US Small Business Administration has reported that 43% of all cybersecurity attacks target small businesses, thereby making it riskier for those small businesses that spend less on their security. Apart from these costs, SMEs have to incur the recruitment of cybersecurity experts to run these systems with additional financial burdens that exacerbate the situation. Despite these financial constraints, cloud-based IDS solutions are a better and more cost-effective solution for SMEs with scalable security systems at lower up-front costs. Government efforts, through such programs as the Cybersecurity and Infrastructure Security Agency (CISA) providing small businesses with cybersecurity guides, are also part of bridge-building activities that advance accessible and affordable mechanisms in cybersecurity.

MARKET SEGMENTATION ANALYSIS

BY COMPONENT TYPE

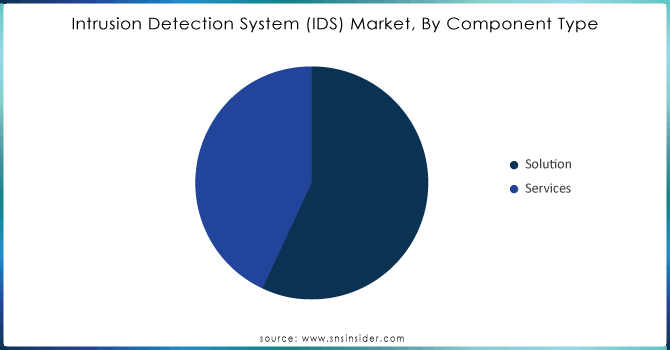

In 2023, the Solution Segment led the global Intrusion Detection System (IDS) market with a significant revenue share of about 56.00%, majorly due to the increasing demand for sophisticated cybersecurity strategies in light of increasing cyber-attacks. Organizations are increasingly investing in deploying robust IDS solutions to improve their security posture. Major players, such as Cisco Systems have designed cutting-edge AI-based IDS capabilities to increase their threat detection and response capabilities. In the meantime, Palo Alto Networks also pushed its cloud-based IDS solutions to hybrid environments. This should help ensure that the organization can scale its security infrastructure effectively. Such a rising need for effective intrusion detection must be complemented by similar initiatives from the Cybersecurity and Infrastructure Security Agency (CISA), which regards real-time monitoring tools as critical to safeguarding the nation's critical infrastructure. The rise in cybercrime tactics will just increase the focus on IDS solutions, as they comprise a vital part of cybersecurity.

The Services Segment is expected to grow the most in the IDS market during the forecast period. It will have an estimated CAGR of 9.33%. It is driven by increased demand for managed security services and expert advice on tackling sophisticated cyber threats. For instance, IBM expanded its services to include advanced analytics in its managed security services to better detect threats and respond more effectively. Fortinet, not long ago, launched FortiGuard, which includes tailored detection of threat capabilities and incident response. McAfee recently launched a new set of managed security services targeting the real-time monitoring of emerging threats so organizations become responsive in a timely fashion. As companies are looking for integrated solutions that combine technology with expert services, the IDS service is going to rise in demand and will form a vital part of modern strategies on cybersecurity.

Do You Need any Customization Research on Intrusion Detection System Market - Inquire Now

BY DEPLOYMENT TYPE

Cloud-based was the largest segment in the intrude detection system (IDS) market in 2023. The segment accounted for 66.00% of revenue. It is because organizations these days are adopting cloud technology to achieve scalable and flexible security solutions without the burden of carrying on-premises infrastructure. These innovations have further empowered AWS to introduce the Amazon GuardDuty, a cloud-native threat detection service, that continuously scans for malicious activity and unauthorized behavior thereby emphasizing more cloud-based security. Cisco also extended its cloud security portfolio by integrating advanced IDS features that allow organizations to protect data stored within various environments of the cloud. With the growing demand for cloud-based infrastructure among enterprises, the requirement for solid IDS solutions in the cloud is expected to rise exponentially and hence will constitute a critically vital area in the overall IDS market.

The infrastructure-Based segment in the Intrusion Detection System (IDS) market is expected to grow at the highest compound annual growth rate over the coming years due to the need for customized security solutions for the on-premises environment. This growth is enormously impacted by the rise in cybersecurity threats on critical infrastructures in the financial, healthcare, and government sectors. which streamlines threat detection and response across network environments. In addition, IBM has designed its QRadar system, which offers rich visibility into network flows, enabling organizations to become aware of potential intrusions more easily. As organizations continue to pay greater attention to securing their infrastructure, investments in robust IDS solutions are expected to increase dramatically.

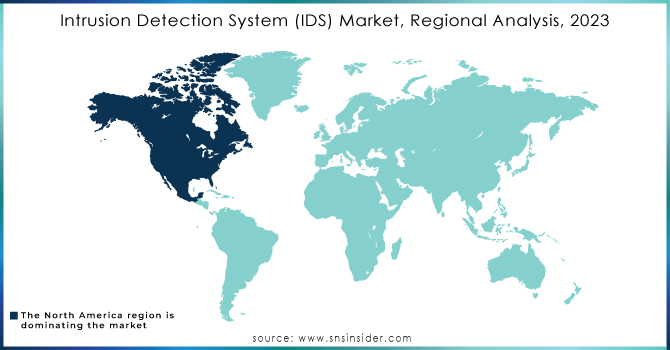

REGIONAL ANALYSIS

North America is one of the most prized markets for intrusion detection systems currently and is likely to continue in the future as well, due to soaring government spending on data safety & security, the mature IT industry, and growing awareness about security solutions. Countries like the USA are witnessing a high demand for intrusion detection systems as cases of cyberattacks are on the rise. At times, these countries have accused their adversaries, including Russia and China, of launching cyber-attacks. The threat of such cyber-attacks in these countries is fueling the growth of the intrusion detection system market.

The Asia Pacific IDS market is expected to grow at a healthy CAGR of 10.23% over the review period, led by several factors. Notably, the emerging IT infrastructure in countries such as India and China is driving the adoption of advanced security solutions. For example, the Indian government has allocated around USD 14 billion towards strengthening the cybersecurity infrastructure of the country under its National Cyber Security Strategy. Another factor is the growth of cloud computing in the region, where Frost & Sullivan has indicated that growth is expected to be 30% per year. Scalable IDSs that can monitor and protect the cloud environment will become more important. Government support also increases this growth trend. For instance, Singapore's Cybersecurity Strategy 2021 commits to public-private partnerships toward strengthening cybersecurity efforts, which has triggered enterprises to move forward toward the advanced protection offered by modern IDS technologies. The potential escalation in demand for IDSs will be justified by the relevance of sound security frameworks in organizations, which will give an impetus to market growth in the Asia-Pacific region.

Key Players

Some of the major players in the Intrusion Detection System Market are:

-

Palo Alto Networks (Palo Alto Networks WildFire, Cortex XDR)

-

Cisco (Cisco Firepower Next-Generation Firewall, Cisco Advanced Malware Protection)

-

McAfee (McAfee Enterprise Security Manager, McAfee Advanced Threat Protection)

-

Fortinet (FortiGate Next-Generation Firewall, FortiSandbox)

-

IBM (IBM QRadar Security Intelligence Platform, IBM Security Guardium Data Security Platform)

-

Check Point Software Technologies (Check Point Infinity Architecture, Check Point Threat Prevention)

-

Trend Micro (Trend Micro Deep Security, Trend Micro Network Security Platform)

-

Sophos (Sophos XG Firewall, Sophos Intercept X Advanced Endpoint Protection)

-

Kaspersky (Kaspersky Security Center, Kaspersky Endpoint Security)

-

Symantec (Symantec Endpoint Protection, Symantec Advanced Threat Protection)

-

Rapid7 (InsightVM Vulnerability Management, InsightIDR Security Detection and Response)

-

Darktrace (Darktrace Enterprise Immune System, Darktrace Antigena)

-

CrowdStrike, (CrowdStrike Falcon Platform, CrowdStrike Falcon Endpoint Protection)

-

Carbon Black (Carbon Black Cloud Platform, Carbon Black Endpoint Protection)

-

Qualys (Qualys Vulnerability Management and Compliance, Qualys Cloud Agent)

-

Tripwire (Tripwire Enterprise, Tripwire Log Center)

-

ArcSight (ArcSight Enterprise Security Management (ESM), ArcSight Logger)

-

LogRhythm (LogRhythm NextGen SIEM, LogRhythm Threat Detection and Response)

-

AlienVault (AlienVault OSSIM, AlienVault Threat Intelligence Platform)

-

Suricata (Suricata Open-source IDS, Suricata Cloud IDS)

List of the Suppliers

-

Cisco Systems, Inc.

-

McAfee, LLC

-

Palo Alto Networks, Inc.

-

Fortinet, Inc.

-

IBM Corporation

-

Juniper Networks, Inc.

-

Check Point Software Technologies

-

FireEye, Inc.

-

AT&T Cybersecurity

-

Rapid7, Inc.

RECENT TRENDS

-

In June 2024: the rail system will install an optical fiber-based intrusion detection system along its 33-km Kottekkad-Madukkarai section. This would be the first time the Southern Railway would be using the system, which has been successfully installed in four divisions of the NFR.

-

In August 2024: Fortinet the global cybersecurity leader that builds trust in and protects the digital world, delivering comprehensive, end-to-end security and strong risk/reward. today announced enhancements to its OT security platform, a benchmark for the industry as the most comprehensive. The new features enhance the company's customers' ability to improve secure networking and security operations capabilities while further expanding Fortinet's strategic alliances with some of the top OT vendors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.71 Billion |

| Market Size by 2032 | US$ 11.43 Billion |

| CAGR | CAGR of 8.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User Type (BFSI, IT & Communication, Aerospace and Defense, Software Industry, Manufacturing) • By Deployment Type (Cloud-Based, Infrastructure-Based) • By Component Type (Solution, SERVICES) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Palo Alto Networks, Cisco, McAfee, Fortinet, IBM, Check Point Software Technologies, Trend Micro, Sophos, Kaspersky, Symantec, Rapid7, Darktrace, CrowdStrike, Carbon Black, Qualys, Tripwire, ArcSight, LogRhythm, AlienVault, Suricata |

| Key Drivers | • Rise in Security Breaches and Cyberattacks Fuels Growth of the IDS Market • Impact of BYOD and CYOD Trends on the Growth of the IDS Market |

| Restraints | • Limited Security Budgets for SMEs and Its Impact on the IDS Market |