Underwater Concrete Market Report Scope & Overview:

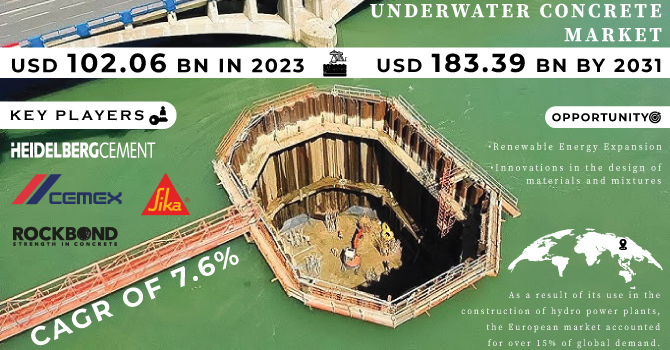

The Underwater Concrete Market size was USD 102.06 billion in 2023 and is expected to Reach USD 183.39 billion by 2031 and grow at a CAGR of 7.6 % over the forecast period of 2024-2031.

Due to the substitution of traditional coastal protection materials with maritime concrete, the market is estimated to have maintained a steady growth.

Get More Information on Underwater Concrete Market - Request Sample Report

With the development of improved cement mixtures and formulations, together with an increasing efficiency in production processes, it is expected that this sector will experience strong growth. Moreover, market growth is expected to be driven by the development of new admixtures and adhesives that will lead to increased strength of underwater structures. Demand for this product is expected to grow significantly over the forecast period, driven by growing use of hydropower and extensive capacity expansion in the US and Canada. Moreover, the market growth is projected to be driven by growing demand for submarine concrete as a means of bridge and tunnel construction. In this sector, the product used for maintenance and rehabilitation of dams and structures is very much in demand.

Furthermore, industry growth is anticipated to be supported by an increase of demand for swimming pool products in association with the proposed construction of tunnels across the region. In the next few years, industry growth is forecast to be driven by a large stock of high strength material like cement, admixtures, adhesives and sealants in the economy.

MARKET DYNAMICS

KEY DRIVERS:

-

Rise in Infrastructure Development

The demand for underwater concrete is increasing as a result of ongoing infrastructure development, in particular coastal and marine environments. Special concrete which can cope with the challenges posed by submarine placement must be used in projects like ports, harbours, wind farms and bridges.

-

Increased demand for protective measures along the sea coast has been driven by concerns of increasing sea levels due to climate change.

RESTRAIN:

-

Complexity of Placement and Safety Concerns

The use of specialized techniques and equipment to build concrete underwater requires that the construction process be more complex, which may lead to delays and higher costs. Construction workers are also exposed to other safety risks in the course of their employment, including diving hazards, undersea currents and possible exposure to hazardous materials.

OPPORTUNITY:

-

Renewable Energy Expansion

The increase in offshore wind and tidal energy projects has created substantial demand for underwater concrete foundations and supports, which provide opportunities for specialized construction services.

-

Innovations in the design of materials and mixtures

CHALLENGES:

-

Difficulty in Maintenance and Repair

Due to the limited accessibility, maintenance and repairs of underwater structural structures may pose a technical challenge and cost.

IMPACT OF RUSSIAN UKRAINE WAR

Russia and Ukraine are the main exporters of underwater concrete raw materials, holding a combined market share of 15%. The war disrupted the supply of underwater concrete from Russia and Ukraine, leading to inflated prices and shortages. War also increased the risk of transporting concrete underwater, due to supply chain disruptions.

Due to the war, the underwater concrete market is expected to slow down in 2023.

In the United States, the Navy has suspended all underwater concrete contracts from Russia and Ukraine.

In Europe, several countries have banned the import of underwater concrete from Russia.

The price of underwater concrete has increased by 10% since the beginning of the war.

Underwater concrete delivery time increased by 20%.

IMPACT OF ONGOING RECESSION

Economic downturn is expected to negatively impact the underwater concrete market as businesses and consumers are less likely to invest in new construction projects during a downturn. However, the market is expected to remain stable as there is still demand for underwater concrete for repair and maintenance of existing infrastructure. In the United States, the National Association of Home Builders (NAHB) reported that the number of homes started fell by 17.6% in June 2022, the largest decline since April 2020. is expected to negatively impact the demand for underwater concrete in the United States. In the UK, the construction industry is facing a number of challenges including rising material costs and labor shortages. The market is expected to grow at a slower rate in 2023 than in previous years.

KEY MARKET SEGMENTS

By Material

-

Admixtures

-

Cement

-

Aggregates

In 2023, it was estimated that more than 24% of the world's concrete volume would be used for underwater concrete. Due to the development of advanced Portland cement with improved anti washout properties, which makes it easier to install concrete, the demand for cement is expected to increase.

Due to superior binding properties of aggregates, demand for aggregates has emerged as the largest raw material segment during the forecast period. Moreover, it is anticipated that an increasing use of recycled aggregates as partial substitutes for natural aggregates would lead to a high level of product over the forecast period.

By Laying Techniques

-

Bucket Placing

-

Tremie Method

-

Pump Method

-

Others

By Application

-

Hydropower

-

Shore protection

-

Tunnels

-

Marine

-

Underwater repairs

-

Swimming pools

-

Others

It is anticipated that growth in the underwater concrete market will be stimulated by significant addition of hydropower generation capacity, together with a growing commitment from national governments to adopt hydro power.

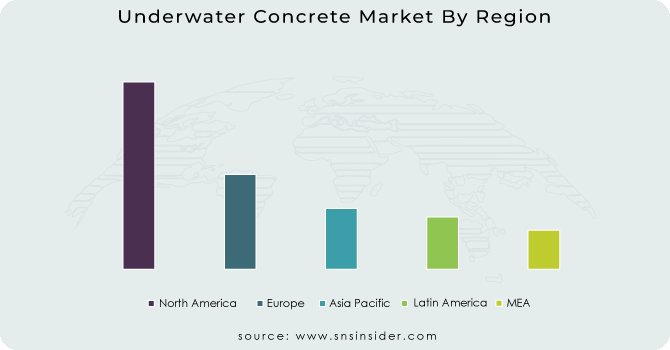

REGIONAL ANALYSIS

As a result of its use in the construction of hydro power plants, the European market accounted for over 15% of global demand. Moreover, it is foreseen that one of the major drivers for growth over the coming years will be increased construction activity by means of water tunnels like planned a link tunnel between Germany and Denmark.

In Germany, the increase of ocean and maritime infrastructure development is likely to bring about increased growth in the underwater concrete industry. Moreover, as part of the country's policy to introduce renewables into its energy mix, the market is anticipated to gain from increased adoption of hydropower generation plants.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Underwater Concrete market are Sika AG, RockBond SCP Ltd, Cemex S.A.B. de C.V, HeidelbergCement AG, Conmix Ltd, Underground Supply Inc, Weiser Concrete Products Inc, M-Con Products Inc and other players.

HeidelbergCement AG-Company Financial Analysis

RECENT DEVELOPMENT

-

An undersea tunnel measuring 18 kilometres will soon connect Denmark and Germany. This 10 billion project will connect Rdbyhavn on the Danish island of Lolland and Puttgarden in northern Germany by crossing a stretch of the Baltic Sea known as the Fehmarn Belt.

-

It will be completed in 2023 for India to have its initial underwater train at Kolkata. A way to pass under the Hooghly River has been established by the Kolkata Metro Rail Corporation. Through this twin tunnel more than 500 metres long, the East & West Corridor will be connected. The train's going to be 13m beneath the Hooghly River.

| Report Attributes | Details |

| Market Size in 2023 | US$ 102.06 Bn |

| Market Size by 2031 | US$ 183.39 Bn |

| CAGR | CAGR of 7.6 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Admixtures, Cement, Aggregates) • by Laying Techniques (Bucket Placing, Tremie Method, Pump Method, Others)) • by Application (Hydropower, Shore protection, Tunnels, Marine, Underwater repairs, Swimming pools, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Sika AG, RockBond SCP Ltd, Cemex S.A.B. de C.V, HeidelbergCement AG, Conmix Ltd, Underground Supply Inc, Weiser Concrete Products Inc, M-Con Products Inc |

| Key Drivers | • Rise in Infrastructure Development • Increased demand for protective measures along the sea coast has been driven by concerns of increasing sea levels due to climate change. |

| Market Restraints | • Complexity of Placement and Safety Concerns |