Unmanned Traffic Management (UTM) Market Report Scope & Overview:

To get more information on Unmanned Traffic Management (UTM) Market - Request Free Sample Report

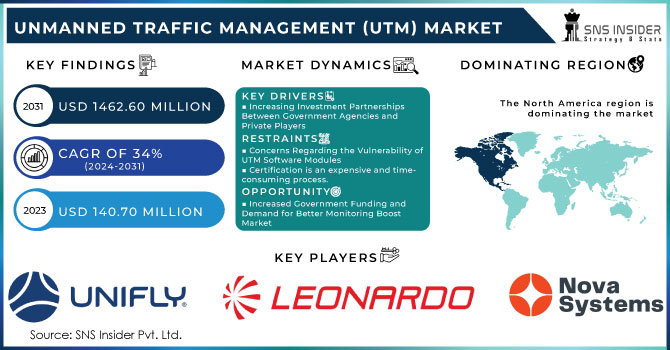

The Unmanned Traffic Management (UTM) Market Size was valued at USD 140.70 Million in 2023 and is expected to reach USD 1462.60 Million by 2031 with a growing CAGR of 34% over the forecast period 2024-2031.

Unmanned traffic management is an air traffic management ecosystem being developed by the National Aeronautics and Space Administration, the Federal Aviation Administration, other federal partner agencies, and industry participants to autonomously manage the operations of unmanned aerial systems. Services, information architecture, software functions, data exchange protocols, performance requirements, and infrastructure for managing low-altitude uncontrolled unmanned aerial vehicle operations are provided by unmanned traffic management.

unmanned traffic management is a digital air traffic management technology that enables new aerial vehicles, such as delivery drones and air taxis, to safely access and share future airspace. This adaptive and sophisticated air traffic management solution is expected to allow the safe adoption of unmanned aerial vehicles for leisure and commercial uses.

MARKET DYNAMICS

KEY DRIVERS

-

Increasing Investment Partnerships Between Government Agencies and Private Players

-

UTM Solutions are required to integrate autonomous aerial vehicles into commercial airspace.

RESTRAINTS

-

Concerns Regarding the Vulnerability of UTM Software Modules

-

Certification is an expensive and time-consuming process.

OPPORTUNITIES

-

Improved government funding and increased demand for improved monitoring are projected to offer

CHALLENGES

-

Aviation Authorities Enforce Strict Drone Regulations

-

Certification for Bvlos operation is an expensive and time-consuming process.

IMPACT OF COVID-19

The influence of COVID-19 on the unmanned traffic management business is unpredictable, and it is expected to be in effect for a few years. The COVID-19 outbreak compelled governments around the world to institute strict lockdown and ban import-export of raw materials for the majority of 2020 and a few months in 2021. This resulted in a dramatic decrease in the availability of critical components for the manufacture of unmanned traffic management components. Furthermore, the nationwide shutdown forced unmanned traffic management manufacturing factories to shut down partially or fully. The COVID-19 epidemic has caused delays in actions and initiatives aimed at developing sophisticated autonomous traffic control services around the world.

Drones, or unmanned aircraft vehicles, are becoming more common in everyday life and are spreading rapidly and in a variety of ways. Drones are also utilized for a variety of objectives, including recreational, commercial, and other uses. Drones, for example, are used in agriculture to optimize fertilizer, seed, and water use, reduce crop scouting time, respond faster to pests, weeds, and fungi, validate treatment performed, improve various treatments in real-time, and anticipate production from a field. The increasing use of drones in numerous industries, as well as advancements in advanced drones, are expected to drive the growth of the unmanned traffic management market over the forecast period.

The autonomous traffic management market is divided into two components: hardware and software. Due to increasing demand for unmanned traffic management software, which can enable the development of future-centric unmanned traffic management around the world, the software segment accounted for the most revenue.

The market is divided into three sections based on application: agricultural and forestry, logistics and transportation, and surveillance and monitoring. Because of the significant demand for creating a suitable ecosystem for the easy use of drones for logistics and transportation applications, the logistics and transportation category generated the most income.

Unmanned traffic management differs from the air traffic control system used by the Federal Aviation Administration for commercial aeroplane, according to the National Aeronautics and Space Administration. UTM is based on each user's anticipated flight details being shared digitally. Unlike in air traffic control, each user will have the same situational knowledge of the airspace.

Furthermore, UTM systems share real-time information with unmanned aerial vehicle or drone pilots in order to operate safely and manage operations based on information. Except for voice communication, such data is transmitted via a distributed network of highly automated devices using application programming interfaces. As a result, there is a risk of cyber threats or data hacking used to deceive drone pilots via UTM systems. This aspect is expected to slow the market's growth.

KEY MARKET SEGMENTATION

By Application

-

Agriculture and Forestry

-

Logistics and Transportation

-

Surveillance and Monitoring

By End User

-

Airports

-

Emergency Service and Local Authorities

-

Drone Operators or Pilots

-

Recreational Users

By Component

-

Hardware

-

Software

By Type

-

Persistent

-

Non-Persistent

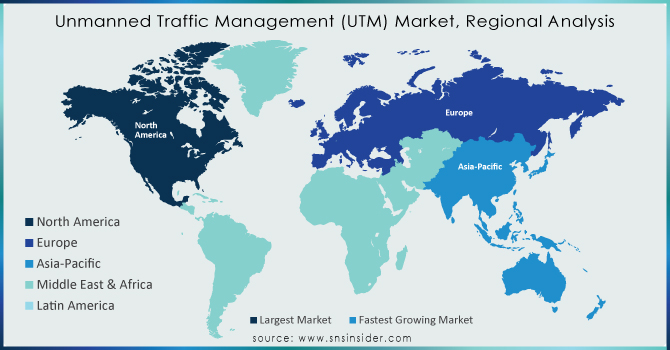

REGIONAL ANALYSIS

The North American area will lead the global market, according to the regional research report. It is expected to maintain its strength over the predicted time frame because to an increase in drone activity, an increase in government office speculation on drone BVLOS activities, and the presence of key actors such as Air Map, Lockheed Martin, and Harris Corporation in the district. During the forecast period, the North America market is expected to grow at the fastest CAGR.

Need any customization research on Unmanned Traffic Management (UTM) Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major players are Frequentis, Nova Systems, Unifly, Leonardo SpA, OneSky, Terra Drone Corporation, Airbus, Altitude Angle, Droniq GmbH, PrecisionHawk Inc, Thales Group, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 140.70 Million |

| Market Size by 2031 | US$ 1462.62 Million |

| CAGR | CAGR of 34% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Persistent, Non-Persistent) • By End User (Drone Operators or Pilots, Recreational Users, Airports, Emergency Service and Local Authorities) • By Application (Agriculture and Forestry, Logistics and Transportation, Surveillance and Monitoring) • By Component (Hardware, Software) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Frequentis, Nova Systems, Unifly, Leonardo SpA, OneSky, Terra Drone Corporation, Unifly NV, Airbus, Altitude Angle, Droniq GmbH, PrecisionHawk Inc, Thales Group |

| Key Drivers | • Increasing Investment Partnerships Between Government Agencies and Private Players • UTM Solutions are required to integrate autonomous aerial vehicles into commercial airspace. |

| RESTRAINTS | • Concerns Regarding the Vulnerability of UTM Software Modules • Certification is an expensive and time-consuming process. |