Utility Vehicle Market Report Scope & Overview:

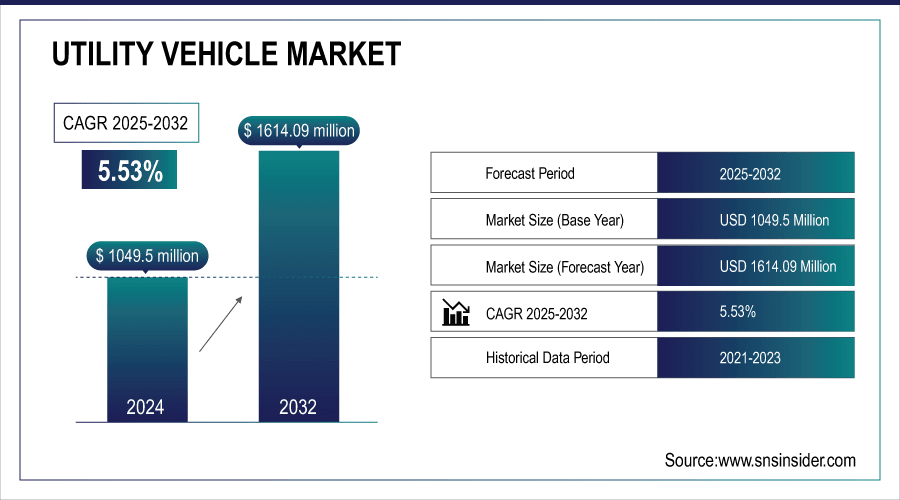

The Utility Vehicle Market size was valued at USD 1049.5 Million in 2024 and is projected to reach USD 1614.09 Million by 2032, growing at a CAGR of 5.53% during 2025–2032.

The Utility Vehicle Market is witnessing strong growth driven by increasing demand across agriculture, construction, government, and recreational sectors. Key factors include the need for versatile, durable, and efficient vehicles capable of handling diverse terrains and heavy-duty tasks. Technological advancements such as electric propulsion, 4WD drivetrains, and enhanced safety features are reshaping product offerings. Expanding applications in hospitality, entertainment, and municipalities are further fueling market adoption. Additionally, sustainability initiatives and the shift toward low-emission and electric vehicles are driving innovation and influencing purchasing decisions, making utility vehicles an essential tool across multiple industries.

August 26, 2025 – Can-Am unveiled the 2026 Defender HD11 and Outlander Electric at the Farm Progress Show in Decatur, Illinois, offering improved performance, quieter cabins, reduced maintenance, and the first mass-produced electric ATV.

To Get More Information On Utility Vehicle Market - Request Free Sample Report

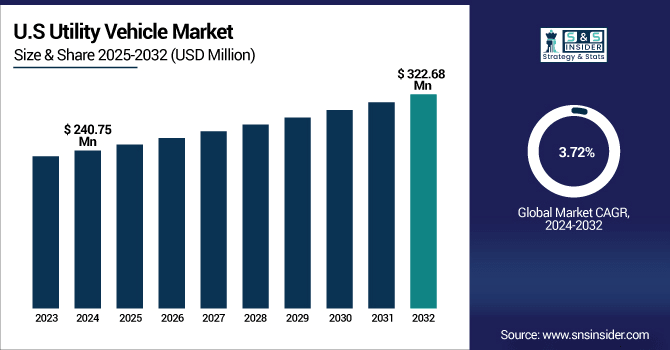

The U.S. Utility Vehicle Market size was valued at USD 240.75 Million in 2024 and is projected to reach USD 322.68 Million by 2032, growing at a CAGR of 3.72% during 2025–2032. growth is fueled by rising demand for versatile and durable vehicles across agriculture, construction, government, and recreational sectors. Technological advancements, including electric propulsion and 4WD drivetrains, along with increasing focus on sustainability, are driving adoption and innovation in the market.

Utility Vehicle Market Highlights:

-

Rising electrification and advanced features are accelerating utility vehicle adoption.

-

High costs, limited charging infrastructure, and strict regulations constrain market growth.

-

Innovations in autonomous driving, smart controls, and displays create new opportunities.

-

Electric drivetrains meet sustainability demands by reducing emissions and operational costs.

-

Kia launched the EV5 with advanced features, and Hyundai Mobis showcased 20+ mobility technologies at IAA Mobility 2025.

Utility Vehicle Market Drivers:

-

Rising Electrification and Advanced Features Drive Utility Vehicle Adoption

The increasing shift toward electric propulsion and integration of advanced safety and convenience features is accelerating the adoption of utility vehicles. Enhanced battery technology, efficient drivetrain systems, and improved cabin comfort allow vehicles to handle diverse tasks across agriculture, construction, government, and recreational applications. High-performance electric drivetrains reduce operational costs and emissions, meeting growing sustainability demands. Additionally, innovations like smart climate controls, spacious storage, and user-friendly interfaces improve usability and appeal. These technological advancements create a compelling value proposition for consumers, driving market growth and encouraging broader acceptance of modern utility vehicles worldwide.

Sept. 3, 2025 – Kia launched the EV5, a compact electric SUV built on the E-GMP platform, in South Korea, featuring an 81.4 kWh battery, advanced safety and convenience features, and plans for exports to Europe and Canada.

Utility Vehicle Market Restraints:

-

High Costs and Regulatory Hurdles Constrain Utility Vehicle Expansion

Rising production costs, especially for electric and technologically advanced utility vehicles, limit market growth by making vehicles less affordable for small-scale farmers, construction operators, and recreational users. Insufficient charging infrastructure and extended battery charging times reduce the convenience of electric models, slowing adoption. Stringent safety and emission regulations increase compliance expenses and lengthen development timelines, delaying market entry. These factors collectively restrict widespread adoption, hinder investment in new technologies, and temper the pace of market expansion, despite growing demand for versatile, durable, and efficient utility vehicles across multiple sectors.

Utility Vehicle Market Opportunities:

-

Advancements in Mobility Technology Transform Utility Vehicle Market

Rapid innovations in electrification, autonomous driving, and advanced display technologies are reshaping the utility vehicle market. Integration of smart control systems, enhanced safety features, and holographic displays improves vehicle efficiency, user experience, and operational capabilities, increasing adoption across agriculture, construction, and recreational applications. Collaboration between automotive manufacturers and technology providers accelerates innovation and supports the development of next-generation vehicles. As consumers demand versatile, high-tech, and environmentally friendly solutions, these technological advancements enable manufacturers to expand product portfolios, enter new segments, and meet evolving market requirements while enhancing competitiveness across multiple sectors.

Sept. 3, 2025 – Hyundai Mobis will participate in IAA Mobility 2025 in Munich, showcasing over 20 technologies in electrification, electronics, lighting, chassis, and safety. The company will feature Kia’s EV9 with a holographic windshield display, promote autonomous driving solutions, and engage European automakers to highlight technological competitiveness and explore collaboration opportunities.

Utility Vehicle Market Segment Highlights:

-

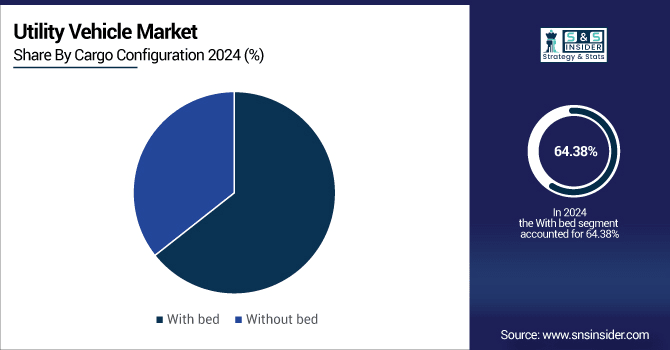

By Cargo Configuration: Dominant With bed (64.38%), Fastest-Growing: Without bed (CAGR-6.85%)

-

By Propulsion: Dominant (2024 & 2032): Gasoline (48.25%), Fastest-Growing: Electric (CAGR-10.74%)

-

By Application: Dominant (2024 & 2032): Construction (39.38% → 35.63%), Fastest-Growing: Entertainment (CAGR - 8.12%)

-

By Drivetrain Configuration: Dominant (2024 & 2032): 2WD (59.38% → 55.63%), Fastest-Growing: 4WD (CAGR- 6.70%)

By Cargo Configuration, With Bed Lead While Vehicles Without Bed Show Fastest Growth

In the cargo configuration segment, with-bed setups continue to lead due to their ability to handle heavy loads and support a wide range of utility applications. At the same time, without-bed configurations are showing the fastest growth, driven by increasing demand for more compact and versatile options that can navigate smaller spaces and serve both work and recreational purposes. This trend reflects a shift in preference toward flexible configurations that balance functionality and convenience across diverse operational needs.

By Propulsion, Gasoline Remains Dominant While Electric Shows Fastest Growth

Gasoline continues to dominate the propulsion segment, reflecting its widespread use across traditional applications. Meanwhile, electric propulsion is experiencing the fastest growth, driven by increasing demand for sustainable, low-emission, and energy-efficient solutions. This shift highlights the market’s gradual transition toward cleaner and more advanced propulsion technologies.

By Application, Construction Leads While Entertainment Shows Fastest Growth

Construction remains the dominant application segment, driven by ongoing demand for heavy-duty and task-oriented solutions. In contrast, the entertainment segment is witnessing the fastest growth, fueled by increasing adoption for recreational and leisure purposes. This trend reflects a diversification of use cases and evolving consumer preferences across applications.

By Drivetrain Configuration, 2WD Remains Dominant While 4WD Shows Fastest Growth

The 2WD configuration continues to lead due to its efficiency and suitability for standard applications. Meanwhile, 4WD is experiencing the fastest growth, driven by increasing demand for enhanced traction, versatility, and performance in challenging terrains. This trend reflects evolving preferences toward more capable and adaptable drivetrain options.

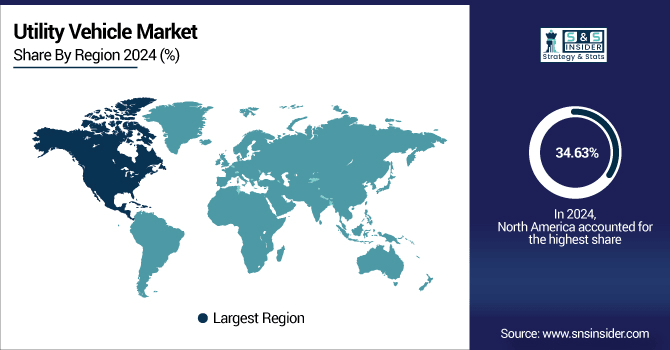

Utility Vehicle Market Regional Highlights:

-

North America – Dominant: 34.63% in 2024 → 32.38% in 2032; CAGR 4.64%

-

Asia-Pacific – Fastest-Growing: 20.88% in 2024 → 26.13% in 2032; CAGR 8.49%

-

Europe – 24.88% in 2024 → 24.13% in 2032; CAGR 5.13%

-

South America – 9.88% in 2024 → 9.13% in 2032; CAGR 4.49%

-

Middle East & Africa – 9.75% in 2024 → 8.25% in 2032; CAGR 3.33%

Utility Vehicle Market Regional Analysis:

North America Utility Vehicle Market Insights:

North America leads the Utility Vehicle Market, driven by strong demand across agriculture, construction, and recreational sectors. Well-established infrastructure, advanced technology adoption, and supportive regulations contribute to its dominant position. Meanwhile, growing mechanization and increasing demand in other regions are reshaping the competitive landscape, highlighting evolving market dynamics.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Utility Vehicle Market Insights:

The U.S. leads North America’s Utility Vehicle Market, supported by high demand across agriculture, construction, and recreational sectors, advanced infrastructure, technological adoption, and favorable regulations driving widespread use and market dominance.

Asia-Pacific Utility Vehicle Market Insights:

Asia-Pacific is the fastest-growing region in the Utility Vehicle Market, fueled by increasing mechanization in agriculture, expanding construction activities, rising infrastructure development, and growing demand for versatile, durable, and efficient utility solutions across multiple sectors.

-

China Utility Vehicle Market Insights:

China leads Asia-Pacific in Utility Vehicle adoption, driven by rapid industrialization, agricultural mechanization, infrastructure expansion, and increasing demand for versatile and efficient solutions across multiple sectors.

Europe Utility Vehicle Market Insights:

The European Utility Vehicle Market is expanding steadily, supported by infrastructure development, technological advancements, and growing adoption across agriculture, construction, and municipal applications. Increasing focus on efficiency, safety, and low-emission solutions is encouraging investment, driving consistent market demand, and promoting the adoption of advanced and versatile utility solutions across the region.

-

Germany and Norway Utility Vehicle Market Insights:

Germany leads Europe’s utility vehicle market, driven by a strong automotive industry, advanced infrastructure, high demand across agriculture and construction, and increasing adoption of sustainable and electric utility solutions.

Latin America Utility Vehicle Market Insights:

The Latin American Utility Vehicle Market is emerging, supported by growing agricultural mechanization, expanding construction activities, and increasing infrastructure development. Rising demand for versatile, durable, and cost-effective solutions is driving adoption across multiple sectors. Although growth is moderate compared to other regions, ongoing investments and modernization efforts are gradually strengthening the market and expanding its potential.

-

Brazil Utility Vehicle Market Insights:

Brazil leads Latin America’s Utility Vehicle Market, driven by strong demand in agriculture, tourism, and recreational sectors. The country’s large, urbanized population and a growing middle class contribute to its dominance. Brazil's automotive industry benefits from a robust manufacturing base, housing major automotive giants like Volkswagen and Fiat, which supports local production and drives sales.

Middle East & Africa Utility Vehicle Market Insights:

The Middle East & Africa Utility Vehicle Market is gradually expanding, driven by growing demand in agriculture, construction, and mining sectors. Infrastructure development, rising mechanization, and increasing adoption of versatile, durable solutions are supporting market growth. Although expansion is slower compared to other regions, ongoing investments and modernization efforts are steadily enhancing market potential across the region.

-

Saudi Arabia Utility Vehicle Market Insights:

Saudi Arabia leads the Middle East & Africa utility vehicle market, driven by large-scale infrastructure projects, growing adventure tourism, and expanding agricultural activities, while the UAE follows with strong recreational and construction demand.

Utility Vehicle Market Competitive Landscape:

Club Car Established in 1958, Club Car is a global leader in small-wheel, zero-emission vehicles, specializing in golf and utility vehicles. Known for innovation, performance, and safety, the company delivers advanced technology, premium design, and customizable solutions for golf courses, resorts, and commercial operators worldwide.

-

In March 2025, Club Car launched updated Tempo golf cars featuring an Automatic Park Brake with StopSmart™ Technology, redesigned dashboards, premium storage, and integrated USB/charging options, enhancing performance, safety, and on-course convenience.

The Toro Company – Established in 1914, Toro is a leading manufacturer of commercial and residential utility vehicles, turf maintenance equipment, and irrigation solutions. Renowned for innovation, durability, and performance, Toro delivers versatile, customizable vehicles and equipment that enhance productivity across sports fields, resorts, campuses, and commercial operations worldwide.

-

In January 2024, Toro showcased the Vista® Shuttle, a versatile utility vehicle offering gas or battery power, customizable capacity, HyperCell® lithium-ion batteries, ergonomic seating, and a smooth ride for sports complexes, resorts, and campuses

Utility Vehicle Market Key Players:

-

Club Car

-

Columbia Vehicle Group Inc.

-

Cushman

-

Garia

-

John Deere

-

Kubota

-

Star EV Corporation, USA

-

The Toro Company

-

Yamaha

-

Polaris Industries

-

Textron Specialized Vehicles

-

Mahindra & Mahindra

-

Arctic Cat

-

Mitsubishi Heavy Industries

-

Honda Motor Co., Ltd.

-

Suzuki Motor Corporation

-

Peugeot Motocycles

-

Bollinger Motors

-

Nikola Corporation

-

Ford Motor Company

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1049.5 Million |

| Market Size by 2032 | USD 1614.09 Million |

| CAGR | CAGR of 5.53% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cargo Configuration (With Bed, Without Bed) • By Propulsion (Gasoline, Diesel, Electric) • By Application (Construction, Universities, Government/Municipalities, Entertainment, Hospitality, Others) • By Drivetrain Configuration (2WD, 4WD) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Club Car, Columbia Vehicle Group Inc., Cushman, Garia, John Deere, Kubota, Star EV Corporation USA, The Toro Company, Yamaha, Polaris Industries, Textron Specialized Vehicles, Mahindra & Mahindra, Arctic Cat, Mitsubishi Heavy Industries, Honda Motor Co Ltd, Suzuki Motor Corporation, Peugeot Motocycles, Bollinger Motors, Nikola Corporation, Ford Motor Company |