Freezing Fishing Vessels Market Report Scope And Overview:

Get More Information on Freezing Fishing Vessels Market - Request Sample Report

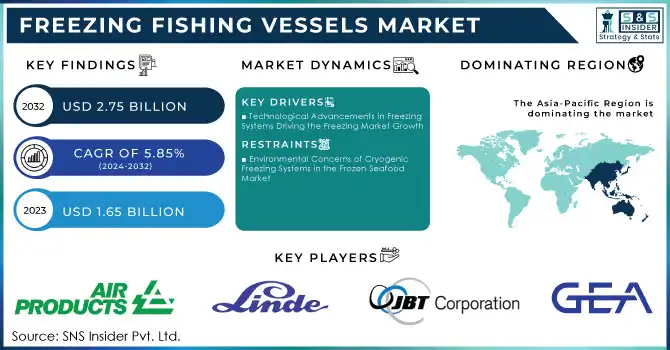

The Freezing Fishing Vessels Market Size was valued at USD 1.65 Billion in 2023 and is expected to reach USD 2.75 Billion by 2032 and grow at a CAGR of 5.85% over the forecast period 2024-2032.

The freezing fishing vessel market is experiencing significant growth, driven by increasing demand for seafood and advancements in freezing technology. In 2024, Vietnam’s seafood exports surged by 28% year-on-year, reaching USD 8.27 billion, with key markets such as China, the U.S., Japan, and the EU showing notable increases in demand. Exports to China saw a remarkable rise of 37%, positioning it to potentially become Vietnam's largest seafood market, surpassing the U.S. Exports to the U.S. rose by 31%, while Japan and South Korea showed more modest increases of 22% and 13%, respectively. However, inflationary pressures in these regions limited growth. This trend reflects the growing need for efficient freezing vessels capable of maintaining seafood quality during transportation across long distances.

The demand for seafood has been significantly influenced by both rising consumer consumption and global seafood trade growth, particularly in regions like Asia-Pacific. To meet the rising demand, companies are investing in advanced freezing technology. Fishing vessels equipped with advanced freezing systems, such as cryogenic and IQF freezing methods, are in high demand to ensure the seafood reaches markets in optimal condition. The adoption of sustainable freezing practices is also helping companies meet increasing environmental standards, which is crucial for maintaining competitiveness in the market.

The surge in exports from countries like Vietnam highlights a clear market shift towards more energy-efficient and environmentally friendly freezing solutions, which are likely to continue to dominate the sector. As the market continues to expand, technological innovations will play a key role in improving freezing efficiency, reducing transportation emissions, and ensuring the sustainability of the seafood supply chain. This growing demand for frozen seafood and the investments in freezing technology will contribute significantly to the ongoing growth of the frozen fishing vessel market through 2032.

Freezing Fishing Vessels Market Dynamics

Drivers

-

Technological Advancements in Freezing Systems Driving the Freezing Market Growth

Technological advancements in freezing systems, including cryogenic freezing, Individually Quick Frozen (IQF) technology, and energy-efficient solutions, are significantly driving the growth of the frozen fishing vessel market and enhancing seafood quality globally. Cryogenic freezing, which uses gases like nitrogen or carbon dioxide, quickly chills seafood, reducing ice crystal formation and preserving texture and flavor. This is crucial for maintaining high-quality seafood, especially in export markets such as China, which saw a 37% rise in seafood imports from Vietnam in 2024, and the U.S., which experienced a 31% increase. IQF systems, which freeze individual seafood pieces rapidly, ensure better portion control and minimize freezer burn, further boosting product quality. These innovations are critical as the global demand for frozen seafood grows, driven by consumer preferences for convenient, healthy food options. Energy-efficient freezing technologies are becoming increasingly vital as energy costs rise and sustainability concerns mount. These systems not only reduce operational expenses but also align with global sustainability objectives, As the market for frozen seafood continues to grow, these technological innovations will remain essential for improving efficiency, lowering costs, and maintaining the high quality of frozen products, further solidifying the growth of the frozen fishing vessel market.

Restraints

-

Environmental Concerns of Cryogenic Freezing Systems in the Frozen Seafood Market

Cryogenic freezing systems, which rely on gases like nitrogen and carbon dioxide, are essential for preserving the quality of frozen seafood by rapidly freezing products and maintaining their texture and nutritional value. However, the environmental impact of these gases, if not managed properly, raises significant concerns. The production of cryogenic gases is energy-intensive, contributing to greenhouse gas emissions, and transportation of these gases increases the carbon footprint, particularly when energy efficiency is not prioritized. Additionally, the leakage of carbon dioxide, a potent greenhouse gas, and improper disposal of unused gases can exacerbate global warming. As the seafood market continues to grow, especially in key regions like China and the U.S., addressing these environmental challenges becomes crucial. Many companies are investing in carbon capture technologies and exploring alternative refrigerants to mitigate these environmental impacts. Ensuring the sustainability of cryogenic freezing systems through better energy management and regulatory compliance is essential for balancing technological advancement with environmental responsibility in the frozen seafood industry.

Freezing Fishing Vessels Market Segment Analysis

By System

In 2023, the Individually Quick Frozen (IQF) system captured the largest share of the revenue in the freezing fishing vessel market, accounting for approximately 53%. IQF technology plays a pivotal role in enhancing the quality and shelf life of seafood products by freezing individual pieces of fish or seafood rapidly. This process prevents ice crystal formation within the product, preserving its texture, flavor, and nutritional value. The ability to freeze items individually also facilitates easy portioning and minimizes the risk of freezer burn, making it highly preferred for the frozen seafood market. As demand for high-quality, convenient frozen seafood continues to grow, IQF technology’s efficiency and product quality preservation make it a dominant player in the market.

By Vessel Length

In 2023, fishing vessels longer than 40 meters captured the largest share of revenue in the freezing fishing vessel market, accounting for approximately 32%. These larger vessels are designed to handle high-capacity freezing systems, making them ideal for extended offshore fishing trips and large-scale operations. With the ability to carry more catch and process it on board, these vessels offer greater efficiency in preserving seafood quality, ensuring longer shelf life, and maintaining freshness. The demand for larger vessels is driven by the need for more advanced freezing technologies, such as IQF and cryogenic freezing, which require ample space and power. This trend reflects the growing global demand for high-quality frozen seafood and the need for vessels capable of handling increasing volumes.

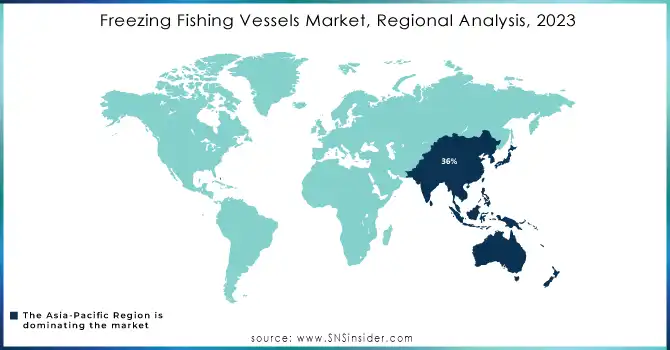

Freezing Fishing Vessels Market Regional Overview

In 2023, the Asia-Pacific region dominated the freezing fishing vessel market, accounting for approximately 36% of the global revenue. This dominance is driven by several factors, including the region's extensive coastline and the high demand for frozen seafood from key markets such as China, Japan, and South Korea. China, being one of the world's largest seafood producers and exporters, continues to invest heavily in advanced freezing technologies, such as IQF and cryogenic freezing systems, to maintain the high quality of its frozen seafood products. Similarly, Japan’s advanced freezing techniques, particularly for high-value seafood like tuna, play a crucial role in maintaining its competitive edge in the global market.

Additionally, South Korea has been focusing on improving its freezing systems to enhance the preservation and export of seafood. Indonesia, with its vast marine resources, has been investing in modern freezing fishing vessels to boost its seafood export industry. The rising focus on sustainable and energy-efficient freezing solutions in these countries further contributes to the market's growth. As Asia-Pacific continues to lead global seafood production and export, its share of the freezing fishing vessel market is expected to remain strong, with technological advancements and government support driving future developments.

In 2023, North America became the fastest-growing region in the freezing fishing vessel market, driven by rising demand for high-quality frozen seafood and advancements in freezing technologies. The U.S. and Canada, with their extensive coastlines and robust seafood industries, are central to this growth. The U.S. has heavily invested in modernizing freezing systems, incorporating technologies like Individually Quick Frozen (IQF) and cryogenic freezing, which preserve seafood quality, texture, and flavor for longer shelf life. Canada is also upgrading its freezing systems, focusing on sustainability and energy efficiency. As both nations expand frozen seafood exports to Europe and Asia, government support and technological innovation will continue to propel the market’s growth in North America.

Need Any Customization Research On Freezing Fishing Vesssels market - Inquiry Now

Key Players in Freezing Fishing Vessels Market

Some of the major players in Freezing Fishing Vesssels market with product :

-

GEA Group (Frigoscandia Freezing Systems, IQF Freezers, Plate Freezers)

-

JBT Corporation (Frost Freeze IQF Systems, Plate Freezers)

-

Linde Engineering (Air Blast Freezing Systems, Cryogenic Freezing Solutions)

-

Marel (IQF Freezers, Tunnel Freezers, Batch Freezers)

-

Air Products and Chemicals, Inc. (Cryogenic Freezing Systems, IQF Freezing Solutions)

-

OctoFrost (IQF Freezing Technology, Tunnel Freezers)

-

HRS Heat Exchangers (Brine Freezers, Thermal Processing Solutions)

-

Taylors International (IQF Freezing Solutions, Air Blast Freezing Systems)

-

Kärcher (Air Blast Freezers, Mobile Freezing Units)

-

Koma Anlagenbau GmbH (Plate Freezers, Industrial Freezing Equipment)

-

Stork Food & Dairy Systems (Air Blast Freezers, Blast Freezing Systems)

-

Wittmann Battenfeld (Injection Molding Freezing Technology)

-

Tetra Pak (IQF Freezing Systems, Integrated Freezing Solutions)

-

Sanden International (Commercial Freezers, Integrated Refrigeration Systems)

-

Sonic Air Systems (Cryogenic Freezing Solutions, IQF Freezers)

-

Buhler AG (IQF Freezing Systems, Freezing and Cooling Technologies)

-

Nordic Refrigeration (Plate Freezers, Cryogenic Freezing Systems)

-

Tefcold (Commercial Freezers, Blast Freezing Units)

-

Koch Modular Process Systems (Custom Freezing Systems, Cryogenic Solutions)

-

AHT Cooling Systems (Modular Freezing Systems, IQF Tunnel Freezers)

List of suppliers Companies for fish freezing vessels:

-

KOCKS COOLING SYSTEMS

-

STOCO SYSTEMS

-

Kvaerner

-

Frigoscandia

-

Aker Solutions

-

MacGregor

-

TOMRA Food

-

Panasonic Refrigeration Systems

-

Optimar

-

Fujian Snowman Co., Ltd.

-

Takasago Thermal Engineering Co., Ltd.

-

AHT Cooling Systems

-

Marel

-

Global Freeze Systems

-

Sundsvalls Kylteknik AB

-

Tetra Pak

-

Norway Seafood Technology

-

JBT Corporation

-

Zanotti

-

Golder Associates

Recent Development

-

September 3, 2024 At the SMM 2024 trade fair, GEA unveiled its latest refrigeration technology, highlighting the GEA Grasso M screw compressor, a core component of refrigeration and freezing systems on fishing vessels and cruise ships. This technology supports the use of natural refrigerants such as ammonia and CO₂, offering high efficiency, reliability, and low maintenance.

-

September 30, 2024,Frigoscandia introduced the ADVANTEC™ Narrow Impingement Freezer, a compact solution designed to reduce gas bills and fit into small production spaces. This freezer provides the benefits of full-impingement freezing, offering better preservation for fish, seafood, and meat, while helping processors switch from costly cryogenic gas freezers. With its reduced footprint, the ADVANTEC Narrow enables longer production hours and a more cost-effective freezing process

-

January 25, 2024 Air Products will showcase its latest innovations in cryogenic freezing at the International Production & Processing Expo (IPPE) in Atlanta. The company will highlight its Freshline® Smart Technology, enabling remote monitoring of food manufacturing processes, and the Freshline® IQF+ Tunnel Freezer, designed for high-efficiency, large-throughput IQF production. Additionally, Air Products will feature its Freshline® Bottom Injection Cooling System for improved product safety and efficiency.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 1.65 Billion |

|

Market Size by 2032 |

USD 2.5 Billion |

|

CAGR |

CAGR of 5.85 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By System(Air Blast Freezing, Plate Freezing, Brine, Individual Quick Frozen (IQF)) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

GEA Group, JBT Corporation, Linde Engineering, Marel, Air Products and Chemicals, Inc., OctoFrost, HRS Heat Exchangers, Taylors International, Kärcher, Koma Anlagenbau GmbH, Stork Food & Dairy Systems, Wittmann Battenfeld, Tetra Pak, Sanden International, Sonic Air Systems, Buhler AG, Nordic Refrigeration, Tefcold, Koch Modular Process Systems, and AHT Cooling Systems. |

|

Key Drivers |

• Technological Advancements in Freezing Systems Driving the Freezing Market Growth |

|

RESTRAINTS |

• Environmental Concerns of Cryogenic Freezing Systems in the Frozen Seafood Market |