Luxury Car Rental Market Report Insights:

Get More Information on Luxury Car Rental Market - Request Sample Report

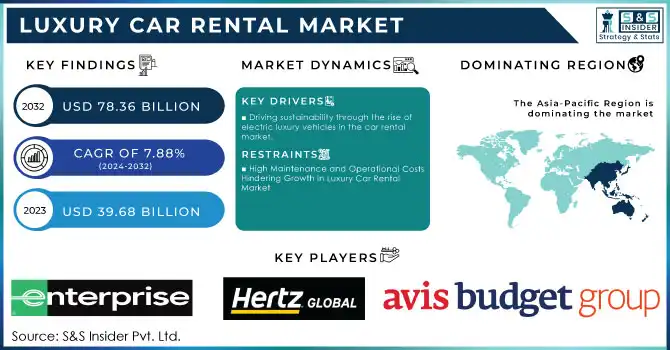

The Luxury Car Rental Market Size was valued at USD 39.68 Billion in 2023, and is expected to reach USD 78.36 Billion by 2032, and grow at a CAGR of 7.88% over the forecast period 2024-2032.

The luxury car rental market is experiencing significant growth, driven by the expansion of the tourism industry and rising demand for premium travel experiences. As global tourism continues to flourish, particularly in high-demand vacation destinations, there has been an increased inclination among tourists to opt for luxury vehicles to enhance their travel experience. The substantial rise in passenger traffic and the expansion of airports worldwide have further contributed to this trend, as they offer improved accessibility and convenience for travelers seeking upscale transportation options. Airports, as key hubs of international tourism, are becoming essential touchpoints for luxury car rental services, offering easy access to high-end vehicles directly at their locations.

The growing availability of luxury vehicles, such as high-end sedans, elegant SUVs, and multi-utility vehicles (MUVs), in car rental fleets is fueling this demand. These premium vehicles, priced approximately 30-35% higher than standard economy cars, offer superior comfort and brand prestige, appealing to both leisure and business travelers. However, despite the high rental costs, the demand for luxury car rentals remains robust, particularly due to the increasing number of business activities and international events that require luxurious transportation options.

Mobile applications and demand-responsive transport services are making it easier for customers to access luxury car rental options, compare prices, and book vehicles with features such as real-time feedback, vehicle tracking, and chauffeur services. For instance, the collaboration between GoAir and Eco Europcar to offer luxury car rentals at airports across India exemplifies the market’s expansion into diverse regions. As luxury car rental services become more accessible through these innovative platforms, the industry is expected to continue its growth trajectory over the forecast period, offering new opportunities for both luxury car rental businesses and travelers seeking premium mobility solutions.

Luxury Car Rental Market Dynamics

Drivers

-

Driving sustainability through the rise of electric luxury vehicles in the car rental market

One of the key drivers of the luxury car rental market is the growing demand for electric luxury vehicles (EVs), driven by environmentally conscious consumers and the increasing adoption of sustainable transportation options. As electric mobility continues to gain traction, the luxury car rental market is witnessing a shift towards the integration of electric high-end cars like the Tesla Model S, Audi e-tron, and Jaguar I-PACE into rental fleets. This shift caters to consumers who prioritize eco-friendly travel while still seeking the prestige, comfort, and advanced technology that define luxury vehicles. The rapid growth and demand for electric luxury cars. This growth is supported by government incentives such as USD 7.51 billion for EV infrastructure in the US and cash rebates in New Zealand. The expansion of charging infrastructure, with 2.71 million public charging points globally as of 2022, further fuels the market by alleviating concerns over range and charging accessibility. The luxury EV market is being propelled by increased technological advancements, including ultra-modern features like autonomous driving capabilities and smartphone integration, and performance that matches traditional luxury vehicles. For example, the Audi e-tron GT can accelerate from 0-100 km/h in just 4 seconds, demonstrating the high-performance capabilities of these vehicles. This combination of sustainability, advanced technology, and performance is driving substantial growth in the luxury car rental market as consumers demand both luxury and eco-friendly options.

Restraints

-

High Maintenance and Operational Costs Hindering Growth in Luxury Car Rental Market

High maintenance and operational costs are significant restraints for the luxury car rental market, especially when it comes to luxury and electric vehicles (EVs). Luxury cars, such as the Tesla Model S, Audi e-tron, and Jaguar I-PACE, incur maintenance costs that are 20% to 30% higher than standard vehicles. This is primarily due to the specialized care required for high-end components, including advanced infotainment systems, premium tires, and high-performance engines. Additionally, the battery maintenance for electric luxury vehicles can be particularly expensive, adding a substantial financial burden to rental companies. Insurance premiums for luxury vehicles are also significantly higher, further contributing to the overall operational costs. Studies show that the operational expenses for maintaining luxury cars can be up to 30% higher than for economy vehicles, making them less profitable for rental businesses. Furthermore, the challenge of maintaining a reliable charging infrastructure for electric vehicles compounds the issue. A shortage of charging stations and the high cost of EV upkeep remain key barriers to the widespread adoption of electric luxury cars in rental fleets. Despite the growing demand for electric vehicles, the high upfront costs and the lack of suitable EV models for heavy-duty use continue to slow the market's expansion. As a result, this high maintenance, operational and insurance costs present significant challenges for rental agencies, limiting the profitability and scalability of the luxury car rental market.

Luxury Car Rental Market Segment Analysis

By Rental

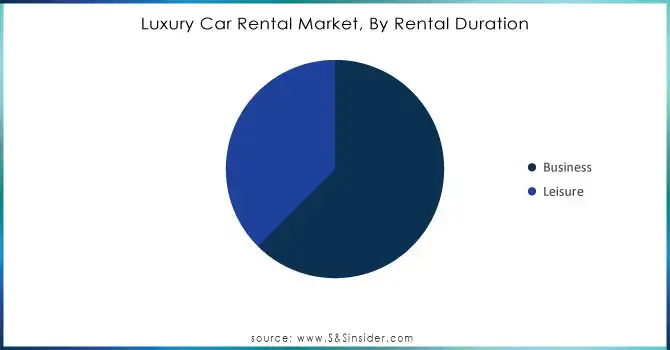

In 2023, the business segment captured the largest revenue share of around 63% in the luxury car rental market. This is primarily driven by the increasing demand for high-end vehicles among corporate clients, business executives, and professionals who require premium transportation for meetings, conferences, and corporate events. Luxury car rentals offer businesses an opportunity to maintain a sophisticated image and provide their employees with comfortable, high-performance vehicles for work-related travel. Additionally, the growth in international business activities and the rise in executive travel have further fueled the demand. With top-tier models such as luxury sedans, SUVs, and electric vehicles becoming accessible for business rentals, this segment is expected to maintain its dominance in the coming years.

Need Any Customization Research On Luxury Car Rental Market - Inquiry Now

By Booking Type

In 2023, the online booking segment accounted for the largest revenue share of approximately 56% in the luxury car rental market. This growth is largely driven by the increasing preference for digital platforms among consumers who seek convenience, flexibility, and a seamless booking experience. Online booking offers customers the ability to compare prices, select vehicles, and secure reservations in real time, all from the comfort of their devices. The rise of mobile apps and online portals has made it easier for consumers to access luxury car rental services, even for last-minute bookings. Additionally, the integration of features like customer reviews, loyalty programs, and personalized recommendations has enhanced the overall user experience, further boosting online bookings. The ability to access a wide range of luxury vehicles, including electric models, via online platforms aligns with the growing trend of digital-first services in the travel and leisure industry, contributing to the dominance of this segment.

Luxury Car Rental Market Regional Overview

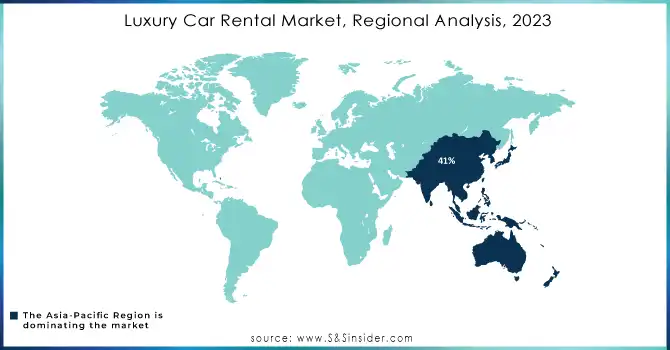

In 2023, the Asia-Pacific region led the luxury car rental market, accounting for around 41% of total revenue. This growth is driven by rapid economic development, rising disposable incomes, and increasing tourism in countries like China, Japan, South Korea, and India. The region is expanding middle class and growing demand for premium transportation, both for business and leisure, have fueled the demand for luxury car rentals. Major cities such as Tokyo, Shanghai, and Sydney have become key hubs for this demand. Additionally, the shift toward eco-friendly luxury vehicles, including electric and hybrid models, has boosted market growth. The increasing trend toward digitalization has made booking luxury cars more accessible, while urbanization and international events continue to drive demand. China’s expanding economy, along with India’s growing urban population and high-net-worth individuals, is making the region a key player in the global luxury car rental market.

North America is poised to be the fastest-growing region in the luxury car rental market from 2024 to 2032. The growth is primarily driven by strong demand from affluent consumers and the increasing number of business and leisure travelers seeking high-end transportation options. The United States, with its large number of high-net-worth individuals and thriving tourism industry, is expected to lead the region. Major cities such as New York, Los Angeles, Miami, and Las Vegas continue to experience strong demand for luxury rentals, driven by both local residents and international tourists. Additionally, the increasing popularity of electric luxury vehicles is contributing to the region's market growth, supported by incentives and investments in EV infrastructure. Canada also sees significant growth, with rising disposable incomes and a growing tourism sector boosting demand. The growing trend toward digital platforms for booking and the expanding presence of luxury rental services in urban and tourist destinations will further drive the market in North America.

Key Players in Luxury Car Rental Market

Some of the major players in Luxury Car Rental Market with their product

-

Enterprise Rent-A-Car (BMW, Audi, Mercedes-Benz, Cadillac)

-

Hertz Global Holdings (Ferrari, Porsche, BMW, Mercedes-Benz - "Dream Collection")

-

Avis Budget Group (BMW, Audi, Lexus, Jaguar)

-

Sixt SE (Mercedes-Benz, BMW, Porsche, Audi)

-

Europcar (Mercedes-Benz, BMW, Audi)

-

Luxury Rentals (Ferrari, Lamborghini, Bentley)

-

Turo (Tesla, Porsche, Range Rover, Ferrari - Peer-to-peer rentals)

-

Green Motion (BMW, Mercedes-Benz - Eco-friendly luxury options)

-

National Car Rental (BMW, Audi, Lexus)

-

Rent A Ferrari (Ferrari models exclusively)

-

Riviera Luxury Rentals (Rolls-Royce, Lamborghini, Porsche)

-

Premier Car Rental (Mercedes-Benz, BMW, Range Rover)

-

Elite Rent-A-Car (Ferrari, Bentley, Lamborghini)

-

DriveNow (BMW Group) (BMW, Mini)

-

Exotic Car Collection by Enterprise (Porsche, Ferrari, Corvette)

-

Silvercar by Audi (Audi models exclusively)

-

Auto Europe (Mercedes-Benz, BMW, Jaguar)

-

CarTrawler (Audi, BMW, Mercedes-Benz)

-

Limos.com (Rolls-Royce, Bentley, Mercedes-Benz - Chauffeur services)

-

Auto Bavaria (BMW, Audi, MINI, and other luxury vehicles)

-

SKIL Cabs (Electric vehicles for eco-friendly transportation)

List of companies providing luxury car rentals:

-

Enterprise Rent-A-Car – Offers a selection of luxury vehicles including BMW, Audi, Mercedes-Benz, and Cadillac.

-

Hertz Global Holdings – Provides high-end vehicles such as Ferrari, Porsche, BMW, and Mercedes-Benz through its "Dream Collection."

-

Avis Budget Group – Offers luxury cars including BMW, Audi, Lexus, and Jaguar.

-

Sixt SE – Provides luxury vehicles like Mercedes-Benz, BMW, Porsche, and Audi.

-

Europcar – Offers premium cars such as Mercedes-Benz, BMW, and Audi.

-

Luxury Rentals – Specializes in luxury car rentals with options like Ferrari, Lamborghini, and Bentley.

-

Turo – A peer-to-peer rental platform that offers luxury vehicles like Tesla, Porsche, Range Rover, and Ferrari.

-

LUXURY CAR RENTAL USA – Offers high-end cars like Ferrari, Rolls-Royce, and Aston Martin.

-

Green Motion – Provides eco-friendly luxury options, including BMW and Mercedes-Benz.

-

National Car Rental – Offers luxury cars from brands like BMW, Audi, and Lexus.

-

Rent A Ferrari – Specializes in renting Ferrari models exclusively.

-

Riviera Luxury Rentals – Offers vehicles like Rolls-Royce, Lamborghini, and Porsche.

-

Premier Car Rental – Provides luxury options such as Mercedes-Benz, BMW, and Range Rover.

-

Elite Rent-A-Car – Offers Ferrari, Bentley, and Lamborghini for luxury rentals.

-

DriveNow (BMW Group) – Provides luxury cars including BMW and Mini for rental.

-

Exotic Car Collection by Enterprise – Offers exotic cars like Porsche, Ferrari, and Corvette.

-

Silvercar by Audi – Exclusively offers Audi models for rental.

-

Auto Europe – Offers luxury rentals including Mercedes-Benz, BMW, and Jaguar.

-

CarTrawler – Provides access to luxury cars including Audi, BMW, and Mercedes-Benz.

-

Limos.com – Specializes in chauffeur services with luxury vehicles like Rolls-Royce, Bentley, and Mercedes-Benz.

Recent Development

-

February 6, 2024: Sime Darby Introduces EV Rental Partnership Sime Darby Auto Bavaria (SDAB) has partnered with Sime Darby Rent-A-Car (SDRAC) to offer electric vehicle (EV) rentals in Malaysia, starting with the BMW iX. This collaboration provides customers with the opportunity to experience high-tech, luxury EVs, with rental prices starting at RM550 per day and RM5,500 per month.

-

January 16, 2024: SIXT and Stellantis Form Strategic Agreement for Vehicle Purchase SIXT has reached a multi-billion euro agreement with Stellantis to purchase up to 250,000 vehicles by 2026, enhancing its rental fleet across Europe and North America. The deal includes a wide range of Stellantis brands and vehicle types, including electric models, aligning with both companies' decarbonization and customer-centric goals.

-

3rd January 2024: SKIL Cabs Launches Electric Car Rentals to Promote Sustainable TravelSKIL Cabs has introduced electric car rentals in India, marking a significant step towards sustainable transportation. This initiative reflects the company's commitment to reducing carbon footprints and promoting eco-friendly travel options in the country.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 39.68 Billion |

| Market Size by 2032 | USD 78.36 Billion |

| CAGR | CAGR of 7.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Model Style( Hatchback, Sedan, Sport Utility Vehicles, Multi-purpose Vehicles) • By Rental Duration(Business, Leisure) • By Booking Vehicle Model Style(Online Booking, Offline Booking) • By Drive Vehicle Model Style( Self-driven, Chauffeur-driven) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Key players in the luxury car rental market include Enterprise Rent-A-Car, Hertz Global Holdings, Avis Budget Group, Sixt SE, Europcar, Luxury Rentals, Turo, LUXURY CAR RENTAL USA, Green Motion, National Car Rental, Rent A Ferrari, Riviera Luxury Rentals, Premier Car Rental, Elite Rent-A-Car, DriveNow (BMW Group), Exotic Car Collection by Enterprise, Silvercar by Audi, Auto Europe, CarTrawler, and Limos.com.,Auto Bavaria ,SKIL Cabs. |

| Key Drivers | • Driving sustainability through the rise of electric luxury vehicles in the car rental market |

| Restraints | • High Maintenance and Operational Costs Hindering Growth in Luxury Car Rental Market |