Vaccine Adjuvants Market Size Analysis

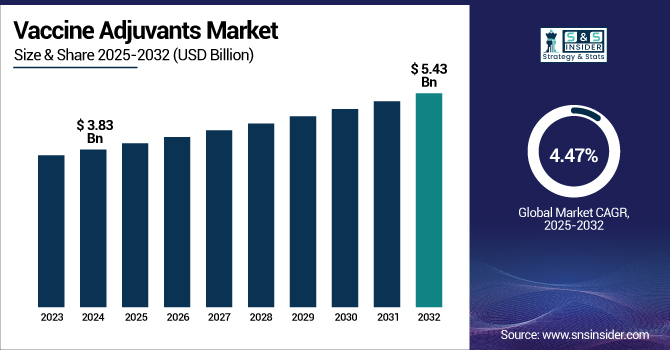

The Vaccine Adjuvants Market size was valued at USD 3.83 billion in 2024 and is expected to reach USD 5.43 billion by 2032, growing at a CAGR of 4.47% over the forecast period of 2025-2032.

To Get more information on Vaccine Adjuvants Market - Request Free Sample Report

The vaccine adjuvants market is seeing robust expansion, driven by government immunization campaigns, the growing incidence of infectious diseases, and technological innovation in vaccine enhancement technologies.

For example, the Centers for Disease Control and Prevention (CDC) reports that U.S. public health labs examined 129,638 specimens and found 39,885 to be influenza positive during the 2023–2024 season, therefore highlighting the ongoing need for enhanced adjuvants and effective vaccines.

Regulatory bodies such as the European Medicines Agency (EMA) and the U.S. FDA have sped up processes for adjuvant approval, enabling the commercialization of new adjuvants and promoting market expansion.

Reflecting the nation's leadership in vaccine research, funding, and adoption of next-generation adjuvants, the U.S. vaccine adjuvants market held approximately 86% of the North American market share in 2023, accounted for USD 1.25 billion in 2024, and is expected to reach USD 1.76 billion by 2032. Rising government and corporate sector investments drive the market even more; the U.S. government recently announced USD 122 million in funding for global vaccine development in June 2022. These elements together, with the increasing attention on vaccination efficacy and safety, are changing the present scene of the global vaccine adjuvants market.

Vaccine adjuvants are compounds included in vaccines to boost the immunological response of the body, therefore providing better and more long-lasting immunity. Reducing the antigen dosage needed per vaccination, increasing cost-effectiveness, and allowing protection against several disease strains depend on these agents, which are crucial. With major expenditures in sophisticated adjuvant technologies and immunostimulatory agents to handle changing public health issues, the industry is seeing rising government financing and policy support.

Vaccine Adjuvants Market Dynamics

Drivers

-

Growing Demand for Enhanced Vaccination Adjuvants Is Driven by The Global Burden of Infectious Illnesses and Chronic Conditions

The constant increase in infectious diseases, such as tuberculosis, HIV, influenza, and COVID-19, has made more efficient vaccinations even more important, driving the adoption of potent adjuvants.

For instance, the World Health Organization (WHO) estimates that 1.5 million people contracted HIV, with 650,000 deaths worldwide, while 10.8 million people were afflicted with tuberculosis, resulting in 1.6 million deaths in 2023.

This alarming disease burden emphasizes the need for vaccinations that can generate strong, long-lasting immune responses across diverse populations, including the elderly and immunocompromised. Vaccine adjuvants such as saponin-based compounds and toll-like receptor (TLR) agonists have shown the capacity to increase immunogenicity and lower necessary antigen dosages. It is Important in both pandemic and regular vaccination campaigns. Initiatives by companies such as Gavi and CEPI, which emphasize the global focus on pandemic preparedness, have hastened research and application of next-generation adjuvants, enabling fast vaccine production and more general coverage. Recent developments, such as TLR4 agonists in hepatitis B and cervical cancer vaccinations and Matrix-M in Novavax COVID-19 vaccines, show how technological advancements is transforming vaccine efficacy and public health outcomes.

Restrains

-

Stringent Regulatory Guidelines and Exensive Development Costs Present Major Obstacles To Market Expansion

Complicated and strict regulatory systems set by authorities, including the FDA, EMA, CDSCO, and ICMR, which demand thorough safety, immunogenicity, and quality studies before approval, significantly influence the vaccine adjuvants market. These criteria call for extensive preclinical studies, multi-phase clinical trials, and repetitive data entries, hence extending timetables and significant financial obligations. Advanced adjuvant technologies, including polymeric systems and lipid nanoparticles, demand specific manufacturing and adherence to changing requirements, hence driving additional expenses. These obstacles can be exorbitant for small and mid-sized biopharmaceutical companies, therefore restricting their capacity for innovation or introduction of new adjuvants into the market.

Furthermore, complicating supply chains and raising manufacturing costs are ethical questions and regulatory scrutiny over animal-derived adjuvants, combined with growing demand for synthetic or plant-based substitutes. Particularly in low- and middle-income countries where improved vaccines are most needed, regulatory authorities routinely evaluate and change their policies to guarantee strong product evaluation, but this may lead to delayed product introductions and limited access. The high cost and long approval procedure continue to be obstacles for the vaccine adjuvants market, notwithstanding incentives such as orphan drug designations and accelerated paths for pandemic preparedness.

Vaccine Adjuvants Market Segmentation Insights

By Type

With a market share of 31% in 2024, the particulate sector led the vaccine adjuvants market where particulate sector comprise liposomes, nanoparticles, and aluminum-based adjuvants. With a demonstrated track record of safety and efficacy in both human and veterinary vaccines, aluminum-based adjuvants remain the most commonly used ones. Their ability to replicate pathogen structures and improve antigen presentation makes them essential in contemporary vaccination formulations. Aluminum-based adjuvants have been routinely approved by regulatory authorities, including the FDA and EMA, for their compatibility and potency.

For instance, for high-risk groups, especially, the CDC still advises aluminum-adjuvanted influenza and hepatitis vaccinations in its immunization guidelines.

Using components derived from bacteria or viruses, the pathogen-based adjuvants segment is expected to expand at fastest CAGR in the vaccine adjuvants market throughout the forecast period. These adjuvants, including saponin-based molecules and toll-like receptor (TLR) agonists, closely reflect natural infection and induce strong immune reactions. Recent regulatory approvals, including the EMA's 2024 approval of a TLR4 agonistic adjuvant for HPV vaccinations, have shown the safety and efficacy of these advanced medicines. With the U.S. National Institutes of Health (NIH) and European Commission sponsoring clinical trials for vaccines targeting malaria, HPV, and other difficult diseases, government research funding is hastening the development of these immunostimulatory agents.

The vehicles and mucosal adjuvants segment, which includes oil-in-water emulsions such as MF59 and AS03, held a significant share in 2023 due to their ability to enhance vaccine stability and delivery.

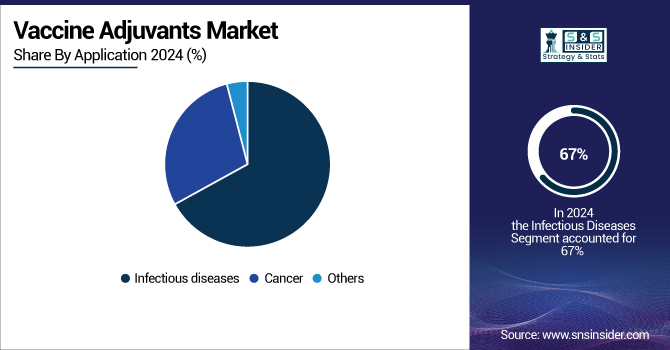

By Application

The infectious diseases segment led the global vaccine adjuvants market with a revenue share of 67% in 2024, reflecting the continuous burden of communicable diseases and the priority of immunization programs by governments all around. With almost 40,000 positive cases in the U.S., the CDC's 2023–2024 influenza data emphasizes the ongoing need for adjuvanted vaccinations. Global projects such as Gavi and the Coalition for Epidemic Preparedness Innovations (CEPI) are increasing the availability of adjuvanted vaccinations in low- and middle-income countries, therefore enhancing market penetration.

With the U.S. Department of Health and Human Services (HHS) funding approximately USD 200 million for vaccine and adjuvant research aimed at infectious illnesses, government investments remain high. Demand for adjuvants in vaccines for tuberculosis, malaria, and influenza is also resulting from the spread of national immunization campaigns in Asia-Pacific and Latin America.

Rising interest in therapeutic vaccines and tailored medicine is likely to propel the others segment, which comprises cancer, allergies, and autoimmune diseases, along with the fastest CAGR of 5.44% during the projection period to expand swiftly. Seeing their ability to transform treatment paradigms, governments, and research organizations are funding adjuvants specifically for oncology and chronic disease vaccines.

For instance, with multiple clinical trials scheduled for 2024, the U.S. NIH and the European Union's Innovative Medicines Initiative (IMI) have increased funding for cancer vaccination adjuvant research.

By Administration

Withheld a 34% share of the vaccine adjuvants market in 2024, the intramuscular segment led the market. The CDC and WHO advise this approach for major vaccinations, including those using aluminum-based adjuvants and oil-in-water emulsions, since it guarantees effective delivery and strong immune activation. Its ongoing supremacy is supported by its compatibility with a broad spectrum of vaccination formulations, including combination vaccine adjuvants.

Over the forecast period, the intradermal route is expected to be the fastest growing segment. Because of its dose-sparing capabilities and ability to target the dense network of immune cells in the skin, the intradermal approach is becoming more popular. Technological developments such as microneedle patches are making accurate and easily available intradermal distribution possible.

For instance, following NIH-funded experiments showing enhanced immunogenicity and patient compliance, the U.S. FDA authorized a new microneedle patch for intradermal vaccination administration in January 2024.

Regional Outlook

North America Vaccine Adjuvants Market Trends

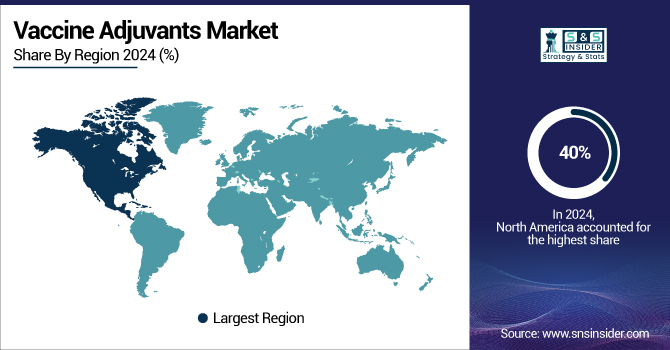

The North America region dominated the global vaccine adjuvants market in 2024 with a 40% share. Major vaccine adjuvant firms, a well-developed healthcare system, and large public and commercial funding in vaccine research and development underlie this dominance.

The U.S. vaccine adjuvants market was valued at USD 1.25 billion in 2024 and is expected to rise at a CAGR of 4.36% over the forecast period. Strong government programs, including funding for next-generation adjuvant systems and a high uptake rate of adjuvant-containing vaccines in both human and veterinary applications, drive market growth in the U.S. The increased skills in vaccine improvement technologies, regulatory backing, and strategic alliances between biotech companies and academic institutions are reflected in the market development of North America. Artificial intelligence integration in vaccine design and adjuvant discovery is also boosting innovation, therefore reinforcing the region's leadership in vaccine adjuvant market trends and vaccine adjuvant market growth.

Asia Pacific Vaccine Adjuvants Market Trends

Over the forecast period, Asia-Pacific is expected to grow with the fastest CAGR in the vaccine adjuvants market. Rising healthcare costs in developing nations such as China and India, as well as the region's expanding population and increasing frequency of infectious diseases, drive this fast increase. Ambitious immunization campaigns are being carried out by governments all around, and funding for vaccine research and manufacturing capacity is being greatly raised. Expanding pharmaceutical manufacture and the acceptance of sophisticated immunostimulatory drugs and combination vaccination adjuvants complement these programs. Supported by government-backed R&D and public health initiatives, the growing demand for both human and veterinary vaccinations is driving the vaccine adjuvants market analysis and orienting Asia-Pacific as a focal point for future market expansion. The area is positioned as a major driver of worldwide vaccine adjuvant market development by its dedication to raising immunization coverage and adopting technical developments.

Supported by high vaccination rates, robust government financing, and increasing R&D expenditure, Europe accounted for a significant share of the Vaccine adjuvant market in 2024. Advances in biotechnology, an increasing load of infectious and chronic diseases, and the presence of creative research organizations and biotech companies drive the market. Focusing on safety and efficacy, regulatory authorities, including the European Medicines Agency (EMA), have simplified the licensing process for new adjuvants, therefore promoting the adoption of new immunostimulatory agents and oil-in-water emulsions. Leading the regional market are nations including Germany, the UK, and France; Germany is expected to keep dominating through 2032. Furthermore, helping to drive vaccination adjuvant technologies across Europe are Italy's expanding biotechnology industry and government backing of life sciences research.

The Latin America, Middle East, and Africa (LAMEA) region is experiencing notable growth in the Vaccine adjuvant market, albeit from a smaller base. Rising infectious disease burden, more healthcare expenditures, and the acceptance of enhanced vaccination and adjuvant technologies drive the increase. These governments are concentrating on enhancing vaccination access, growing immunization campaigns, and funding indigenous production capability. Particularly, the Middle East and Africa are projected to show notable increase rates given fast technological development and increasing healthcare expenses. To improve vaccination efficacy and coverage, these innovations are helping the adoption of new adjuvants like aluminum-based adjuvants and combination vaccine adjuvants, addressing regional health issues.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Vaccine Adjuvants Market

The key vaccine adjuvants companies are CSL Limited, GlaxoSmithKline plc, Phibro Animal Health Corporation, Novavax, Inc., Adjuvance Technologies, Inc., Agenus, Inc., InvivoGen, Brenntag Biosector, SPI Pharma, Hawaii Biotech Inc., Aurorium, Dynavax Technologies Corporation., and others.

Recent Developments in the Vaccine Adjuvants Industry

-

Vaxine finished Phase II trials of its Advax-based RSV vaccine in January 2024, therefore demonstrating its potential against major competitors.

-

Croda International joined AAHI in March 2024 to create creative adjuvant compositions meant to increase world vaccination availability.

-

To increase its lipid-based adjuvant capacities and strengthen its cooperation with the University of Copenhagen to enhance vaccination platforms for infectious diseases and cancer, Croda bought Avanti Polar Lipids in May 2023.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.83 Billion |

| Market Size by 2032 | USD 5.45 Billion |

| CAGR | CAGR of 4.47% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Adjuvant emulsion, Pathogen, Combination, Particulate, and Others) • By Administration (Oral, Intramuscular, Intradermal, Intranasal, and Others) • By Application (Cancer, Infectious diseases, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | CSL Limited, GlaxoSmithKline plc, Phibro Animal Health Corporation, Novavax, Inc., Adjuvance Technologies, Inc., Agenus, Inc., InvivoGen, Brenntag Biosector, SPI Pharma, Hawaii Biotech Inc., Aurorium, Dynavax Technologies Corporation., and others |