Vein Finder Market Report Scope & Overview:

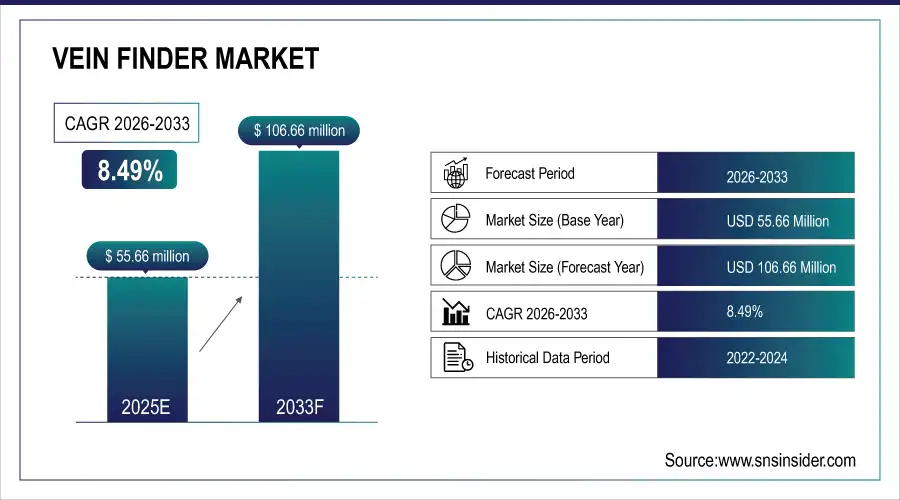

The vein finder market size was valued at USD 55.66 million in 2025E and is projected to reach USD 106.66 million by 2033, growing at a CAGR of 8.49% during 2026-2033.

The global vein finder market is growing with the growing focus of healthcare providers on patient safety during an injection. Vein finders alleviate pain and other problems by facilitating precise access to the vein and enhancing the patient's treatment process. Demand is increasing, and the number of vulnerable populations, including pediatric, geriatric, obese, and oncology patients, who need more predictable vascular access is increasing. The vein finder trend is directed towards patient-driven solutions with superior imaging technology.

For instance, in July 2024, the WHO reported that pediatric and geriatric patients face the highest venipuncture risks, boosting demand for vein finder devices and driving global market growth.

Market Size and Forecast:

-

Market Size in 2025: USD 55.66 million

-

Market Size by 2033: USD 106.66 million

-

CAGR: 8.49% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Vein Finder Market - Request Free Sample Report

Vein Finder Market Trends

-

Increasing need for precise venous access in pediatrics, geriatrics, oncology, and overweight patients is encouraging the usage of vein finders to reduce patient discomfort and procedure complications.

-

Recent progress in near-infrared (NIR), ultrasound, and AI-enhanced imaging has contributed to better vein visualization, a smaller number of needle sticks, and more efficient clinical workflow.

-

Connectivity with mobile and hand-held systems is improving A&E, ambulances, and home patient care, which further enhances the speed and safety of patient care.

-

Increasing acceptance of digital and AR-based products for vein visualization is boosting the real-time guidance to clinicians, leading to better success in the complex venipuncture procedures.

-

Government projects and hospital safety procedures are promoting the use of vein finders to lower complications, increase patient satisfaction, and improve treatment outcomes.

-

Partnerships between medical device manufacturers, AI technology developers, and healthcare providers are driving innovation and increasing access to the next wave of vein finder technologies.

-

Home care and chronic management of disease are trending, and demand for economical portable vein finder options is on the rise, especially in elderly or long-term care patients.

U.S. Vein Finder Market Insights

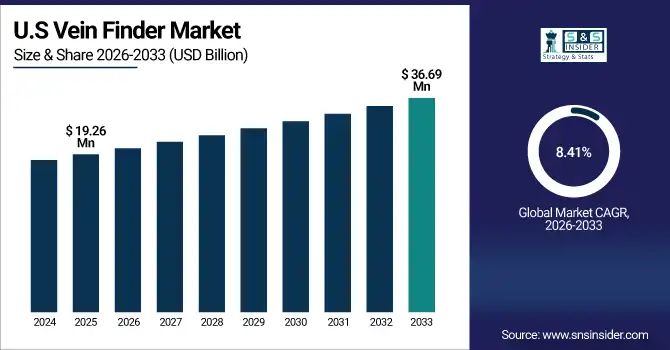

The U.S. vein finder market size was valued at USD 19.26 million in 2025E and is projected to reach USD 36.69 million by 2033, growing at a CAGR of 8.41% during 2026-2033. The US vein finder market dominance is driven by the advanced healthcare infrastructure, according to indicates US vein finder market analysis. World-class hospitals and Ambulatory Surgical Centers make it an easy fit for the vein finder in clinical practice. In addition, increasing demand in varied patient populations, including pediatric, geriatric, cancer, and obese patients, indicates a more widespread utilization. This robust healthcare environment and demand from patients position the US to be a dominant player in the global vein finder market.

Vein Finder Market Growth Drivers:

-

Growing Pediatric and Geriatric Populations Driving Vein Finder Consumption Growth

The rising pediatric and geriatric populations are one of the major factors driving the vein finder market, as venous access is problematic within these age groups owing to small, fragile, or difficult veins. Vein illuminators increase success rates on first attempts, decrease pain, and lower the risk of complications when drawing blood or starting an IV. Such demand attributes of related vein visualization technologies are driving considerable adoption of vein visualization devices in hospitals and other healthcare facilities.

For instance, in August 2024, the WHO reported that the rapidly growing global geriatric population with fragile veins is driving increased adoption of vein finders in hospitals and long-term care.

Vein Finder Market Restraints:

-

Limited Awareness in Emerging Regions Limits Market Expansion Globally

Low awareness profile of the vein finder in developing regions also serves as a major impediment to the vein finder market. When vein visualization instruments are not utilized, many caregivers in these developing countries still practice the traditional form of venipuncture and are unaware of the potential value offered by these instruments. Lack of awareness then slows uptake, despite significant increases in first-attempt success rates, decreased patient pain response, and lower complication rates associated with the newer vein finders. More education and marketing will be needed to overcome these obstacles and gain penetration.

Vein Finder Market Opportunities:

-

Integration With AI And Digital Health Platforms Creates Growth Opportunities for the Vein Finder Market

The fusion of AI and digital health platforms is a good opportunity for the vein finder market share. Vein-visualization aided by AI (VAI) helps in increasing precision, decreasing multi-needle tries, and helps clinicians in finding hard-to-find veins. Real-time monitoring, data analytics, and workflow optimization are also enabled in hospitals and clinics through digital platforms, thereby improving the efficiency of the institutions. With the integration of AI and vein finders, manufacturers can provide advanced, intelligent systems that address the increasing need for safe, quick, and accurate venous access.

For instance, in June 2024, Healthcare AI Journal reported that AI-assisted vein finders increased first-attempt venous access success rates by over 30%, boosting adoption in US and European hospitals.

Vein Finder Market Segmentation Analysis

-

By product type, infrared vein finders led the vein finder market with a 43.88% share in 2025e, while the near-infrared imaging systems are the fastest-growing segment with a CAGR of 9.06%.

-

By application, the pediatric use segment dominated the market with a 27.12% share in 2025e, and it is expected to grow fastest with a CAGR of 9.08%.

-

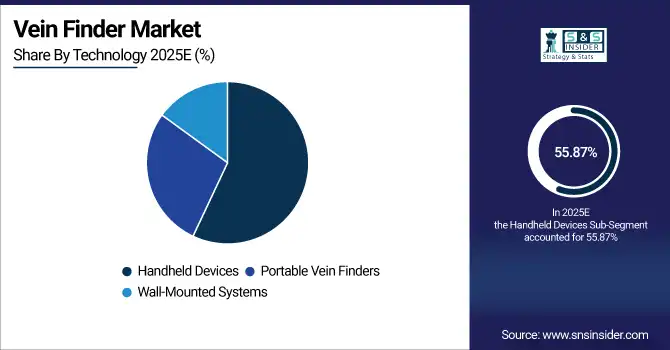

By technology, handheld devices led the market with a 55.87% share in 2025e, while portable vein finders are registering the fastest growth with a CAGR of 9.06%.

-

By end user, hospitals held a 57.85%share in 2025e, while ambulatory surgical centers are growing the fastest with a CAGR of 9.16%.

By Product Type, Infrared Vein Finders Lead the Market, While Near-Infrared Imaging Systems Register the Fastest Growth

The infrared vein finders segment dominated the vein finder market in 2025E, as they were cheap, portable, and easy to use. They have become standard in most hospitals, clinics, and emergency departments, where first-attempt success rates help clinician efficiency and patient satisfaction & comfort. The near-infrared imaging systems segment will grow at the highest CAGR over the forecast period, due to its great precision, improved imaging, and ability to find hard-to-hit veins. Growing use in pediatrics, oncology, and geriatrics drives global market expansion.

By Application, Pediatric Use Dominates and Shows Rapid Growth

The pediatric use segment was estimated to be the largest revenue generator of the total market share in 2025E, due to children having small, frequently hard-to-find veins. Vein finders increase first-attempt success, minimize pain and complications, and improve patient experience, contributing to their adoption in hospitals, clinics, and dedicated pediatric care facilities. For instance, it is also anticipated to be the fastest growing with a CAGR by 2026-2033, driven by the desire for safe, precise venous access for children. Vein finders save multiple needlesticks, increase patient comfort and procedure efficiency, and are driving adoption globally in hospitals and pediatric/children’s hospitals.

By Technology, Handheld Devices Lead, While Portable Vein Finders Register Fastest Growth

The handheld devices segment accounted for the highest share of revenues in the vein finder market in the year 2025E, due to their portability, simplicity, and cost. They enable healthcare providers to easily find veins in the hospital, clinic, or out in the field, increasing first-stick success rates and overall patient comfort for all types of patients, in all kinds of care settings, and are the most desired technology globally. While the portable vein finder segment is expected to achieve the fastest CAGR during the predicted period from 2026-2033, driven by the need for mobility and point-of-care uses. In emergency care, ambulatory and home healthcare, they offer rapid vein access and greater efficiency while reducing the risk of needlestick injuries and infection.

By End User, Hospital Lead, While Ambulatory Surgical Centers Grow Fastest

The hospital segment accounted for the largest share of the vein finder market in 2025E, as they have high patient loads and diverse patient characteristics, including pediatrics, oncology, surgery, and the emergency department. Veinilight devices facilitate a higher first-attempt success rate, fewer procedural complications, and a more efficient workflow in hospitals globally. The ambulatory surgical centers segment will have the highest CAGR over the forecast period 2026–2033, propelled by growth in outpatient procedures and minimally invasive operations. Vein finders aid in venous access efficiency, patient comfort, and workflow, leading to greater use in large-volume and fast-paced ASC settings.

Vein Finder Market Regional Analysis:

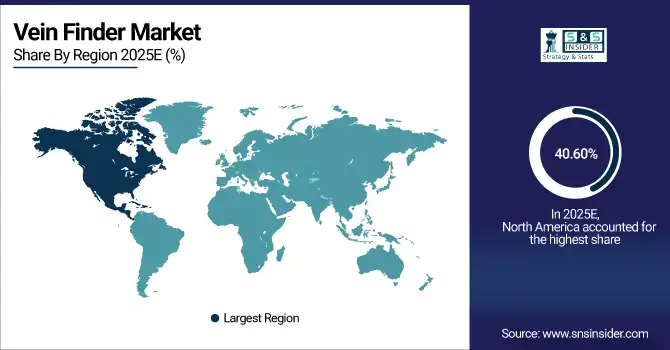

North America Vein Finder Market Insights

North America dominates the vein finder market with a market share of 40.60% 2025E, owing to a well-developed health care infrastructure, high health care spending, and early acceptance of advanced medical technology. A high patient turnover from pediatrics, geriatrics, oncology, and the obese population makes reliable venous access a necessity in the region. The presence of established manufacturers, including AccuVein, Christie Medical, and TransLite, also augments the market position of this region. Moreover, patient safety regulations, government initiatives, and hospital spending on advanced imaging systems have led to its widespread adoption, making North America the largest and most established market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Vein Finder Market Insights

The North America vein finder market is led by the US owing to well well-established health care infrastructure, an increase in patient pool, early availability of the technology; however, easy availability from private and public institutions made it widely employed in hospitals and ambulatory surgical centers.

Asia-Pacific Vein Finder Market Insights

Asia-Pacific is the fastest-growing region in the vein finder market, registering a CAGR of 9.40% over the forecast period, owing to the rapid growth of healthcare infrastructure, growing awareness about patient safety, and the growing burden of chronic diseases and cancer. Developing markets, including China, India, and Japan, are experiencing high demand for portable and advanced vein visualization devices in hospitals, clinics, and home care settings. Moreover, government programs, growing healthcare device funding, and emerging adoption of AI-based and near-infrared vein finders are some other factors propelling the growth of the market. Regional adoption is further accelerated by large patient populations and increasing access to healthcare.

China Vein Finder Market Insights

The Asia Pacific vein finder market is dominated by China owing to a large patient pool, increasing healthcare infrastructure, increasing prevalence of chronic diseases, and changing consciousness among the population regarding the benefits of advanced visualizing devices, along with the increasing government initiatives and increasing hospital and clinic networks.

Europe Vein Finder Market Insights

The vein finder market in Europe is the second largest market, in terms of value, owing to the strong presence of HCIT solutions, a large patient population for chronic and lifestyle diseases, and increasing awareness regarding the benefits of vein illuminators. Rising pediatric, oncological, and geriatric applications are supporting hospital and clinic utilization. Moreover, government programs, reimbursement coverage, and growing recognition of vein visualization technologies support the region’s major share and position Europe in the second place after North America.

Germany Vein Finder Market Insights

Germany holds the largest share in the European vein finder market, owing to its well-established healthcare infrastructure, increasing patient population, growing number of surgeries, rising focus on patient safety, increasing utilization of advanced vein visualization devices, government efforts, and presence of a large number of hospitals and clinics in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Vein Finder Market Insights

Latin America and the Middle East & Africa are the developing markets in the vein finder market, with the growth of healthcare infrastructure, patient safety awareness, and usage of advanced medical instruments being relatively moderate. In Latin America, Brazil and Mexico are heavily investing in hospitals and diagnostic centers, and in Middle Eastern and African nations, including the UAE and Saudi Arabia, they are bolstering healthcare facilities. The rising prevalence of chronic diseases and increasing demand for pediatric and geriatric care contribute to market expansion in these geographies.

Vein Finder Market Competitive Landscape:

AccuVein Founded in 2005, AccuVein Inc. is the world's only maker of handheld, non-contact vein illumination devices. Using cutting-edge, near-infrared (NIR) imaging and detection, AccuVein allows practitioners to see a map of these veins on the skin’s surface with the goal of improving first-stick success rates and reducing patient discomfort. Their devices are used in hospitals, clinics, and ambulatory care settings globally.

-

In March 2024, AccuVein launched an AI-enhanced handheld vein visualization device in the US, improving first-attempt success rates and integrating real-time analytics to support clinicians in pediatric and oncology care.

Christie Medical Holdings Inc. Christie Medical Holdings, Inc., is a global company based in Memphis, Tenn., that discovers, develops, and commercializes medical technologies. Their technology improves the accuracy of venous access, decreases multiple needle sticks, and is employed in a variety of settings, including pediatric, oncology, and surgery, demonstrating their focus on innovation and clinical efficacy.

-

In August 2024, Christie Medical introduced the VeinViewer Flex 2.0, featuring improved portability and near-infrared imaging capabilities, expanding adoption in outpatient surgical centers and emergency care facilities across North America and Europe.

TransLite LLC has been developing infrared and digital vein visualization devices since 2001, and is based in the USA, St. Paul, Minnesota. The VeinLite technology is based on portability, ease of use, and better vein puncture results with deployments in hospitals, labs, and physician offices globally.

-

In February 2025, TransLite upgraded its VeinLite iX series with advanced digital imaging and augmented reality guidance, targeting hospitals and home healthcare providers to enhance vein detection accuracy and procedural efficiency.

Vein Finder Market Key Players:

Some of the vein finder market Companies are:

-

AccuVein Inc.

-

Christie Medical Holdings, Inc.

-

TransLite LLC

-

Near Infrared Imaging, Inc.

-

Infrared Imaging Systems, Inc.

-

Venoscope LLC

-

AimVein

-

Zhongke Meiling Cryogenics Co., Ltd.

-

Shenzhen Bestman Instrument Co., Ltd.

-

Healicom Medical Equipment Co., Ltd.

-

OSANG Healthcare Co., Ltd.

-

Bio-Medical Devices Intl.

-

Medtronic plc

-

Koninklijke Philips N.V.

-

GE HealthCare Technologies Inc.

-

Shenzhen Vivolight Medical Device Technology Co., Ltd.

-

RaBandy Vein Finder

-

Novarix Ltd.

-

BLZ Technology

-

Venoscope Europe GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 55.66 Million |

| Market Size by 2033 | USD 106.66 Million |

| CAGR | CAGR of 8.49 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Infrared Vein Finders, Ultrasound Vein Finders, Near-Infrared Imaging Systems, Digital Vein Visualization Devices) • By Application (Pediatric Use, Oncology, Surgical Procedures, IV Insertions, Chronic Disease Management) • By Technology (Handheld Devices, Portable Vein Finders,, Wall-Mounted Systems) • By End User (Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Home Healthcare Providers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | AccuVein Inc., Christie Medical Holdings, Inc., TransLite LLC, Near Infrared Imaging, Inc.,Infrared Imaging Systems, Inc., Venoscope LLC, AimVein, Zhongke Meiling Cryogenics Co., Ltd., Shenzhen Bestman Instrument Co., Ltd., Healicom Medical Equipment Co., Ltd., OSANG Healthcare Co., Ltd., Bio-Medical Devices Intl., Medtronic plc, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Shenzhen Vivolight Medical Device, Technology Co., Ltd., RaBandy Vein Finder, Novarix Ltd., BLZ Technology, Venoscope Europe GmbH and other players. |