Sleep Apnea Devices Market Size Analysis:

To Get More Information on Sleep Apnea Devices Market - Request Sample Report

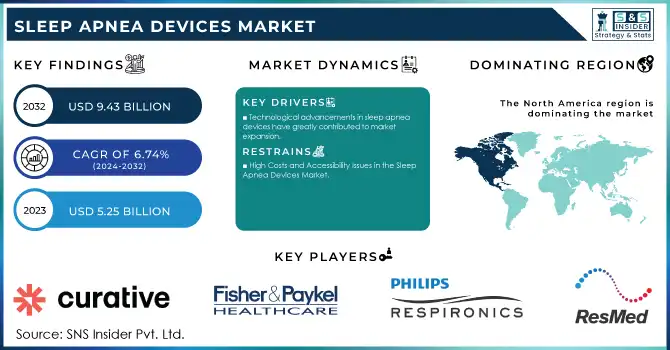

The Sleep Apnea Devices Market size was valued at USD 5.25 billion in 2023 and is projected to reach USD 9.43 billion by 2032, growing at a CAGR of 6.74% over the forecast period 2024-2032.

The Sleep Apnea Devices Market is experiencing significant growth, largely driven by the rising prevalence of sleep apnea, growing public awareness, and advancements in treatment technologies. Sleep apnea affects millions worldwide, particularly obstructive sleep apnea. According to the National Sleep Foundation, approximately 22 million Americans suffer from sleep apnea, with a staggering 80% of moderate and severe cases remaining undiagnosed. Globally, the World Health Organization estimates that 936 million people aged 30-69 are affected by sleep apnea, with key contributing factors such as obesity—affecting over 40% of U.S. adults—and an aging population. These statistics underscore the growing need for effective treatment options.

Technological advancements have played a pivotal role in the market’s expansion. Continuous Positive Airway Pressure machines, Bi-level Positive Airway Pressure devices, and Automatic Positive Airway Pressure machines have evolved to be more compact, portable, and comfortable, addressing patient compliance challenges. For example, the Somnetics Transcend 3 mini CPAP offers a portable solution for patients needing CPAP therapy on the go. Innovations like these make it easier for individuals to manage their condition at home and while traveling. Additionally, the FDA’s recent approval of the Oral Appliance for Severe Sleep Apnea Therapy represents a significant shift in treatment options, providing an alternative for patients who struggle with traditional CPAP devices.

Awareness campaigns by organizations like the American Academy of Sleep Medicine and the Centers for Disease Control and Prevention have significantly contributed to increasing public knowledge about sleep apnea and its associated risks. Through initiatives like the Obstructive Sleep Apnea Awareness Project, these organizations have helped educate the public on the importance of early diagnosis and treatment. This heightened awareness has led to a growing number of people seeking sleep apnea screenings and treatments.

The integration of telemedicine and mobile health technologies has further transformed the market. Platforms like SleepCycle and ApneaLink offer remote monitoring and diagnostic services, allowing patients to track their sleep patterns and receive timely feedback on their condition. These innovations are especially beneficial for individuals in remote areas or those with limited access to traditional healthcare facilities.

Market Dynamics

Drivers

-

Awareness of Health Risks and Public Health Campaigns

The growing awareness of the health risks associated with untreated sleep apnea is a significant driver of market growth. As sleep apnea is linked to serious conditions such as cardiovascular disease, stroke, and hypertension, more individuals are seeking early diagnosis and treatment. Medical professionals and advocacy groups, including the American Academy of Sleep Medicine, have played a pivotal role in educating the public on these risks. Public health campaigns have been instrumental in encouraging individuals to take proactive steps in managing their sleep apnea, leading to increased acceptance of sleep apnea therapies. This heightened awareness is driving demand for early intervention and treatment options, fueling the market for sleep apnea devices.

-

Technological advancements in sleep apnea devices have greatly contributed to market expansion.

Manufacturers have focused on developing more effective, user-friendly, and comfortable treatment options. Innovations such as quieter and more compact CPAP machines have made treatment easier and more accessible, especially for individuals who previously found the devices cumbersome. Portable CPAP machines designed for travel have made it easier for patients to comply with therapy even when away from home. Additionally, the rise of non-invasive treatments, such as oral appliances, offers alternative solutions for patients who may find traditional CPAP machines uncomfortable. These technological improvements are enhancing patient compliance and contributing to the growth of the sleep apnea device market.

-

The improvement in reimbursement policies and insurance coverage is another key factor driving the growth of the sleep apnea device market.

In the United States, Medicare and private insurance plans now cover home sleep apnea testing and the purchase of treatment devices, making these products more affordable and accessible to a wider range of patients. Furthermore, integrating mobile health solutions and telemedicine has allowed patients to monitor and manage their condition remotely, enhancing the overall treatment experience. Remote monitoring through mobile applications has made it easier for healthcare providers to track progress, adjust treatment plans, and ensure better patient outcomes. This combination of improved reimbursement and technological integration is accelerating market growth.

Restraints

-

High Costs and Accessibility Issues in the Sleep Apnea Devices Market

One of the primary restraints in the Sleep Apnea Devices Market is the high cost of advanced treatment devices such as CPAP and BiPAP machines. While these devices are essential for managing sleep apnea, the initial purchase cost and maintenance expenses can be prohibitive for many individuals, particularly in lower-income regions or developing countries. Despite improvements in insurance coverage, many patients still face substantial out-of-pocket expenses. This financial burden, combined with limited insurance reimbursement in certain areas, restricts access to necessary devices for a large segment of the population. As a result, the affordability factor becomes a key barrier, preventing widespread adoption of sleep apnea treatments, especially for those with insufficient financial resources.

-

Patient Compliance Challenges in Sleep Apnea Treatment

Another significant challenge facing the Sleep Apnea Devices Market is patient non-compliance with traditional treatments, particularly CPAP therapy. While CPAP machines are the gold standard for sleep apnea treatment, they often come with discomfort, including noise, air pressure issues, and difficulty with mask fit. Many users find it hard to adapt to these machines, leading to poor adherence rates. This non-compliance is one of the major reasons why the effectiveness of sleep apnea treatments is sometimes limited. The discomfort associated with continuous use can result in patients discontinuing their treatment or using the devices intermittently, reducing the overall success rate. Additionally, the complexity of some devices may deter patients from fully committing to therapy, impacting market growth.

Sleep Apnea Devices Market Segmentation Analysis

By Product

In 2023, therapeutic devices held the largest share of the Sleep Apnea Devices Market, accounting for approximately 65% of the market revenue. The dominance of this segment is attributed to the rising adoption of CPAP machines, BiPAP machines, and oral appliances, which are widely recognized as effective treatment options for managing sleep apnea. Technological advancements, such as quieter and more portable devices, have further increased patient preference for therapeutic devices. Additionally, the growing awareness about the adverse health impacts of untreated sleep apnea has led to increased usage of therapeutic solutions for timely intervention.

The diagnostic devices segment is expected to witness the fastest growth during the forecast period, driven by an increasing emphasis on early detection of sleep apnea. Portable home sleep testing devices are gaining traction due to their convenience, cost-effectiveness, and ability to deliver accurate results. The adoption of diagnostic devices is further supported by insurance coverage policies and public health initiatives promoting early diagnosis.

By Age Group

The age group of 40–60 years dominated the market in 2023, contributing approximately 55% of the overall revenue. This age group is at a higher risk of developing sleep apnea due to lifestyle factors, comorbidities like obesity and hypertension, and natural aging processes. Increased health awareness among this demographic and better access to diagnostic and therapeutic solutions have strengthened its market dominance.

The above-60 age group is anticipated to grow at the highest rate, fueled by the increasing prevalence of sleep apnea among older adults. Aging-related factors, such as reduced muscle tone in the airway and a higher likelihood of coexisting conditions like cardiovascular diseases, contribute to the demand for sleep apnea devices in this segment. Moreover, improvements in healthcare infrastructure and insurance coverage are making these devices more accessible to elderly populations.

Regional Outlook

In 2023, North America emerged as the leading region in the Sleep Apnea Devices Market, holding the largest share of 49%. This dominance is attributed to the high prevalence of sleep apnea, advanced healthcare infrastructure, and widespread adoption of innovative devices. The region benefits from an extensive network of sleep centers, rising public awareness initiatives, and supportive reimbursement policies. The United States spearheads this growth, driven by robust R&D investments, frequent regulatory approvals, and early adoption of cutting-edge technologies.

Europe secured the second-largest market share, supported by increasing awareness of the health risks associated with untreated sleep apnea and proactive government measures encouraging early diagnosis and treatment. Key contributors, such as Germany and the United Kingdom, leverage their well-established healthcare systems and growing emphasis on non-invasive treatment options to drive market expansion.

The Asia-Pacific region is poised for the fastest growth during the forecast period, fueled by a rising population, an increasing prevalence of sleep apnea, and improved access to healthcare services. Nations like China, India, and Japan are at the forefront of this regional surge, backed by rapid urbanization, growing healthcare spending, and portable and affordable diagnostic device availability. These factors make Asia-Pacific a critical area for market development, offering significant opportunities for industry stakeholders.

Do You Need any Customization Research on Sleep Apnea Devices Market - Enquire Now

Key Players and Their Sleep Apnea Products

-

-

Continuous Positive Airway Pressure (CPAP) devices

-

Automatic Positive Airway Pressure (APAP) devices

-

Bilevel Positive Airway Pressure (BiPAP) devices

-

Masks and accessories

-

Cloud-connected software solutions

-

-

Respironics (a subsidiary of Koninklijke Philips N.V.)

-

DreamStation CPAP and BiPAP machines

-

DreamWear nasal and full-face masks

-

Sleep therapy tracking tools

-

-

Fisher & Paykel Healthcare Limited

-

SleepStyle CPAP machines

-

Evora nasal masks

-

Vitera full-face masks

-

Humidifiers and breathing circuits

-

-

Curative Medical, Inc.

-

CPAP and BiPAP machines

-

Portable sleep therapy devices

-

Sleep diagnostic systems

-

-

React Health (Respiratory Product Line from Invacare Corporation)

-

Sleep therapy solutions (CPAP, BiPAP devices)

-

Masks and accessories

-

-

Somnetics International, Inc.

-

Transcend portable CPAP devices

-

Sleep apnea therapy accessories

-

-

BMC Medical Co., Ltd.

-

G3 CPAP series

-

Masks and sleep diagnostic devices

-

Non-invasive ventilators

-

-

Natus Medical Incorporated

-

Sleep diagnostic systems

-

EEG and polysomnography equipment

-

-

SOMNOmedics GmbH

-

Portable sleep diagnostic devices

-

Home sleep testing solutions

-

-

Compumedics Limited

-

Somte PSG diagnostic systems

-

Grael polysomnography systems

-

-

Itamar Medical Ltd.

-

WatchPAT sleep apnea diagnostic devices

-

Home sleep testing solutions

-

-

Nihon Kohden Corporation

-

Polysomnography systems

-

Sleep lab diagnostic tools

-

-

OpenAirway

-

Oral appliances for sleep apnea

-

Non-invasive airway management solutions

-

-

Cadwell Industries, Inc.

-

Polysomnography systems

-

Diagnostic tools for sleep studies

-

-

SomnoMed

-

Oral appliance therapy devices

-

Customized mandibular advancement splints

-

-

Braebon Medical Corporation

-

Sleep diagnostic and therapy systems

-

PSG accessories and sensors

-

Recent Developments

-

In Dec 2024, Eli Lilly's weight-loss drug, Zepbound, received approval from the U.S. Food and Drug Administration (FDA) as the first-ever medication to treat obstructive sleep apnea directly. This groundbreaking approval marks a significant milestone in addressing the common sleeping disorder through pharmaceutical intervention.

-

In Oct 2024, LuxCreo, Inc., a leader in personalized medical and dental device manufacturing, collaborated with EMA Sleep, Inc. to enable same-day, in-clinic, and scalable production of advanced EMA devices for treating Obstructive Sleep Apnea (OSA). This partnership leverages cutting-edge 3D printing technology to enhance patient care and streamline manufacturing processes.

-

In April 2024, Philips disclosed that the costs associated with a consent decree issued by a U.S. court, which imposed restrictions on producing its sleep apnea devices, resulted in a provision of USD 378 million for Q4 2023. The company projected these costs to account for approximately 1% of its total revenue in 2024.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.25 billion |

| Market Size by 2032 | USD 9.43 billion |

| CAGR | CAGR of 6.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Therapeutic Devices (PAP Devices {CPAP Devices, APAP Devices, BPAP Devices}, Facial Interfaces) Masks {Full-face Masks, Nasal Pillow Masks, Nasal Masks}, Cushions), Accessories (Humidifiers Accessories, Power Accessories, Transportation Accessories, Communication Accessories, Chin Restraints, Other Accessories), Oral Appliances (Mandibular Advancement Devices, Tongue-retaining Devices, Daytime-Nighttime Appliances), Other Therapeutic Devices, [Diagnostic Devices, (PSG Devices {Ambulatory PSG Devices, Clinical PSG Devices}, Home Sleep Testing Devices, Oximeters (Fingertip Oximeters, Handheld Oximeters, Wrist-worn Oximeters, Tabletop Oximeters, {Actigraphy Systems, Sleep Screening Devices})] •By Age Group [Below 40 Years, 40-60 Years, Above 60 Years] •By Gender [Male Patients, Female Patients] •By End User [Sleep Laboratories, Clinics, and Hospitals, Home Care Settings/ Individuals] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ResMed, Respironics (Philips), Fisher & Paykel Healthcare, Curative Medical, React Health, Somnetics, BMC Medical, Natus Medical, SOMNOmedics, Compumedics, Itamar Medical, Nihon Kohden, OpenAirway, Cadwell Industries, SomnoMed, Braebon Medical. |

| Key Drivers | • Awareness of Health Risks and Public Health Campaigns • Technological Innovations and Enhanced Treatment Options • Improved Reimbursement Policies and Integration of Mobile Health |

| Restraints | • High Costs and Accessibility Issues in the Sleep Apnea Devices Market • Patient Compliance Challenges in Sleep Apnea Treatment |