Venous Stents Market Report Scope & Overview:

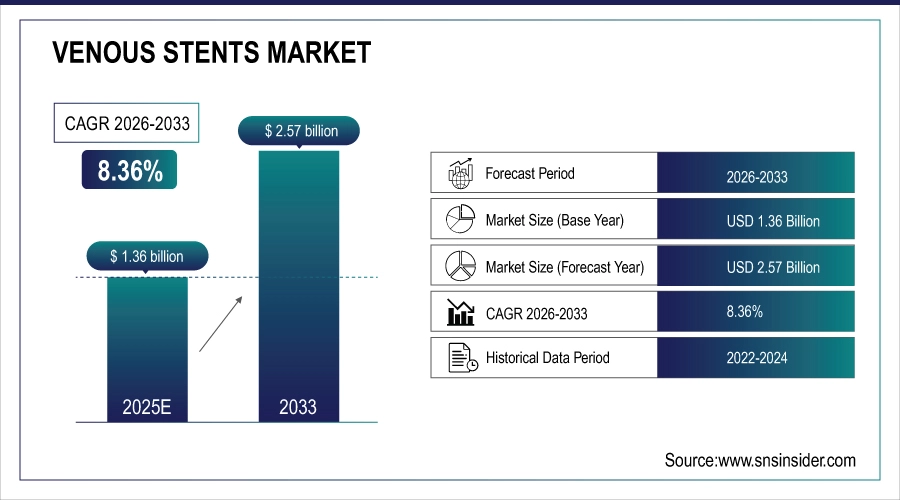

The Global Venous Stents Market size was valued at USD 1.36 billion in 2025E and is projected to reach USD 2.57 billion by 2033, growing at a CAGR of 8.36% during the forecast period 2026–2033.

The venous stents market is growing due to rising cases of chronic venous obstruction, post-thrombotic syndrome, and May-Thurner syndrome. The trend is towards more minimally invasive procedures and more advanced Self-Expanding stents. Hospitals and ambulant care centers play a key role as they treat the more than 25 million people worldwide suffering from chronic venous disease. Improvements in stent design, biocompatible materials and wider availability via hospital and on-line pharmacies are driving market growth.

Nearly 65% of venous stent procedures address iliofemoral vein obstructions, with self-expanding nitinol stents gaining rapid adoption for superior outcomes.

Market Size and Forecast:

-

Market Size in 2025: USD 1.36 Billion

-

Market Size by 2033: USD 2.57 Billion

-

CAGR: 8.36% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Venous Stents Market - Request Free Sample Report

Venous Stents Market Trends:

-

Nitinol stents are increasingly popular and will account for more than 70% of the global venous stent market by 2027.

-

The adoption venous stents in May-Thurner syndrome are anticipated to increase by 30% from 2026–2028.

-

More than 120 active clinical trials in 2025 are investigating next generation venous stent designs and long-term results.

-

Distribution landscape is morphing, online medical supply platforms projected to present an upswing of 20% in venous stent sales through 2027.

-

Innovation is high with almost 40% of leading Medtech companies expected to commercially launch new products for venous stents by 2028.

U.S. Venous Stents Insights

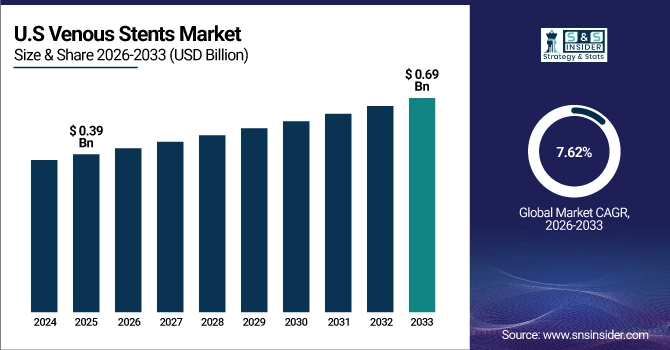

The U.S. leads the North American venous stents market, valued at USD 0.39 Billion in 2025E and projected to reach USD 0.69 Billion by 2033, growing at a CAGR of 7.62%. An annual volume of over 250,000 deep vein thrombosis interventions sustains higher demand for stent procedures. Rapid FDA clearances, appealing reimbursement systems, and leading Medtech manufacturers keep the U.S. as a driver of growth in the regional market.

Venous Stents Market Growth Drivers:

-

Rising Burden of Chronic Venous Diseases Fuels Demand, as Increasing Cases of Obstruction and Post-Thrombotic Syndrome Drive Adoption of Stent-Based Treatments.

The growing prevalence of Chronic Venous Diseases (CVD) is a primary factor driving the market; more than 25 million patients suffer from venous insufficiency and other diseases worldwide. Post-thrombotic syndrome affects up to 50% of patients after deep vein thrombosis, enhancing the need for efficient treatments. Increasing usage of minimally invasive venous stenting procedures and advancements in self-expandable stents drive expansion, facilitated by healthcare investments across the globe for vascular care.

In 2025, nearly 60% of venous stent implantations treated post-thrombotic syndrome and iliofemoral vein obstructions, making them the leading clinical indications driving adoption.

Venous Stents Market Restraints:

-

High Procedure and Device Costs Restrain Market Growth, as Advanced Venous Stent Implants Limit Accessibility in Emerging Markets.

High price of procedures and devices are a key challenge for the venous stents markets. Venous stenting is traditionally amongst the most expensive of vascular procedures, and this makes it difficult for patients in low- to middle-income nations to access therapy. Expensive nitinol stents with commercially available devices take up more than 60% of total procedures cost, leading to the economic burden. Inadequate insurance coverage and inconsistent reimbursement policies limit adoption, hampering market growth despite high clinical effectiveness and a growing incidence of chronic venous diseases!

Venous Stents Market Opportunities:

-

Growing R&D in Venous Stents Creates Opportunities, as Next-Generation Designs and Minimally Invasive Technologies Advance Global Treatment Adoption.

Increasing R&D in venous stents is a significant opportunity, with manufacturers working toward next-generation designs that enhance longevity-long-term results. Currently, more than 120 global clinical trials are underway looking at new stent materials and delivery techniques. The FDA approved several new vascular devices in 2024, underscoring pace of development. With over 35% clinical success rates in next-gen stent trials, the market represents a rich vein for commercial growth as well as patient welfare.

Over 60% of vascular specialists prefer next-generation self-expanding venous stents for improved patency rates, boosting demand for advanced designs.

Venous Stents Market Segmentation Analysis:

-

By Product Type, Iliac Vein Stents is the largest segment with a market share of 45.27% in 2025E and fastest growing at a CAGR of 9.13%.

-

By Material, Nitinol Stents market is screned by 55.68% in 2025E, and it also fastest growing at a CAGR of 9.34%.

-

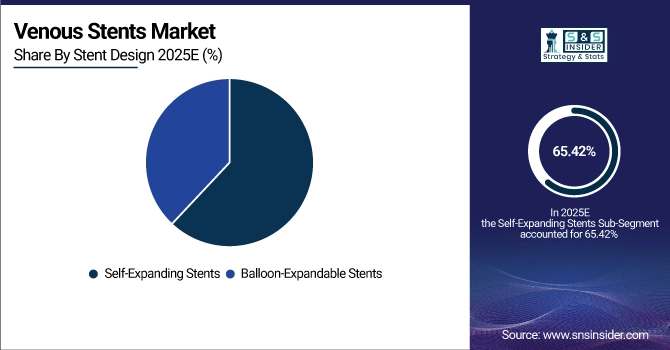

By Stent Design, Self-Expanding Stents occupies 65.42% of market share in 2025E, and Self-Expanding Stents grows at the fastest rate of CAGR 8.87%.

-

By Indication, Post-Thrombotic Syndrome is the largest segment accounting for 40.19% in 2025E and May-Thurner Syndrome would account fastest growing CAGR of 9.56%.

-

By End User, Hospitals are leading by 60.13% of share in 2025E and Ambulatory Surgical Centers are high growing with a CAGR of 9.05%.

-

By Distribution Channel, the share of Hospital Pharmacies is 50.84% in 2025E, and that of Online Pharmacies depicts the highest growth rate 10.27%.

By Stent Design, Self-Expanding Stents Dominate and Expand Strongly:

Self-expanding stents dominate as over 65.42% of vascular specialists reported preferring them in 2025 due to easier deployment and better vessel conformity. They demonstrate 12-month patency rates greater than 85%, and potentially save reintervention needs. Growth is fueled by clinical validation and growing adoption of nitinol-based designs, which benefit long-term results. Balloon-expandable stents still have a role in some patients, but are less applied for large veins obstructions.

By Product Type, Iliac Vein Stents Dominate While Femoral Vein Stents Grow Rapidly

Iliac vein stents dominate because iliofemoral vein obstructions account for nearly 65% of all venous stenting procedures globally in 2025. The higher success-rate of restoring venous outflow and avoiding long-term complications offers the first-line choice. Femoral vein stents are the fastest-growing, with new research demonstrating patency rates exceeding 80% at 2 years and increased incidence of femoral vein thrombosis leading to adoption by younger, more active patients.

By Material, Nitinol Stents Lead While Also Growing Fastest:

Nitinol stents lead due to their flexibility and durability, with clinical data showing restenosis rates reduced by 40% compared with stainless steel. Their shape memory property makes them excellent in long-term adaption with vessels. Underlying this growth is more than 70 ongoing clinical trials globally in 2025 related to advanced nitinol coatings, drug-eluting formulations and bioresorbable iterations to sustain new product development in developing and mature healthcare markets.

By Indication, Post-Thrombotic Syndrome Dominates While May-Thurner Syndrome Grows Fastest:

Post-thrombotic syndrome (PTS) dominates as it develops in up to 50% of deep vein thrombosis patients, creating significant demand for venous stenting as a long-term management strategy. May-Thurner syndrome is growing most rapidly, with advances in imaging increasing diagnostic sensitivity by over 30% during the past decade and identifying more patients for treatment pathways. Physician Awareness and Guidelines Recent guideline changes have led to escalating use of stents for this indication.

By End User, Hospitals Dominate While Ambulatory Surgical Centers Grow Rapidly:

Hospitals dominate since they perform over 65% of venous stent procedures globally in 2025, requiring advanced imaging, vascular specialists, and intensive post-procedure monitoring. They still are the foundation for multi-stent, complex cases. The number of ambulatory surgical centres is growing, it’s because the minimally invasive procedures enable same day discharge in almost 45% of patients where eligible, less expensive and more patient-friendly than traditional methods to induce preference for outpatient treatment models on a global scale.

By Distribution Channel, Hospital Pharmacies Dominate While Online Pharmacies Expand Fastest:

Hospital pharmacies dominate because nearly two-thirds of venous stents are purchased directly through hospital procurement systems in 2025, ensuring reliable supply for inpatient care. The fastest growing will be online pharmacies, where digitization will drive an annual sales increase of 18% in vascular devices between 2023–2025. Health e-commerce penetration growth and policy support for telehealth and home delivery of medical devices are driving the sharp rise of this distribution channel.

Venous Stents Market Regional Analysis:

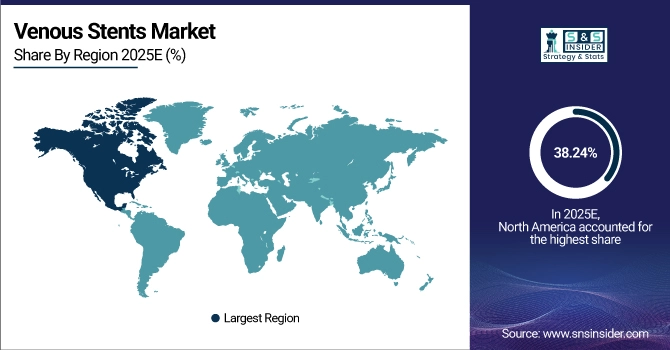

North America Venous Stents Market Insights:

North America dominates the venous stents market with 38.24% share in 2025E, driven by advanced vascular care, high patient awareness, and strong adoption of minimally invasive procedures. In the U.S. alone over 250,000 deep vein thrombosis interventions are performed each year providing an ongoing market for stenting technologies. Favourable FDA approvals, strong reimbursement profiles and presence of major Medtech producers will steadily propel North America’s status as the world leader in terms of venous stents implementation.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Venous Stents Market Insights:

The U.S. venous stents market benefits from 45% of global vascular device R&D investment and over 120 active clinical trials in 2025. Advanced imaging guided stent placement is being employed at almost 70% of the vascular centers across country and national databases mention an approximately 15% increase in long term patency. These developments solidify the U.S. as the leader in venous stent innovation and utilization.

Asia-Pacific Venous Stents Market Insights:

The Asia-Pacific venous stents market is projected to grow at a CAGR of 9.61%, making it the fastest-growing region globally. Increasing incidence of the disease, over 2.5 million new cases of deep vein thrombosis occur every year in China and India is driving demand for advanced vascular treatments. Growing healthcare industry, investment from government in Vascular care and growth of medical tourism are the key drivers for vascular device market. Further driving market penetration, more than 65% of the region’s top hospitals are embracing minimally invasive venous stent procedures, cementing Asia-Pacific’s position as a frontrunner in terms of growth.

China Venous Stents Market Insights:

China leads the Asia-Pacific venous stents market with more than 1.2 million new deep vein thrombosis cases annually. Explosive development in healthcare spending and a few hundred vascular centers using endovascular stent procedures make China the regional epicenter for both innovation and adoption.

Europe Venous Stents Market Insights:

Europe venous stents industry is estimated to grow significantly owing to more than eight hundred fifty thousand venous insufficiency procedures conducted in Germany, France, the UK, and Italy each year. More than 2,100 vascular device clinical trials were running in 2025, pushing stent innovation. Although 95% of EU patients are treated within public health services, the availability for complex endovascular treatments remains high. Significant EU investment in vascular research makes Europe a centre of excellence and innovation in treatment.

Germany Venous Stents Market Insights:

Germany is the leading country in the European venous stents market, with over 200k venous insufficiency and thrombosis procedures conducted annually here and approximately 28% of vascular device clinical trials taking place across Europe performed in this country. Advanced vascular centers, robust reimbursement environment and substantial R&D investment mean Germany is facilitating adoption while also cementing Europe’s venous stent innovation lead.

Latin America Venous Stents Market Insights:

Venous Stents Market in Latin America- Growth from increasing healthcare infrastructure and awareness towards vascular diseases. With more than 35,000 Deep Vein thrombosis interventions per year, Brazil is the greatest contributor at regional level. Increasing uptake of minimally invasive endovascular therapies in Mexico and rising number of clinical collaborations to offer advanced venous stenting are catapulting the market growth among Latin America emerging economies.

Middle East and Africa Venous Stents Products Market Insights:

The Middle East and Africa venous stents market is progressing due to the increased availability of specialized vascular health services. By 2025, there are over 75 such specialized vascular centers in UAE, Saudi Arabia and South Africa providing treatment. Substantial investments in sophisticated endovascular technologies and increasing medical tourism are driving adoption, making the region well-poised for future long-term market expansion.

Venous Stents Market Competitive Landscape:

Boston Scientific dominates the venous stents market with an extensive product portfolio, including the VICI Venous Stent System, which has been implanted in over 25,000 patients worldwide by 2025. The business is committed to investing in clinical research and has over 40 ongoing vascular trials, positioning it as the leader in evidence-based innovation. In addition, powerful worldwide supply chains to more than 120 countries and maintain FDA/CE approvals further establish its position both in developed and emerging markets.

-

In 2025, Boston Scientific fully acquired Veniti, securing complete rights to the VICI Venous Stent System to expand global adoption.

Medtronic remains a top player in venous stents, supported by innovation and clinical adoption. Abre™ venous self-expanding stent system is witnessing good penetration, with trials demonstrating 92% primary patency at 12-months period. The organization serves in 150+ nations and uses integrated digital health monitoring applications to assist improved patient management. These benefits combined with regular physician interaction keep Medtronic ahead in the worldwide venous stents competitive field.

-

In April 2025, Medtronic’s Spectrum VLU study confirmed strong healing outcomes with VenaSeal™, showing only 0.8% hypersensitivity.

Cook Medical is a key innovator in venous stents with more than 35 years of vascular device expertise and a robust presence in interventional radiology. Its Zilver® Vena Venous Stent demonstrates published two-year patency rates over 90%; the stent is a reliable option for physicians. Cook Medical’s world leadership is buttressed by its presence in more than 135 countries as well as stron emphasis on physician training programs.

-

In 2025, Cook Medical launched the Zilver Vena Venous Self-Expanding Stent in Canada, expanding treatment options for iliofemoral obstruction.

Venous Stents Market Key Players:

Some of the Venous Stents Market Companies are:

-

Medtronic plc

-

Cook Medical LLC

-

Becton, Dickinson & Company (BD)

-

W. L. Gore & Associates, Inc.

-

Cordis Corporation

-

Optimed Medizinische Instrumente GmbH

-

Bentley InnoMed GmbH

-

Veniti, Inc.

-

iVascular S.L.U.

-

AngioDynamics Inc.

-

Jotec GmbH

-

MicroPort Scientific Corporation

-

Medica Germany GMBH & Co. KG

-

Plus medica GmbH & Co. KG

-

Sinomed

-

Zinas Medical

-

Zylox-Tonbridge

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.36 Billion |

| Market Size by 2033 | USD 2.57 Billion |

| CAGR | CAGR of 8.36% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Iliac Vein Stents, Femoral Vein Stents, Others) • By Material (Nitinol, Stainless Steel, Others) • By Stent Design (Self-Expanding Stents, Balloon-Expandable Stents) • By Indication (Chronic Deep Vein Thrombosis, Post-Thrombotic Syndrome, May-Thurner Syndrome, Others) • By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Boston Scientific Corporation, Medtronic plc, Cook Medical LLC, Abbott Laboratories, Becton, Dickinson & Company (BD), W. L. Gore & Associates, Inc., Cordis Corporation, Terumo Corporation, Optimed Medizinische Instrumente GmbH, Bentley InnoMed GmbH, Veniti, Inc., iVascular S.L.U., AngioDynamics Inc., Jotec GmbH, MicroPort Scientific Corporation, Medica Germany GMBH & Co. KG, Plus medica GmbH & Co. KG, Sinomed, Zinas Medical, Zylox-Tonbridge |