ENT Devices Market Report Scope & Overview:

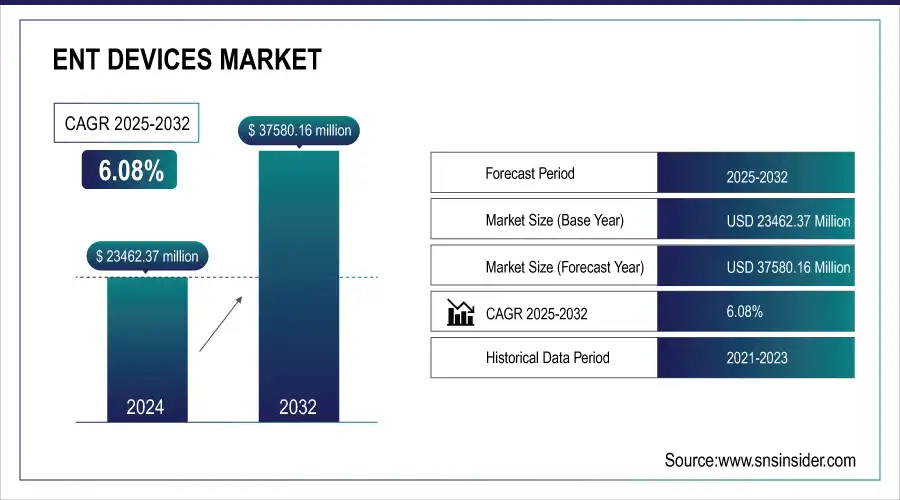

The ENT Devices Market size was valued at USD 23462.37 million in 2024 and is expected to reach USD 37580.16 million by 2032, growing at a CAGR of 6.08% over the forecast period of 2025-2032.

To Get more information on ENT Devices Market - Request Free Sample Report

The global ENT devices market is expanding as the healthcare infrastructure is growing. Growing hospitals and clinics, particularly in rural and developing areas, further promote the availability of ENT diagnostics and therapy. With the installation of new facilities also comes advanced procedures such as minimally invasive surgeries and smart diagnostics, thereby boosting the demand for novel ENT devices. Government programs and public-private partnerships lower out-of-pocket costs, reducing the cost of care and increasing device usage. Also, a higher teaching ratio of patients in the department of ENT increases the treatment ability. Telehealth and medical tourism increase market potential, and digital health system integration takes connected ENT to new heights. These developments are combined to assist in quality improvement in caregiving, provide more affordable and available care, which is propelling increased demand in the developed and developing world, and which in turn supports growth for ENT devices in these markets.

For instance, in February 2024, India expanded the Ayushman Bharat Health Infrastructure Mission, investing ₹5,000 crore to upgrade healthcare in Tier 2/3 cities, enhancing access to diagnostics and boosting ENT device demand.

ENT Devices Market Size and Forecast:

-

Market Size in 2024 USD 23,462.37 million

-

Market Size by 2032 USD 37,580.16 million

-

CAGR of 6.08% from 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025–2032

-

Historical Data 2021–2023

ENT Devices Market Highlights:

-

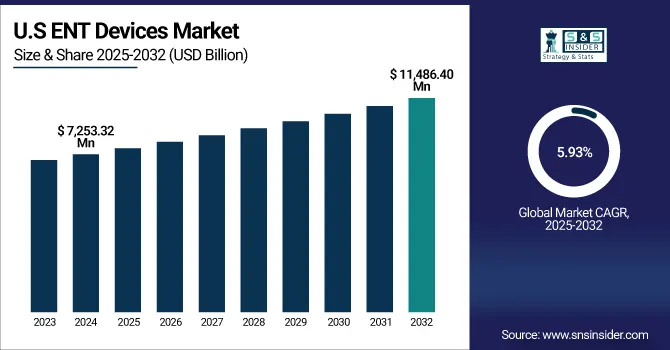

The U.S. ENT Devices Market was valued at USD 7,253.32 million in 2024 and is projected to reach USD 11,486.40 million by 2032, growing at a CAGR of 5.93% from 2025–2032.

-

Strong FDA regulations and clearances boost physician and patient confidence, enable insurance reimbursement, and accelerate market entry for innovative ENT devices.

-

Significant R&D investments by U.S. firms drive innovation in hearing aids, navigation systems, and surgical instruments, with FDA-approved devices often receiving funding or acquisitions.

-

Rising demand for minimally invasive ENT procedures, supported by AI-assisted navigation, 3D imaging, and outpatient surgeries, is driving market growth and device adoption.

-

High costs of advanced ENT devices, limited affordability in developing regions, and inadequate infrastructure or digital connectivity restrain market expansion globally.

-

Examples include GN ReSound’s FDA-cleared AI-powered hearing aid (ReSound Nexia) and Medtronic’s AI-enhanced StealthStation ENT system, illustrating innovation and market trends.

The U.S. ENT Devices Market was valued at USD 7253.32 million in 2024 and is expected to reach USD 11486.40 million by 2032, growing at a CAGR of 5.93% from 2025-2032.

The US dominates the ENT devices market as the regulatory issues about the FDA are strong there. FDA clearance provides confidence to physicians and patients that ENT devices are safe, effective, and of high quality. Resources such as Breakthrough Device Designation enable innovative products to enter the market more quickly and help to ensure a competitive edge for our U.S. firms. Insurance reimbursement and hospital purchase require FDA clearance to be used more extensively in a clinical setting. Moreover, firms pour significant funds into R&D in order to comply with regulations, and this process boosts innovation in hearing aids, navigation systems, and surgical instruments, among others. “Many of the devices approved by the FDA get funding and/or get acquired, e.g., when Medtronic acquired Intersect ENT, and continue to drive U.S. dominance of the global ENT devices market.

For instance, in January 2025, GN ReSound received FDA clearance for its AI-powered hearing aid, “ReSound Nexia,” offering advanced noise reduction and Bluetooth LE Audio, enhancing smart hearing aid adoption in the U.S.

ENT Devices Market Drivers:

-

Rise in Minimally Invasive Procedures, Driving the ENT Devices Market Growth

Increase in demand for minimally invasive ENT procedures is one of the key factors propelling the ENT devices market. These procedures have advantages, including less invasive incisions, lower pain, shorter recovery, and lower risk, so they are becoming popular with patients and doctors. With a decrease in traditional open surgeries, the need for sophisticated ENT devices such as balloon sinuplasty devices, endoscopes, and image-guided surgery systems is increasing. The procedures are supported by new-age technologies like AI-assisted navigation and 3D imaging and are driving device sales. Also, many of such surgeries are done in outpatient facilities, saving costs and are very convenient. Such clinical, technical, and economic benefits drive the volume of procedures, thereby promoting the adoption of ENT devices globally.

For instance, in February 2024, Medtronic launched the advanced StealthStation ENT system with AI and 3D imaging, enhancing precision in minimally invasive ENT surgeries and boosting demand for image-guided surgical technologies.

ENT Devices Market Restraints:

-

Limited Affordability, Restraining the ENT Devices Market

Limited affordability is forever restricting access to cutting-edge ENT technology, especially in developing as well as low-income areas. The high price tags of devices such as cochlear implants and AI-based diagnostics and surgical systems are beyond the reach of most public hospitals and patients. Understaffed hospitals and a lack of government backing also reduce the chances of adoption. Thus, many practices use outdated technologies and methods, which translates to poor clinical results. Besides, the expensive infrastructure and skilled personnel also restrict the option to a lower level. And the pricing pressure also deters manufacturers from investments in inexpensive innovation. Limited access to tele-ENT systems exists in some areas due to inadequate digital connectivity. Together, these barriers inhibit worldwide deployment of advanced ENT services where the demand is most significant.

For instance, in February 2024, the WHO reported that over 80% of people in low-income countries lack access to assistive hearing technologies due to high costs and underfunded healthcare systems, limiting ENT device adoption.

ENT Devices Market Segmentation Analysis:

By Product

Hearing Aids were the dominant segment in the ENT Devices Market analysis, with a market share of 32.40% share in 2024. Hearing aids boast the largest ENT devices market share, driven by a large global hearing loss population, particularly among the elderly, and perpetual technological innovations. AI advancements, digital sound processing, and Bluetooth capabilities improve user experience and encourage adoption. Greater awareness, improvements in diagnostic capabilities, and supportive reimbursement in developed markets such as the U.S. and Europe will further drive usage. Also, increased expenditure and access in the emerging markets are factors driving growth.

Surgical ENT Devices is emerging as the fastest-growing segment in the ENT Devices Market trend, with the highest CAGR of 6.52% over the forecast period. Due to the demand for minimally invasive procedures and patient preference for minimally invasive surgeries. These philosophies focus on better results, shorter recovery periods, and more comfort and have driven the popularity of minimally invasive instruments, robot-assisted platforms, and AI-aided navigation. Hospitals are progressively investing in technology for advanced surgeries to bring treatment levels up to patient demands and to improve precision. Telemedicine facilitates preoperative and postoperative care and increases the volume of surgical cases. Patient-specific care coordination promotes earlier interventions, and operating rooms driven by AI increase efficiency and lower costs. Collectively, these developments are quickly increasing the deployment of surgical ENT devices, such as in the technically advanced and high-volume healthcare settings all across the globe.

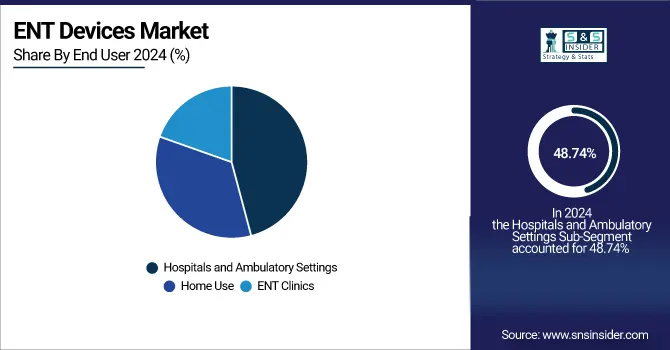

By End User

In 2024, the Hospitals and Ambulatory Settings segment was the dominant one in the ENT Devices Market. It holds a 48.74% market share. As they carry out a large number of surgeries, they help in achieving improved patient outcomes and operational efficiency. High volume surgery leads to increased surgeon experience and success, which further consolidates caseload and referrals. Profits from high-volume surgeries give hospitals the means to invest in cutting-edge ENT technologies and enhance service quality, while keeping a leading position on the market. Further, the rise in the number of outpatient and ambulatory centers by hospitals widens the availability of the ENT devices used in surgical procedures. It is this virtuous cycle of superior clinical outcomes, financial solidity, together with the trust of the patient that is driving the ENT devices market growth, particularly in established healthcare economies across the globe.

The Home use is the fastest-growing area as there is a growing requirement for easy, accessible, and cost-effective healthcare. The rising prevalence of hearing loss, particularly in the geriatric population, is driving the growth of smart hearing aids and self-care ENT devices. The development of these super tech hearing devices, along with others such as digital, app-connected hearing aids, wireless otoscopes, and tele-diagnostic systems, helps patients to manage their symptoms from the comfort of their home. Telemedicine and remote hearing aid fittings have also contributed to this trend. Also, heightened consciousness and health monitoring behavior after COVID is pushing up the adoption of home care. This has increased the ENT devices market share for home use, thereby significantly aiding the growth of the global ENT devices market share.

ENT Devices Market Regional Analysis:

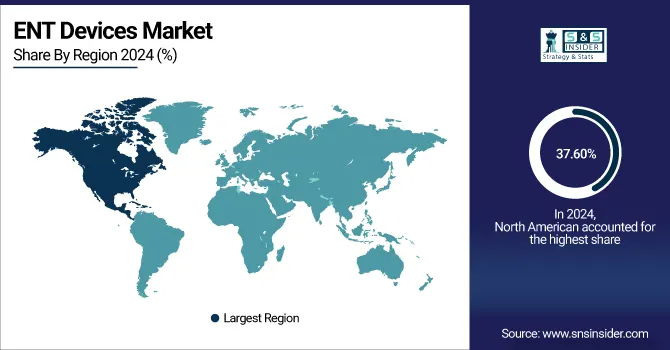

North America ENT Devices Market Insights:

In 2024, the North American region dominated the ENT Devices industry and accounted for 37.60% of the overall revenue share. owing to it has developed healthcare infrastructure, a rise in technologically advanced medical devices like Medtronic, Inc., Stryker, and Cochlear Ltd. The growing elderly population in the region, coupled with the high prevalence of hearing loss and sinus disorders, is significantly driving demand for ENT devices such as hearing aids, cochlear implants, and surgical tools. Favorable reimbursement policies, high insurance penetration, and well-developed healthcare infrastructure also facilitate sturdy market reach. Moreover, stringent regulatory policies such as the FDA encourage innovation and early acceptance of advanced ENT devices, further enhancing the dominance of North America in the global ENT devices market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe ENT Devices Market Insights:

The second largest share of the global ENT devices industry belongs to Europe on account of strong healthcare infrastructure, a large aging population, and good awareness related to hearing and sinus issues. Countries such as Germany, France, and the UK have strong public health systems, which are conducive to the early diagnosis and treatment of cases of ENT disease. An aging demographic in the region is increasing demand for hearing aids and related devices. Moreover, favorable reimbursement policies and government initiatives to improve ENT devices are further driving market growth. ENT device manufacturers and the increase in the number of research institutions in this region uphold Europe as one of the major contributors to the growth of the ENT devices market. Increasing adoption of minimally invasive surgical procedures and digital hearing devices also adds to Europe being a prominent driver in the global ENT devices market growth.

Asia-Pacific ENT Devices Market Insights:

The Asia Pacific region is projected to grow with the fastest CAGR of 6.59% over the forecast period. Factors such as a surge in population growth, a high incidence of ENT-related diseases, and improving healthcare infrastructure in emerging economies are expected to boost the market growth. Countries such as China, India, Japan, and South Korea are experiencing an increase in incidence of hearing, chronic sinusitis, and other ear, nose, and throat (ENT) diseases due to urbanisation, pollution, and an aging population. With improving awareness for ENT health, more of patients go for early treatment, which in turn increases demand for hearing aids, diagnostic endoscopes, and surgical equipment.

Increasing disposable income and the growth of the middle class have made advanced healthcare options accessible and affordable in India and Southeast Asia. A rise in government projects for the enhancement of rural and public healthcare services (such as India’s Ayushman Bharat program) has been fostering the utilization of ENT devices as well. Also, an increasing number of foreign and regional medical device producers and surging investment in local production and distribution are expected to make access to ENT technologies cheaper and more affordable. There is also strong growth in medical tourism in the region, especially in ENT surgeries, as treatment costs are cheaper and care quality is increasing. All these factors pushed Asia Pacific as the largest and fastest-growing market in the global ENT devices market.

Middle East & Africa ENT Devices Market Insights:

The Middle East & Africa is the smallest ENT devices industry due to poor medical facilities, lack of technical knowledge, and poor medical facilities. Many countries in the region struggle with financial and logistics limitations that impede the adoption of sophisticated devices such as hearing aids, endoscopic units, and surgical systems. Government healthcare is underfunded, and private care is unaffordable for the majority of the population. Inadequacy of ENT specialists and audiologists, particularly in rural areas, is also a limitation. Furthermore, inadequate insurance, low level of awareness of ENT disorders, and poor regulatory structure are some of the challenges to the growth of the market. This region has a low presence and investment from global medical devices companies; therefore, technology adoption is slower. All these factors combine to result in the region’s low market penetration.

Latin America ENT Devices Market Insights:

Latin America's share of the global ENT devices market is modest but rising, supported by better healthcare facilities, a growing number of patients with ENT conditions, and a growing middle-class population. The markets in Brazil, Mexico, and Argentina are among the fastest growing, and many offer strong potential for hearing aids, diagnostic products, as well as minimally invasive surgical devices. The is more being adopted in the urban center because of better access to health care services and specialists. But obstacles, including relatively restricted reimbursement policies, economic instability, and discrepancies in access to rural healthcare, are slowing the growth. Despite these obstacles, public health programs and government encouragement of early diagnosis and treatment are driving market growth. International ENT device companies are also extending their worldwide reach through local alliances. Thereby, Latin America is set to experience sustained but slow growth in the ENT devices market.

ENT Devices Market Key Players:

-

Medtronic plc

-

Smith & Nephew plc

-

Stryker Corporation

-

Olympus Corporation

-

Karl Storz SE & Co. KG

-

Cochlear Limited

-

Sonova Holding AG

-

Demant A/S

-

GN Store Nord (GN Hearing)

-

WS Audiology

-

Atos Medical AB

-

Richard Wolf GmbH

-

Pentax Medical

-

Rion Co., Ltd.

-

Starkey Hearing Technologies

-

Baxter International (Hill-Rom)

-

Acclarent Inc. (Johnson & Johnson)

-

Boston Scientific Corporation

-

Fujifilm Holdings Corporation

-

Hoya Corporation

ENT Devices Market Competitive Landscape:

Stryker Corporation was established in 1941 and is a leading global medical technology company. It specializes in innovative surgical equipment, orthopedic implants, and endoscopic and neurotechnology devices. Committed to improving patient outcomes, Stryker focuses on advanced solutions for hospitals and healthcare providers worldwide, driving efficiency and precision in medical care.

-

In March 2024, Stryker acquired EndoSurg Innovations, gaining advanced tools for laryngoscopy and sinus surgery, strengthening its ENT surgical device segment and expanding presence in minimally invasive procedures.

Olympus Corporation was established in 1919 and is a global leader in medical and optical technologies. The company specializes in endoscopic systems, imaging solutions, and precision instruments for healthcare and life sciences. Olympus focuses on innovation and quality, enabling advanced diagnostics, minimally invasive surgeries, and improved patient care worldwide.

-

In January 2025, Olympus launched a next-gen 4K rhinolaryngoscope with AI-assisted lesion detection, enhancing outpatient ENT diagnostics and positioning itself strongly in high-definition endoscopic technologies.

Karl Storz SE & Co. KG was established in 1945 and is a leading global provider of endoscopic instruments and medical devices. The company specializes in innovative endoscopes, imaging systems, and surgical instruments for ENT, urology, and minimally invasive procedures. Karl Storz focuses on precision, quality, and advancing surgical care worldwide.

-

In May 2024, Karl Storz upgraded its IMAGE1 S™ platform with 3D and near-infrared imaging, improving ENT surgical visualization and driving demand for precision-guided ENT surgeries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 23462.37 million |

| Market Size by 2032 | USD 37580.16 million |

| CAGR | CAGR of 6.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Diagnostic ENT Devices, Surgical ENT Devices, Hearing Aids, Hearing Implants, Nasal Splints) •By End User(Home Use, Hospitals and Ambulatory Settings, ENT Clinics)" |

| Regional Analysis/Coverage | NNorth America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic plc, Smith & Nephew plc, Stryker Corporation, Olympus Corporation, Karl Storz SE & Co. KG, Cochlear Limited, Sonova Holding AG, Demant A/S, GN Store Nord (GN Hearing), WS Audiology, Atos Medical AB, Richard Wolf GmbH, Pentax Medical, Rion Co., Ltd., Starkey Hearing Technologies, Baxter International (Hill-Rom), Acclarent Inc. (Johnson & Johnson), Boston Scientific Corporation, Fujifilm Holdings Corporation, Hoya Corporation. |