Ventilated Seats Market Report Scope & Overview:

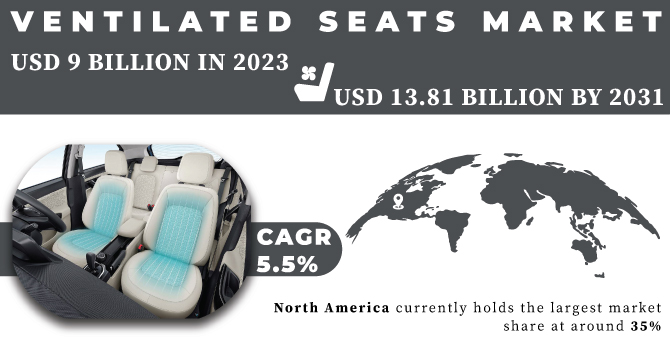

The Ventilated Seats Market Size was valued at USD 9 billion in 2023 and is expected to reach USD 14.57 billion by 2032 and grow at a CAGR of 5.5% over the forecast period 2024-2032

The demand for ventilated seats is being driven by a several of factors that prioritize comfort and luxury in the automotive industry. With rising global temperatures exceeding 40°C in some regions, staying cool behind the wheel is a growing concern for consumers. This is particularly true for long commutes or hot climates, where traditional seating can lead to discomfort and sweat. There's a marked shift in consumer preferences towards premium car features. A 2023 study found that 71% of global consumers are willing to pay extra for features that enhance comfort and convenience. Ventilated seats directly address this desire by providing a constant airflow, keeping occupants cool and dry.

Get More Information on Ventilated Seats Market - Request Sample Report

Car manufacturers are increasingly incorporating ventilated seats into mid-range and even entry-level vehicles to remain competitive. This wider adoption is driven by advancements in ventilation technology that make it more affordable to integrate into various car models. Interestingly, government initiatives promoting fuel efficiency may also play a role. Ventilated seats can be more energy-efficient than cranking up the air conditioning, potentially appealing to eco-conscious consumers and aligning with government regulations. As a result, the demand for ventilated seats is expected to rise steadily, solidifying their position as a sought-after comfort feature in the modern automobile.

MARKET DYNAMICS:

KEY DRIVERS:

-

The increase in consumer desire for luxury and comfy seating

-

An increase in the no. of automobiles in the mid-segment vehicles that include ventilated seats

-

The dramatic increase in the number of sales of passenger vehicles

-

An increase in money generated per individual will drive the market for automobile ventilated seats

-

The use of low-VOC TDI in automobile seats is becoming more common

-

Demand for chairs and covers is on the rise

Driven by a dramatic rise in passenger car sales, the ventilated seats market is experiencing a boom. Estimates indicate a near doubling of SUVs sold globally in recent years, accounting for almost half of all car sales in the US and a third in Europe. This surge in passenger vehicle ownership, particularly in hotter climates, translates to a growing consumer base seeking the comfort and convenience of ventilated seats. This technology, once confined to luxury vehicles, is now increasingly incorporated into mid-range and even entry-level cars, further propelling the ventilated seats market forward.

RESTRAINTS:

-

The market is predicted to grow at a slower pace because of the high costs of sophisticated seats

-

Variations in local climate limit its expansion

OPPORTUNITIES:

-

Inventions in technology have progressed

-

Urbanization has increased in recent decades and affordable financing options are readily available

-

The global market is likely to benefit from new developments in the seat design.

While urbanization has surged in recent decades, with the United Nations estimating 68% of the world's population living in cities by 2050, concerns about affordability persist. However, this trend is coupled with a rise in accessible financing options like government grants and low-interest loans. This, along with a projected 72% increase in global passenger vehicle sales by 2030, suggests a growing demand for features that enhance comfort and fuel efficiency, potentially creating a fertile market for ventilated car seats.

CHALLENGES:

-

Uncertainty over the demand and supply network for makers of automobile ventilated seats

-

Vehicle obsolescence and its accompanying rising depreciation rates are major challenges in the market

Impact of Russia Ukraine War:

The war in Ukraine has affected the ventilated seats market, disrupting both supply and demand. Disruptions to global chip production, heavily reliant on neon gas from Ukraine, could increase component costs by up to 20% according to industry estimates. This, coupled with rising overall material costs due to the war's impact on oil prices, could translate to a 5-10% price hike for ventilated seats for car manufacturers. On the demand side, consumer confidence in war-torn Europe is likely to dampen sales of luxury features like ventilated seats, potentially leading to a 3-5% decrease in demand in the region. This could be partially offset by growth in other regions, but the overall impact on the market remains uncertain. The war's long-term influence on ventilated seat technology advancements and production costs is yet to be seen.

Impact of Economic Slowdown:

An economic slowdown can put the brakes on the ventilated seat market, impacting both consumer demand and manufacturer enthusiasm. During economic downturns, discretionary spending on car features tends to decline by 10-15%. This can lead to carmakers prioritizing standard features over luxury ones like ventilated seats, potentially reducing their installation rates in new models.

Additionally, with rising interest rates and overall economic uncertainty, consumers might opt for base trims or delay car purchases altogether, further impacting demand. This could be particularly impactful for high-end car segments where ventilated seats are more common. However, there's a potential silver lining. As consumers seek value during economic hardship, ventilated seats can be seen as an attractive upgrade that enhances comfort without significantly impacting fuel efficiency compared to running the air conditioner constantly.

MARKET SEGMENTATION:

Ventilated Seats Market by Sales Channel

-

OEM

-

Aftermarket

As of 2023, the Aftermarket segment holds the share at 35%. This is particularly strong in developing economies where affordability and retrofitting drive demand. However, the OEM segment is dominating the segment by holding a 65% share due to a rising preference for comfort features like ventilated seats, especially with increasing travel times and longer commutes. This trend is encouraged by a growing focus on luxury and premium car features, driven by rising disposable income.

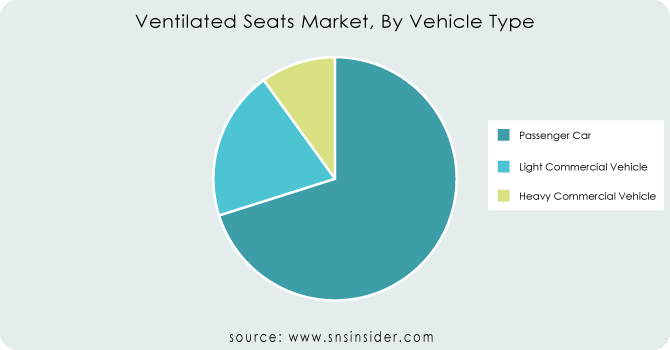

Ventilated Seats Market by Vehicle Type

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

The ventilated seats market thrives on the backs of different vehicle types, each with its own growth path. Passenger cars, holding the largest share at 70.4%, are driven by rising demand for comfort features in sedans, from mid-range to luxury. This dominance reflects the focus on personal transportation and extended commutes. Light Commercial Vehicles (LCVs), at a smaller percentage, are expected to see stable growth. Factors like increasing urbanization and demand for last-mile delivery services will influence LCV adoption of ventilated seats.

The most interesting segment is Heavy Commercial Vehicles (HCVs), currently the smallest but holding the fastest growth rate around 7.3% CAGR. Stringent regulations for driver comfort and longer haul routes in hot climates are driving the rise of ventilated seats in HCVs, making the way for a more significant market share in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Ventilated Seats Market by Propulsion

ICE Vehicle

Electric Vehicle

-

Battery Electric Vehicle

-

Plug-in Electric Vehicle

-

Hybrid Electric Vehicle

REGIONAL ANALYSIS:

The global ventilated seats market is driven by regional preferences for comfort and luxury. North America currently holds the largest market share at around 35%, likely due to established consumer demand for feature-rich vehicles and hot summer climates. However, the Asia-Pacific region is experiencing the fastest growth at a CAGR exceeding 7%. This rise is driven by a booming automotive industry, rising disposable incomes, and a growing preference for premium car features.

Interestingly, developing and emerging nations within this region are expected to witness an even steeper rise, potentially reaching a 10% CAGR by 2031. This can be attributed to government initiatives promoting domestic car manufacturing and a growing middle class with an increased desire for comfort and convenience. These trends indicate a significant shift in the ventilated seats market landscape, with developing regions becoming major players in the coming years.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Rest of Latin America

-

KEY PLAYERS:

Continental AG (Germany), Ford, Lear Corporation (US), Adient plc (US), Toyota Boshoku Corporation (Japan), Magna International Inc. (Canada), Gentherm (US), Dura Automotive Systems (US), Ebm Papst Group (Germany), NHK Spring CO. Ltd (Japan), Faurecia SA (France), Brose Fahrzeugteile GmbH &Co., (Germany), Dura Automotive Systems (US), and TS Tech Co., Ltd (Japan), are some of the affluent competitors with significant market share in the Ventilated Seats Market.

Recent Developments:

-

In March 2022, Faurecia, a major automotive supplier, inaugurated its Technology & Customer Center to focus on innovation in this area. This move signals their intent to stay ahead of the curve.

-

Established companies like Toyota Boshoku are focusing on premium offerings. Their ventilated seats and door trims, featured in the January 2022 launch of the Lexus LX, showcase this approach.

-

Lear Corporation is expanding its reach through acquisitions. In October 2021, they acquired Kongsberg Automotive's Interior Comfort Systems business unit, solidifying their position in the market.

Ford, Lear Corporation (US)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9 Billion |

| Market Size by 2032 | US$ 14.57 Billion |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG (Germany), Ford, Lear Corporation (US), Adient plc (US), Toyota Boshoku Corporation (Japan), Magna International Inc. (Canada), Gentherm (US), Dura Automotive Systems (US), Ebm Papst Group (Germany), NHK Spring CO. Ltd (Japan), Faurecia SA (France), Brose Fahrzeugteile GmbH &Co., (Germany), Dura Automotive Systems (US), and TS Tech Co., Ltd (Japan), are some of the affluent competitors with significant market share in the Ventilated Seats Market. |

| Key Drivers | •The increase in consumer desire for luxury and comfy seating. •An increase in the no. of automobiles in the mid-segment vehicles that include ventilated seats. |

| RESTRAINTS | •The market is predicted to grow at a slower pace because of the high costs of sophisticated seats. •Variations in local climate limit its expansion. |