Veterinary Digital Pathology Market Size & Overview:

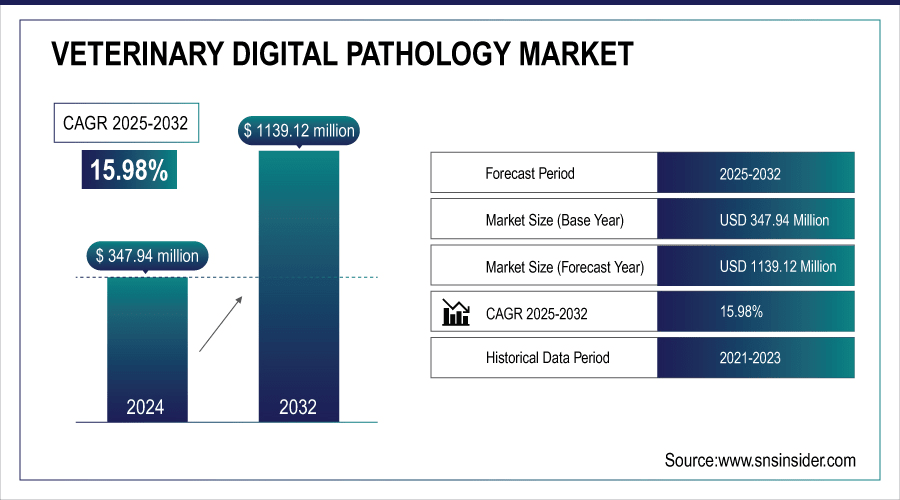

The Veterinary Digital Pathology Market was valued at USD 347.94 million in 2024 and is expected to reach USD 1139.12 million by 2032, growing at a CAGR of 15.98% from 2025-2032.

The Veterinary Digital Pathology Market is growing due to increasing adoption of advanced diagnostic technologies in veterinary practice, which enhance accuracy, speed, and efficiency in disease detection. Rising awareness about animal health, coupled with growing prevalence of pet ownership and livestock production, drives demand for digital pathology solutions. Additionally, integration of AI and imaging software facilitates remote diagnostics and telepathology, reducing operational costs. Expansion of veterinary research, rising investments in precision medicine, and government initiatives supporting animal healthcare further fuel market growth, positioning digital pathology as a vital tool in modern veterinary diagnostics.

To Get More Information On Veterinary Digital Pathology Market - Request Free Sample Report

Veterinary Digital Pathology Market Trends

-

Rising demand for accurate and rapid diagnosis in animal healthcare is driving market growth.

-

Adoption of AI and image analysis tools is enhancing diagnostic precision and workflow efficiency.

-

Integration with cloud platforms is enabling remote consultations and telepathology services.

-

Growing prevalence of livestock diseases and pet ownership is expanding market opportunities.

-

Increasing use of digital slides and automated imaging systems is improving laboratory productivity.

-

Regulatory support and standardization in veterinary diagnostics are encouraging technology adoption.

-

Collaborations between veterinary hospitals, research institutes, and tech providers are accelerating innovation.

Veterinary Digital Pathology Market Growth Drivers

-

Technological Innovations and Pet Care Demand Propel Market Expansion

The veterinary digital pathology market is booming, particularly with the use of artificial intelligence (AI) and machine learning (ML) in diagnostics. These advances improve disease detection accuracy and speed leading to better outcomes for animals. For example, AI-powered image analysis software can scan slides in seconds, taking the workload off pathologists. With over 67% of US households now owning a pet (according to the American Pet Products Association (APPA)), the demand for advanced veterinary care is increasing with the rising prevalence of diseases in pets, and a focus on preventative healthcare, veterinary clinics, and hospitals are adopting digital pathology. With these digital pathology tools, vet professionals can have access to better diagnostic solutions for a range of diseases including the common cancer in companion animals.

Veterinary Digital Pathology Market Restraints

-

High Initial Costs and Shortage of Skilled Professionals Hinder Market Growth

Digital pathology systems require hefty investment in such infrastructures as whole slide scanners, image analysis software, and storage systems. Such investments can place quite a financial strain on smaller stations. The incomplete number of skilled professionals available to interpret digital pathology data is of additional concern. Digital pathology is complex, requiring veterinarians to be trained in the art of using any of these systems, which, for the most part, is outside the available educational support in much of the developing regions. The latter impedes the introduction of digital pathology in developing nations, as the shortage of trained pathologists is further compounded by these factors. These scenarios point to slower gestation in the penetration of the markets within certain regions and may tend to hinder the overall growth of the sector.

Veterinary Digital Pathology Market Opportunities

-

Expanding Opportunities in Emerging Markets with Growing Pet Ownership and Enhanced Veterinary Services

A burgeoning middle class with more disposable income is fueling the demand for sophisticated veterinary care in areas like Asia-Pacific and Latin America. Significant innovation potential is also presented by the incorporation of AI and ML into veterinary digital pathology tools. AI-powered diagnostic technologies can help vets spot illnesses early on, improving the likelihood that treatments will be successful. AI systems, for example, can help detect early cancer symptoms in animals, allowing for quicker therapies. Digital pathology solutions are anticipated to become more and more in demand as pet healthcare gains global attention, especially in regions where advanced veterinary care is still developing.

Veterinary Digital Pathology Market Challenges

-

The veterinary digital pathology market faces challenges related to data privacy concerns and regulatory hurdles.

High-resolution photos of animal tissue samples and other sensitive patient data must be transmitted and stored in large quantities for digital pathology systems to function. A major difficulty is making sure that this data is protected, especially in areas with strict data privacy regulations like the General Data Protection Regulation (GDPR) of the EU. Additionally, makers of digital pathology systems face substantial obstacles due to regionally disparate regulatory standards. For instance, different nations may have different approval procedures for digital pathology devices, which would delay the release of new goods onto the market. Additionally, the use of these technologies may be hampered in some areas by the lack of established standards in veterinary digital pathology, which presents obstacles to smooth integration and data sharing between various systems.

Veterinary Digital Pathology Market Segment Analysis

-

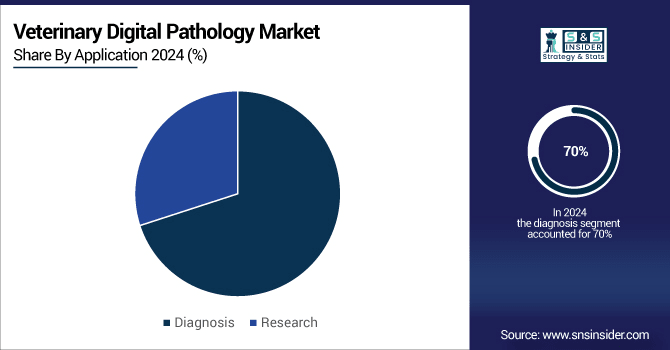

By Application Diagnosis dominated while Research Application is expected to grow fastest

The diagnosis segment reached a remarkable record of 70% of the total revenue in 2024. This dominance was attributed to the rise in demand for diagnostic services, especially for the diagnosis of complex diseases such as cancer, infections, and genetic disorders in animals. Digital pathology has been absolutely important in providing high-resolution images that facilitate the precise and prompt diagnostics of these diseases by veterinarians. Due to this, veterinarians have been relying heavily on digital pathology, as it is more reliable, quick, and cost-effective.

Research application is the fastest-growing category for the expanding application of veterinary digital pathology in the fields of academia and clinical research in recent years. Research institutes are rapidly transitioning toward utilizing the technology for animal disease studies for improved veterinary therapy, which is driving growth in this segment.

-

By Product Type Whole Slide Imaging Systems dominated while Image Analysis Software is expected to grow fastest

Whole Slide Imaging Systems accounted for 55% of the veterinary digital pathology market in 2024. Because of the growing inclination towards complete and high-resolution imaging solutions that enable veterinarians to view slides digitally and remotely, this segment registered the highest demand. WSI systems are vital in delivering fast, accurate, and dependable diagnosis results, which is essential for the prompt and effective treatment of animal diseases. This segment continued to grow due to the growing acceptance of AI and machine learning tools in improving image analysis. These systems are becoming the go-to for cancer diagnosis in animals, with high-quality imaging vital for proper staging and treatment planning.

The Image Analysis Software segment is projected to be the fastest-growing type of product owing to the rising demand for advanced diagnostic tools that will support veterinary professionals in diagnosing diseases. These image analysis tools work using artificial intelligence, wherein their increasing use might enhance efficiency and diagnostic accuracy and accordingly minimize the pathologists' workload.

-

By Animal Type Companion Animals led while Exotic Animals are projected to grow fastest

Companion animals led the market in 2024, holding 60% of the total market share. This was due mainly to the increasing pet ownership and growing awareness of advanced veterinary care. With the continual rise of pets as family members, the demand for specialized diagnostic tools such as digital pathology has increased. Also, the allied growing concern concerning health issues in pet animals such as cancers, infectious diseases, and genetic disorders has forced veterinarians to turn to digital solutions for pet animal pathology for effective diagnosis.

The Exotic Animals category is the fastest-growing segment in the veterinary digital pathology market. As exotic pet ownership continues to rise, so does the demand for advanced diagnostic instruments for this unique market. This is leading vets to adopt digital-pathology-based solutions for the diagnosis of rare diseases that exotic animals occasionally come down with, thereby propelling the growth of this segment.

-

By End User Veterinary Hospitals and Clinics led while Veterinary Research Institutes are projected to grow fastest

Veterinary Hospitals and Clinics represented 50% of the overall market share in the veterinary digital pathology market, thus standing out the most among the end-user categories. This is largely because veterinary hospitals and clinics are dedicated to animal healthcare and provide diagnostic and treatment services to growers for the majority of companion and livestock animals. Digital pathology systems are already being integrated into clinical practice in these settings due to the increasing demand for advanced diagnostic tools to render quick and accurate diagnoses.

The fastest growing is the veterinary research institutes segment, as there is a need for digital pathology solutions in those research environments focusing on veterinary medicine. Research institutes put their advanced pathology research tools to good use in animal disease research, disease progression, and treatment development, thus promoting further growth in the segment.

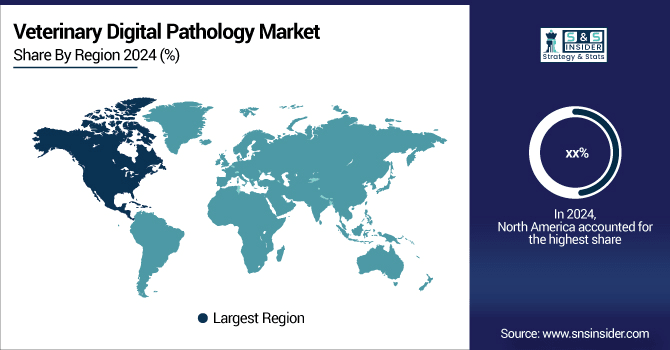

Veterinary Digital Pathology Market Regional Analysis

North America Veterinary Digital Pathology Market

In 2024, North America dominated the veterinary digital pathology market, due to the high adoption rate for advanced technologies, well-structured healthcare infrastructure, and growing awareness of digital pathology solutions among veterinary practitioners. The presence of leading veterinary diagnostic and technology companies such as IDEXX Laboratories Inc. and Zoetis Inc. has driven the growth of the market. Also, the increasing incidence of pet ownership and the unprecedented demand for fast and accurate diagnostics for companion animals are working to wax the market in North America. Furthering the case for the whole region, regulatory surroundings extended support for the use of digital health technologies, thus hastening the uptake of digital pathology solutions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Veterinary Digital Pathology Market

On the other hand, Asia-Pacific is the fastest-growing region in the veterinary digital pathology market. The region has been witnessing rapid growth by increasing awareness regarding digital healthcare technologies, especially in countries such as China, Japan, and India. Increased pet ownership, elevated animal health standards, and growing adoption of veterinary services propel the demand for digital pathology tools. Furthermore, the Asia-Pacific market is experiencing advancement in veterinary care, and both governments and private enterprises are contributing much to developing digital health technologies. The growth of livestock health management is due to the spurt in the number of veterinary research initiatives. Hence, the Asia-Pacific veterinary digital pathology market is anticipated to retain its growing streak throughout the years that lie ahead.

Europe Veterinary Digital Pathology Market

Europe holds a significant share in the Veterinary Digital Pathology Market due to advanced veterinary infrastructure, high adoption of innovative diagnostic technologies, and strong investment in animal healthcare research. Increasing pet ownership, rising awareness of animal diseases, and supportive government initiatives further drive growth. The region also benefits from telepathology adoption, enabling remote diagnostics and improving efficiency in veterinary practices across countries like Germany, the UK, and France.

Middle East & Africa and Latin America Market

The Middle East & Africa and Latin America are emerging markets in Veterinary Digital Pathology, driven by growing livestock industries, rising awareness of animal health, and increasing adoption of advanced diagnostic technologies. Investments in veterinary infrastructure, expanding research activities, and government initiatives to improve animal healthcare support market growth. Telepathology and digital imaging solutions are gaining traction, enhancing diagnostic accuracy and accessibility across these regions.

Veterinary Digital Pathology Market Competitive Landscape

IDEXX Laboratories

IDEXX Laboratories plays a leading role in the Veterinary Digital Pathology Market through its IDEXX VetPath and IDEXX Digital Imaging solutions. The company offers advanced diagnostic tools that enhance accuracy, efficiency, and accessibility in veterinary pathology. By integrating digital imaging with AI-driven analysis, IDEXX supports rapid disease detection and remote consultation. Its strong global presence, continuous innovation, and investment in veterinary healthcare make it a key driver of digital transformation in animal diagnostics.

-

In 2025, IDEXX Laboratories introduced IDEXX Cancer Dx, a $15 early-detection blood panel for canine lymphoma, delivering results in 2–3 days and integrating seamlessly into routine wellness testing.

-

In 2023, IDEXX Laboratories pioneered IDEXX Digital Cytology, enabling whole-slide scanning with 24/7 pathology consultation and diagnostic reports in under two hours through VetConnect PLUS.

VCA Animal Hospitals

VCA Animal Hospitals is a key player in the Veterinary Digital Pathology Market, leveraging its extensive network of veterinary clinics to deliver advanced diagnostic services. Through its digital pathology solutions, VCA enables faster and more accurate disease detection, improving treatment outcomes for pets. The company emphasizes integration of digital imaging and telepathology, allowing veterinarians to access expert consultations remotely. With strong backing from Mars, Inc., VCA continues advancing innovation in veterinary diagnostics and care.

-

In 2024, VCA launched a cutting-edge 3D printing lab at its Northwest Veterinary Specialists to produce personalized surgical models and guides for pet orthopedic procedures, improving precision and recovery.

-

In 2024, VCA, alongside Antech, advocated for a Six-Step One Health framework, integrating companion animal data into public health reporting to strengthen disease surveillance and collaborative health response.

Heska Corporation

Heska Corporation holds a strong position in the Veterinary Digital Pathology Market by offering innovative diagnostic solutions tailored for companion animals. The company focuses on integrating digital pathology with imaging and advanced software to support accurate, timely diagnostics. Through its comprehensive portfolio, Heska enhances efficiency in veterinary practices while improving patient outcomes. Its continued investment in research and expansion of diagnostic capabilities reinforces its role as a trusted partner in modern veterinary healthcare.

-

In 2023, Heska completed the acquisition of LightDeck Diagnostics, gaining its planar-waveguide fluorescence immunoassay platform and Longmont facility, enhancing point-of-care diagnostics and manufacturing capacity for pet healthcare.

Key Players in Veterinary Digital Pathology Market

Some of the Veterinary Digital Pathology Market Companies

-

VCA Inc.

-

Zoetis Inc.

-

Leica Biosystems Nussloch GmbH (Danaher Corporation)

-

Agfa-Gevaert Group

-

Sakura Finetek USA Inc.

-

Hamamatsu Photonics K.K.

-

Indica Labs Inc.

-

Antech Diagnostics, Inc.

-

Motic

-

Scopio Labs

-

3DHISTECH

-

NovoPath

-

Synlab Group

-

PathAI

-

Ibex Medical Analytics

-

Akoya Biosciences

-

Paige

| Report Attributes | Details |

| Market Size in 2024 | USD 347.94 Million |

| Market Size by 2032 | USD 1139.12 Million |

| CAGR | CAGR of 15.98% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Whole Slide Imaging Systems, Image Analysis Software, Storage and Communication Systems] • By Animal Type [Companion Animals, Livestock Animals, Exotic Animals] • By Application [Diagnosis, Research] • By End User [Veterinary Hospitals and Clinics, Veterinary Reference Laboratories, Veterinary Research Institutes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IDEXX Laboratories Inc., VCA Inc., Zoetis Inc., Heska Corporation, Philips Healthcare, Leica Biosystems Nussloch GmbH (Danaher Corporation), Agfa-Gevaert Group, Sakura Finetek USA Inc., Hamamatsu Photonics K.K., Indica Labs Inc., Antech Diagnostics, Inc., Motic, Scopio Labs, 3DHISTECH, NovoPath, Synlab Group, PathAI, Ibex Medical Analytics, Akoya Biosciences, Paige. |