Veterinary Stereotactic Radiosurgery System Market Report Scope & Overview:

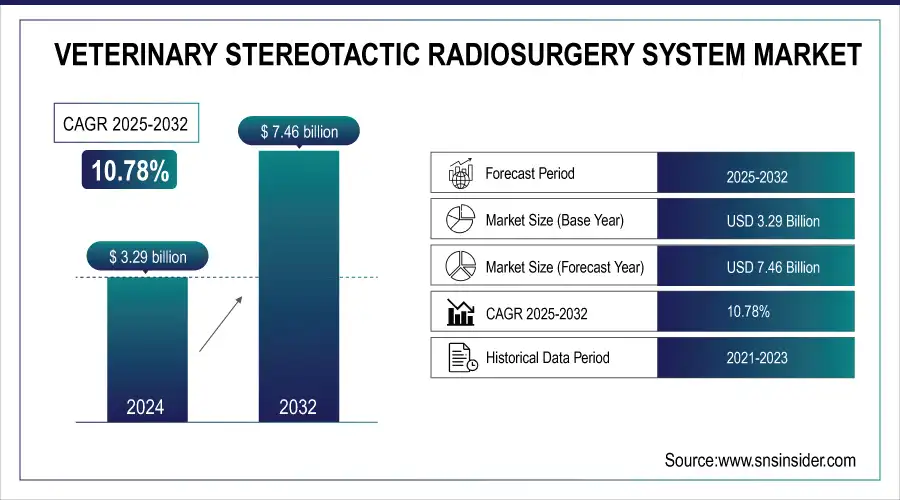

The veterinary stereotactic radiosurgery system market size was valued at USD 3.29 billion in 2024 and is expected to reach USD 7.46 billion by 2032, growing at a CAGR of 10.78% over the forecast period of 2025-2032.

Increasing the humanization of pets and rapid growth in the number of veterinary specialty and referral centers are also fueling revenue growth in the global veterinary stereotactic radiosurgery market. A primary veterinary stereotactic radiosurgery system market trend is that, with pets regarded as family, comes a need for human-grade, minimally invasive cancer treatment, including SRS. Additionally, the proliferation of multi-specialty veterinary hospitals drives demand for more sophisticated SRS systems that support in-house precision oncology and enhance treatment outcomes.

To Get more information on Veterinary Stereotactic Radiosurgery System Market - Request Free Sample Report

For instance, in February 2025, 72% of the U.S. pet owners were willing to spend over USD 5,000 on SRS and advanced cancer care, reflecting rising pet humanization and premiumization trends.

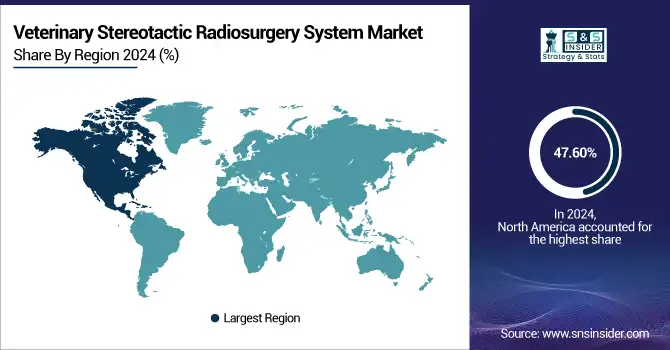

For instance, in August 2024, North America contributed over 50% of global veterinary radiotherapy equipment revenue, with the U.S. demand for advanced stereotactic systems driving growth in referral and academic hospitals.

Key Veterinary Stereotactic Radiosurgery System Market Trends

-

Integration of advanced imaging and targeting technologies improves precision and treatment outcomes in veterinary radiosurgery.

-

Development of eco-friendly and durable SRS system components meets rising demand for sustainable, long-lasting veterinary equipment.

-

Expansion of automated treatment planning and delivery platforms enhances workflow efficiency, reduces human error, and ensures consistent results.

-

Adoption of predictive analytics and AI in treatment design allows personalized, high-accuracy radiotherapy for animal patients.

-

Growing use of temperature- and motion-resistant system materials supports complex stereotactic procedures in veterinary oncology.

Veterinary Stereotactic Radiosurgery System Market Growth Drivers:

-

Expansion of Veterinary Specialty Clinics is Driving the Veterinary Stereotactic Radiosurgery System Market Growth

The increasing number of veterinary specialty clinics, especially in metropolitan areas, adds to the growth of the veterinary stereotactic radiosurgery system market share. SRS, on the other hand, has been far more prohibitively difficult to apply at volume, especially in a veterinary setting, as these are sophisticated centers, generally with state-of-the-art imaging and high-quality radiosurgery. A rapidly growing rate of referral to these clinics is also fueling the adoption of stereotactic systems for pinpoint, non-invasive procedures.

For instance, in June 2025, AVMA reported a 14% rise in the U.S. veterinary specialty clinics, with 68% adopting stereotactic radiosurgery, boosting market share growth.

Veterinary Stereotactic Radiosurgery System Market Restraints:

-

Limited Access in Rural Clinics and High Equipment Costs are Hampering the Veterinary Stereotactic Radiosurgery System Market Growth

High equipment costs, limited availability in rural clinics, and a lack of trained veterinary oncologists have hampered the veterinary stereotactic radiosurgery system market growth. In addition, some geographies are adopted even less as there are no reimbursement policies and greater regulatory complexities. barriers hinder the possibility of integrating an advanced quality delivery system into general veterinary practices.

For instance, in December 2024, Regulatory delays and import tariffs kept veterinary stereotactic radiosurgery system adoption below 3% in Romania, Hungary, and Bulgaria, limiting Eastern Europe’s market growth.

Veterinary Stereotactic Radiosurgery System Market Segment Analysis

-

By Product

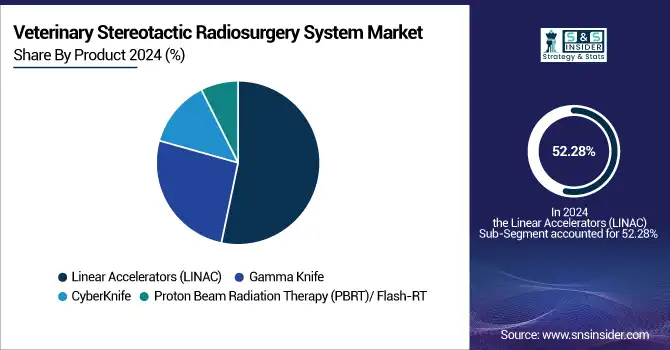

Linear Accelerators (LINAC) was the dominant segment in the global veterinary stereotactic radiosurgery system market, with a 52.28% share in 2024, as it is precise, non-invasive, and have a shorter treatment time. Driving factors include the broad range of animal cancers that can be treated and the increasing use by veterinary oncologists. Also, sharp technology and better clinical results in some cases have extended its vulnerability in veterinary oncology.

The Proton Beam Radiation Therapy (PBRT) segment is emerging as the fastest growing with a CAGR of 11.28% in the global veterinary stereotactic radiosurgery system market, as it has superior tumor specificity and minimal damage to surrounding tissue. Increasing requirement for improved cancer care in domestic animals, awareness among pet owners, and technological advancements in veterinary oncology are the few factors that are expected to power the growth of proton beam radiation therapy (PBRT) market.

-

By Application

In 2024, the tumor treatment dominated the veterinary stereotactic radiosurgery system industry, owing to the high prevalence of cancer among companion animals and increasing need for non-invasive, accurate treatments. This growth is expected to be fuelled by developments in imaging and radiotherapy technology, and wider pet insurance coverage and the attitude of pet owners toward investing in quality cancer care.

Neurological Disorders is emerging as the fastest-growing segment in the veterinary stereotactic radiosurgery system market, registering a CAGR of 11.68 % over the forecast period, driven by an increasing number of companion animals being diagnosed with brain tumors, epilepsy, and spinal cord ailments. This rapid growth of the segment is attributed to growing awareness among pet owners, advancements in neuroimaging, and rising adoption of precision radiosurgical treatments in veterinary neurology.

-

By Type

Dogs held a dominant veterinary stereotactic radiosurgery system market share of 72.94% in 2024, as they develop more tumors and neuro problems than other animals. Rise in pet adoption, growth in veterinary health expenditure, and emotional value of canines as companions fuel the demand for advanced treatment. Rich growth of radiosurgery for dogs also facilitates higher market control.

Small Animals is emerging as the fastest-growing segment in the global veterinary stereotactic radiosurgery system market, registering a CAGR of 12.61% over the forecast period, driven by increased pet adoption of cats and rabbits, and exotic pets. The increasing knowledge regarding the availability of advancements, growing veterinary oncology services, and development in imaging technologies ensures accurate tumor targeting even for small animal species. Segment growth is being driven by owners who are increasingly likely to buy top-end care.

-

By End-User

Academic & Research Institutions are the largest segment of the veterinary stereotactic radiosurgery system industry, owing to their technology, grants for innovations, and working closely with veterinary hospitals. These centers are home to leading clinical trials, oncology research, and equipment installation for animal studies. Their focus on precision in veterinary medicine and training the up-and-coming cadre of oncologists drives adoption and propels market growth.

The Hospitals & Clinics segment is witnessing the highest growth in the global veterinary stereotactic radiosurgery system industry, as pet cancer diagnoses are on the rise, and minimally invasive treatments and specialized veterinary oncology centers proliferate. Increasing pet insurance coverage, growing pet owner awareness, and the presence of advanced imaging and treatment technologies in clinical settings also support adoption and market expansion.

Veterinary Stereotactic Radiosurgery System Market Regional Analysis

North America Veterinary Stereotactic Radiosurgery System Market Insights

In 2024, the North American region held a dominant market share of 47.60% of the global veterinary stereotactic radiosurgery system market, owing to the relatively mature veterinary healthcare system, increased pet ownership, and the rising expenditure on companion animal health in this region. Furthermore, the availability of a majority of renowned veterinary oncology centers, proliferating adoption rates for next-generation radiotherapy technologies, and well-established utility of pet insurance coverage further affirm prevalence across the European market. Besides, increasing knowledge and growing preferences for various cancer therapy options will continue to maintain dominance in the target market. At the same time, rising investment in R&D by academic institutions and private ones is a key contributor to propelling the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Veterinary Stereotactic Radiosurgery System Market Insights

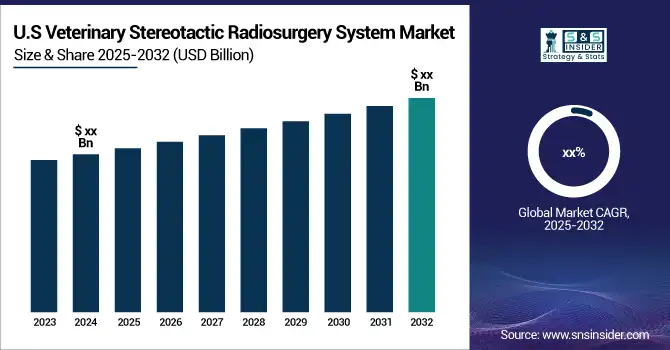

The U.S. veterinary stereotactic radiosurgery system market was valued at USD 1.23 billion in 2024 and is expected to reach USD 2.75 billion by 2032, growing at a CAGR of 10.65% over 2025-2032. The U.S. is expected to lead the veterinary stereotactic radiosurgery systems market, accounting for high spending on pet healthcare services and advanced veterinary oncology infrastructure, along with wide acceptance of precision radiation technologies. With the veterinary stereotactic radiosurgery system market analysis, the country has a high rate of specialty referral centers and pet insurance coverage, and owner willingness to spend for non-invasive cancer treatment modalities, including SRS in companion animals.

Europe Veterinary Stereotactic Radiosurgery System Market Insights

Europe is the second largest market for the veterinary stereotactic radiosurgery systems industry due to a well-established veterinary care infrastructure, increasing awareness about cancer treatment in pets, and continuously rising investment inflow in animal health care. Increasing supportive regulations, a rise in the number of veterinary oncology practices, and collaborations between research institutions and clinics are also bolstering the adoption of stereotactic radiosurgery systems in this region.

Asia-Pacific Veterinary Stereotactic Radiosurgery System Market Insights

Asia Pacific emerges as the fastest-growing region with the highest CAGR of 11.65%, owing to the growing trend of pet ownership and increasing disposable income in China, India, Japan, and South Korea, leading to rapid development of veterinary healthcare. Factors including increasing awareness of pet oncology, the opening up of various types of specialty and super-specialty hospitals for animal care, and high-level radiation procedures are on the rise. Animal welfare approaches by governments, veterinary education programs, and radiotherapy exchange programs with international radiotherapy companies are some of the driving factors that industries have on animals.

Technological adoption of reference labs and urbanization can contribute to driving veterinary care over volume treatments to precision medicine as well. The rise in investments and the number of procedures in the region is primarily due to an increase in the middle-class population, and owners have become more willing to spend on superior treatment of their companion animals.

Middle East & Africa Veterinary Stereotactic Radiosurgery System Market Insights

The veterinary stereotactic radiosurgery systems market in the Middle East and Africa is expected to register relatively slower growth due to low awareness in the region, limited availability of veterinary infrastructure, and high costs associated with equipment. Furthermore, a smaller number of skilled veterinary professionals and negligible government investment in animal healthcare inhibit the growth of the market, leading to slower adoption of these advanced technologies in this region.

Latin America Veterinary Stereotactic Radiosurgery System Market Insights

Latin America has a relatively modest share in the veterinary stereotactic radiosurgery system market because of the increasing awareness of pet healthcare and growing penetration of advanced veterinary treatments in countries including Brazil, and Mexico, among others. Nonetheless, market expansion is hindered due to restricted availability of specialized equipment, high procedural costs, and uneven distribution of veterinary pharmacists. However, a steady increase in demand for advanced veterinary oncology solutions is likely over the coming years, a direct result of growing urbanization and pet ownership.

Veterinary Stereotactic Radiosurgery System Companies are:

Some of the Veterinary Stereotactic Radiosurgery System Market Companies

-

Xstrahl Ltd

-

Accuray Incorporated

-

Varian Medical Systems

-

Elekta AB

-

VetRay Technology by Sedecal

-

Universal Medical Systems

-

Advanced Radiation Therapy

-

Avante Health Solutions

-

Brainlab AG

-

RaySearch Laboratories

-

Canon Medical Systems

-

GE HealthCare

-

Philips Healthcare

-

CIVCO Radiotherapy

-

Radiance Medical Systems

-

ViewRay Inc

-

JPI Healthcare Solutions

-

Veterinary X-Ray and Equipment

-

Mitsubishi Electric Corporation

-

Reflexion Medical

Competitive Landscape for the Veterinary Stereotactic Radiosurgery System Market:

-

In May 2024, UW–Madison used the Radixact System with Synchrony for the first time in veterinary oncology, enabling real-time adaptive stereotactic radiotherapy for pets with moving tumors.

-

In April 2024, LINAC-based systems held over 53% of the veterinary SRS market, led by North America due to strong demand, infrastructure, and growth in pet cancer treatment centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.29 billion |

| Market Size by 2032 | USD 7.46 billion |

| CAGR | CAGR of 10.78% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Gamma Knife Linear Acceleration, Proton Beam Radiation Therapy, CyberKnife) • By Application (Tumor Treatment, Pain Management, Neurological Disorders, Research) • By Type (Dogs, Cats, Horses, Small Animals) •By End User (Hospitals & Clinics, Academic & Research Institutions) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Xstrahl Ltd, Accuray Incorporated, Varian Medical Systems, Elekta AB, VetRay Technology by Sedecal, Universal Medical Systems, Advanced Radiation Therapy, Avante Health Solutions, Brainlab AG, RaySearch Laboratories, Canon Medical Systems, GE HealthCare, Philips Healthcare, CIVCO Radiotherapy, Radiance Medical Systems, ViewRay Inc, JPI Healthcare Solutions, Veterinary X-Ray and Equipment, Mitsubishi Electric Corporation,Reflexion Medical, and other |