Intra-abdominal Pressure Measurement Devices Market Size Analysis:

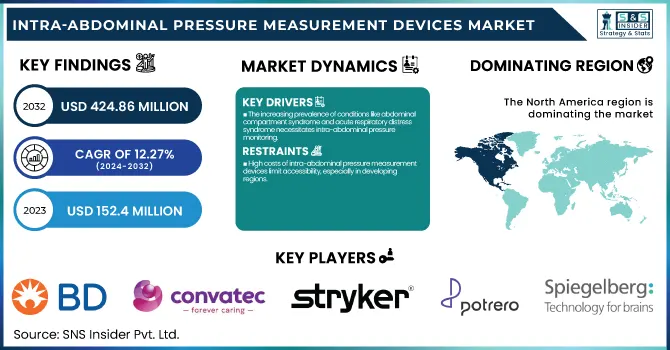

Intra-abdominal Pressure Measurement Devices Market Size was valued at USD 152.4 million in 2023 and is expected to reach USD 424.86 million by 2032, growing at a CAGR of 12.08% over the forecast period of 2024-2032.

To Get more information on Intra-abdominal Pressure Measurement Devices Market - Request Free Sample Report

This report provides key statistical insights and trends in the Intra-abdominal Pressure Measurement Devices Market, focusing on critical industry data. In 2023, it addresses the incidence and prevalence of intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS) as well as emerging market growth patterns, and projected growth patterns across different regions. The essentials of the analysis are an insight into changes in device volume and usage patterns and a clear transition toward digital and sensor-based monitoring solutions. It also examines healthcare spending trends, breaking down investments made by hospitals, governments, and private stakeholders. It provides analysis by region of technology adoption, EHR integration, and regulatory compliance. This information helps the stakeholders understand the market trends and forecast the future. Increasing surgical procedures and the rising prevalence of abdominal conditions are the major growth factors for the intra-abdominal pressure measurement devices market.

Intra-abdominal Pressure Measurement Devices Market Dynamics

Drivers:

-

The increasing prevalence of conditions like abdominal compartment syndrome and acute respiratory distress syndrome necessitates intra-abdominal pressure monitoring.

The increasing incidence of disorders including abdominal compartment syndrome (ACS) and acute lung injury/acute respiratory distress syndrome (ARDS) has driven the demand for intra-abdominal pressure (IAP) monitoring devices. While relatively rare, ACS can be highly damaging among critically ill patients. A study analyzing data from 2010 to 2020 revealed that ACS occurred in approximately 0.17% of intensive care unit (ICU) admissions in the United States. Patients with ACS faced a nearly fourfold increase in mortality risk compared to those without the condition. Patients with ACS were almost four times more likely to die than those without it. ACS also resulted in an average of 5 more hospital days and an average of $ 49,300 more in each patient’s total healthcare costs. Likewise, ARDS continues to be a major problem in critical care environments. The United States had an estimated 591,000 new ARDS cases in 2023, comprising around 62% of total cases among seven major markets (EU4 countries (Germany, France, Italy, Spain), United Kingdom, and Japan). Severity assessments in the U.S. indicated that 177,000 cases were mild, 276,000 moderate, and 138,000 severe. Pneumonia and sepsis, in particular, featured as leading risk factors, underlying 210,560 and 175,076 cases of ARDS respectively. These statistics highlight the urgent need for efficient monitoring of IAP which can alleviate the negative effects of ACS and ARDS. The incidence of these conditions is still considerable, and there will always be a demand for reliable IAP measuring devices, which in turn will lead to medical advancements.

Restraints:

-

High costs of intra-abdominal pressure measurement devices limit accessibility, especially in developing regions.

The high costs associated with IAP measurement devices represent a major restraint to widespread adoption, especially in developing regions. These devices are pivotal in the assessment of conditions such as intra-abdominal hypertension (IAH) and abdominal compartment syndrome (ACS), yet they are frequently costly, posing a fiscal challenge for many healthcare systems. The burden of costs, and most specifically for healthcare, is even more pronounced in low- and middle-income countries and must be allocated wisely. Then again, another reason that may hold back IAP testing but not Fenestrated Abdominals is that these devices are expensive, and running IAP tests is extremely costly. Most healthcare facilities have other priorities that they need to fulfill and thus they might not invest in the equipment. As a result, patients from resource-limited environments might not be monitored for IAH and ACS promptly, which can contribute to increased morbidity and mortality. Addressing this cost barrier is crucial to ensure equitable access to essential diagnostic tools across diverse healthcare landscapes.

Opportunities:

-

Emerging economies' focus on enhancing healthcare infrastructure presents growth prospects for these devices.

The growth of healthcare infrastructure in developing regions creates an opportunity for the intra-abdominal pressure (IAP) measurement devices market. As these countries are investing significantly in healthcare infrastructure, they are expected to witness an increase in demand for advanced medical devices such as IAP measurement systems. Current reports show a strong pipeline for healthcare construction projects worldwide. Reportedly, the value of all global healthcare construction projects between announcement and execution totaled around $646.9 billion in September 2024. This is up from $636.8 billion as of June 2024. Notably, North America leads with a combined project pipeline valued at $250.9 billion, followed by Western Europe at $146 billion, and North-East Asia at $60.8 billion.

The substantial investments in healthcare infrastructure are driven by the need to meet the demands of aging populations and to modernize existing facilities. For example, one report has noted that over $200 billion is expected to be injected into the global healthcare infrastructure market over the next five years, with the UK being one of the most desirable regions for this investment. These developments reflect a global commitment to strengthening healthcare systems, especially in the developing world. With the establishment of new hospitals and medical facilities, it is essential to incorporate the best medical technologies. As a result, the demand for IAP measurement devices is expected to increase globally, providing manufacturers and suppliers lucrative opportunities to serve this emerging market.

Challenges:

-

Procedural complications, such as bladder infections and needlestick injuries, can deter device usage.

Intra-abdominal pressure (IAP) is important to assess in order to recognize intra-abdominal hypertension in critically ill patients and prevent abdominal compartment syndrome. The conventional method would be indirect measurement through especially the bladder with a Foley catheter. This technique is considered non-invasive, cost-effective, easy to perform at the bedside, and safe for patients. Despite the safety profile of the standard bladder pressure measurement technique, challenges persist in clinical practice. A study assessing nurses' knowledge and practices regarding IAP measurement revealed that most had poor knowledge of IAP measurement, intra-abdominal hypertension, and complications of abdominal compartment syndrome. Moreover, the IAP measurement practices of the nurses were unsatisfactory in over two-thirds of the instances. Although the traditional approach to diagnosing IAP by measuring bladder pressure is a safe, low-cost, and intracavitary approach, the effective utilization of this method is limited by barriers, including a lack of healthcare workers’ knowledge or practices. Focusing education and training toward addressing these issues is crucial to optimizing patient outcomes.

Intra-abdominal Pressure Measurement Devices Market Segment Analysis

By Product

The equipment segment held the largest revenue share of 65% of the intra-abdominal pressure measurement devices market in 2023 That supremacy is due to technological progress, resulting in more accurate and user-friendly equipment. In addition, the increasing need for durable and reusable instruments in situations with repeated measurements also drives this trend. Statistics from the government show how essential correct monitoring in medical institutions is, which is in line with the advantages provided by the mentioned equipment. Moreover, the low-cost and simple nature of indirect measurement methods (using devices) has made them more popular among healthcare providers. Governments are also stricter about the requirement of proper medical devices to ensure efficient and reliable use of these items, which plays a role in the medical refocus from disposables to equipment. The demand for equipment is predicted to stay strong as healthcare institutions keep adopting new technology to enhance patient outcomes. It is especially common in critical care settings like ICUs, where the demand for 24-hour monitoring exists and devices can be integrated into an already established hospital system.

Besides, the support of the government in improving healthcare infrastructure and encouraging the adoption of advanced medical devices has resulted in the surge of this segment. Digital health platforms and the integration of medical devices with electronic health records (EHRs) have made possible streamlined patient care and the efficient integration of intra-abdominal pressure monitoring into patient care. Furthermore, the presence of regulatory frameworks that guarantee the safety and efficacy of medical equipment has increased healthcare providers' confidence, resulting in the enhanced adoption of these devices.

By Procedure

In 2023, the market was dominated by the abdomen segment, accounting for the largest revenue share. This is primarily because intra-abdominal hypertension is very common in critically ill patients requiring frequent monitoring of intra-abdominal pressure. According to government data, to-date there has been a surge in abdominal compartment syndrome cases and other relevant illnesses, which will propel the need for accurate monitoring instruments. The abdomen segment benefits from the widespread use of intra-abdominal pressure measurement devices in critical care settings, where timely and accurate assessments are crucial for patient management. The abdomen segment majorly grew due to initiatives from the government raising awareness towards intra-abdominal hypertension and its implications. However, these initiatives have resulted in a greater awareness of the need for arresting the progression of abdominal diseases which is help a wide array of intra-abdominal pressure measuring devices be used in a clinical environment. In addition, regulatory guidance focusing on patient safety and the prevention of complications due to elevated intra-abdominal pressure has supported the expansion of these devices.

The integration of intra-abdominal pressure measurement devices with existing healthcare systems has been a key factor in their widespread adoption. Devices that can seamlessly integrate with patient monitors and electronic health records facilitate better clinical decision-making by providing healthcare professionals with timely and accurate patient data. This synergy is especially vital in critical care environments, where fast reactions to shifts in patient condition are essential. The measurement of intra-abdominal pressure devices is an essential element in the management of patients with abdominal injuries, sepsis and surgical conditions. As healthcare providers continue to emphasize early detection and treatment, the demand for these devices is expected to grow. The focus on developing more accurate and reliable monitoring systems will remain crucial for market expansion.

By Application

The intra-abdominal hypertension (IAH) segment had the highest revenue share of around 55% in 2023. The rationale is the growing incidence of IAH in ICU patients that substantially impairs the core organs and requires accurate measurements. A significant number of ICU patients develop IAH according to government statistics, which is expected to drive the demand for accurate measurement devices. Increased adoption of intra-abdominal pressure measurement devices in the critical care setting has resulted from the significance of early detection and the management of IAH. The prevalence of intra-abdominal hypertension in critically ill patients is well documented in government data. IAH is associated with both increased mortality and morbidity rates, which highlights the significance of intra-abdominal pressure measurement devices in the management of the patient. With growing awareness of untreated IAH complications, greater adoption of these devices is noted by healthcare providers to enhance patient outcomes. These devices have also seen improvements in the accuracy and reliability of pressure measurement technology within the abdomen over the years. Examples include the introduction of non-invasive measurement techniques and real-time monitoring capabilities that allow for real-time access to patient-centric data, which continues to improve clinical decision-making. These developments are responsible for the growth of the IAH segment as they help in better management of intra-abdominal hypertension.

Intra-abdominal Pressure Measurement Devices Market Regional Insights

North America held a leading position in the intra-abdominal pressure measurement device market in 2023, owing to the presence of high-quality healthcare facilities and a large population suffering from chronic diseases in the region. The region dominates the medical research industry owing to advanced healthcare infrastructure and high investment in medical research. North America is anticipated to grab the market lead owing to the well-established healthcare system and proper regulatory framework. The demand for Intra-abdominal Pressure Measurement Devices in the region is primarily due to the growing focus on patient safety and the adoption of advanced medical technologies in the region. Moreover, government efforts to bolster healthcare infrastructure and encourage the use of digital health platforms have paved the way for other contributing factors behind this dominant expansion for the region.

The Asia Pacific region is expected to witness the highest CAGR growth owing to growing healthcare expenditure and government support for upgrading medical facilities. The healthcare infrastructure in nations such as China and India is expanding at a rapid pace, which will continue to drive the growth of this market. The rapid growth of the Asia Pacific region is mainly due to rising healthcare expenditure and favorable government policies for the development of healthcare infrastructures. Other factors driving the growth of this region include the increase in the incidence of chronic disorders and the demand for advanced medical technologies. With the growing investment in healthcare in countries such as China and India, the need for devices to measure intra-abdominal pressure is expected to surge significantly. The growth of the market in the Asia Pacific region can be attributed to the economic initiatives undertaken by the governments such as healthcare infrastructure investments and policies that facilitate the adoption of advanced medical technologies. Alongside improving performance among healthcare providers, these have opened doors to incorporating intra-abdominal pressure measurements in critical care centers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Intra-abdominal Pressure Measurement Devices Market Key Players

Key Service Providers/Manufacturers

-

Becton, Dickinson and Company (BD) (TraumaGuard System, AccuDrain)

-

ConvaTec Group PLC (AbViser AutoValve, Flexi-Seal SIGNAL Fecal Management System)

-

Stryker Corporation (Intra-Compartmental Pressure Monitor System, Stryker InTouch Critical Care Bed)

-

Biometrix Ltd. (Urimetrix Pressure Transducer, Biometrix Foley Catheters)

-

Centurion Medical Products (Medline Industries, Inc.) (Compass Digital Pressure Transducers, Centurion Foley Catheterization Trays)

-

Potrero Medical (Accuryn Monitoring System, Accuryn Critical Care Monitoring System)

-

Spiegelberg GmbH & Co. KG (Spiegelberg ICP Monitoring Catheters, Spiegelberg Microchip Catheter)

-

Gaeltec Devices Ltd. (Gaeltec Microchip Transducers, Gaeltec Pressure Monitoring Systems)

-

Holtech Medical (Abdo-Pressure Monitoring Kit, Holtech Intra-Abdominal Pressure Monitoring Device)

-

Nutrimedics S.A. (Nutrimedics IAP Monitoring Kit, Nutrimedics Foley Catheters)

-

Cheetah Medical (Cheetah Starling SV, Cheetah NICOM)

-

C2DX, Inc. (STIC Intra-Compartmental Pressure Monitor, STIC Pressure Monitor Accessories)

-

Codan US Corporation (CODAN IAP Monitoring Set, CODAN Pressure Transducer)

-

Thermo Fisher Scientific, Inc. (SureTect PCR System, Ion Torrent Next-Generation Sequencers)

-

SSEM Mthembu Medical (Pty) Ltd. (SSEM IAP Monitoring Kit, SSEM Medical Pressure Transducers)

-

Degania Silicone Ltd. (Degania IAP Monitoring Catheters, Degania Pressure Monitoring Kits)

-

Abviser Medical (Abviser AutoValve, Abviser IAP Monitoring System)

-

C.R. Bard, Inc. (Bard IAP Monitoring Device, Bard Foley Catheters)

-

Accuryn Medical (Accuryn Monitoring System, Accuryn Critical Care Monitoring System)

-

Biometrix Corporation (Biometrix IAP Monitoring Kit, Biometrix Pressure Transducers)

Recent Developments in the Intra-abdominal Pressure Measurement Devices Market

-

In June 2024, The U.S. FDA announced that the intra-abdominal pressure monitoring in critically ill patients emphasizes the importance of precise measurement and encourages the development of the devices.

-

In September 2023, The World Society of Abdominal Compartment Syndrome (WSACS) hosted a congress focused on spreading awareness and promotion of research for intra-abdominal hypertension.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 152.4 Million |

| Market Size by 2032 | USD 424.86 Million |

| CAGR | CAGR of 12.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Procedure (Muscle, Abdomen) • By Product (Disposables, Equipment) • By Application (Intra-compartment Pressure, Intra-abdominal Hypertension) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company (BD), ConvaTec Group PLC, Stryker Corporation, Biometrix Ltd., Centurion Medical Products (Medline Industries, Inc.), Potrero Medical, Spiegelberg GmbH & Co. KG, Gaeltec Devices Ltd., Holtech Medical, Nutrimedics S.A., Cheetah Medical, C2DX, Inc., Codan US Corporation, Thermo Fisher Scientific, Inc., SSEM Mthembu Medical (Pty) Ltd., Degania Silicone Ltd., Abviser Medical, C.R. Bard, Inc., Accuryn Medical, Biometrix Corporation. |